Summary:

- The story of activist fund Starboard Value taking a $1 billion position in Pfizer is grabbing headlines the last few days.

- However, no good new solutions are being offered, at least according to the stories and articles that have surfaced since the stake was first mentioned.

- Additional cost cutting, more share repurchases, or management and board changes are unlikely to make a change for the better at Pfizer.

- Starboard’s previous biopharma activist campaigns have been unsuccessful, casting doubt on their ability to drive positive change at Pfizer.

- I remain bullish on Pfizer’s long-term growth, based on a return to growth and potential multiple expansion, as well as improvement in the financials through cash flows and debt reduction.

JHVEPhoto

The story of activist fund Starboard Value taking a $1 billion position in Pfizer (NYSE:PFE) and reaching out to former CEOs for advice is grabbing headlines the last few days.

The articles I have seen are pointing out the issues the company has and the missteps it made, but no good solutions are offered. At least no solutions that the company is not already trying to implement – cutting costs, shedding low probability of success clinical programs, share buyback program, although the repurchases are suspended until the debt position comes down following last year’s acquisition of Seagen. The change in business development strategy was also mentioned, but since the company’s balance sheet is stretched, there is not much to change on that front.

More cost cutting?

Pfizer has made two cost cutting rounds already with $4 billion in expected net savings by the end of the year and another $1.5 billion by 2027. Can it do more? Yes. But at some point, cost cutting can make more harm than good, and we may be past that point already.

Management has already been chastised for out-licensing U.S. and Japan rights to a TL1A antibody called RVT-3101 to Roivant Sciences (ROIV) because Roivant quickly turned around and earned more than $5 billion by selling the candidate to Roche (OTCQX:RHHBY) for $7.1 billion. Pfizer did keep 25% of the asset and earned approximately $1.8 billion from the deal, and it kept the ex-U.S. and ex-Japan rights, but all investors saw was that it lost more than $5 billion by giving these rights to Roivant. This is, of course, hindsight bias, and no one could have known with certainty that this asset would be worth so much shortly after Pfizer gave the asset to Roivant.

Another asset that Pfizer gave to Roivant is the TYK2/JAK1 inhibitor brepocitinib and it could very well turn out as another significant lost opportunity as Roivant reported positive phase 2 results of this candidate in non-infectious uveitis earlier this year and it will report the phase 3 results in dermatomyositis next year. Roivant also has plans to explore brepocitinib in other indications.

I am mentioning these deals with Roivant as examples of cost cutting. Pfizer did not want to invest hundreds of millions of dollars to conduct phase 2 and phase 3 trials of RVT-3101 and brepocitinib and it decided to keep some of the economics and let Roivant cover the cost and take the clinical trial risk.

If Pfizer cuts spending even more, the risk of letting go of additional promising clinical programs would increase, and workforce reductions can negatively impact morale and lead to loss of key talent to competitors. I do not really see more cost cutting as a solution.

Changes to business development strategy?

With more benefit of hindsight, some deals should not have been made. The Roivant deal on RVT-3101 from the previous section that I mentioned with Pfizer being the seller is one example, but there are others with Pfizer being the buyer.

Case in point is last month’s voluntary withdrawal of Oxbryta from global markets due to an imbalance of vaso-occlusive crises and deaths which also creates doubt about the next-generation candidate osivelotor Pfizer gained from the $5.4 billion acquisition of Global Blood Therapeutics. In all likelihood, this acquisition will be marked down to zero. But that is the risk in the biopharma industry. Pfizer acquired Global Blood Therapeutics two years ago with a product that has been on the market since 2019, meaning this issue was identified unusually late in the product’s life cycle.

The big bet on Seagen is also being criticized, but the jury is still out and it will take years before we see whether the deal was worth making or not. I still have a favorable view on this deal and believe Seagen will be a big long-term driver for the oncology business in the next 10+ years.

But this is also the company that brought the COVID-19 vaccine and COVID-19 treatment Paxlovid to market and that created the revenue windfall that the company used to significantly expand the product portfolio and pipeline in the last three years. The COVID-19 vaccine was a business development deal with BioNTech (BNTX), and it is one of the best ones any company in this industry has made in quite some time.

You cannot just cherry-pick bad deals and criticize the company for them.

One big mistake I believe the company is actively making is insisting on oral obesity drugs. The first oral GLP-1 candidate lotiglipron was discontinued last year due to liver toxicity, and the second one danuglipron is still alive, but with tolerability baggage that the company is trying to address by another dose optimization study. I believe the company should actively try and find injectable incretin candidates, and that it should expand beyond incretins as multiple additional and promising mechanisms are emerging that can act standalone or in combination with the incretin class of drugs. Interestingly, while the company has not been shy about doing deals, it is very shy about doing deals in an area where the upside potential is the highest. If I were Starboard, this is where I would push for a more aggressive and broader development strategy.

