Summary:

- Cisco has delivered minimal returns over 25 years, but I hold it for its dividend yield and potential total return.

- My YARP™ investing strategy focuses on balancing yield and total return, avoiding steep losses through tactical management rather than buy-and-hold.

- CSCO’s slow price movement and moderate dividend yield make it a suitable, though not favorite, part of my diversified 40-stock portfolio.

- Tactical management around dividend stocks like CSCO helps mitigate risk, aiming for a 7%-10% annual yield with potential upside.

raisbeckfoto

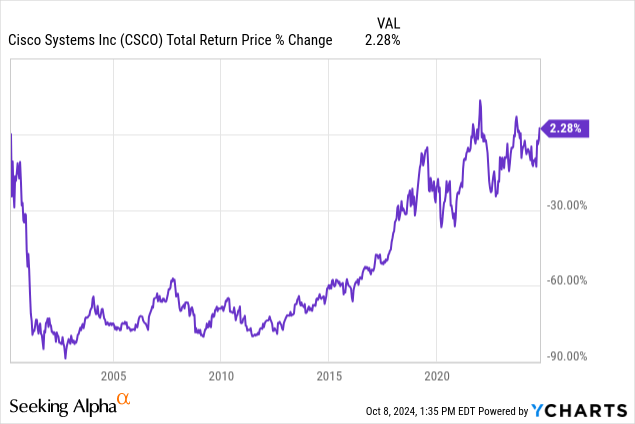

I included Cisco (NASDAQ:CSCO) in a recent article that cited it as one of 11 Dow Industrials stocks I consider to be the “zero return club” in that they have produced near zero return for at least a few years. In CSCO’s case, it is more than a few years. It’s been a quarter of a century.

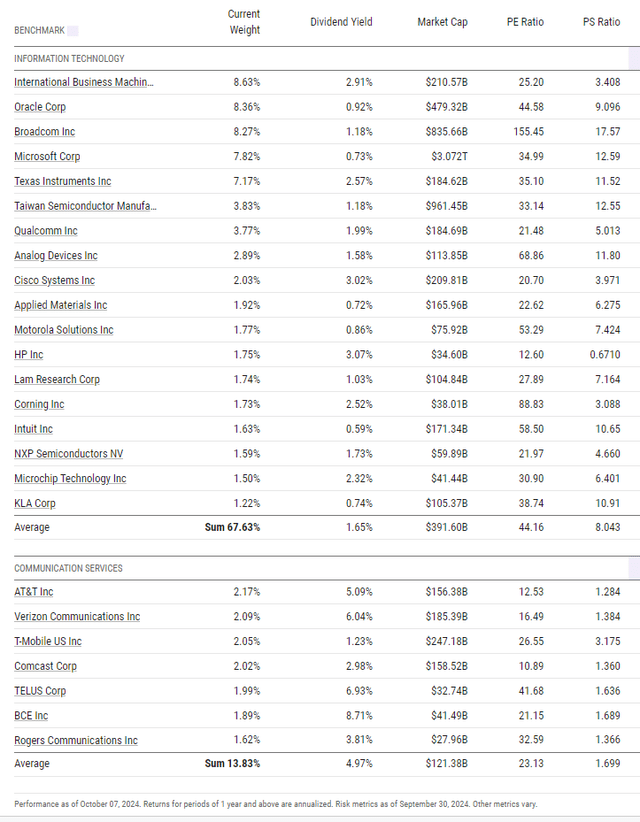

Yet, I’ve owned it since late January of this year. And as I described in the article I wrote back then (“Tech Stocks Don’t Have to be Pretty”), CSCO was one that “got over the bar” to make it into my 40-stock YARP (Yield At a Reasonable Price) portfolio. It is not easy to focus on dividend stocks and end up with a heavy technology sector weighting. In fact, looking at the current top 25 holdings of the First Trust NASDAQ Technology Dividend ETF (TDIV), which is tech without many of the shining stars of the sector that pay little or no dividends, CSCO is one of only two stocks that yield at least 3%. The rest of the yield-rich names there are actually communications sector stocks. Suffice it say, tech and dividend investing don’t go together as well as other sectors do.

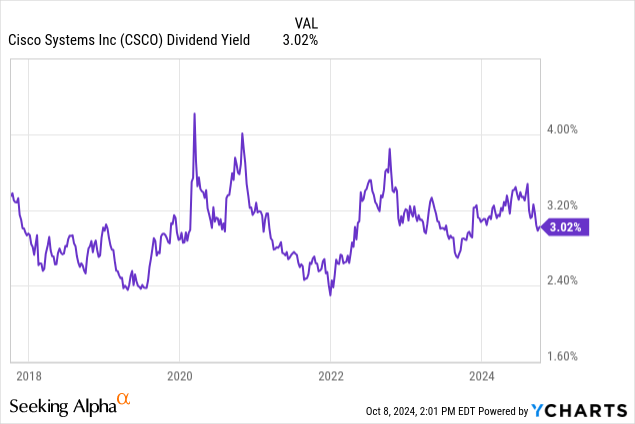

Ycharts

That said, I am not your typical dividend stock investor. As noted here previously, the approach I created over the decades I spent managing other people’s money (and now, my own) is based on the idea that:

1. Yield is important, but total return is more important.

2. In the current market environment, pursuit of dividends and total return from stocks is fraught with risk, but worth the effort... just not all of the risk.

