phillyskater/iStock Editorial via Getty Images

- Loop Capital Markets on Wednesday upgraded home improvement retailers Home Depot (NYSE:HD) and Lowe’s (NYSE:LOW) to ‘buy’ from ‘hold’ following recent store checks and management conversations.

- LOOP’s price target on HD is raised from $360 to $460, and for Lowe’s from $250 to $300 as the Fed moves to lower interest rates.

- LOOP’s F2024 revenue estimate is unchanged, despite a likely lift from recent storm damage. The storms May well disrupt current quarter sales, but LOOP expects investors to look beyond this to a future demand lift.

- LOOP is pleased with the quick resolution to the port strike, as it saw a prolonged strike as a material risk, and raises F2025 estimates on the back of recent extreme weather and an easing rate cycle. LOOP’s F25 EPS estimate for HD is 44 cents ahead of consensus.

- For Lowe’s LOOP is six cents above consensus.

- The brokerage is more bullish on Home Depot (HD) given the incremental growth opportunity it sees following the SRS acquisition. LOOP expects HD’s long-term growth to accelerate into the high-single digits, compared to LOW (LOW) in the mid-single digits.

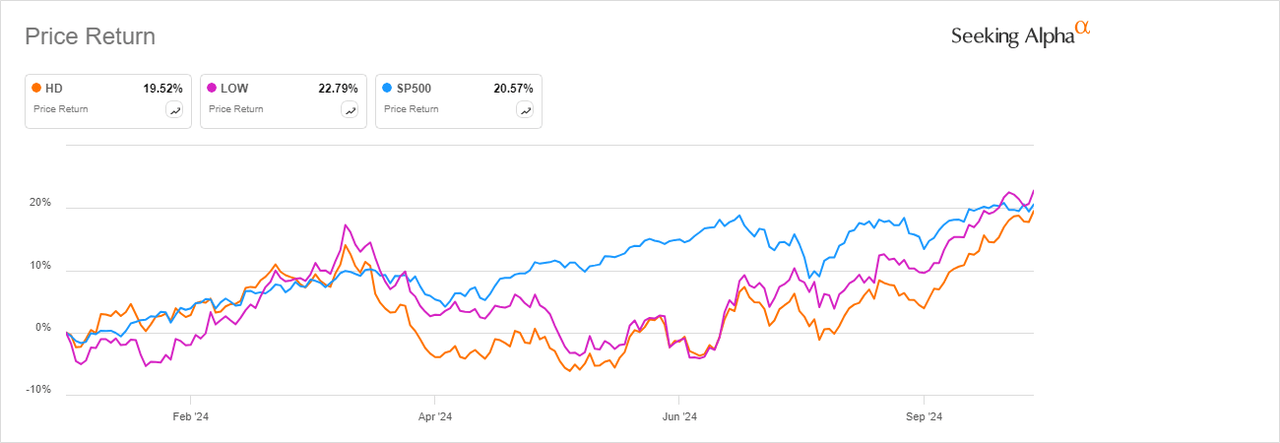

- On a YTD basis, Home Depot (HD) and Lowe’s (LOW) have advanced 19.5% and 22.8% respectively.

-

Oppenheimer recently upgraded Lowe’s Companies (LOW) to an Outperform rating after having it set at Market Perform.