Summary:

- Amazon’s Q3 EBIT guidance was lower than expected, but its EBIT is projected to grow by 18% YoY, which is quite strong given the firm’s scale.

- Amazon’s Q2 FY2024 results showed strong growth in AWS and advertising, with a notable 39% jump in GAAP EPS, despite a revenue miss.

- Wall Street’s lowered forecasts create an opportunity for Amazon to exceed Q3 expectations, supported by robust FCF and margin expansion.

- Based on my DCF model, despite the recent increase in WACC, AMZN is still undervalued by the market today by 20.5%.

- Risks include potential macroeconomic challenges and management’s guidance, but Amazon’s cloud technology growth and undervaluation support maintaining a “Buy” rating.

4kodiak/iStock Unreleased via Getty Images

Intro & Thesis

Since I first initiated my coverage on Amazon.com, Inc. (NASDAQ:AMZN) stock here on Seeking Alpha, my ratings have fluctuated between “Buy” and “Hold”, depending on market developments and my assessment of the company’s nearest prospects. In my last article, published about 2 months ago, I stated that despite Amazon’s Q3 EBIT guidance falling short of market expectations, the operating profit is going to grow by ~18% YoY anyway, and since my valuation model was pointing to an undervaluation of over 21% at the time, I left my “Buy” rating unchanged.

Since that call the stock basically stayed flat, slightly underperforming the broader market (the S&P 500 index (SP500) (SPY) is up 2% while AMZN is up only about 0.7%):

Seeking Alpha, the author’s coverage of AMZN

The company is due to report Q3 FY2024 results on October 25 – exactly 2 weeks after I wrote this article – and I have reason to believe that we’ll likely see another earnings beat. Apart from this, potential bullish catalyst, I think it is unlikely that management’s comments will be negative, and the current undervaluation of the stock should provide a nice incentive for further growth in the medium term. For this reason, I reiterate my “Buy” recommendation for AMZN.

Why Do I Think So?

Since nothing new has happened on Amazon’s financial front since my last article, I’d like to briefly refer to my previous analysis before showing why AMZN should again beat expectations (this time for Q3) and why it’s still undervalued.

Amazon’s Q2 FY2024 showed a 10% year-over-year growth in revenue to $148.0 billion, which is a 3% sequential growth (from Q1) – this was in Amazon’s guided range but it, unfortunately, fell just short of analysts’ forecasts by around $780 million (that was the first miss since 2022). Yet the business achieved a 39% jump in GAAP EPS to $1.26, which is almost twice as much as last year and better than consensus by ~$0.24. It was led by strong performance in AWS, with 18% sequential revenue growth at $26.3 billion and 74% growth in operating profit at $9.3 billion, driven by the growing appetite for generative AI services. AWS is still an important growth area for Amazon’s future, accounting for more than 34% of the cloud computing market globally.

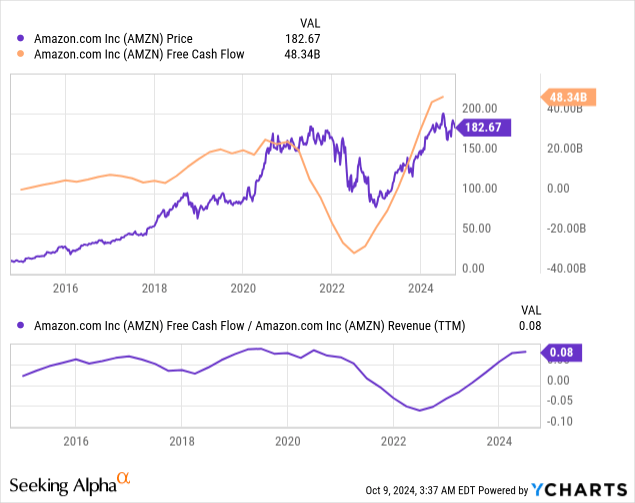

North American retail revenues rose by 9% to ~$90.0 billion and international retail revenues rose by 7% to $31.6 billion. Third-party merchant sales increased by 12%, versus 4% for physical store sales. And yet, sales for e-commerce stores only increased by 5% YoY which shows the importance of Amazon’s diversification of income sources. Last quarter the company had North America margin pressure due to investment in projects such as Kuiper/satellites, and seasonally related events like Prime Day and Holiday. Despite this, Amazon’s ability to produce meaningful FCF continued to be robust at $49.5 billion in FCF over the trailing 12 months, despite spending more than expected on CapEx.

