Summary:

- Leading into Q3 earnings, expect continued strength in Google Search, Google Cloud, and advertising. It’s important to monitor how the ROI of Google’s AI capex is developing.

- Microsoft is showing a clearer AI ROI horizon; this is one of the core elements that validate Google’s lower valuation ratios. Lower volatility risk comes at a cost.

- I have a $190+ 12-month price target for Google stock, indicating a 17% upside from the current price of $165.90.

- I expect Google to have a lagging position in AI over the long term, with Meta and Microsoft taking the market lead with significant moats in artificial general intelligence.

J Studios

In my last analysis of Google (NASDAQ:GOOGL) (NASDAQ:GOOG), I mentioned that it was attractively valued amid a recent 10%+ drawdown in price. Following my Buy rating at the time, the stock has gained 10.3% in price. Google and Tesla (TSLA) are the only companies in my portfolio that are part of the Magnificent Seven. As we approach big tech earnings, Google is attractively valued to me even after its recent stock price increase.

In Google’s Q3 Earnings, expect to see continued strength in Google’s advertising business, as well as growth in its Cloud segment, especially related to AI. Despite the strength for the quarter, Google’s long-term position in AI is looking weaker than Meta (META) and Microsoft (MSFT), and Google’s lowest valuation in the Big Three is appropriate as a result of this. I have a 12-month price target for Google stock of $190+, indicating a 17% price increase from present levels.

Advertising & Cloud Growth Are Crucial to Monitor at Q3 Earnings

As Google Search continues to be the largest contributor to Google’s revenues (growing 18% YoY in Q3 2023), it’s vital to monitor this. This is especially true at this time, with the rise of threats like SearchGPT and ChatGPT challenging Google’s dominance in Internet navigation. Unlike Google Search, SearchGPT offers an ad-free experience, which could be one of the drivers taking market share from Google Search. Despite the presence of the threat, it’s worth remembering that the primary use case for ChatGPT and other generative AI models is evolving to become more about critical thought rather than pure Internet navigation. I believe Google Search is still going to have a significant place in the market for non-professional users who are seeking an ordinary Internet navigation experience. ChatGPT currently offers an advanced interface, a quality that works for it in professional markets but likely against it in mass consumer markets, which Google Search continues to corner effectively, based on my analysis.

In addition to strong growth in Google Search in Q3, we’re also likely to see YouTube’s ad revenue further expand (this was up 15% YoY in Q3 2023). YouTube’s expansion into Shorts and connected TV offerings is helping the platform to develop and have users spend more screen time on the platform. Shorts now average over 70 billion daily views, providing significant opportunities for advertising. Amid the threat of a U.S. ban on TikTok, YouTube Shorts is likely going to be the dominant replacement.

This strength in advertising is somewhat quelled by the recent DOJ antitrust cases against Google, of which one was focused specifically on its advertising monopoly. A federal judge ruled that Google illegally monopolized both the search and search advertising markets through exclusive contracts and other anticompetitive practices. The DOJ has suggested that structural remedies may be sought, although I find it highly unlikely that this will involve the breaking up of parts of Google’s business. Google plans to appeal the decision, and the outcome could take several more years to finalize. I expect management to talk in detail about this in the Q3 earnings call. The DOJ is yet to make a verdict on the second antitrust case, which was focused on Google’s monopoly position in the digital advertising market.

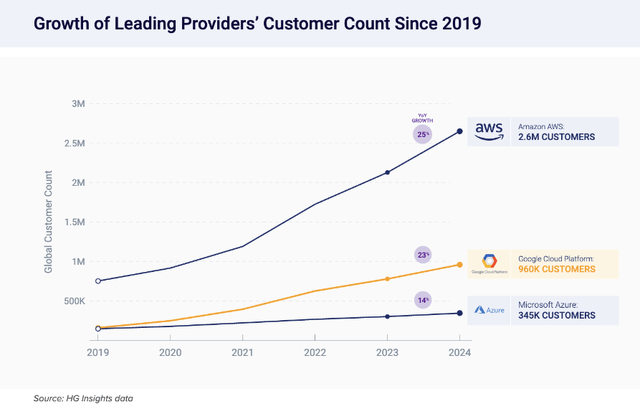

Additionally, Google Cloud’s growth will be important to monitor, especially given that in Q3 2023, the segment grew by 22%, which was below expectations and a decline from the 28% growth seen in Q1 and Q2 of the same year. Google Cloud has recently grown to approximately a 28% market share among the top 10 cloud providers and 11% of the global cloud market, according to recent data from an HG Insights report. AWS (AMZN) is the obvious outlier in Big Tech cloud services, with now over 2.6 million customers compared to over 960,000 for Google Cloud and over 345,000 for Microsoft Azure. Further expansion in this area will also demonstrate that the company is embedding its AI capabilities effectively and clarify how it is positioned against Microsoft Azure in terms of AI ROI, especially considering the ongoing heavy capital expenditures planned for FY25.