3. So, to get what I want (dividends and price appreciation) but not what I don’t want (steep losses in DOLLAR TERMS from the stocks I own), I have to proceed in a manner very different from buy and hold strategies, and popular dividend ETFs. The latter, by their nature, may rebalance holdings every three months, but that doesn’t change much. It simply sells winners and buys losers, without regard to where they might be real, imminent price risk. No thanks!

Even in all the work I’ve done over the years using dividend ETFs in my portfolio, I usually treat them as “rentals” and will until the market broadly has more of a “clearing out” that I think it needs. Or, if dividend stocks continue to float along earning little more than their dividends for a while. And that sets up a long-term hold opportunity. I’m not holding my breath.

So what I call “Yield At a Reasonable Price (YARP™) investing, and portfolio construction around that core idea, is about first choosing the businesses I want to own, committing to a 1% minimum position in the portfolio when I do, and giving myself the flexibility to lift that position to 5% (at cost) maximum weighting. I do this across 40 stocks, though there might be markets where I dial that figure down a bit. I also keep a “bench” of 35 stocks for a total of 75 I will consider at any time. That’s my “stock universe.”

The clear & present danger of high P/E stocks

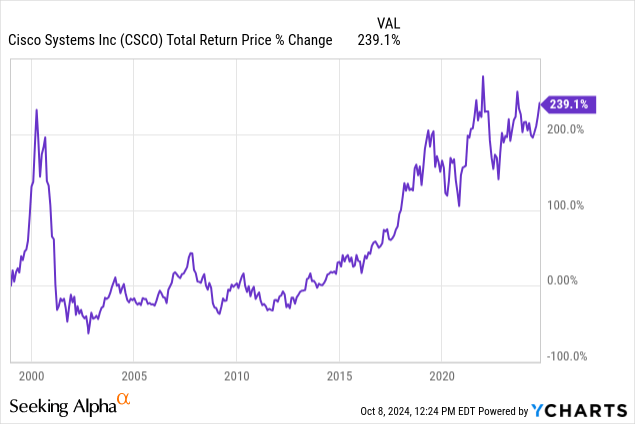

Imagine committing to a long-term investment, and being up 239% over 25 years. Not a great return when you annualize it. That’s a very long time, after all. But what if you then consider that you made most of that gain in the very first year of those 25 years! That’s disheartening. But that’s the journey CSCO and a few other high-profile stocks have taken investors on.

That is not a lesson about long-term investing. It is a lesson about what can happen when investors believe so much in a company that they will pay any price for it. That’s a clear and present danger, and it is a risk every investor must determine ahead of time, how much to take. Because the S&P 500 and Nasdaq 100 are currently in rarefied air as to P/E and P/S multiples. That was the lesson CSCO taught us in the dot-com era.

This is CSCO from the first day of 1999 through Monday of this week.

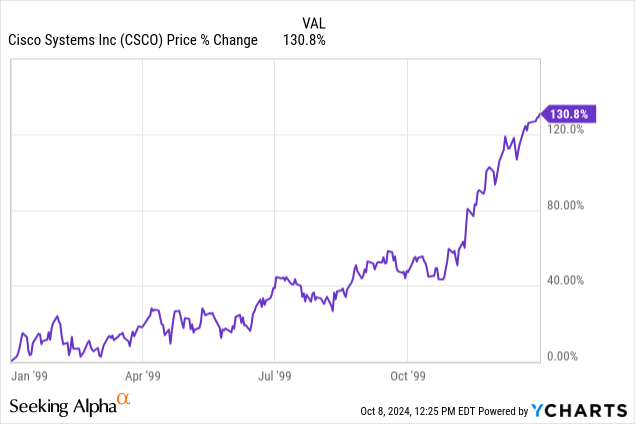

Here’s what it did in the last full year of the dot com bubble, 1999. At the time it was an iconic name, similar to Nvidia (NVDA) today. I am far from the first person to make that connection. That’s not meant to be a prediction, just a warning that risk management is something investors need to contemplate before risk “happens” to a stock. That is, before the risk becomes reality.