Again, what I noted above in the introductory part was that Amazon’s Q3 EBIT guidance was skewed downward, prompting comments on its investment and profitability plan – this fact created some pressure on the stock’s expansion, potentially driven by the EPS beat. Yet, they project 18.3% YoY growth in operating profit for FY2024, which is pretty awesome, in my view.

AWS’s top-line growth rate climbed to 19% in Q2, and consolidated EBIT topped expectations with healthy consumer demand (but still slow retail growth). Overall, as I see it, Amazon’s Q2 numbers in general showed strong growth and the AWS and advertising businesses increased year-over-year growth rates of 19% and 20%, respectively. Margin is also better than expected, with a second-quarter operating profit of $14.7 billion and an EBIT margin of 9.9% (up from 5.7% a year earlier). Adding the international unit’s strong operating profit in its second consecutive quarter indicates longer-term potential. I think the investments and efficiency at Amazon position it well for future growth and profitability, even in the face of all existing obstacles.

In the August article, I mentioned that AMZN’s Q3 guidance miss didn’t have a major impact on earnings revisions. Apparently, Wall Street analysts needed more time to do so because as we can see today, over the last 3 months, EPS forecasts for several quarters ahead have been lowered in 64.7% of cases (and in 78.9% of cases for sales estimates):

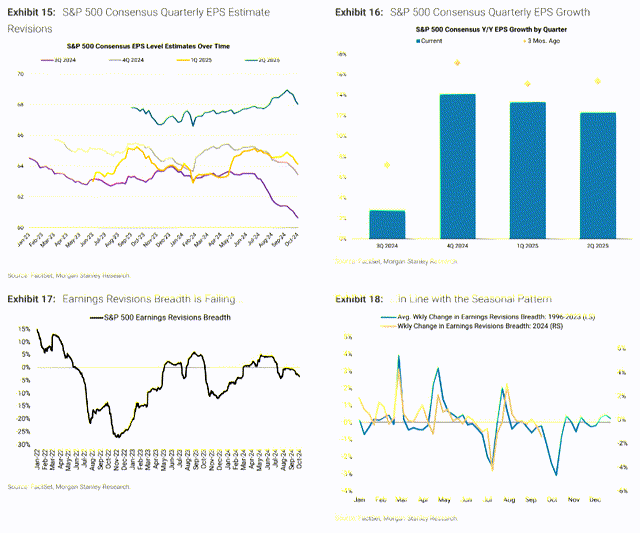

Just yesterday, my macro article on the S&P 500 was published, in which I quoted Mike Wilson from Morgan Stanley, who clearly shows that Q3 EPS projections have decreased for the entire market as a whole:

The consensus estimate for Q3 FY2024 EPS has decreased by 4% over the past 3 months, while the full-year 2024 EPS estimate is down by 1.4%. While this lowered expectation may set the stage for a potential mid-single-digit beat for the S&P 500, I’d like to see a reaction from the market’s price action, but we don’t see it (SPY is still going higher amid those negative changes). Looking ahead to 2025, the consensus EPS estimate has declined by 1% in the last 3 months, reflecting a broader trend of declining earnings revisions. However, this is expected to stabilize by the end of the year, according to Mike Wilson. He also notes that trailing earnings growth has improved significantly, now at 6.5%, primarily due to margin expansion from cost-cutting and operational efficiency.

