Summary:

- The developer of the iconic “Dakota” New York City apartment building (pictured below) moved way ahead of obvious and immediate need… Other visionaries did likewise.

- Critics jumped all over them for having done that, but in the end, the visionaries won the day.

- I expect the same will happen with AI and Broadcom in general.

- The latter is helping big cloud “hyperscalers” build for where AI is going, even ahead of here-and-now needs.

- I believe AVGO, like other forward thinkers, will ultimately win.

OSTILL/iStock Editorial via Getty Images

Edward Cabot Clark supposedly didn’t get it.

Real estate is about location, location, and location.

But the big New York City apartment building he announced in 1879 was to be way, way, way uptown… on 72nd Street and 8th Avenue. There was nothing there except for fields and dirt roads.

Then, as now, New York City (Manhattan only in those days) was big. Like most cities, it had its downtown area. That was at the southern tip of the island, the Wall Street area. But it already had a second key district, midtown. That was focused on 23rd Street.

[S]ophisticates of the day quipped that Mr. Clark might as well have moved a few blocks farther out and built it in Dakota, then a territory. The name caught on, and he made it official.

Before it became The Dakota, the building had another name… “Clark’s folly.”

But Clark had the last laugh (albeit posthumously).

Upon completion in 1884, the New York Times called it “one of the most perfect apartment houses in. the world.” It became fully rented immediately upon completion.

Over the years, many celebrities have called it home. It’s now a high-end co-op. It has also been designated as a National and New York City landmark.

And by the way, the location, not just the Dakota but also the surrounding blocks on which Clark developed smaller row houses, and in fact the entire area, is now a highly vibrant urban area, the Upper West Side. (See the picture above). In fact, that part of 8th Avenue now has a fancier name: It’s Central Park West.)

Clark’s early detractors aren’t the only ones who would up eating their words.

Railroads, airplanes, telephones, light bulbs, movies with sound, home computers, laptops, the internet, and even the notion of an Apple (AAPL) phone were all disparaged early on.

Credit Oracle (ORCL) co-founder, former CEO and now Chief technical Officer Larry Ellison for, perhaps, the most colorful nay saying rant. As reported by the 9/25/08 Wall Street Journal, Ellison thusly bashed the idea of the cloud:

The interesting thing about cloud computing is that we’ve redefined cloud computing to include everything that we already do. I can’t think of anything that isn’t cloud computing with all of these announcements. The computer industry is the only industry that is more fashion-driven than women’s fashion. Maybe I’m an idiot, but I have no idea what anyone is talking about. What is it? It’s complete gibberish. It’s insane. When is this idiocy going to stop?

Broadcom (NYSE: AVGO), too, is running ahead of obvious demand. So, if you’re bearish on it or AI, you have plenty of company.

I’m not part of that group. I think AVGO is a “Buy.”

But I think it’s important to understand views on a stock that differ from mine. So, in that spirit, let’s recognize…

The Bearish Views on AI and AVGO

When it comes to AI, AVGO is not interested in pursuing the enterprise market. The company is focusing its efforts on “hyperscalers.” That refers to gigantic cloud providers.

Right now, they’re pursuing a FOMO (Fear of Missing Out) approach to AI capital spending. They believe they must spend now to build capacity. If they don’t, they assume they won’t be ready for when demand grows down the road.

FOMO resembles that which motivated Edward Abel Clark and other ahead-of-the-pack folks whose efforts are mentioned above.

Massachusetts Institute of Technology Professor Daron Acemoglu doesn’t see it that way. He fears a crash in AI stocks.

And on 9/16/24, Seeking Alpha Analyst Livy Investment Research published an article downgrading AVGO to “Sell.”

I recommend reading that piece. I disagree with its assumptions about key issues. But it was well reasoned.

It does more than express concern about AI FOMO. It also prompts readers to consider what AVGO is, aside from AI.

The latter is important.

AVGO’s secular growth is coming from AI. So, too, is a lot of investment community bullishness.

However, AI is not the majority of AVGO’s business. It’s part of the company’s Semiconductor Solutions Group.

