Summary:

- Apple is still reporting solid results, but in the last few quarters it was especially China which was struggling.

- And while we can be optimistic about China turning around, I still see a high risk for the United States being headed for a recession.

- Aside from a recession having a negative impact on Apple’s business, the valuation multiples still seem excessive.

- Maybe we should follow the steps of Warren Buffett and also trim exposure to AAPL a bit.

husayno

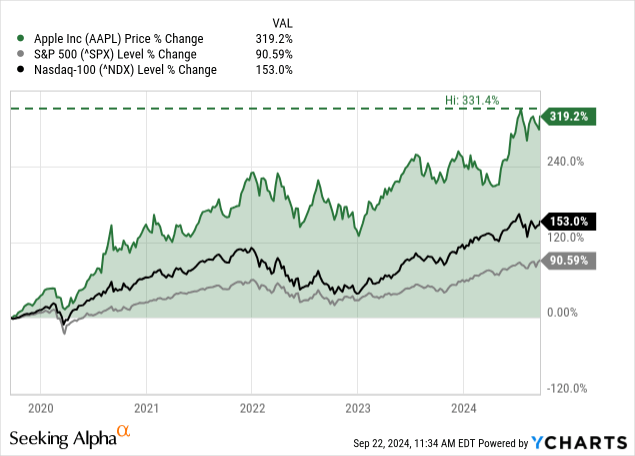

My last article about Apple Inc. (NASDAQ:AAPL) was published in February 2024 and the stock was a “Hold” for me. However, Apple outperformed the S&P 500, (SPY) which already increased 12% since the last article was published. Apple, on the other hand, increased 20% and was therefore a great investment, and we can certainly argue that I was wrong about Apple in the last seven months.

And when looking at the last few years (the last five years, for example), Apple outperformed the overall stock market in an impressive way. Apple did not only outperform the S&P 500, but also the Nasdaq-100 (QQQ) which usually performs much better in bull markets than the broader S&P 500.

In the following article, I will look at Apple again. We will look at the situation in China and what to expect here considering the stock market jump we saw in the last few weeks; we will look at the United States, and we will calculate an intrinsic value for the Apple once again.

