Summary:

- Pfizer’s stock has likely bottomed and shows strong technical and fundamental indicators, including a “Golden Cross” and robust cost reduction plans.

- The company’s promising pipeline, including weight-loss treatments and AI-driven drug discovery, offers significant long-term upside potential.

- The Seagen acquisition enhances Pfizer’s cancer treatment portfolio, positioning it well in a high-demand sector.

- With a nearly 6% dividend yield and potential for share price appreciation, Pfizer is an attractive buy, especially on pullbacks.

georgeclerk

My last article on Pfizer (NYSE:PFE)(NEOE:PFE:CA) was bullish and published back in February, 2024. I am even more bullish now because the stock seems to have found a bottom. I am also bullish because it appears that Pfizer is on the right path towards improved profits and it is building a strong pipeline. Pfizer still seems to be viewed as a Covid stock, but I believe this association with Covid vaccines will fade over time, especially as the company rolls out new treatments from its promising pipeline. Some tobacco stocks such as Philip Morris (PM) yield about 4.5% or more, and yet those companies are increasingly dependent on a shrinking customer base. Starboard is an activist investment fund and they just reported buying a $1 billion stake in Pfizer. I think they see a lot of value in this stock and Starboard’s involvement could become a catalyst to unlock value in this stock. I see many reasons to be bullish on Pfizer, so let’s take a closer look now:

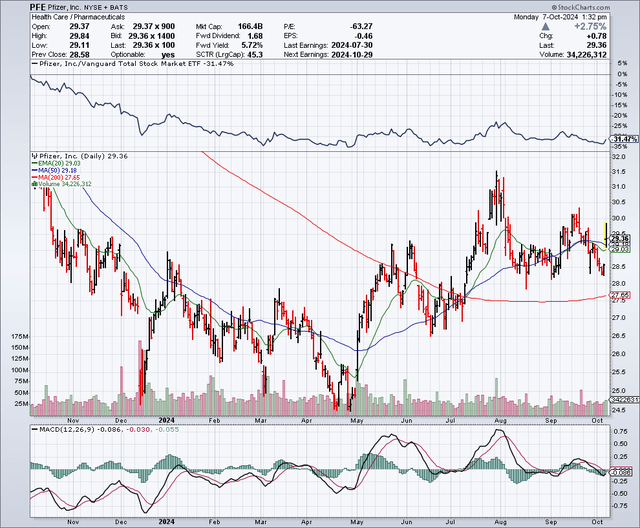

The Chart

As the chart below shows, this stock bottomed out in the $24 range, in April 2024. In July, a “Golden Cross” formation appeared on the chart when the 50-day moving average (which is currently around $29.20), crossed over the 200-day moving average (which is currently around $27.50). The stock is currently trading right around the 50-day moving average, and I believe this stock is a buy on any dips, not just because the technicals have improved and are now bullish, but also because the fundamentals appear strong as well.

Expense Reductions Could Be A Major Growth Driver For Earnings In The Next 3 Years

Pfizer announced a plan to cut costs by $4 billion by the end of 2024; however, it also announced another plan earlier this year to reduce expenses by another $1.5 billion over the next three years. Pfizer currently has about 5.67 billion shares outstanding. With these 2 cost reduction plans which total about $5.5 billion, this could potentially add nearly $1 per share in profits to the bottom line, based on the current share count. It could be another 3 years or so before the full impact of these cost reductions, but it could be worth the wait and be a catalyst for share price appreciation and earnings growth.

Pfizer’s Pipeline Could Surprise To The Upside Long-Term

There are currently 113 candidates in Pfizer’s pipeline, (33 of which are in phase 3) and while not every candidate will make it to market, some will and there is always the chance of a blockbuster or two which could be game changing for Pfizer and the share price in the future. Just look (see chart below) at Eli Lilly (LLY), which less than 10 years ago was trading for about $30 per share, (this is close to the current share price of Pfizer) and now it trades for nearly $900 per share. Back when the stock was trading for about $30, I am sure if you asked shareholders if they thought Eli Lilly shares would be worth $900 in 2024, they would have said no chance, and yet it happened. Clearly, I am not expecting Pfizer to go from nearly $30, to $900 in the next few years, but it does have major upside potential from current levels, and it has multiple shots on goal for potential blockbuster drugs.

The Seagen Acquisition Gives Pfizer A Big Opportunity In Cancer Treatments

Seagen developed the process of using antibodies to deliver cell-killing agents to cancer cells. It developed Adcetris to treat Hodgkin lymphoma, PADCEV to treat urothelial cancer, Tivdak to treat cervical cancer, and TUKYSA to treat breast cancer. This is in addition to many other high-potential candidates to treat cancer and other diseases that are currently advancing through clinical trials at Pfizer. I think it is ironic that Pfizer is working on cancer treatments, and it is yielding what some tobacco stocks are yielding. The concern with tobacco stocks is that the business is shrinking every year, as fewer people around the world choose to smoke. The concern with Pfizer and other pharma companies is that patents expire, and that generates generic competition and creates margin pressures. For this reason, pharma and biotech companies constantly have to be developing new treatments or acquiring new companies, as Pfizer did with Seagen.

