Summary:

- Altria, a major tobacco producer, offers an 8% dividend yield, making it an attractive long-term investment despite its “sin stock” label.

- The company’s strong earnings support its high dividend yield, providing consistent returns for shareholders.

- Altria’s divestment from diversification, like AB InBev, increases its risk as it becomes more concentrated in declining tobacco markets.

- The main risk is Altria’s reliance on nicotine addiction, which could impact future shareholder returns as tobacco consumption declines.

krblokhin

Altria (NYSE:MO) is one of the largest “sin stocks” in the world, focusing on both lower-risk E-Vapor and its traditional business. The company has an 8% dividend yield, driven by its strong earnings, which, as we’ll see throughout this article, helps to make the company an interesting and long-term investment.

Altria E-Vapor

Altria is working to grow its e-vapor business, reducing concerns for investors, and continuing its growth.

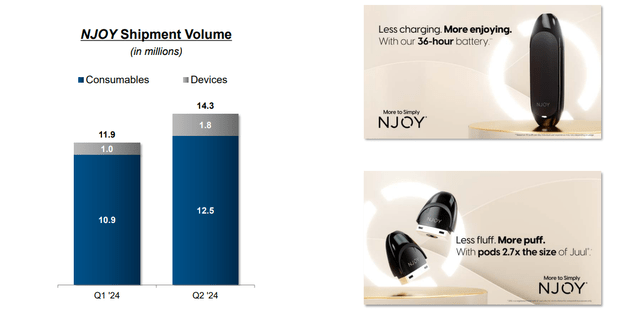

The company expects NJOY shipment volume to grow by double-digits, with devices sold almost doubling, and consumables growing by 25%. The company’s devices here satisfy customers’ nicotine addictions and the resulting high that they receive. At the same time, the efficient nature of the devices means the potential for higher margins to be earned over the long term.

On top of all of this, the devices are less risky than traditional cigarettes, which will help profits to continue increasing.

Altria Illicit Concerns

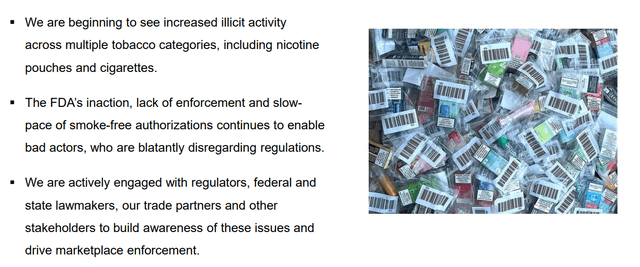

The company operates in a tightly controlled regulatory framework.

That regulation makes it in the company’s best interest to stomp out illicit activity, working with regulators to do so. Not only does it drive customers towards the company’s legal and higher-margin products, but it also helps minimize a more negative reputation for the industry. Here the company is blatantly calling out the FDA for not increasing enforcement.

What happens here remains to be seen; however, it’s worth highlighting that the company’s E-Vapor businesses benefited from increased regulation around what was once a major competitor (Juul) and other related businesses that first emerged on the scene. That’s something that’s worth paying close attention to.

Altria Earnings

Altria has managed to keep its earnings relatively flat, despite continued market volatility.

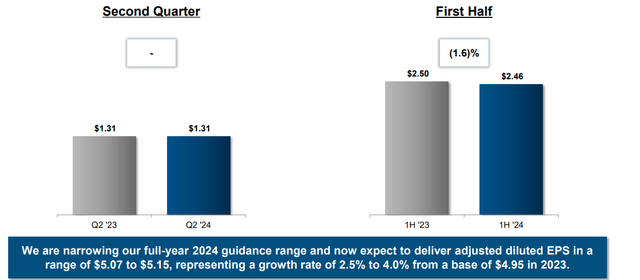

The company had $1.31/share in earnings for the quarter, with $2.46 / 1H of the year. Annualized, the company’s guidance is roughly $5.1/share, which puts the company at the upper end of a single-digit P/E ratio. That represents roughly a 3-3.5% growth rate, slightly above current inflation rates, showing the company’s continued growth ability in a tough market.