Quarterly Results

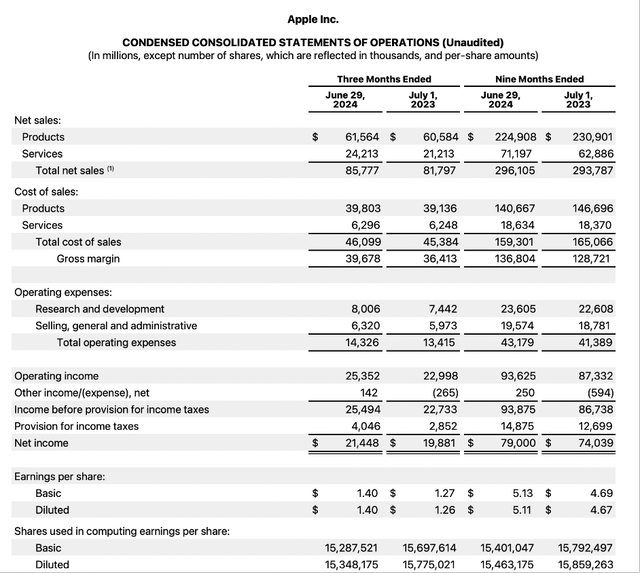

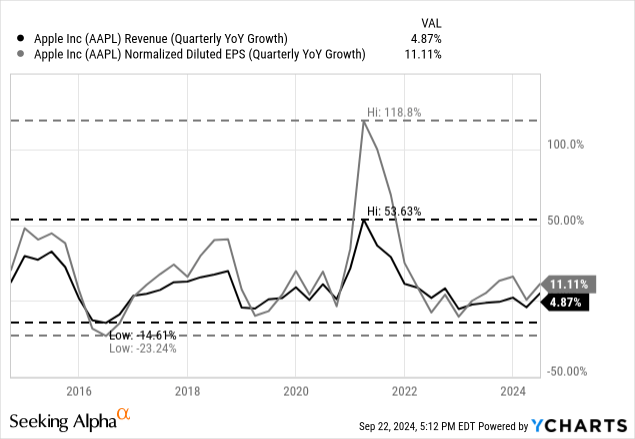

When looking at the last quarterly results, we can start by Apple beating estimates once again – revenue as well as earnings per share were above expectations. Revenue was $1.42 billion higher than estimates, and earnings per share were $0.06 higher than expectations. And Apple did not only beat estimates but could grow year-over-year. Total net sales increased from $81,797 million in Q3/23 to $85,777 million in Q3/24 – resulting in 4.9% year-over-year growth. And while the top line increased in the mid-single digits, operating income increased 10.2% year-over-year from $22,998 million in the same quarter last year to $25,352 million this quarter. Diluted earnings per share increased from $1.26 in the same quarter last year to $1.40 this quarter, resulting in 11.1% year-over-year growth.

We can also look at the two different types of revenue and while product sales increased only slightly from $60,584 million in the same quarter last year to $61,564 million this quarter (resulting in 1.6% year-over-year growth), service sales increased 14.1% year-over-year from $21,213 million to $24,213 million and drove growth for the top line.

And Apple will already report fourth quarter results in three weeks from now – on October 31, 2024 – meaning we can already take a look at what to expect. Analysts are expecting revenue to be about $94.2 billion and GAAP EPS to be $1.59. This would result in 5.3% top-line growth and 8.9% bottom-line growth. And for revenue this would actually mean a little higher growth rate than in the previous quarters, for earnings per share it is rather a low growth rate compared to the last few quarters. And in the last three months, analysts got rather optimistic about the upcoming earnings, with mostly up revisions. However, I don’t know how optimistic we should be about Apple not only in the coming quarters, but next few years.

China Still a Problem

When looking at the sales by region, we can see that Greater China was still one of the major problems for Apple. Revenue from Greater China declined from $15,758 million in Q3/23 to $14,728 million in Q3/24 – resulting in a decline of 6.5%. All other regions still reported growing revenue in the third quarter.

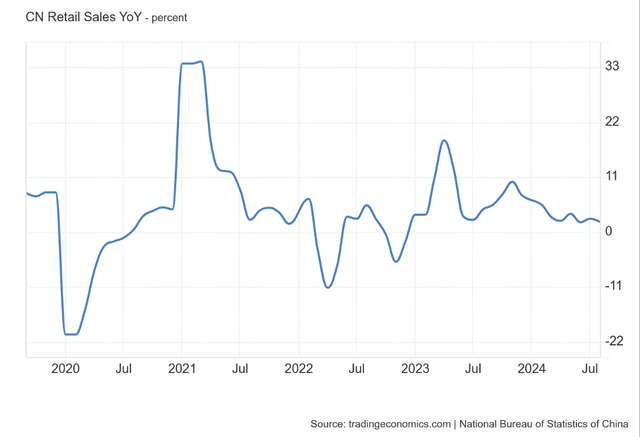

However, in the last two weeks, the situation in China suddenly got interesting. The metrics and numbers are still not great, and retail sales growth – probably one of the most important metrics for Apple – is still slowing down.

China Retail Sales YoY (Trading Economics)

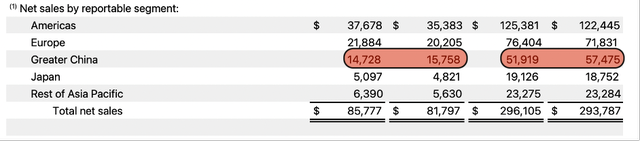

But in the last two weeks, the stock market suddenly rallied, and the CSI 300 increased almost 28% in the last two weeks. Of course, nobody has a crystal ball, and the stock market could decline again and continue its downtrend in the years to come. And from a technical point of view, we are still in a downtrend at this point, but we have to see the last two weeks as a strong bullish sign and potential sentiment change.