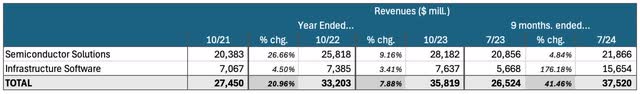

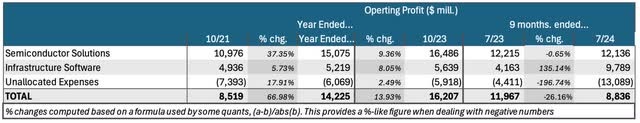

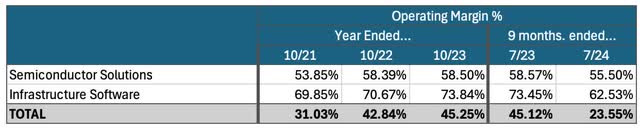

Here are the segment breakdowns:

Analyst Compilation and Calculations based on data from page 83 of latest 10-K and page 24 of latest 10-Q Analyst Compilation and Calculations based on data from page 83 of latest 10-K and page 24 of latest 10-Q Analyst Compilation and Calculations based on data from page 83 of latest 10-K and page 24 of latest 10-Q

We see that in the first half of fiscal 2024 (ends 10/31/24), Semiconductor Solutions contributed 58% of revenue.

AVGO expects AI to contribute about 25% of Semiconductor Solutions revenue in ’24. (Source: AVGO AI presentation, slide 14). This implies that AI should contribute approximately 14.5% of company revenue this fiscal year (that’s based on 25% of the 58% total).

AI does represent meaningful growth. It contributed less than 5% of revenues in 2019, 2020 and 2021. It contributed about 10% in 2022. And it amounted to about 15% in 2023.

But there’s a lot to AVGO’s business that doesn’t come from AI. Lily Investment Research correctly points out that non-AI businesses haven’t been hot.

Also, on November 22, 2023, AVGO bought virtualization software expert VMWare. It spent $69 billion (including assumption of $8 billion in VMWare debt).

This was a big purchase. It’s the main reason why Infrastructure Software jumped from 21% of revenue in the fiscal 2023 first half to 41% this year.

Click here for an excellent analysis of the transaction by Seeking Alpha Analyst Tangerine Tan Capital.

The latter analyst wasn’t bothered by the deal’s having immediately boosted AVGO’s net debt from $25 billion to $70-$80 billion. The article points out that AVGO has successfully used a strategy that entails acquiring, improving the purchased unit’s margins, and de-leveraging.

That’s fine. But for me, a one-time conglomerates analyst and junk-bond fund manager, it raises red flags. I’ve seen a lot of debt-financed deals disappoint. I’ll have to overcome those to recommend AVGO.

And it does make me wonder about AVGO’s business mission. Clearly, it’s not all AI.

Having put all this on the table, it’s now time I turn things around. I’ll next discuss five elements of what I see as the bullish case for AVGO….

(1) The AI Opportunity is For Real

I completely understand those who recoil against the ridiculous AI hype that’s out there.

We’re beyond the initial stage. We’re now moving past trade-show type gimmicks and toward more substantive uses.

We see, for example, how effective it can be in summarizing information and even citing verifiable sources. We’re learning how bots can help navigate through customer service and shopping assistance.

But anybody who has used these, or other AI applications, knows the field is a very long way from where it eventually needs to go.

But that’s no reason to throw up our hands.

Doing so would be like saying the old Tandy TRS-80 is the ultimate in personal computing.

Or try getting hold of VisiCalc or pfs:Write. Compare them to the Excel and Word programs we use today. (I’m not even sure you can load the old programs. They were available on 5.25″ floppy disks.)

I’ve lived through and experienced much digital-tech evolution. So, I feel very comfortable suggesting there’s a heck of a lot more to AI than we see right now.

Investment opportunities here aren’t based on present-day AI. We’ll eventually look back and see today’s offerings as laughably primitive.

The opportunities are to own companies that will help bring AI from where it is now to where it will eventually go.

That’s going to require much more, much better, and much faster equipment and programming. I discussed this further in my 7/24/24 DELL (DELL) write-up.

(2) AVGO is a Substantial Player When it Comes to Building AI

When we think of AI builders, we usually start, not with AVGO, but with Nvidia (NVDA). We celebrate its super and still-improving family of GPU processors. (GPU means Graphic Processing Unit.)

GPUs were originally designed for processing intense graphic imagery. These chips serve well for the massive volume of repetitive calculations needed to “train” AI models.

But GPUs alone can’t do it.

Data and computations need to be stored somewhere. Hence, my 10/6/24 PSTG Buy recommendation.

AI needs servers that can handle the workloads. Many on Seeking Alpha recommend Super Micro Computers (SMCI), which makes those. (I would too, except for the accounting issues that bother me. DELL also makes such servers.)

There’s still something missing.

We must move information from one place to another. That’s where AVGO’s networking products (part of its Semiconductor Solutions group) loom large.