Morgan Stanley (Proprietary Source, October 2024)

Mike Wilson’s findings suggest that companies will now find it easier to beat forecasts after these downward revisions, and I think this is true in the specific case of Amazon.

When I look at the dynamics of the 2nd quarter, I don’t see a pronounced slowdown in growth. Yes, management has decided to play it safe and warned of the risks to EBIT, but the margin remains on an upward trend and FCF continues to recover. On a relative basis, the lack of growth in AMZN stock paints a very interesting picture, in my opinion: the company’s FCF has doubled since 2021, and the stock itself is now at the same level as three years ago. This is not just a one-off effect due to changes in working capital or something similar – the FCF margin (FCF as a percentage of sales) is growing steadily and is now at 8%, similar to past peaks. At the same time, I think Amazon today has every chance of beating those historical extremes in FCF margin because the higher margin AWS is taking a much higher share of sales and EBIT.

It’s also important to note the undervaluation AMZN is under as it approaches Q3 numbers. First, without changing the financials or my forecasts for Amazon’s EBIT margin over the next few years. Again, I expect EBIT growth to accelerate further, but I’m intentionally making my model more conservative than before to avoid bias.

Assuming the same cost of debt (at 5%) and the same market risk premium (also 5%) as last time, I get a slightly higher WACC today (9.2% vs. 9.1%), so the final model should become a bit more conservative.

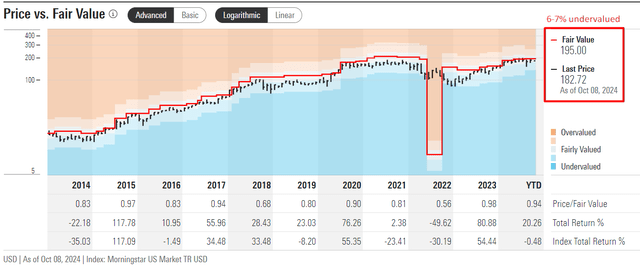

Amazon’s 5-year median and 7-year median EV/FCF multiples are 42.6x and 48x, respectively. Given my assumption that the FCF margin has the potential to go even higher, I think it’s a fairly conservative assumption that the stock could trade at 45x EV/FCF by the end of 2028. This means that despite the increase in WACC, AMZN is still undervalued by the market today by 20.5%:

Given the potential to beat current discounted analyst forecasts for Q3, and taking into account the revealed undervaluation of the company, I think AMZN deserves a “Buy” rating today.

Where Can I Be Wrong?

First, I could be wrong about the likelihood of AMZN beating EPS estimates again. If macro challenges, which are difficult to quantify on a forward-looking basis, have a stronger negative effect than I am assuming, then my conclusions will be wrong and AMZN could fall sharply when it releases its earnings.

Second, investors are not immune to the possibility that management will once again hedge their bets and lower their guidance or give more negative comments than the market expects. I don’t think this will be the case, but still – this risk can’t be ruled out and underestimated because even against the backdrop of earnings growth, stocks may still fall sharply on guidance.

Thirdly, I could be wrong in my conclusion that the company is undervalued. I take into account rather bold forecasts for EBIT margin expansion in future periods, which may be far from reality. Also, my DCF model is based on EV/FCF, which has been quite unstable in the past. Other analysts see a far less impressive undervaluation – Morningstar’s fair value model shows only 6-7% potential upside from the current price, which seems quite modest given all the risks.

Morningstar Premium, notes added

The Bottom Line

Despite the aforementioned risks, I believe my “Buy” rating for Amazon remains justified. The company continues to expand its presence in cloud technologies, which is a significant growth area. During the last few months, Wall Street analysts appeared to have overly reduced their forecasts, creating an opportunity for Amazon to exceed expectations for Q3 figures. Additionally, I do not anticipate management to be overly negative in their outlook this time. Together, these factors should provide Amazon with a strong bullish catalyst, potentially driving its shares higher. Therefore, I’m maintaining my “buy” rating as we eagerly await the report at the end of October.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AMZN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!