Summary:

- AMD is leading the pack in challenging Nvidia’s crown in AI chips.

- AMD faces significant challenges in untethering Nvidia’s system dominance. However, its acquisition of ZT systems has strengthened its hand.

- The market expects AMD’s forward outlook to improve further, justifying its recent recovery and market outperformance.

- AMD’s growth-adjusted valuation metrics suggest it remains relatively attractive, and the stock is still well below its March 2024 highs.

- I explain why AMD investors who missed buying its August and September 2024 lows shouldn’t wait any further to add more exposure.

JHVEPhoto

AMD: Outperformed The S&P 500 Confidently

Advanced Micro Devices, Inc. (NASDAQ:AMD) investors who capitalized on the collapse toward its August 2024 lows have significantly outperformed the S&P 500 (SP500). AI investors have lifted the stock of AI infrastructure companies, and the market seems unperturbed by fears of AI fatigue. Nvidia’s (NVDA) recent conference has corroborated the start of shipping its Blackwell chips, as the company touts its significantly improved power efficiencies. In addition, the AI monetization theme has also gained increased traction, as the leading software companies need to justify their capabilities to sustain the AI growth inflection.

In my previous bullish AMD article, I urged investors not to give up even as the stock suffered a hammering and entered a deep bear market. I highlighted AMD’s attractive valuation metrics, suggesting the pessimism was likely overstated. Therefore, I’m unsurprised by its recent market outperformance, as investors realized that the AI upcycle has shown little signs of slowing down.

AMD Remains A Distant Second to Nvidia

As one of the leading AI chips companies challenging Nvidia’s throne, AMD is a distant second in the race. It also needs to compete against the rise of custom silicon, which is anchored by the dominance of Broadcom (AVGO) and Marvell (MRVL). Notwithstanding these challenges, Wall Street is increasingly confident in AMD’s ability to gain more market share in data center AI chips. However, questions remain on whether AMD could replicate the massive market share gains it managed in the data center CPU segment (reaching a low 30% share). The company is also confident of progressing in the enterprise market, given its already robust penetration in the hyperscaler business (at or above 50% share).

However, I assess that AMD and Intel (INTC) will likely face monumental challenges against Nvidia, as the Jensen Huang-led company aims to penetrate the enterprise base further with AI chips. Nvidia needs to justify its high-growth profile, even as the aggressive investments by its hyperscale and big tech customers should continue to underpin the market’s confidence. However, enterprise AI adoption has been somewhat more cautious, corroborating the potential risks of AI infrastructure overinvestment.

AI Upcycle Should Lift Most Boats, Including AMD’s

Notwithstanding these near-term challenges, the market is likely confident about an upgrade to AMD’s AI revenue outlook of $4.5B, given the massive requirements for LLMs upscaling. The much-increased power requirements underpinning the AI revolution have bolstered the sustainability of the AI growth thesis. Hence, AMD seems well-positioned to gain more share in a rapidly evolving market. CEO Lisa Su’s confidence in its recent acquisition of ZT systems highlights the progress made against Nvidia’s system dominance. However, unless management telegraphs a much-improved outlook on AI revenue growth prospects, investors must be cautious about reflecting further valuation re-rating potential.

I believe AMD still needs to convince the hyperscalers to diversify their reliance on Nvidia’s market-leading AI chips for a much faster growth re-rating opportunity. However, Nvidia’s ability to innovate and launch new products has quickly intensified challenges for AMD. Moreover, the substantial demand for Nvidia’s AI chips to build mega AI clusters suggests share gains for AMD in the near term are likely limited. Coupled with the start of shipment of Blackwell chips to customers, it has likely dispelled the notion that Nvidia could face significant supply chain challenges, lowering the opportunities for AMD to capture share more quickly.

However, the increased scrutiny by the DoJ against Nvidia’s competitive practices could provide a much-needed tailwind for AMD. However, a probe (if any) is likely still in the earlier stages and could take several years for further investigations to yield a decisive outcome. Hence, I don’t expect significant reallocation opportunities toward AMD, cementing Nvidia’s dominance against its peers.

