Summary:

- After its latest slide, I’m upgrading Snowflake to a buy rating, with a $154 price target (~35% upside from current levels).

- SNOW has hit a very opportune valuation at <8x forward revenue, while many software peers with a similar growth profile are still trading at a low/mid-teens multiple.

- Revenue growth is still strong in the high-20s, while new client adds and revenue retention rates also remain promising.

- The company has leaned in on its AI strategy, believing that AI applications need to work closely in tandem with their data platforms.

sakkmesterke/iStock via Getty Images

Snowflake (NYSE:SNOW) serves as a great reminder to all of the hot AI stocks of today: investment fads in the tech world are often quite short-lived. It’s difficult to remember this now, but cloud data warehousing stock Snowflake was once one of the hottest trades on Wall Street during the pandemic, with shares at one point reaching just shy of $400.

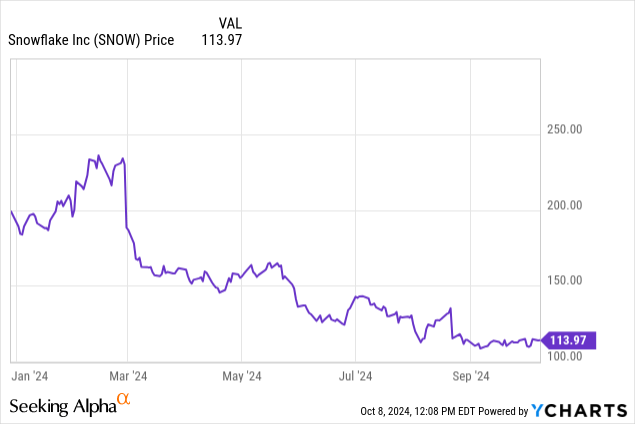

Fast forward to today, and investors have moved onto AI growth stocks and discarded Snowflake on its slowing growth trajectory. At issue is the company’s consumption-based business model and the fact that customers have shrunk their usage in order to preserve their IT budgets. This year alone, shares of Snowflake have shed 40% of their value.

Upgrading Snowflake to a buy after its latest slide

I turned wary on Snowflake when it hit YTD peaks in the mid-$200s earlier this year, and I last wrote a cautious neutral article in July, when the stock was still trading in the mid-$130s. Now, however, after Snowflake’s shares have finally dipped below my key $120 levels after a decent but overall disappointing Q2 earnings release and plans for a $2 billion debt raise, I am finally advocating for a buy on Snowflake.

One key thing to note here: alongside its Q2 earnings print, Snowflake announced that its board authorized an additional $2.5 billion for share repurchases, on top of the $492 million (of an original $2 billion amount) that was remaining under the existing repurchase agreement. The ~$3 billion of gunpowder that Snowflake now has for repurchases represents a healthy ~8% chunk of the company’s current market cap (though one could argue that the company was too hasty in executing the first ~$1.5 billion in repurchases as the stock kept falling). The $2 billion debt offering, which takes a convertible structure with minimal interest and deferred maturity (2027 and 2029), will be used in part to finance these buybacks. To me, this is an opportune time to buy back Snowflake shares while it’s undervalued, and reflects management’s confidence in turning around the ship.

Here is my updated long-term bull case on Snowflake:

- Powerful expansion engine. Unlike many software companies, Snowflake stresses that it is not SaaS, nor is it a subscription company. As its customers’ data volumes grow, so does its billings; which positions Snowflake for tremendous expansion potential within the existing customer base.

- Massive TAM that is still growing. Snowflake estimates its overall cloud data platform TAM at $342 billion by 2028, which is double the market size of 2023. This also suggests that at its current scale of ~$4 billion in annual revenue, Snowflake is barely more than 1% penetrated into this market.

- AI tailwinds. Data, and an efficient data management strategy, is the backbone of speedy AI models. Snowflake firmly believes that AI applications need to run close to their data platforms, necessitating thoughtful spend on data platforms like Snowflake. Snowflake’s hiring of Sridhar Ramaswamy as CEO in February of this year also indicates the importance that the company is placing on its own AI strategy.