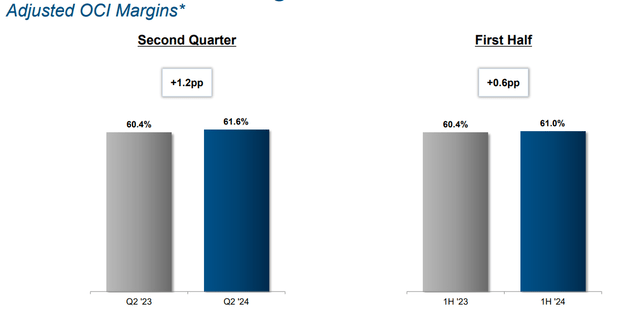

The company has managed to continue growing its margins, 1.2% YoY in the most recent quarter, which is exciting to see in a tough market. However, with that said, the company does continue to suffer from declining volumes as is expected in its business. That could hurt the company’s long-term growth as it hits limits.

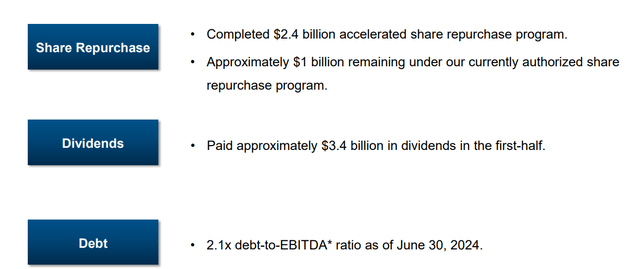

Altria Shareholder Returns

The company is committed to continue driving shareholder returns.

The company recently completed a $2.4 billion accelerated share repurchase program and has roughly $1 billion remaining. The company paid ~$3.4 billion in dividends in the 1st half of the year, which it can comfortably afford, and the company has a 2.1x debt-to-EBITDA ratio, which is also manageable for the company.

The company’s FY 2024 earnings guidance is roughly $5.1/share. That puts the company at a P/E of ~10, with continued earnings growth expected to be at almost 3.5% YoY. The company’s manageable debt means it’s directing roughly all of its cash flow towards shareholder returns. That’s a strong yield that shows the company’s growth.

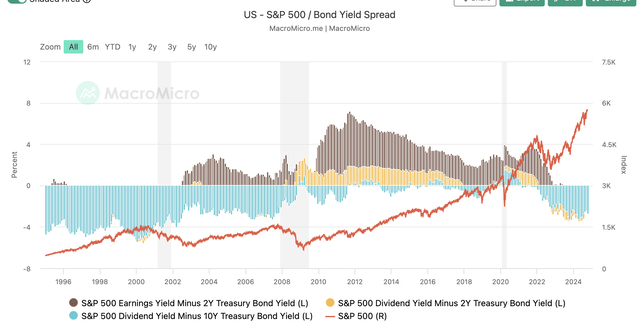

Changing Interest Rates

The reason why now specifically is a great time to invest in Altria is changing interest rates.

The spread on bond yields versus the S&P 500 yield has hit historic highs, but the market is reducing rates. The FED just cut rates by 0.5%, and after a great September job rates, the elusive soft landing might be here. That means that bond yields will go down, and stock market yields will decline (as a higher-risk investment stocks tend to have a higher yield versus other investments).

That could push down Altria’s yield. Altria had a 6.5% yield 2 years ago before the last interest raises started. That highlights how now is a great time to invest in Altria.

Thesis Risk

The largest risk to our thesis is that Altria is an unpopular company that profits off of nicotine addiction. The company is selling off diversification in its portfolio, such as AB InBev. That puts the company in a riskier and more concentrated going forward, as tobacco declines, which could hurt future shareholder returns.

Another major risk is the chance of problematic regulation. Overall, in our view, the company benefits from regulation. For example, as discussed with E-Vapor above, the company is promoting additional regulation. However, the FDA is still working to balance out the downsides to society, and one proposal is limiting nicotine content.

This could have a major impact on Altria’s long-term sales and earnings.

Conclusion

Altria has an impressive portfolio of assets. The company has a dividend of roughly 8%, a dividend that it can comfortably afford, and it’s continuing to repurchase shares on top. The company is seeing consistent earnings and margin growth, supported by the continued growth of the E-Vapor sector.

These lower-risk products help to bring the company new customers while improving margins. Working with regulators against illicit products can help the company grow even further in the long term. Putting all of this together, Altria is an impressive company, with an impressive portfolio of assets, making it a valuable long-term investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.