HG Insights

Google plans to increase its capital expenditures to $52 billion by 2025, focusing heavily on AI infrastructure, including data center and custom silicon efforts. However, despite this large investment, the return on investment is somewhat less clear than investors would hope at the moment. Google CEO Sundar Pichai has mentioned that underinvestment poses a greater risk than overinvestment, and Google Cloud’s revenue has been strengthened by demand for generative AI tools. Therefore, while there may be moments of volatility related to margin pressure in the medium-term future, I think the ROI horizon is very tangible and unlikely to take several years to manifest at scale. In Q2 2024, Google’s Cloud revenue marked a 29% increase from the previous year, up from the 28% YoY growth reported in Q1. Due to the current trends in AI adoption, I expect we may see Cloud segment growth in line with these previous quarters in Q3. Furthermore, Google Cloud achieved an operating income of over $1 billion for the first time in Q2, showing strength in profitability alongside top-line growth. I will be looking for more of this in the Q3 report to show a continued trend toward high ROI from AI.

Valuation Analysis: $190+ 12-Month Price Target

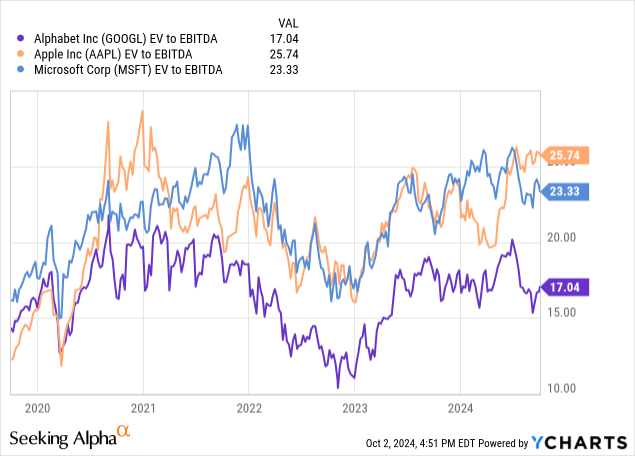

In my last analysis of Google, I outlined a 12-month upside of 25.3%; since then, the stock has already grown by 10.3% in price. At this valuation, the near-term capital gains are likely to be less significant. That being addressed, Google is still the most attractively valued of the Big Three. Google’s valuation is the primary reason why I hold the stock in my portfolio at a high weight. The valuation also provides lower volatility risk during the uncertain macroeconomic environment with high inflation, high U.S. Federal Government debt, and increasing geopolitical pressures. While I am uncertain that a large portfolio weighting toward big tech is wise at this time due to macroeconomics, despite the high growth opportunity from AI, Google could be the exception. At an EV/EBITDA ratio of just 17 compared to 25.7 for Apple (AAPL) and 23.3 for Microsoft, Google is potentially positioned as a Strong Buy rating leading into Q3 earnings.

| Apple | Microsoft | ||

| Three-to-five-year EPS CAGR estimate | 16.6% | 8.6% | 13.3% |

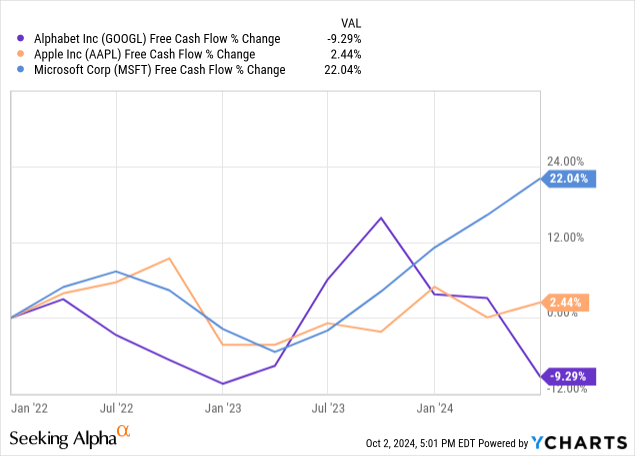

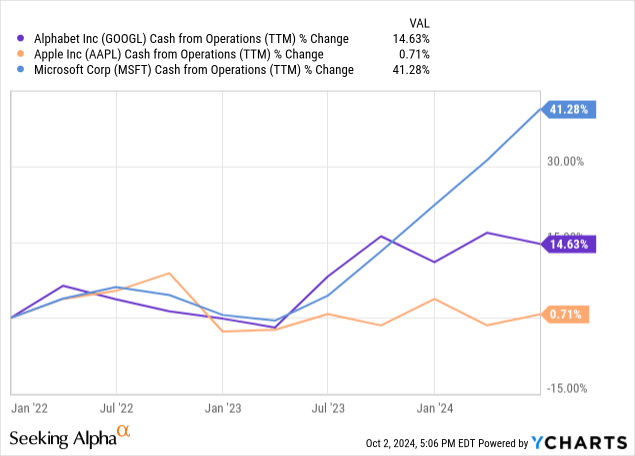

However, I am skeptical on one front, which is Google’s contracting free cash flow growth rates in recent years. This is especially important to note against Microsoft’s extremely strong position in this regard.