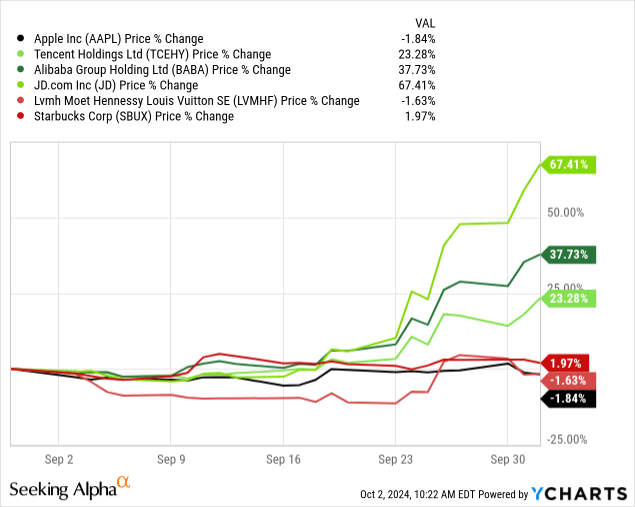

When looking at different stocks, we can also see huge differences in performance. In the last month, Chinese technology companies like Tencent Holdings Limited (OTCPK:TCEHY), Alibaba Group Holding Limited (BABA) or JD.com, Inc. (JD) increased at a high pace. Apple, on the other hand, did not really move, although we might expect that investors are also becoming more optimistic. Luxury companies like LVMH Moet Hennessy – Louis Vuitton (OTCPK:LVMHF), which is also generating a huge part of its revenue in China, did at least react to the news.

And while one might argue that Apple should also benefit from the stimulus, we can see that other companies, which also have a huge exposure to China also didn’t move. One example might be Starbucks Corporation (SBUX), which is also generating a huge part of its revenue in China, but the stock price did not profit from the announcement of stimulus.

Of course, we should also keep in mind that this is a very simplistic view. Not every stock is moving in a similar way as different stocks are, for example, trading for different valuation multiples and a stock that can be considered rather overvalued might not move while a deeply undervalued stock might jump on the news.

But for the Chinese economy, we can be optimistic that the country will manage to break out of this difficult time of rather low growth rates (I am trying to avoid the term recession as the GDP did not shrink, but for China it probably felt like a recession). And at least according to the IMF, Greater China will grow 4.6% in 2024, 4.1% in 2025 and 3.8% in 2026. And especially the retail market is expecting to grow with a CAGR of 8% in the next few years (see Technavio or Mordor Intelligence). And we can assume that Apple will also profit and the sales for Apple’s products will increase again, but this might take a few more quarters before the situation will change.

United States

And while we have small signs of improvement in China and can hope for China to start growing at a higher pace again, the situation in the United States is completely different. I have already pointed out in my last article about Apple (and in several articles about other companies in the last one or two months) that the situation in the United States is getting worse, and we might be only a few months away from a recession.

In the last few weeks, some metrics actually improved again, and this could be reason enough to question again if we are actually headed for a recession. For example, while the Sahm Rule is clearly indicating that we are headed for a recession (as the metric is above 0.5 and increasing), the number of initial claims for unemployment insurance is declining again in the last few weeks (I am looking at the 4-week moving average here).

