Summary:

- I reiterate my buy rating for Acuity Brands, Inc. due to expected near-term growth supported by strong data points and a solid balance sheet.

- AYI’s 4Q24 results showed revenue of $1.03 billion, driven by growth in ABL and ISG segments, with strong gross and adj EBIT margins.

- Favorable macroeconomic trends and rising demand for data centers are expected to drive AYI’s growth, supported by a robust cash position for strategic investments.

EschCollection

Investment summary

My previous investment thought on Acuity Brands, Inc. (NYSE:AYI) (published in July) was a buy rating, as I believed the slowdown in growth was temporary and that it should recover eventually as the macro conditions get better. I reiterate my buy rating for AYI as I expect growth to come online over the near term, which is supported by multiple data points. The business balance sheet is also in a very solid position that should enable it to capture any ramp up in growth opportunities.

Q4, 2024 results update

Released last week, AYI 4Q24 results included revenue of $1.03 billion, coming in line with consensus expectation for $1.024 billion. Revenue growth was driven by 1.1% y/y growth in the ABL segment and 17% y/y growth in the ISG, driving revenue to $955 million and ~$84 million, respectively. By sales channel, retail channel sales saw $43 million, down 8.6% y/y; independent sales network net sales saw $677 million (flattish growth vs. last year) and direct sales network net sales saw $110 million (also flattish growth vs. last year); corporate accounts channel net sales saw $66 million (up ~25% y/y); and OEM and other net sales saw $60 million (up 0.8% y/y). The strong gross margin performance of 47.3% led to a strong adj EBIT margin expansion of 120 bps y/y to 17.3%. Consequently, this led to an adj EPS growth of ~8% to $4.30.

Growth is coming back online

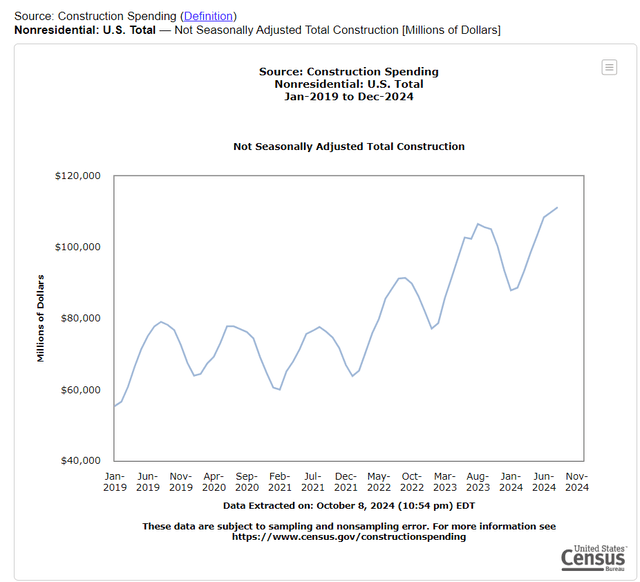

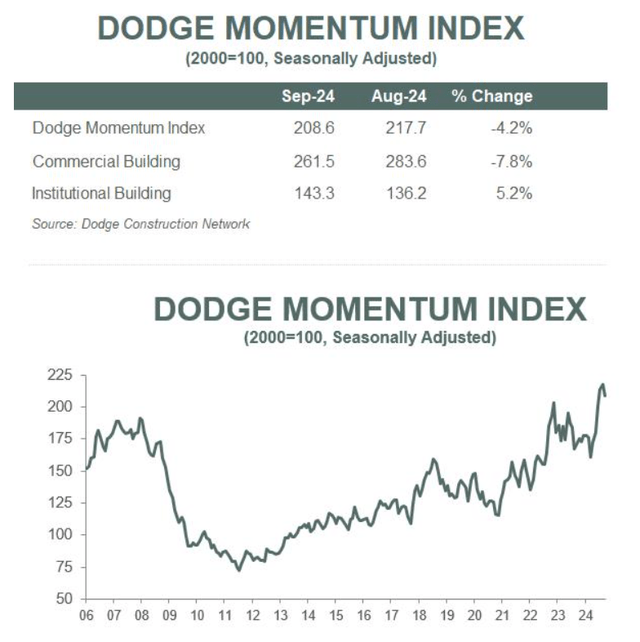

The stars are gradually aligning for AYI, which I expect to drive growth accelerating in the coming quarters. At the top, we have the US macro situation turning better as the Fed has cut rates, which should serve as a stimulus to increase construction projects (as the cost of funding comes down). The tight labor situation has shown signs of easing as job gains in the sector continued into September. Two major indicators of construction demand also moved in the right direction: (1) total construction spending inched further upwards to an all-time high post-covid, and (2) the dodge momentum index continues to stay at all-time high levels since 2006 (despite a slight recede in September).