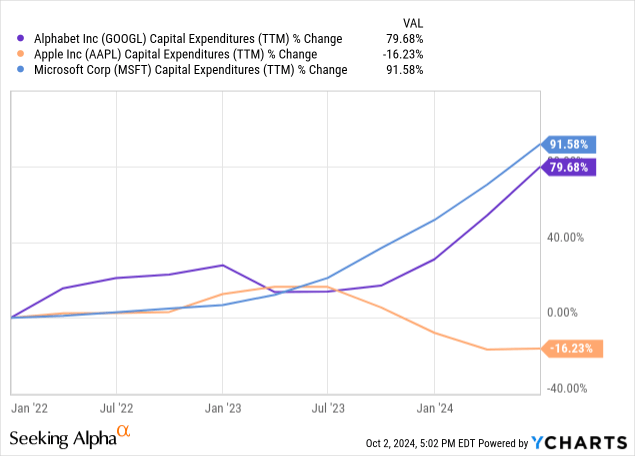

There are currently heavy capital expenditures from both Microsoft and Google in regard to AI and data center operations, with Microsoft recently showing stronger growth rates than Google in cash from operations, as well as free cash flow. Therefore, this indicates high profitability from Microsoft at this time compared to Google, and I think this should be valued as it is an early indicator of how effectively both companies will manage the ROI of their respective AI investments; at the moment, Microsoft takes the lead.

Considering all of these moving parts, I consider both Microsoft and Google as fairly valued, leading to their earnings this month. However, Apple is certainly overvalued and is a stock that should be approached with caution as a result. If Google trades at a P/E non-GAAP ratio of 24 in 12 months’ time and grows its EPS by 15% (which is my prediction based on my operational analysis above and historical growth rates), the stock will be worth $194.30, as the current TTM EPS is $7.04. This indicates a 17.1% upside from the present price of $165.90.

Industry Risk Analysis: AI

We’re currently at a high-risk inflection point of innovation where AI is likely to radically transform the technology industry. While it seems improbable, Google is also prone to disruption. For example, Meta has decided to open-source its frontier AI models, a position that Google has decided not to take (and, for many strategic reasons, cannot). This could propel Meta far ahead of Google and place it at the forefront of Western AI leadership. In addition to this threat, which could make Meta a viable Google Search alternative within its family of apps, we are still in the very early stages of what the new AI-enhanced digital ecosystem will look like. Based on my research and analysis, we are likely to see a diversification of AI models and Internet platform interfaces and less of a monopoly in Internet navigation from Google in this regard. I envisage that the future market will have multiple dominant artificial general intelligence models, primarily owned by big tech companies, but these models are likely to act as a substratum to a broader, diverse ecosystem of tailored and use-case-specific AI models. If Google fails to develop a competitive artificial general intelligence over the long term, I believe it will fail to retain a long-term growth-rate-expansive market position. It seems undeniable to me at this time that due to Google’s inability to strategically open-source its frontier AI (it sells access to its AI rather than Meta’s approach, which is ecosystem enhancement from AI), it will fall behind Meta and perhaps have less future market power. The operational weakness here is reflected in Google’s valuation ratios, which are substantially lower than its other peers in the Magnificent Seven. However, investors should realize they are getting good value based on lower sentiment for appropriate reasons: Google’s position in AI is strong, but it is not market-leading. Allocations should be made with this in mind. This risk is the primary reason why I rate Google a Buy right now in the final analysis rather than a Strong Buy, which is tempting based on my valuation analysis above.

Conclusion

Google offers the best value in the Magnificent Seven, but there are distinct reasons for this, including contracting free cash flow growth rates in recent years. While I believe the stock could achieve a 17% increase in price over the next 12 months, investors need to monitor management’s strategy for AI ROI in the Q3 earnings call, as well as note how the company’s operating income from its Cloud segment is developing. Microsoft is proving more profitable at the moment related to AI, and its ROI horizon is clearer to me than Google’s. Therefore, Google is a Buy at the moment, but investors should not be surprised if growth is much more moderate over the long term compared to the AI market leaders, which will likely be Meta and Microsoft.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.