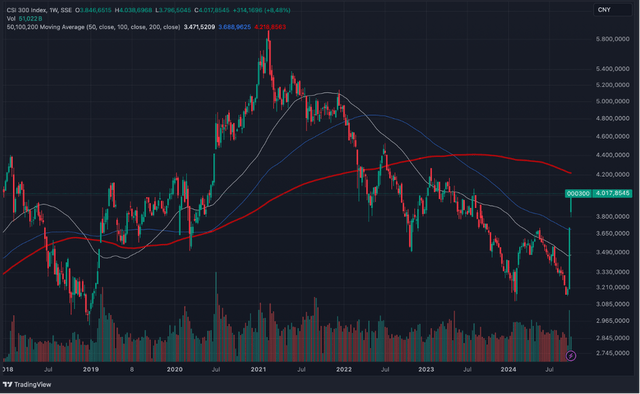

Additionally, housing permits are also rather stagnating than declining. And while the number of housing permits is clearly below the 2021 peak, we don’t see the steep decline we often saw before other recessions in the past decades.

But while some metrics might lead to some doubts if the United States might be headed for a recession, other warning signs are pretty obvious. I mentioned several times in the last few quarters that the inverted yield curve is a first and strong warning sign and a few weeks ago, the yield curve started to re-invert again – a step that is usually happening shortly before the United States entered a recession in the past.

Another step that is usually happening before a recession occurs is the FED pivot and about two weeks ago, the FED lowered interested rates by 50bps and therefore switching from raising interest rates to lowering interest rates. This is another step usually happening before a recession and therefore a potential warning sign.

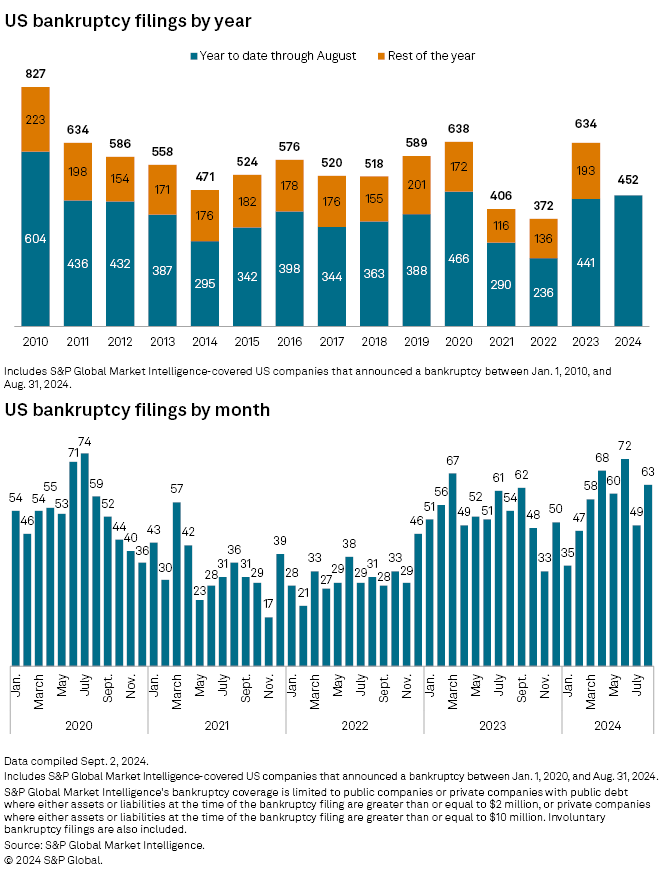

Additionally, we can also look at fundamental data and see for example that bankruptcies are constantly rising in the last few quarters and although the numbers are not dramatic yet, the number of bankruptcies in 2024 will probably be the highest since 2010.