- Secular tailwinds in both cloud adoption and data volume growth. In addition to AI, Snowflake also benefits from two ongoing and important trends in computing that predominated long before AI took center stage: the moving of technology assets into the cloud, as well as data volumes exploding as companies seek to understand everything they can about their customers. Snowflake’s usage-based pricing model helps the company to capture tremendous upside here.

- Cash-rich. The company has nearly $4 billion of cash on its books, which is tremendous firepower for share buybacks and potential acquisitions to chase growth.

Stay long here and use the dip as a buying opportunity.

Q2 download

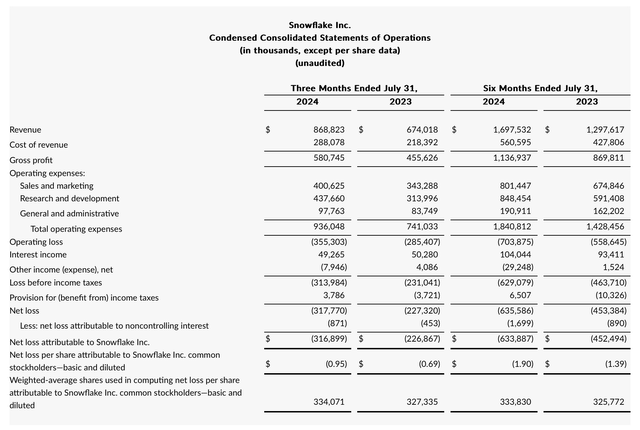

Let’s now go through Snowflake’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Snowflake Q2 results (Snowflake Q2 earnings deck)

Snowflake’s revenue grew 29% y/y to $868.8 million, exceeding Wall Street’s expectations of $850.7 million (+26% y/y), while also decelerating two points from Q1’s 31% y/y growth rate. As a reminder here: Snowflake’s quarterly revenue growth rates are far more likely to be lumpier / less stable than other software companies, as a result of its consumption-based business model. The majority of software companies that run a SaaS business model won’t see as much jumpiness because licenses and seats sold don’t tend to move around much unless customers have massive layoffs or massive hiring sprees: but in a consumption-based model, customers’ decision to ingest more data could suddenly cause a spike in growth. This is one reason that we don’t think Snowflake is fated to keep dropping in the long haul. Budget concerns amid the current macro situation are holding back clients’ spending, but over time as secular trends toward data volume growth and AI needs dominate, clients will eventually be spending again.

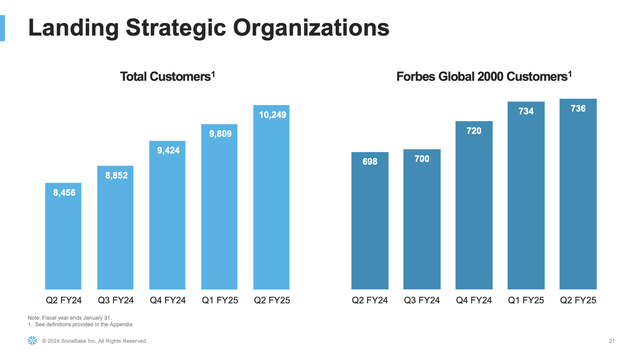

Snowflake’s business consists of two key drivers: “land” and “expand,” similar to other software models. Even amid tougher times, the company continues to do both. In Q2, the company ended with 10,249 total customers, adding ~450 net-new customers in the quarter and growing its customer base 37% y/y. Still, the company has roughly two-thirds of the Global 2000 that it could still sell into.

Snowflake customer trends (Snowflake Q2 earnings deck)

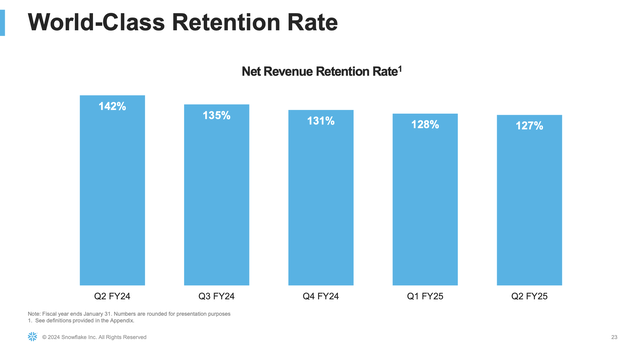

On the retention side, as previously mentioned, Snowflake’s expansion rates have fallen this year as existing customers have optimized their spending. But we do note that revenue retention rates are beginning to show signs of stabilization in the high 120s. And we note that a 27% net expansion is still much better than many SaaS-based companies that are reporting a mid-teens expansion profile. It’s not just Snowflake that’s suffering in the current macro: even subscription-based companies are seeing weaker retention rates because its clients are cutting headcount or seat counts.

