Summary:

- Palantir’s stock has surged due to its successful AI integration and the release of the AIP platform, but insider sales signal potential overvaluation.

- Despite strong revenue growth and positive GAAP EBITDA, our valuation estimates a fair share price of $14, indicating a significant downside of -60%.

- Insider sales by Peter Thiel are a critical signal, while Alex Karp’s transactions are less concerning due to offsetting actions.

- Given the overvaluation and significant insider selling, we recommend considering selling PLTR shares, despite the company’s promising AI products and growth trajectory.

Luke Sharrett

Investment thesis

After so much hype around AI chips, investor attention is starting to shift from hardware to software. Palantir (NYSE:PLTR) is one of the companies that has managed to incorporate AI into its products, and judging by the company’s many customer testimonials, it has done so very successfully.

And the market has noticed that. Thanks to the release of the AIP platform and the AI boom that followed, the company’s stock has risen from ~$8 (April 2023) to ~$40 (October 2024) over the past ~1.5 years, and since the beginning of the year, the stock is up more than +130% (which is close to NVIDIA’s +150%YTD).

Investors were also pleased with the recent news of the company’s inclusion in the S&P 500 index.

Recently, however, it has been quite common to see articles about insider sales of hundreds of millions of dollars worth of Palantir stock by Alex Karp and Peter Thiel. So, should you follow their lead and sell the stock for a profit? Yes, and in this article we will explain why, both by calculating the fair value of the stock and by analyzing insider sales of the company’s stock.

Business overview

Since its founding, Palantir has grown from a single client represented by the CIA to hundreds of government and commercial clients. For those who are interested, the full story of the company’s founding can be read in this Forbes article.

As the company’s homepage currently states:

Palantir has one of the strongest offerings in the AI/ML space, with a vision and roadmap to create a platform that brings together humans and machines.

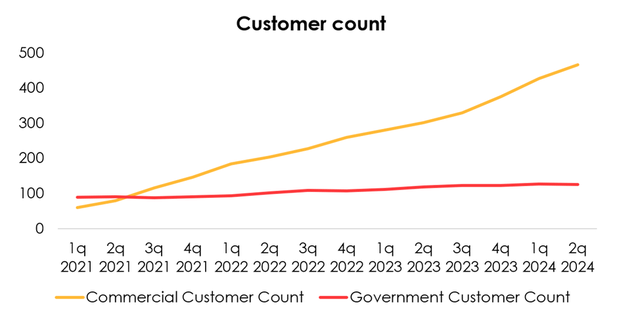

To date, the company’s revenues are generated by two segments: government and commercial. It is the commercial sector that is the catalyst for the company’s revenue: according to the results of Q2 2024, the number of customers in it amounted to 467 (+55% yoy), and in the public sector – 126 (+6% yoy).

Since Q3 2023, there has been an acceleration in the growth of commercial customers, thanks to the new AIP platform announced in April 2023, which has more and more satisfied users over time. At the same time, Palantir is promoting this platform in a unique way – through bootcamps. In short, instead of sending a sales team to spend a long time explaining why their software should be used by the client, Palantir organizes regular (even daily) seminars/workshops where attendees can learn how to implement the software in their exact business. For each, Palantir does the following:

1. Explains and demonstrates the capabilities of its AI platform through real-world examples

2. Personally develop initial use cases for the participants of this software

3. Teaches them how to use it

So, a company can come to the bootcamp with a specific desire to improve something in their business, and in 1-5 days of working with Palantir engineers, develop a solution for it using AIP. So, in less than 2023, the company has held 414 bootcamps, and they continue to be so popular – companies are lining up to get into Palantir’s bootcamp.

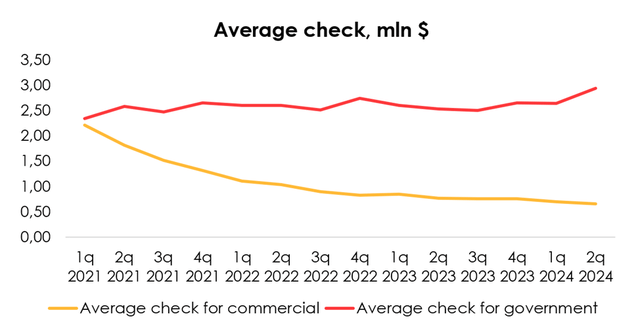

As a result of the large number of commercial companies attracted by bootcamps, the average check in this segment is increasingly blurred and gradually declining.

