Summary:

- Rocket Lab’s revenue surged 71% YoY to $106M in Q2 2024, with gross margins remaining steady, indicating efficient revenue scaling without sacrificing profitability.

- The Neutron rocket project, crucial for Rocket Lab’s future, is progressing well but has a delayed launch date to mid-2025.

- Rocket Lab’s Electron rocket remains the most frequently launched small rocket globally, showcasing the company’s strong operational capabilities in a challenging industry.

- With a substantial backlog of $1.07B and ample liquidity, Rocket Lab is well-positioned for growth, justifying its high valuation.

John M Lund Photography Inc

Last April I wrote an article covering Rocket Lab (NASDAQ:RKLB) mentioning that the space launch company is slowly gaining momentum and could see its stock take off in the future. The stock has more than doubled since my recommendation. I wanted to update my previous article and access my thoughts on the stock after its run-up.

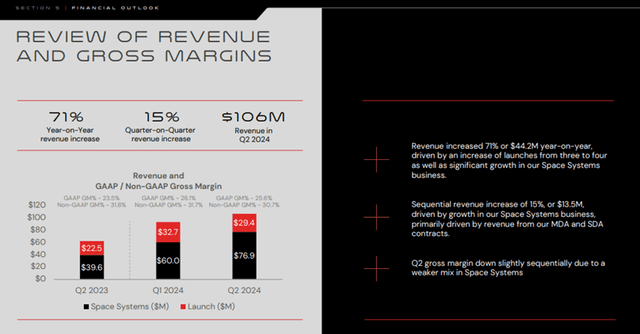

Rocket Lab Revenue is Accelerating

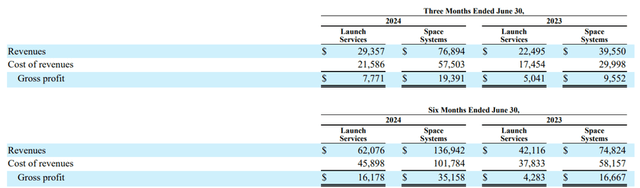

Rocket Lab’s 2024 year-to-date financial results show the company continues to make decent progress. In Q2, 2024, the company’s revenues reached an all-time high of $106 million. This was much higher than the $62 million reported at the same time last year and represented a 71% year-over-year revenue increase. This also represented a 14.2% increase from the $92.8 million reported in Q1 2024. Revenue in Q2 2024 alone was 43% of last year’s full-year revenue, showing the acceleration in growth.

In the latest quarter Q2 2024, GAAP Gross margins were 25.6% which was slightly lower than the 26.1% reported in Q1 2024 and above the 23.5% reported in Q4 2023. Management has indicated that Q2 gross margin decline is due to a weaker mix in the higher-margin Space Systems business. Guidance is for gross margins to be in the range of 25% to 27%. Similar to its results in 2023, Space Systems consisted of the bulk of Rocket Lab’s revenue year to date in 2024 at 68.8%. This was a slight decrease compared to the 70.6% reported in 2023.

Investor Presentation (Rocket Lab) 10-Q (Rocket Lab)

What’s exciting to see for me as an investor is that Revenue growth did not come at the expense of gross profit. The company has seen its Gross Margins improve slightly or remain steady within management’s expected guidelines. In other words, Rocket Lab is not losing money in order to gain revenues.

In fact, based on the company’s latest 10-Q, we can see that the company has even improved upon its operations. A useful metric to ascertain a space company’s competitiveness is the average revenue and cost value per launch. While revenue and cost value per launch can vary due to a whole host of technical factors like unique orbit and insertion requirements etc., it can be a useful metric to get a gauge of the general competitiveness and price sensitivity of the marketplace.

Year to date in 2024, Rocket Lab’s revenue value per launch was $7.7 million, which was 10% higher than the $7.0 million revenue per launch recorded in 2023. More impressively, the company’s cost per launch has decreased significantly at $5.7 million for year-to-date 2024. This figure is much lower than the $5.7 million cost per launch recorded in 2023. The decreasing costs should be a healthy indicator that the company’s margins are moving in the right direction and that they properly scale their revenues.

Management has given guidance for revenues of $100 million and $105 million in Q3 2024, indicating it believes that it can keep its momentum for the latter half of the year. Space Systems is expected to have revenue between $79 million and $84 million, while Launch Services is expected to have revenue of $21 million.