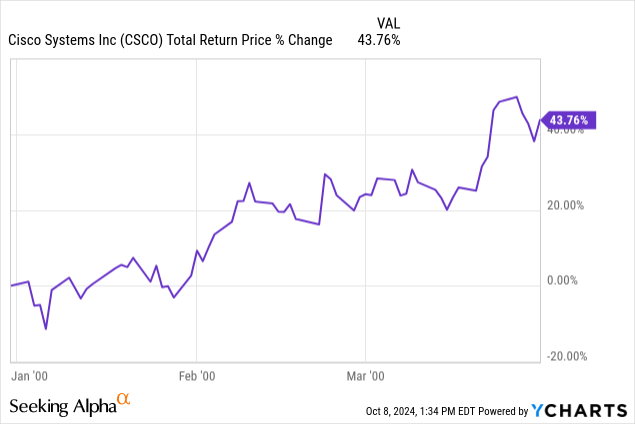

It tacked on another 44% during Q1 of 2000.

And here’s what it has done since 3/31/2000. Astonishing? Not to those of us who managed money through the bubble. No, that’s not an annualized return.

Seeking Alpha and Ycharts

That’s enough of a history lesson, I think. But it does remind us that CSCO is now a much more mature business. Perhaps too mature for some, as it has many detractors. I learned that the first time I wrote about it.

But my choice is to hunt for other tech stocks, or continue allocating to this one and a handful of others that yield at least more than 2%. In a market meltdown, others will come to me. But who knows when that will happen? Apple was once a YARP stock. But that was close to a decade ago.

CSCO: my experience so far, and my current view

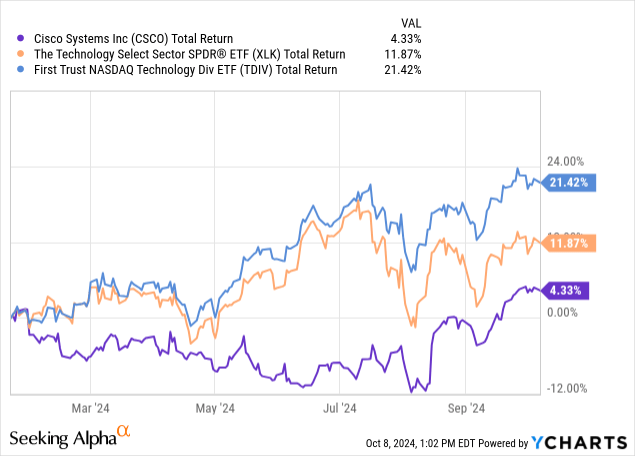

CSCO has underperformed the tech sector and the aforementioned TDIV ETF since my first purchase. However, I have done anything but buy and hold.

I’ve actually owned it throughout the period since late January, but my path in this stock is typical of what happens when I decide to keep a stock that doesn’t have much upward momentum. CSCO did not have some blazing catalyst. It filled a gap for me in being a tech stock with yield. I’ll decide at some point whether it is worth replacing it. But for now, I hold it, since as with any stock, I emphasize the “rental” aspect along the way.

To that end, nearly half of my now 8 1/2-month holding period, I’ve had a 1% position. For nearly the rest, it was 3%. However, I owned it at a 5% position in order to grab more dividend yield, and was willing to keep it at that level. However, there’s no price momentum here, so each time I found a better home for that “extra” 2%.

As a result, my total return in CSCO is in the low single digits, like the stock itself. And most of that is a dividend. In fact, since my minimum objective is to earn some decent yield while reducing risk of major loss along the way, I realized that since CSCO was often a 1% position, and my “risk-seeking” activity was when I lifted it to a 2%-5% weight temporarily, the dividend income I’ve received amounts to about 7% so far, on what has largely been a 1% holding. And that’s with one more quarterly dividend to come into my first full year of holding it (assuming I don’t sell it first).

So, CSCO has been productive, but I had to dance around a mix of flat and down price performance. I’m not willing to do this across all 40 stocks, but with several like this one, I’ll do it all day if the result is close to a 10% annual yield on the stock, with all of the potential upside, but using my measured, tactical approach.

CSCO is as good as an example of how tactical management around dividend stocks can keep investors out of trouble. The stock fell 10% as many stocks did, bottoming in early August. But my position was light during that time, so versus holding 4% or 5%, a 10% dip on a 1% position is a small portfolio impact (10 basis points off the total return, or 0.1%).

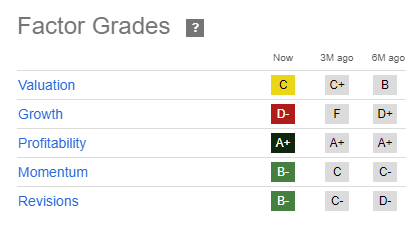

Today, CSCO has the top thing I look for fundamentally, as an investor who makes his living primarily using technical analysis, quant metrics (others and my own, like the YARP Ratio), and portfolio construction and rotation techniques. It carries Seeking Alpha’s top quantitative grade for profitability. That’s been the case from the start of my holding period.