All these favorable macro trends have translated into positive demand strength for AYI, wherein the ABL segment saw 1% y/y growth in the 4Q24. This is important because it tells us that orders/backlog are being translated into actual sales. Note that management noted order rates were outpacing shipments (in the 3Q24 earnings call); as such, my view is that this AYI will start to recognize more of this backlog, which is going to cause growth to accelerate.

Aside from the ABL segment, the strong demand for data centers is also translating into a growth driver for AYI, as evidenced by the 17% y/y growth in the ISG segment, which was driven by the Distech Controls segment that benefited from large data center projects. While this segment is a small part of AYI’s business (just 9% of FY24 adj EBIT), this could become a much larger growth driver as I don’t see the demand for data centers dying down anytime soon. In fact, my expectation is for the number of data centers to continue growing at a rapid rate. The reason is simple: the world is moving towards an AI era, and this necessitates a strong underlying AI infrastructure (computing power, storage capacity, low latency, more LLM training capacity, etc.). All of these translate into more data centers, and to give a sense of things, the top four hyperscalers are expected to spend $50 billion/quarter on digital infrastructure.

Solid balance sheet

Another thing to take away from this earnings result is the solid balance sheet. In the quarter, AYI improved its cash position to $846 million (~$150 million increase vs. last quarter). This strong balance sheet position should easily enable AYI to invest for growth when needed (in particular for the ISG segment that has a strong growth momentum going on) and execute on its pipeline of acquisition targets to juice growth. Moreover, it should also ease any concerns that investors may have regarding AYI’s ability to continue returning capital to shareholders. While AYI did not repurchase any shares in 4Q24, remember that they already repurchased 454,000 shares ($89 million worth) this year, and this is way ahead of management’s initial annual target of repurchasing $40 to $50 million worth of shares. Management also raised the quarterly dividend per share to $0.15 from $0.13 earlier in the year.

Valuation

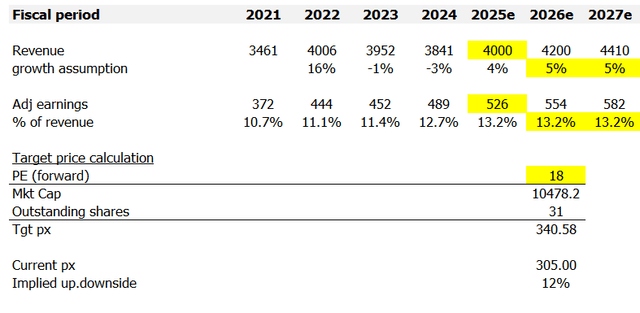

Due to the positive developments since July, I have upgraded my growth expectations for FY25 to be in line with management’s guidance ($4 billion revenue at the midpoint). This growth target shouldn’t be difficult given the backlog, underlying demand trend, and the easy comp base in FY24. Growth ahead should normalize to mid-single-digits (same as my previous assumption that growth will recover back to industry level).

I did adjust my adj earnings expectation upwards given the strong performance in 4Q24. Using the midpoint of FY25 adj EPS guidance, I worked backwards (adj EPS * share outstanding) to derive ~$526 million of adj earnings. This implies an adj. earnings margin of 13.2%. Looking ahead, AYI is likely to invest more of its profits into growth; hence, I assumed margins to stay flat (I do note that this may be too conservative).

My assumption for valuation multiples remains the same at 18x forward PE, as there is no change to my medium-term growth assumption (mid-single-digits). 18x is also the historical average over the past 10 years, and hence, I don’t think there is a strong reason to believe valuation could go higher.

Risk

The timing of demand materializing (backlog turning into recognized revenue) could take longer than expected, especially if the labor situation worsens. Also, the uncertainty revolving around the US election may cause many developers to continue delaying their projects.

Conclusion

My view for AYI is still a buy rating, especially given the recent positive developments. The improving macroeconomic conditions, coupled with AYI’s strong balance sheet, create a favorable environment for AYI to capitalize on growth opportunities. While there are risks associated with the timing of sales recognition and macroeconomic uncertainties, I believe the overall growth outlook is encouraging.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.