Pfizer Is Likely To Enter The Weight-Loss Treatment Market

Weight-loss treatments have become extremely popular and successful. Pfizer has 3 weight loss candidates in clinical trials and several pre-clinical candidates. Danuglipron for weight loss is the most advanced candidate in Pfizer’s pipeline, and it has shown positive results as a twice a day oral treatment. A pill that can be taken orally is preferable for many patients when given a choice between this or a shot. So this could be one big advantage for Pfizer if Danuglipron reaches the market. In addition, Pfizer is working on a once-a-day version of Danuglipron and this could make it even more attractive as a weight-loss choice for patients.

AI Could Benefit Pfizer And The Pharma Sector Tremendously

We are just at the start of what is likely to be a revolutionary time for the pharma and biotech industry as AI and supercomputing is poised to greatly improve the drug discovery process by reducing costs, accelerating development and improving efficacy. While many investors are looking at the obvious and immediate beneficiaries of the demand for AI by investing in chip designers like NVIDIA (NVDA), there are clearly many industries like pharma and biotech that are poised to be big beneficiaries as well. With Pfizer trading with a nearly 6% yield and for just around 10 times earnings estimates, I don’t believe the market is adequately valuing Pfizer for the AI potential that it holds. Pfizer used AI in the development of PAXLOVID, so this is a real-world example, and it was so successful that Pfizer is now using AI in numerous clinical trials. Pfizer summarized the benefits and potential of AI by stating:

“In research and discovery, supercomputing capabilities paired with advanced computational methods helped Pfizer scientists optimize their search for the right molecules to be able to deliver PAXLOVID orally rather than intravenously. This was a game-changer because it meant that patients could take the treatment at home rather than in a hospital setting, which has significantly increased access to treatment for millions of people around the world.

AI and machine learning capabilities also played a key role in running Pfizer’s PAXLOVID clinical trials, enabling the team to perform quality-checks and analyze vast amounts of patient data 50% faster than before. Building on this success, AI and ML capability are used in more than half of all Pfizer’s clinical trials.”

There are biotech companies like Recursion Pharmaceuticals (RXRX) which focus on using AI in the development of new treatments and NVIDIA is an investor in this company. It appears that the pharma and biotech industry sees big opportunities for AI to benefit them, and it also appears that NVIDIA also sees big potential for AI-enabled drug discovery. At some point, I believe the market will also see the potential and that could lead to multiple expansion for Pfizer. A CNBC article points out the benefits of AI for NVIDIA-backed Recursion by stating:

“Recursion was able to use its artificial intelligence-enabled drug discovery platform to identify an area of biology to target for the treatment of solid tumors and lymphoma, match it with a drug candidate and move all the way to gaining regulatory approval to begin studies in less than 18 months.”

Pfizer Has So Much Going For It—Here’s What I Like The Most

I don’t believe Pfizer is getting enough credit for what it is and for the potential it has in the future. Its size alone represents an achievement in terms of industry position. Pfizer has scale that allows it to bring products to market quickly and in a cost-effective manner. The cost reduction plan is another potential earnings growth driver as lower costs could add significantly to earnings per share. Covid is not over, and the variants could keep vaccine demand higher for longer.

A couple more positive factors include that this stock is nearly recession-proof, since demand for health related products is likely to remain strong even in a slower economy. The market has seen strong gains recently, and this might create a “catch-up trade” whereby underperforming stocks and sectors start to see more investor interest. I believe the nearly 6% yield is very attractive, and it pays investors while waiting for a higher share price. Plus, I see the potential for Pfizer to develop a treatment in the future that could be as successful as some of the weight-loss drugs that have fueled a meteoric rise for Eli Lilly and other companies in this industry.

My Pfizer Strategy

While the chart appears to show this stock has bottomed out, it might still provide better buying opportunities in the coming weeks. Tax-loss selling is about to kick into high gear for many retail investors and this could keep pressure on shares of Pfizer starting in October and throughout the rest of 2024. I plan to use any weakness due to tax-loss selling or other factors that could send stocks and the pharma sector down in general. This could include geopolitics, and election year promises to cap drug prices. Buying Pfizer on pullbacks throughout the rest of the year is what I am planning to do. I expect this stock could get a nice bounce into 2025, since tax-loss selling will be drying up by January 1st. Short-covering could also help provide another upside catalyst.

The Dividend

Pfizer pays a quarterly dividend of $0.42 per share, which totals $1.68 per share on an annual basis. This offers a yield of 5.88%, which is very attractive and more generous than the current rates on a typical money market account. A yield of nearly 6% is becoming even more attractive since the Federal Reserve just lowered rates and is expected to continue on a path of interest rate reductions for the foreseeable future. With earnings estimates at $2.65 per share for 2024, the dividend payout ratio appears reasonable and secure.

Potential Downside Risks

There are a number of potential downside risks for any company in the pharmaceutical industry, and this includes Pfizer. Some potentially significant pipeline candidates could fail, and recent acquisitions might not be as successful as management hoped. Pharmaceutical companies are often involved with litigation over safety issues, and also have patent expiration challenges.

In an election year, we could see more politicians talk about price caps on medications. This could lead to potential downside for Pfizer.

In Summary

With a dividend that yields nearly 6%, investors are getting paid to wait for a higher share price. I clearly believe a higher share price is coming fairly soon. This stock could rebound into January as tax-loss selling season comes to an end. Other mid and longer-term catalysts include the expense reduction plans, the potential for pipeline candidates to produce positive trial results, as well as the potential for new blockbuster drug discoveries. I believe that the market is not giving Pfizer enough credit for its pipeline potential and for the opportunities it has to develop new treatments using AI, since this could greatly lower expenses and expedite the development process.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.