Snowflake retention rates (Snowflake Q2 earnings deck)

The good news is that Snowflake isn’t seeing macro impacts getting any worse. On the Q&A portion of the recent Q2 earnings call, CFO Mike Scarpelli noted that the company is seeing signs of “normal” buying patterns:

Yes, I’ll just say, orders showed from a bookings standpoint that it’s a normal environment and we are very pleased with the deals we closed in the quarter. I don’t see it any worse. It’s not euphoric or anything, but it’s very stable customer buying pattern we’re seeing. And in terms of consumption trends, obviously, we just guided our revenue right now for the quarter. We’ve beaten, we’ve raised the full year as well too, and that’s seeing the consumption trends up through this week. So, we’re pleased with that right now with what we’re seeing.”

To me, this indicates that Snowflake has plenty of room to surprise us to the upside, especially as its Q3 guidance calls for only 22% y/y revenue growth, and next year’s consensus also calls for 23% growth. Snowflake tends to start initial deployments small, but once the company’s new customers start using the platform more, they become more meaningful contributors to revenue. The company notes that it’s pleased with new customer additions, which will become more material on revenue in FY26.

One “watch list” item that we continue to be concerned about is Snowflake’s margin profile. Pro forma operating margins continued to recede. Though Snowflake 5% pro forma operating margin is still positive, it’s 3 points worse y/y relative to an 8% margin in the year-ago Q2. The company keeps hiring, and isn’t executing any layoffs like many of its struggling peers. It’s a move that demonstrates confidence in a recovery, to be sure, but we’d also prefer the company to be more conservative and see operating margins expanding while growth is slowing down.

Valuation and key takeaways

At current share prices near $114, Snowflake trades at a market cap of $38.20 billion. After we net off the $3.93 billion of cash on its latest balance sheet (currently unencumbered of debt before the convertible notes are issued), its resulting enterprise value is $34.27 billion.

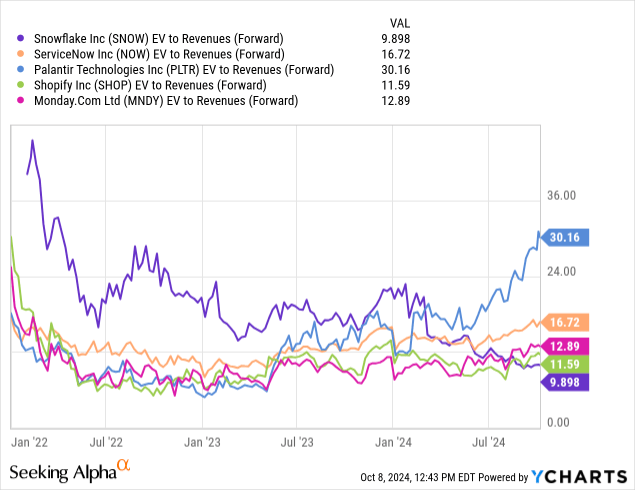

Meanwhile, for next year FY26 (the year for Snowflake ending in January 2026), Wall Street analysts have a consensus revenue target of $4.33 billion for the company, or 23% y/y growth. This puts Snowflake’s valuation at 7.9x EV/FY26 revenue, a sharp cry from when Snowflake traded at multiples in the high teens.

We note that many of its fellow software stocks that were also popular in the pandemic have maintained bloated valuation multiples, like Palantir (PLTR) – whose current growth rate in the mid-20s is even slightly below Snowflake’s. A number of other software companies with mid-20s growth have also held on to elevated revenue multiples:

My 12-month price target on Snowflake is $154, representing 11x forward revenue (still more modest than peers above) and ~35% upside from current levels. Use the dip here as a well-timed buying opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of SNOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.