Palantir’s financial results

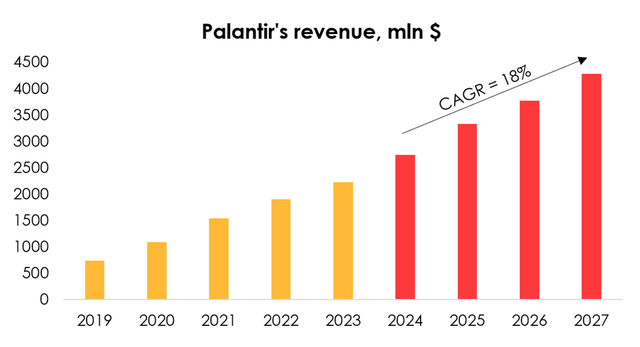

We have built a financial model based on the following:

- The number of commercial customers will continue to grow at a high double-digit rate YoY, gradually declining to 20% YoY by mid-2026. The number of government customers will grow moderately, in the range of 5-10% YoY.

As we said, the company initially worked only with government customers, slowly but surely increasing its customer base. For reference, the first and only customer during 2005-2008 was the CIA. Over the past ~3 years, the average growth rate in the number of government customers has been ~13%. We do not expect the number of government customers to exceed these growth rates due to the unique nature of the industry.

The commercial segment is quite new for the company, the players in this segment have more flexibility in their decisions and, in general, we assume that there are many more potential customers in the commercial market. Because of these factors, and because of the popularity of bootcamps among them, we expect the growth rate in the number of commercial customers to be significantly higher than the growth rate in the number of government customers.

- The average check of commercial customers will continue to decline moderately before stopping its decline. The average check from government customers will remain the same YoY, as GSA contracts are signed with government customers, the price for them cannot fluctuate much and is the “prenegotiated the lowest price”.

Thus, we expect Palantir’s revenue to be $2.75 mln (+23% YoY) in 2024 and $3.33 mln (+21% YoY) in 2025.

Company data, Invest Heroes calculations

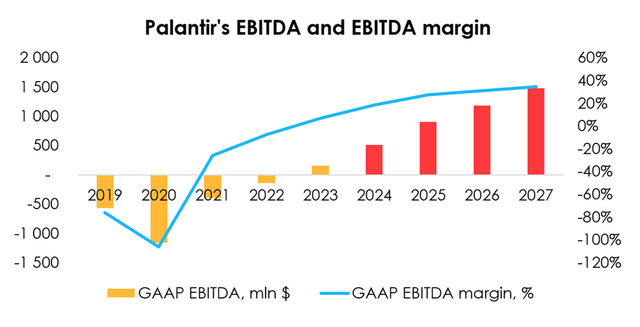

- S&M costs have been Palantir’s largest operating expense to date (although they have been gradually declining in recent years), and we expect them to continue to gradually decline as a percentage of revenue, reaching 20% of revenue by 2027.

- We expect R&D costs to normalize near their current level (16% of revenue in Q2 2024).

- G&A costs will also return to a normalized level of 15% of revenue (by Q2 2025).

- Operating margin will increase by about 3.5% QoQ (based on its average growth over the last 3.5 years)

As a result, we expect the company’s GAAP EBITDA to be $513 mln in 2024 (+235% YoY) and $909 mln in 2025 (+77% YoY).

Company data, Invest Heroes calculations

Valuation

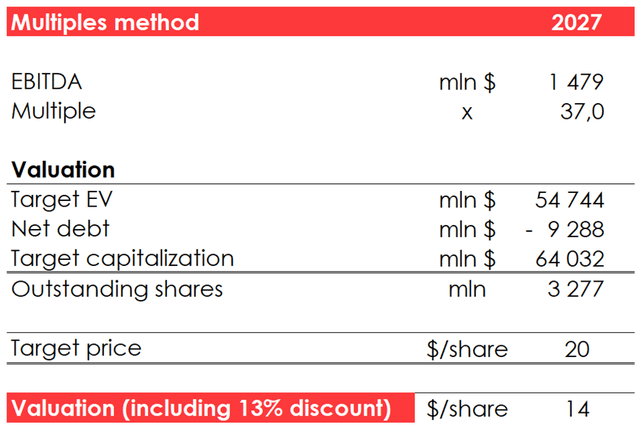

As seen above, 2023 was Palantir’s first year of positive GAAP EBITDA, so it is not possible to calculate historical EV/EBITDA multiples until 2023.

As for competitors, our analysis did not reveal any publicly profitable companies similar to Palantir, which also makes it impossible to analyze the fair multiples of the company’s direct competitors.

In this regard, we used a historical average base multiple for profitable companies in the technology sector and multiplied it by Palantir’s expected GAAP EBITDA CAGR over the 2024-2027 period. This resulted in an EV/EBITDA multiple of 37x.

