Igor Kutyaev

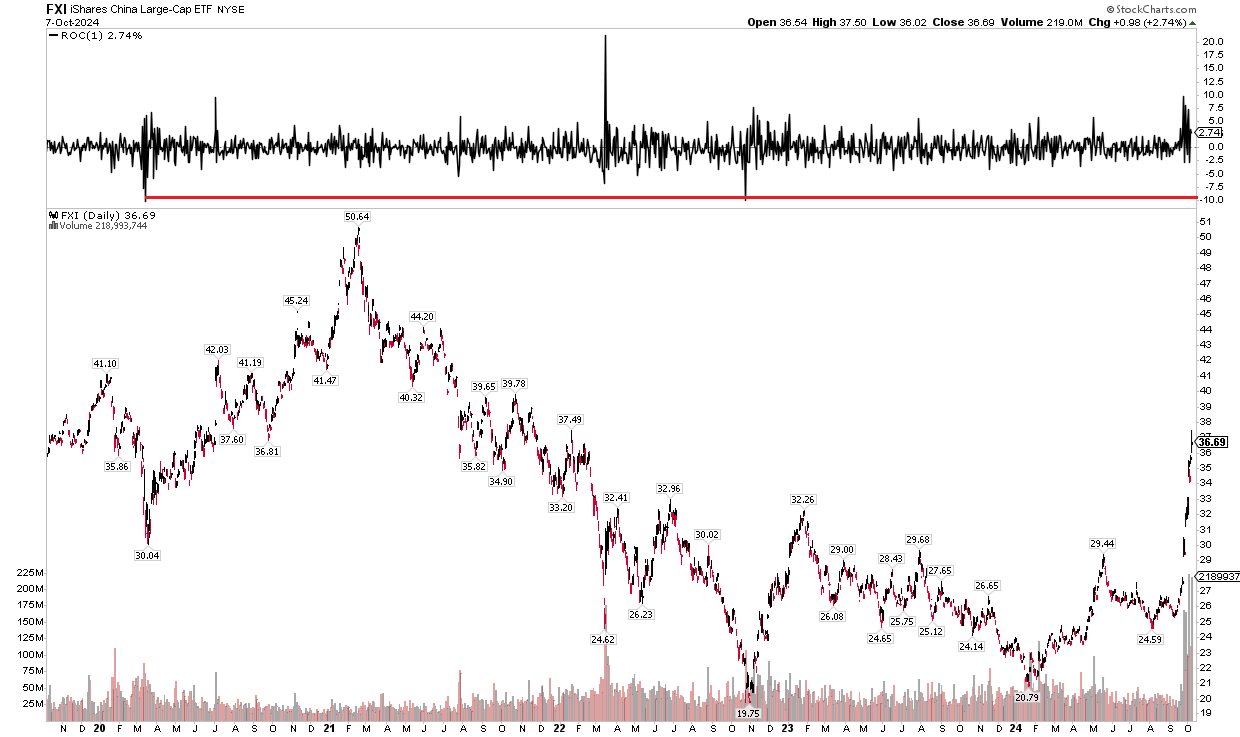

Chinese large-caps (NYSEARCA:FXI) opened at about -9% today, the second-worst session since March 2020.

Due to a lack of new Chinese economic stimulus measures, the iShares China Large-Cap ETF (FXI) is down today, after reaching more than $37, the highest since early 2022. Now, the index is at $33.46, and currently down 8.80%.

The following are the top 10 stocks within the benchmark, and their past month performance. All top 10 are up from the past month.

- Meituan (OTCPK:MPNGF) – Up 52.97% from the past month.

- Alibaba Group Holding (BABA) – Up 35.53% from the past month.

- Tencent Holdings Ltd (OTCPK:TCEHY) – Up 21.33% from the past month.

- JD.com Inc (JD) – Up 71.50% from the past month.

- China Construction Bank Corp (OTCPK:CICHY) – Up 10.62% from the past month.

- Ping An Insurance (Group) Co. of China Ltd (OTCPK:PNGAY) – Up 47.14% from the past month.

- Xiaomi Corp. (OTCPK:XIACF) – Up 28.25% from the past month.

- BYD Company Ltd. (OTCPK:BYDDF) – Up 26.59% from the past month.

- Bank Of China Ltd (OTCPK:BACHF) – Up 11.63% from the past month.

- Industrial And Commercial Bank of China Ltd (OTCPK:IDCBY) – Up 12.55% from the past month.