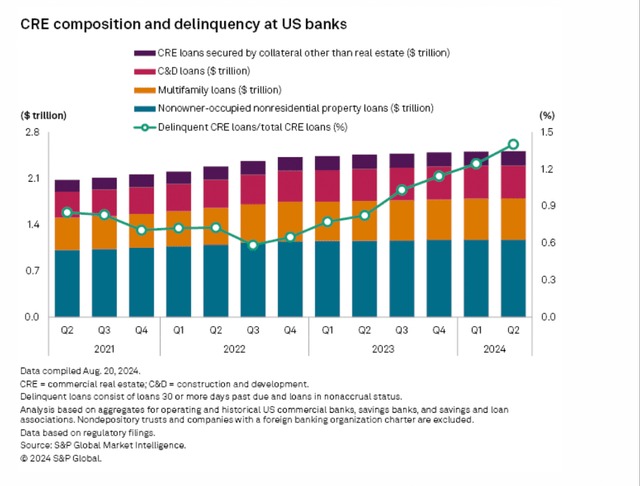

S&P Global

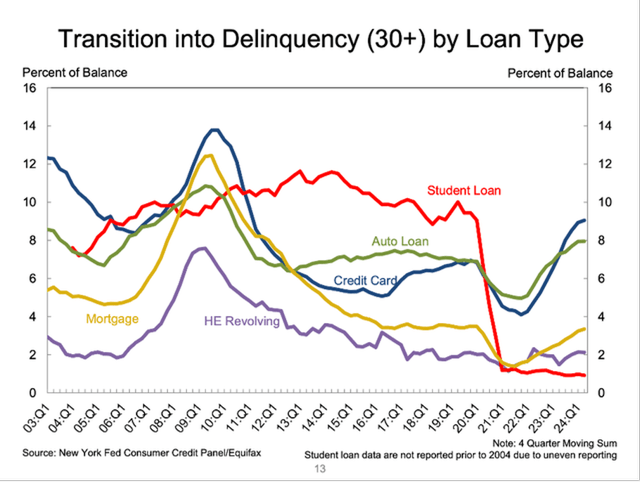

Aside from bankruptcies, delinquency rates are also increasing – for example for the CRE loans, which are often considered to be the most dangerous among the different types of loans banks currently have on the balance sheet.

And not only do delinquency rates for commercial loans increase, delinquency rate for credit cards, auto loans or mortgages are also starting to accelerate. We are still away from the situation during the Great Financial Crisis, but aside from student loans, almost every other type of loan is sending first warning signals as the transition into delinquency (more than 30 days delinquent) is increasing.

New York FED Housing Debt and Credit Report

And even when we can be optimistic, that the situation in China might improve again and consumers are spending more again in the coming quarters and years (and also buying more Apple products), the United States (as well as Western Europe) are a much bigger market for Apple and more important. An improving situation in China will be more than offset by a worsening situation in the United States. The “Americas” region is responsible for about 42% of total revenue and Europe is responsible for about 26% of total revenue. Hence, it seems obvious that the situation in the United States and Europe is way more important than in China and if the Western world should take a turn for the worse, an improving situation in China is certainly not enough to set it off.

What Does Buffett Know?

One story that is certainly important is Berkshire Hathaway, Inc. (BRK.A) (BRK.B) and Warren Buffett selling a huge part of its Apple position. In the second quarter, Berkshire Hathaway reported in its 13-F filing that the company is now holding “only” 400 million shares, and the company reduced its position by 389 million shares and therefore almost 50%.

Of course, Warren Buffett is just one single investor and when looking out there we will find investors that sold Apple shares and investors that bought Apple shares. Simply put, that is how the stock market works: Some people have to sell shares for other to buy these shares – and some will make the right decision, and others will make the wrong decision. Nevertheless, when Buffett acts (or has something to say), we should pay attention and listen – although Buffett could be wrong as well.

And Buffett as a long-term investor has sold huge positions in the past, but Buffett is also famous for holding shares for several decades – two examples might be Moody’s Corporation (MCO) or The Coca-Cola Company (KO). In my opinion, Buffett might have similar issues with the stock as I already made in this article – the looming recession – and trimming the position is certainly a statement. And there is another major issue I see here – the stock price in relation to the fundamental business.