It holds a commanding 80% share in the market for datacenter/AI Ethernet switching and routing chips. J.P. Morgan’s Harland Sur believes AVGO tops Nvidia (NVDA), Cisco Systems (CSCO), and Marvell Technology (MRVL) with its “cutting-edge networking silicon.” AVGO’s new Tomahawk 6 chipset will drive it further along.

There are few hyperscalers. So customer concentration is a concern. What if one big customer slows down or defects?

I’m not discouraged. These scale players are the ones who have the most incentive and capacity to drive AI forward, even running ahead of immediate demand. And their needs especially drive them to AVGO offerings.

Hyperscales are interesting in another respect… custom chips.

NVDA’s leadership in AI chips owes much to the versatility of its family of GPUs. But lately, competition has been brewing.

Versatility (generalization) has its benefits. NVDA’s chips are suitable for many kinds of users. Hence, its overall market leadership.

On the other side, we have a growing demand for customization (specialization). ASICs (Application Specific Integrated Circuits) serve this need.

Hyperscalers are the ones with the most size and financial prowess to demand customized AI chips.

They don’t necessarily care about the needs of the general AI world. They pay to have their individual needs catered to. NVDA GPUs aren’t best for the pickiest customers.

This is where AVGO is on top.

AVGO has no illusions the custom market segment will dominate long-term. It doesn’t expect to become bigger than NVDA and its generalist (merchant) prowess.

Speaking at the 9/7/23 Goldman Sachs Communicopia + Technology Conference, CFO Kirsten Spears said:

It’s our view that merchant silicon will continue to be in higher demand than custom and will win out…. It’s just that when Broadcom sells merchant silicon, we’re selling our leading-edge technologies to multiple verticals and end markets. But when you’re working on an ASIC engagement, you’re ultimately just selling that custom solution to one customer, right? So it’s — you don’t have the scale that you would get with merchants. So we do believe merchant would win in the end.

But having said that, we do have very deep and strategic engagements with our silicon customers in the custom space. And so while I think merchant will ultimately win in the end, there is upside on the ASIC side. Obviously, you’re seeing that now in gen AI. So you decide.

Given the role of AI networking and its leadership of the specialized ASIC niche, AVGO deserves a place in any AI-oriented portfolio.

(3) Non-AI Semiconductors Are Starting to Recover

Apple (AAPL), a longtime AVGO customer for wireless connectivity components, re-upped in 2023 for another five years. This business relationship is critical and solid.

Apple’s new AI-capable iPhone16 line hasn’t been hot out of the gate. But as with the rest of AI, I believe it will grow and ultimately prompt new upgrade cycles.

The strength of the AAPL-AVGO relationship stands in contrast to the Qualcomm (QCOM) situation. There’s much talk that AAPL may drop QCOM after 2026 and start making iPhone modems in-house. (See here, for example.)

Elsewhere outside of AI, AVGO serves a diverse, and fairly typical (relative to the industry) set of end markets.

These include wireless and broadband products, set-top boxes, as well as “industrial automation, power generation and distribution systems, medical systems and equipment, defense and aerospace, and vehicle subsystems.” (Source: latest 10K, pages 4-6.)

Today’s AVGO skeptics are right. These markets have, overall, been cyclically lackluster.

But they’re starting to bounce off their troughs. On AVGO’s 9/5/24 earnings call, management indicated that business had bottomed out in the July quarter and started to improve.

That’s consistent with a recent Semiconductor Industry Association announcement. The group said global chip sales in August rose 20.6% year to year. Sales rose 3.5% month over month.

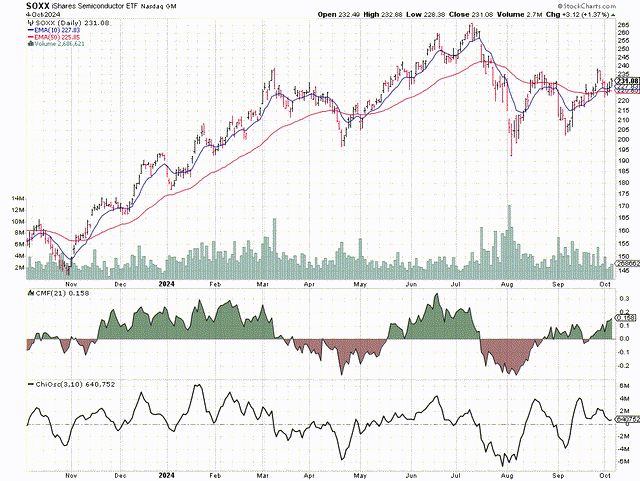

Wall Street believes recovery is at hand. That’s reflected in the chart for the iShares Semiconductor ETF (SOXX).