Let us clarify that in the valuation table below, we refer to net debt as the company’s projected net debt and that the brackets characterize negative numbers. Negative net debt is actually a positive monetary position. By subtracting the lower FCF from the actual current net debt (implying that the entire FCF amount will be used to repay it), we increase the net debt forecast.

Using the EV/EBITDA multiple approach, we estimate a fair share price of $14. The rating is SELL.

The price of $14/share was achieved by computing the target price based on 2027 financial results, which were projected using the EV/EBITDA method and discounting it to the FTM price at the rate of 13% per annum.

The discount rate of 13% is the average growth of the S&P 500 Index over the past 20 years. In other words, when we value a company based on its long-term results, it is important to us that the company’s growth exceeds the average growth of the index.

Does insider stock selling really mean anything?

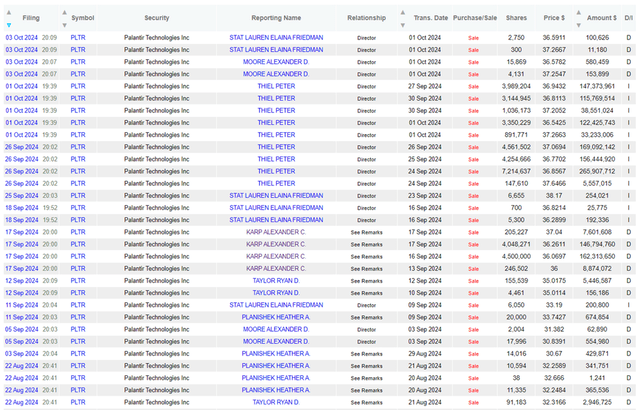

There have always been insider sales of Palantir stock, as you can see in the chart below, just like at any other company, as this is often the normal cashing out of earned money that were not received in the form of salary, but in the form of SBC.

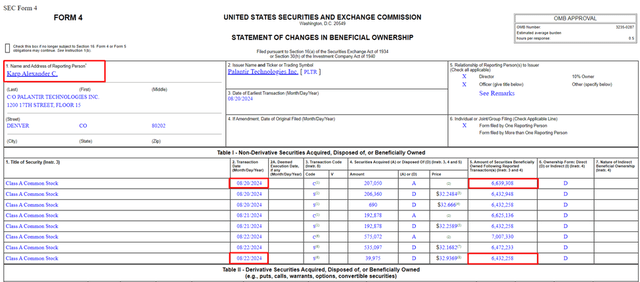

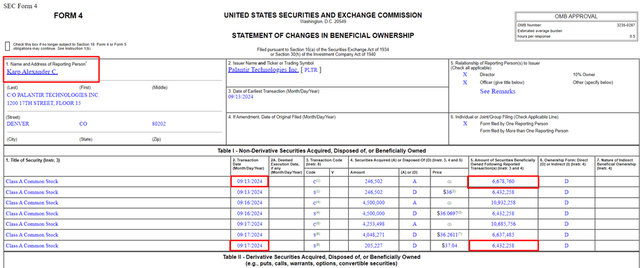

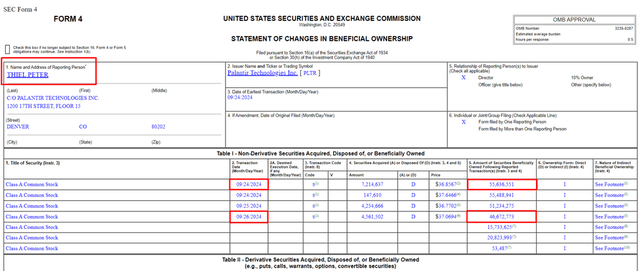

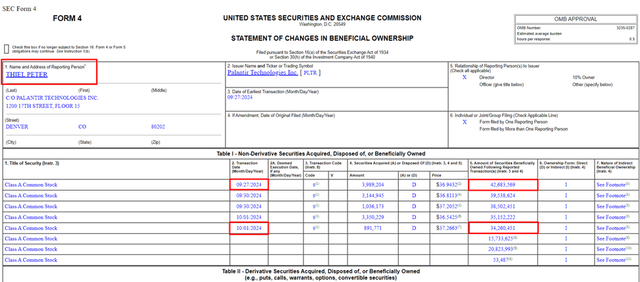

Recently, you could see articles about the insider sales of Alex Karp and Peter Thiel of Palantir shares worth hundreds of millions of dollars (here and here, and so on). In the image below, you can explore the list of insider sales for the last ~1.5 months.

But let’s find out, are insider sales really that scary?