Despite that, AMD’s conviction that its comprehensive portfolio with hyperscaler and enterprise customers could strengthen its engagement while lifting its AI revenue further. Also, the AI PC upcycle could improve from 2025, although near-term sentiment seems somewhat tepid. Despite that, the market’s confidence in lifting AMD shares recently augurs well for its Q3 earnings release and forward outlook.

AMD’s Potential Growth Inflection Through 2025

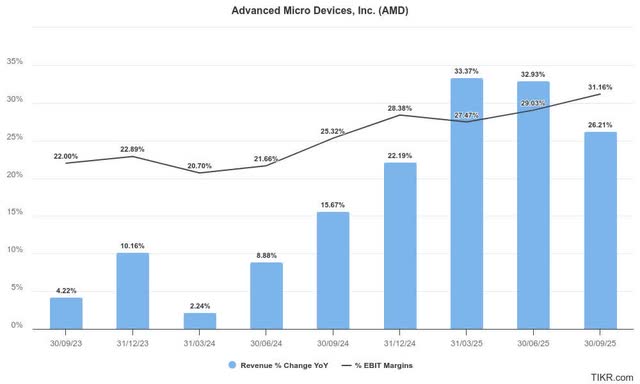

AMD quarterly estimates (TIKR)

As seen above, AMD is anticipated to post more robust revenue growth through 2025, potentially lifting its operating leverage. While the AI PC upcycle has yet to take off, investors have likely reflected improved optimism in AMD’s 2025 performance.

In addition, I assess investor confidence in an improved AI chips outlook for 2025, which seems reasonable, given the “insatiable” underlying demand from the AI infrastructure builders. Also, the AI monetization phase is expected to be bolstered if proof points on productivity gains from AI agents could convince the enterprise base further. Hence, these growth optionalities on an improved market outlook through 2025 should support AMD’s progress in the data center AI market.

Is AMD Stock A Buy, Sell, Or Hold?

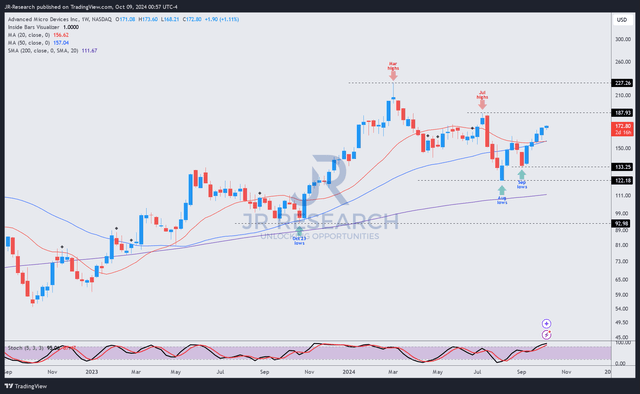

AMD price chart (weekly, medium-term) (TradingView)

Moreover, AMD’s forward adjusted PEG ratio of 1.22 is almost 35% below its tech sector median. In other words, the market has likely not fully revalued its growth prospects, potentially baking in execution risks given its data center CPU exposure.

However, AMD’s price action demonstrates the robustness of its dip-buying opportunities, which underpinned its August lows. Another dip in September also didn’t collapse buying sentiment, as AMD has recovered closer to its previous July 2024 highs.

Notwithstanding the new highs formed by the S&P 500 recently, it’s clear that AMD remains well below its March 2024 highs. Hence, a reallocation toward the leading AI infrastructure stocks could lift AMD further, bolstered by its relatively attractive growth-adjusted PEG valuation metrics. As Nvidia’s recent conference and improved supply dynamics have lifted investor confidence, AMD investors seem well-poised to piggyback on improved market momentum.

Despite that, it’s also critical for investors not to understate the potential for AI overinvestment risks over the next few years. Enterprise adoption is fundamental to the monetization thesis of AI software companies. Hyperscalers are also ramping up their spending, but there are concerns about whether it could justify the CapEx risks, as they could dilute the earnings profile. Hence, slower-than-anticipated hyperscaler spending could spell trouble for AMD, even as it aims to compete against Nvidia’s market leadership in the AI data center market.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!