Intrinsic Value Calculation

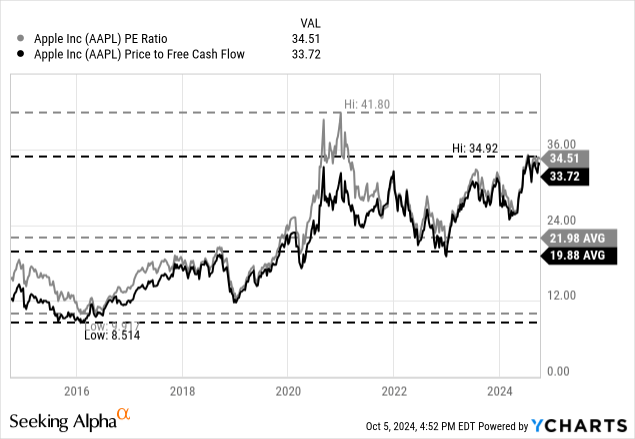

And another problem that remains is the extremely high valuation multiples Apple is trading for. When excluding a brief period in 2020 when Apple was trading for a higher P/E ratio, Apple is right now trading close to the highest valuation multiples – price/earnings and price/free-cash-flow – in the last 10 years.

Not only is Apple trading clearly above the 10-year average, a valuation multiple of 35 is also rather high and justified only for a handful of companies. High valuation multiples can be justified by high growth rates, but while the valuation multiples are almost the highest in the last ten years, Apple’s growth rates are rather at the low end of the range. And when comparing current growth rates with valuation multiples, we really must question if the two are fitting together.

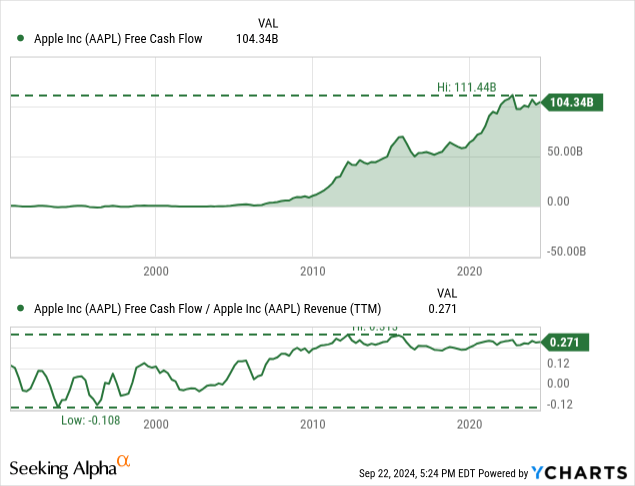

Aside from looking at simple valuation multiples, we can also calculate an intrinsic value by using a discount cash flow calculation. As always, we are using the last reported number of diluted shares outstanding (15,348 million) and a 10% discount rate. As basis for our calculation, we can use the free cash flow of the last four quarters, which was $104.34 billion.

When calculating with these assumptions and a 4% growth rate in 10 years from now till perpetuity, Apple must grow its free cash flow between 14% and 15% in the next ten years. And we certainly can argue that Apple might be able to report such growth rates in the next ten years. In the last ten years, Apple grew its bottom line with a CAGR of 15.75%. But considering the scenario of a potential recession in the United States and the last ten years being 10 years during a bull cycle, I don’t know if we should assume such high growth rates. Of course, we can argue that the United States have been hit by a recession in 2020 but to be honest, Apple rather benefited from the pandemic and the stay-at-home orders. When looking at the quarterly growth rates in the chart above, we see extremely high growth rates, especially in 2021.

Conclusion

I still would argue that Apple is not the best stock to buy right now and while we can be optimistic that the situation in China might improve in the coming quarters, we still must be very cautious about the situation in the United States. I still think the United States is headed for a recession and as this is the most important market for Apple, this could become a problem.

And the mediocre outlook is meeting the extremely high valuation multiples the stock is currently trading for and making me still extremely cautious about Apple as an investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA, JD, SBUX, TCEHY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.