- A 1998 NBER study suggests that insiders tend to behave contrary to the market. When stocks go up, insiders sell, and vice versa. This is logical, since insiders tend to cash out more expensively when the company is doing well. At the same time, insider selling is much less effective at predicting stock prices than insider buying. This is because insider sales are not made due to a loss of confidence in the company, but rather to enrich themselves. Insider purchases, on the other hand, are much more informative because insiders only start to invest their money in the company when they have confidence in it. And insiders usually buy when the stock is falling.

- A 2004 study in the Financials Analyst Journal complements the earlier NBER study. The authors find that it matters how large a block of shares insiders buy or sell in the market. If an insider owns a large stake in a company and sells a relatively large block of stock relative to his stake, then the stock really does fall further later. Conversely, if an insider buys a large number of shares relative to his or her stake, the stock will tend to rise. The sale of a relatively small block of shares has an inverse correlation with the dynamics of the share price, i.e. in the case of spot sales of small packages, the share price will grow.

- A more recent study from 2023 in the Journal of Banking & Finance confirms the above conclusions and complements them by correlating them with investment bank recommendations. Overall, insiders buy more shares after analysts’ recommendations go down and sell more shares after they go up. This pattern holds even after controlling for analysts’ momentum and insiders’ contrarian trading preferences. It should be noted that analyst recommendations rise and fall in the wake of stock momentum. Therefore, the authors suggest that insider buying may be the only strong signal that replaces the informative recommendations of analysts.

Conclusion: Insider purchases and sales are an important information signal when these transactions are large relative to the current volume of the insider’s shares. In other cases, it is worthwhile to consider insiders’ actions as white noise, since they act in contrast to the stock’s movement and do not predict the stock’s future dynamics.

Let’s take a closer look at the sales of Alex Karp and Peter Thiel:

1. Alex Karp

Alex Karp’s recent sales indicate that he sold Class A Common Stock, but later exchanged Class B Common Stock for Class A Common Stock and ended up with the same number of securities beneficially owned. Thus, on August 20, 2024, Alex Karp owned 6.6 million shares of Class A common stock, and on September 17, 2024, he owned 6.4 million shares of Class A common stock.

2. Peter Thiel

Peter Thiel acted differently, and in just one week from September 24, 2024, to October 1, 2024, Peter Thiel reduced the volume of his Class A Common Stock from 55.6 million shares to 34.3 million shares.

Thus, Peter Thiel’s sold stake in Palantir is a large stake relative to the number of shares he previously owned, which is an important information signal. However, Alex Karp’s shareholding did not change because all the Class A Common Stock sold was offset by Class B Common Stock.

Upside risks

We see the following key upside risks:

1. Mass deployment of the AIP

As we mentioned earlier, investor attention is starting to shift from hardware to software. After all the hype around generative AI, more and more companies are wondering when AI will become not just expensive, but useful, and not just solve basic, even typical, tasks and respond with simple text, but have accurate, complete, and visualized answers to the problems they are asked to solve.

That’s what AIP is for, and that’s why it is, and it will continue to be the primary driver of Palantir’s revenue (especially commercial revenue). We expect the number of commercial customers to grow by an average of 53% year over year in 2024 and by an average of 37% year over year in 2025. While these are relatively high numbers, if Palantir can grow its customer base faster, all else being equal, we will raise our price target on PLTR.

2. Operating margin expansion

Again, the widespread adoption of AIP with well-structured operational processes can lead to a significant increase in margins. Given that Palantir’s operating margin only turned positive 1.5 years ago, an acceleration in margin expansion would not only be an upside risk but also a positive signal for investors.

The actual increase in the company’s operating margin and the subsequent signal of further growth will lead to an increase in our operating profit forecast for Palantir. This will lead to an increase in the EBITDA forecast and the EV/EBITDA forward multiple, and a corresponding increase in the PLTR price target.

Conclusion

So two facts are a “YES” to the sale of Palantir stock if you have it in your portfolio:

1. The sale of shares of the company by the insider for a large amount relative to the current volume of the insider’s shares, which is an important information signal;

2. The fair value of the company’s shares, according to our calculations, is $14, which represents a significant downside of -60%.

Fundamentally, we like the product that Palantir makes, but the even double-digit year-over-year revenue growth rates embedded in the financial model and the gradual improvement in profitability do not support a high fundamental valuation of the company’s stock. As a result, we believe that the company’s shares are overvalued and we assign a SELL rating.

So we are not saying that Palantir’s stock is going to go down. But based on our fundamental analysis, we believe the stock is overvalued by the market and trading above its fair value. Insider selling is also an important signal.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.