However, Starboard is a value fund, so, I doubt my suggestion is something that is motivating their activist stake or that this is something they will push for.

More aggressive share buybacks?

Pfizer has an active share buyback program, but the company said it will not be doing any share repurchases this year as it wants to reduce its net debt position. I think this is a reasonable decision. And while Starboard may push for a more aggressive buyback program, it will not change the underlying business, nor will it change the long-term outlook.

Board and management changes?

This is, perhaps, the only real way to make changes, or at least to have an appearance of change. Is Albert Bourla the best CEO in the industry? Probably not. Is he, the board, and the management team incompetent? I do not believe that is the case.

Nobody is perfect, but overall, I think this team has done a decent job running the company. Filling a revenue hole as large as Pfizer had in the last two years with the declining COVID-19-related sales is a near-impossible task. No other big pharma company had a product launch that was as successful in the last few years to plug that kind of a revenue hole. Not even Eli Lilly’s (LLY) and Novo Nordisk’s (NVO) obesity drugs.

Starboard’s track record in the biopharma industry

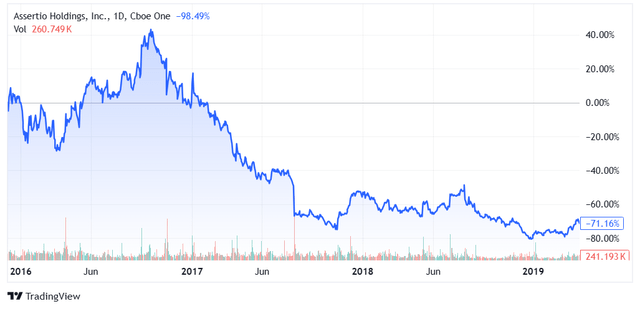

I am old enough to remember when Starboard had an activist campaign in Depomed, the company that carries the name Assertio Therapeutics (ASRT) today. Depomed made an agreement with Starboard and the board of directors was revamped, but their efforts did not bear fruit and they lost a lot of money on Depomed. Starboard held Depomed from March 2016 through September 2018, and while I do not know the actual P&L for Starboard, the stock lost approximately two thirds of its value during this period. I actually lost some money holding Depomed alongside Starboard at the time, though I was long prior to their involvement and exited my position well before they gave up.

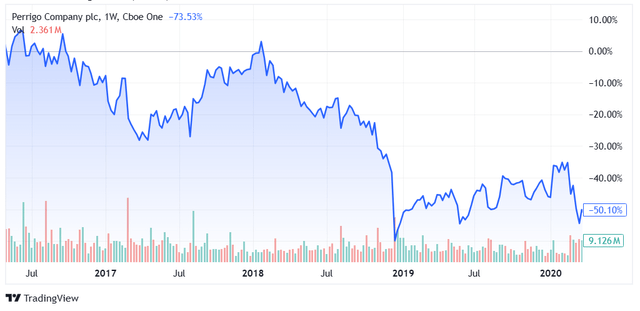

During this time, Starboard also initiated an activist stake in Perrigo (PRGO) and also made a deal to revamp the board of directors. This was another unsuccessful campaign and Starboard ended up holding on to a losing position for approximately three years and exiting in the fourth quarter of 2019. The share price of Perrigo declined approximately 50% during this period.

In 2019, Starboard tried to prevent Bristol-Myers Squibb from acquiring Celgene for $74 billion and shared a lengthy presentation on the reasons the deal should not be consummated. But the effort failed and Starboard quickly gave up.

I am not aware of other examples of Starboard’s activism in the biopharma industry, and granted, this is a small number of activist campaigns to really call this a track record, but it is zero out of three, and I am doubtful Starboard Value is the right activist to make a positive change at Pfizer, even if it asks the former CEOs for help.

Conclusion

The disappointment over Pfizer’s share price performance in the last few years is understandable, but I believe the primary source of underperformance is the COVID-19-related revenues falling short of expectations, and I doubt the company could have done a lot more to prevent this. I do not believe Starboard or other activist investors can make a big change at the company, or at least not for the better, and if I were to change anything, I would push for a broader and more aggressive development strategy in obesity, including injectable incretins that the company is stubbornly avoiding.

I otherwise remain bullish on Pfizer’s long-term growth prospects and expect better days ahead for the company and its share price, driven by the return to topline growth and multiple expansion from the current depressed levels, and by an improved balance sheet through cash flow generation and debt reduction.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ROIV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article reflects the author's opinion and should not be regarded as a buy or sell recommendation or investment advice in any way.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I publish my best ideas and top coverage on the Growth Stock Forum. If you’re interested in finding great growth stocks, with a focus on biotech, consider signing up. We focus on attractive risk/reward situations and track each of our portfolio and watchlist stocks closely. To receive e-mail notifications for my public articles and blogs, please click the follow button. And to go deeper, sign up for a free trial to Growth Stock Forum.