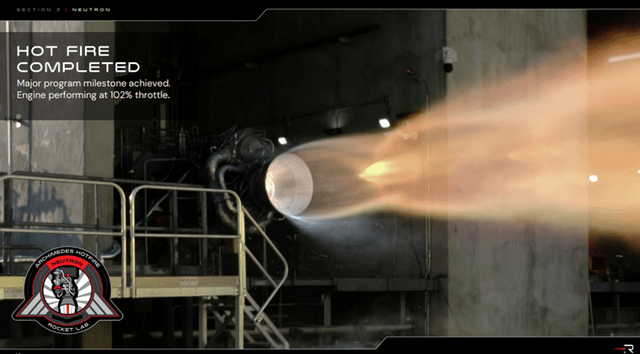

Neutron Advancing at a Steady Pace

As mentioned in my previous article, in my opinion, the company’s most critical project is its Neutron launch rocket. The Neutron rocket is the next generation of the company’s rockets and is designed to handle a high-flight schedule and carry a maximum capacity of 13,000 kg. An overhang for the stock, when I wrote my article, is whether or not the company can make its launch by year-end 2024. It has since abandoned that plan for a mid-2025 launch date. There were already some doubts in the industry on whether or not Rocket Lab could have ever made its 2024 ambitious timeline. Because of these doubts, there was minimal impact on its stock price.

It is disappointing that the company could not hit its year-end target. Especially since this means it won’t be able to bid for the first round of national security launch contracts for medium-lift vehicles. However, as an investor, I am happy that Rocket Lab has decided to take the prudent approach. Building rockets is a complicated endeavor and I would rather management be completely through and get it right rather than try to rush things and have a disaster at launch. This is especially true considering that there have been a few high-profile failures in the spacecraft industry in recent years. Most notably the Boeing Starliner (BA) disaster a few months back.

However, by all accounts, the development of the Neutron seems to be proceeding quite well. The company was able to get past a significant milestone when it successfully hot-fired Neutron’s new rocket engine. The new Archimedes engine performed well in the test according to the company’s press release as it met its key technical objectives such as reaching 102% power. This engine is a key component for the Neutron, as it operates at lower stress levels, allowing “rapid and reliable reusability”. According to CEO, Peter Beck;

“Hot firing Archimedes is a major development milestone for Neutron and our team has done it on an accelerated timeline. Taking a new staged combustion liquid rocket engine from cleansheet design to hot fire in just a couple of years is industry-leading stuff. We’ve been consistently impressed with the performance of Archimedes in test, including with this hot fire, so with this critical milestone completed, we move into production of flight engines confidently and begin to close out the qualification test campaign in parallel to really hone performance for launch next year. From the day we started designing Archimedes we focused on delivering a flight engine, rather than early-stage prototype destined for multiple reworks and adjustments, so it’s gratifying to see this strategy bear fruit.”

Investor Presentation (Rocket Lab)

Apart from the Neutron, Rocket Lab continues to do well with its other services. Its current rocket, the Electron, is a success as it is the most frequently launched small rocket globally. In fact, 64% of all non-SpaceX orbital launches have used the Electron. The company most recently deployed its 53rd Electron mission for five Low Earth Orbit satellites. In my view, management is on top of their game and the company continues to impress in a technically difficult industry.

Valuation and Conclusion

With the most recent financial results and stock price run-up, Rocket Lab’ Seeking Alpha quant metrics have seen some improvement. This is most noticeable in its Quant valuation grade, which has shifted from “C+” to “B”. The company is trading at a TTM and forward price-to-sales ratio of 14.6x and 11.4x, respectively. In my view, the company’s fast-growing revenues justify this high valuation.

As mentioned in my previous article, the company has a substantial backlog. It has also been able to continue winning business, such that its backlog even increased slightly to $1.07 billion from $1.04 billion. Management expects 44% of this backlog to be recognized in the next 12 months.

Rocket lab maintains ample liquidity as well. Based on the latest information, the company has $751.8 million in current assets. Of which, $340 million is in cash and $155.8 million is in marketable securities. This cash is higher than the $162 million in cash and $82.2 million is in marketable securities reported at the beginning of the year, proving the company has more than enough liquidity in order to execute its ambitious plans.

The key risk for the company though will be its Neutron project. Simply put, the company will need to execute; otherwise it could see its share price tumble. However, given that the Neutron is still expected to launch in mid-2025, there are still a few months until then for the hype to build around Rocket Lab. As I mentioned before, as one of the few listed public shares to gain exposure in the burgeoning space industry, Rocket Lab in my opinion, could be an interesting pick even as the price has surged. There are a myriad of execution risks for a company in this industry; however, I have been very impressed with management so far, and I would like to maintain this Buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RKLB either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.