Notice mainly the bullishness of the Chaikin Money Flow and Chaikin Oscillator indexes. These tell us, both for institutional general-market investors, that buyers are more anxious than sellers to execute trades. That’s a tailwind in favor of stock prices.

(4) Infrastructure Software should benefit from recovery and from VMWare

Management indicated that this group, too, has started to recover.

As with non-AI semiconductors, this area has suffered industry-wide cyclical weakness.

Software doesn’t have a trade association analogous to the Semiconductor Industry Association. So we can’t easily quantify the overall improvement. But as with SOXX, we can look at Wall Street sentiment using an ETF as a proxy.

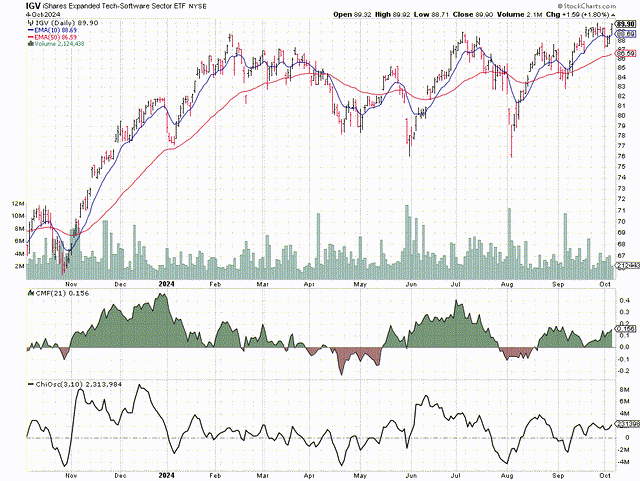

Here’s the price chart for the iShares Expanded Tech-Software Sector ETF (IGV).

As with SOXX and semiconductors, we see with IGV that the Street is looking past cyclical softness to upcoming recovery. The Chaikin Money Flow and Chaikin Oscillator indexes are delivering the same bullish messages.

There is one unique element to AGOV. The VMWare acquisition early in fiscal 2024 is producing outsized revenue comparisons.

In the latest quarter, Infrastructure Software’s top line rose 200% year to year.

The bottom line didn’t grow that much. Acquisition costs factor into the latter. Interest expense, jumped, 150%. And the share court (for purposes of computing EPS) rose 11%.

These comparisons are normal for big acquisitions financed mainly by debt and also some equity.

The primary issue is what VMWare can contribute to AVGO. As per AVGO’s usual acquisition history (see above), the company is working to boost VMWare’s margins.

That’s happening now.

On the earnings call, CEO Hok Tan answered a question about the VMWare margin by saying that in “Q4, we’ll continue the trajectory of revenue continuing to grow and expenses starting — still dropping even as it starts to stabilize but continue to reduce.”

Meanwhile, VMWare’s virtualization specialty seems like an interesting addition to AVGO’s business portfolio.

Virtualization is technology that you can use to create virtual representations of servers, storage, networks, and other physical machines. Virtual software mimics the functions of physical hardware to run multiple virtual machines simultaneously on a single physical machine. Businesses use virtualization to use their hardware resources efficiently and get greater returns from their investment. It also powers cloud computing services that help organizations manage infrastructure more efficiently.

* * * *

Physical servers consume electricity, take up storage space, and need maintenance. You are often limited by physical proximity and network design if you want to access them. Virtualization removes all these limitations by abstracting physical hardware functionality into software. You can manage, maintain, and use your hardware infrastructure like an application on the web.

(Source.)

I’m not an IT expert. But as best I can tell, this seems like a logical way to extend the capabilities of AVGO, a cloud and AI expert.

(5) The Corporate Strategies Make Sense

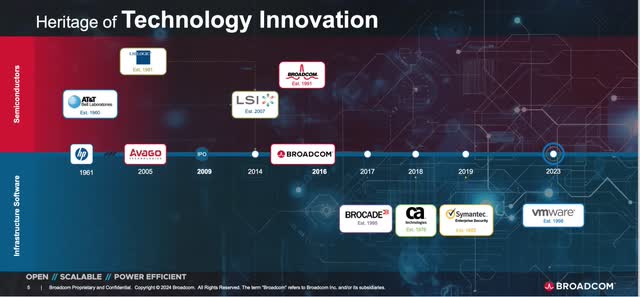

As mentioned above, AVGO is an acquirer.

Note that Broadcom is listed as a company that was acquired in 2016. This name was then attached to the acquiring company. The latter used to be called Avago Technologies. That’s the entity with the AVGO ticker. (Avago debuted after having been spun off in 1991 by pre-breakup HP.)