Seeking Alpha

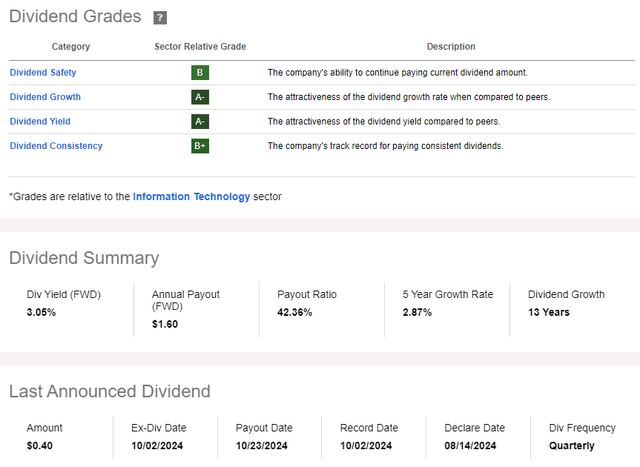

The dividend is safe, though not as safe as it could be. Again, with everything in my portfolio technically a “rental” until there’s a reason to do otherwise, this is just fine for me.

Seeking Alpha

And here is my quick YARP Ratio analysis (visually here, calculated below). CSCO’s dividend yield over the past seven years is pictured below. At just a shade over 3%, it is toward the top of that range and moving subtly downward. That’s what I look for. The issue with CSCO so far is that its price is moving very slowly, in fits and starts. But I’m not bound to have a bunch of “rabbits” in my portfolio given the style, so having some tortoises to get some tech allocation is OK for now.

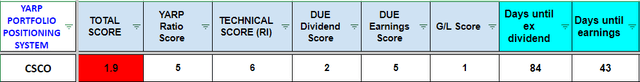

Below is a quick snapshot of the proprietary stock grading system I recently created. Likely my next piece of intellectual property, now that the YARP process, is about to be a registered trademark. Here, I estimate what my portfolio allocation to CSCO (or any stock I track) “should be” based on its attractiveness across several metrics I value. This is less about whether to keep CSCO, though that’s a factor, and it points to a borderline holding. Of course, it depends on what the other 74 names I follow look like.

SungardenInvestment.com

SungardenInvestment.com

The TOTAL SCORE of 1.9 is on a 1-5 scale, so this implies it would be a smaller position if I own it. It is. The other light blue boxes are a combination of current analysis of technicals (the price chart – I’ve been charting for 44 years), and two very important factors: timing of the next ex-dividend date and next earnings announcement.

As the notes below the data explain, the closer a stock is to ex-dividend date, the more attractive it is to me, since less can go wrong in fewer days. And, since I’ve seen too many earnings blowups for one lifetime, I award “negative points” the closer a stock is to its next quarterly report. CSCO is not very close to either, so those two scores are not especially high.

And my gain/loss (G/L) factors in as well. Here’s why. If I’m up 20% in a stock, it is much easier to swap some of that unrealized gain (and the risk that comes with it from holding the stock) for dividend income now. I use the dividend income for part of my living expenses, so with the total portfolio having 7%-10% or higher yield potential if the market “cooperates,” that’s a nice payout for a portfolio that mostly owns safer yielders. I just use tactical position weighting instead of buying and holding securities with sky-high yields but tons of risk from interest rates or dividend cuts. That’s YARP versus “mainstream” dividend approaches.

And, with multiple risk management measures in place in case the market doesn’t cooperate, I feel I’ve used my YARP portfolio approach to insulate myself from the worst of things, while giving myself a fighting chance to ultimately earn more from CSCO and other sluggish names over time.

Final thoughts for now

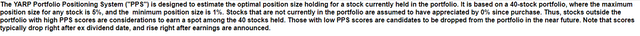

TC2000

As for CSCO itself, I bought it where the purple circle is on the above chart (two different times during April of this year). It currently looks weak but not as weak as several other stocks I chart, including many I don’t consider for the portfolio, as I chart a ton of stocks regularly to form my “macro” view.

So, nothing has really changed for me with this stock:

- It is not my favorite, but good enough to be one of 40 names I own, and better than the 35 I consider but don’t own.

- It has the potential to follow its sector higher if and when we have yet another tech meltup.

- It is well past its prime, despite making up for all of that lost time by finally breaking even over 25 years. That fact itself may be a long-term demand dampener for Cisco.

As with all stocks, I own or consider for the YARP portfolio, CSCO is constantly evaluated, and the position weight I apply with my own money is something that is ultimately determined from my 30+ years of professional active management experience. But as I briefly debuted in this article, I am looking at what parts of the process can be automated. Not to replace myself, but to have a virtual “analyst” in the room with me at all times.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CSCO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.