So, in a sense, M&A-like activities have been part of AVGO’s corporate DNA from day one.

Also, inherent in AVGO is its engineering heritage. That was described by CFO Kirsten Spears at the 9/7/23 Goldman Sachs Communicopia + Technology Conference:

Broadcom is an engineering first company. We’re always open to customers who value our leading engineering capabilities and execution and want to have deep strategic and multiyear sustainable relationships with us.

* * * *

We’re a technology company. We are innovators. Of the 20,000 employees we have, about 80% of them are engineers. So it’s a very engineering-first company.

Subsequently, at a 3/20/24 Infrastructure Investor meeting, AVGO President Charles Kawwas described the organic growth strategy the company had been following for the past 20 years.

It actually has 3 pillars. The first pillar starts with the market…. [T] he first question we ask ourselves, will this market be there in 10 years from now? Now most CEOs that I worked for in the past basically look for green shoots and markets that have hockey sticks. We are not interested in that, if that’s all the markets you looked at.

We’re actually very interested in markets that will be there in 10 years. And by the way, some of the markets that we’re in actually decline low single digits. And by the way, that’s actually very interesting for us as long as the market is durable. Now in the case of AI, which we’ve been investing in for almost a decade, we just happened to hit a market that’s actually growing significantly, and we’re happy to be part of that. But that’s not the criteria.

Now the second pillar, which is the most important pillar, is technology. And that is the heritage of the DNA of Broadcom and especially the semiconductor group here. That is the area that we’re determined in that market that we will bring leadership and innovation. And you cannot do that without investments, R&D investments, and you cannot do that without the engineers who you see here on this campus walking around. These are the engineers who actually bring us this leadership and bring the technologies we’re going to share with you today. That is the most important thing for us at Broadcom.

And the third thing is …. we tend to be #1 in each of these categories. And as a result of these 3 things, we have coined a term that’s called sustainable franchise. And that is the core definition of every business unit or division we have. So today in Broadcom, we have 26 of them. And inside the semiconductor group, there’s about 17 of them.

Now out of these 17, we’ve selected 5 end markets that we play in.

The following image, from slide 18 of AVGO AI presentation, summarizes this.

This makes sense to me.

AVGO doesn’t remotely resemble the kinds of companies from which I recoil due to my past experiences with conglomerates and junk bonds.

This company isn’t an empire-builder acquirer. It has a clear business vision.

Risk

I covered the major business risks above when I discussed the bearish view.

There are just two things to add here.

One is the usual guidance-game risk. I discussed this in my 8/7/24 MSFT write-up and in my 10/6/24 report on PSTG.

AVGO reported its latest quarter after the market closed on 9/5/34. The next day, its stock fell “only” 10%.

That wasn’t as bad as the post-earnings 16% hit suffered by PSTG. But it still hurt.

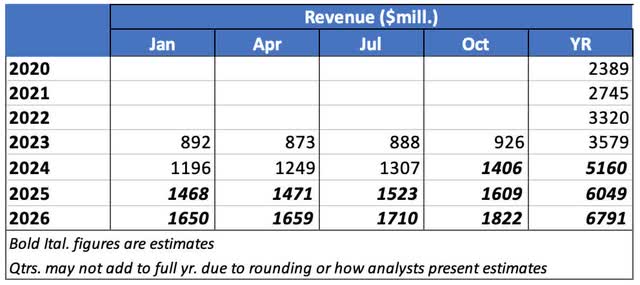

Viewed in the bigger context, though, AVGO’s trends are fine.

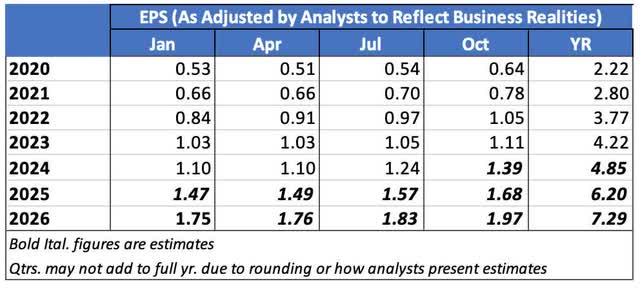

Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations Analyst Compilation based on Data from Seeking Alpha Earnings and Financials Presentations

But like PSTG, and many other AI-oriented companies, AVGO’s quarter-to-quarter progress isn’t as predictable as many would like.

So future hits like this may occur. AVGO simply didn’t win the last round of Wall Street’s guidance game.

I also must mention debt.

Because it acquires, and especially in light of the VMWare purchase, AVGO borrows more than many others in the Semiconductors Industry.

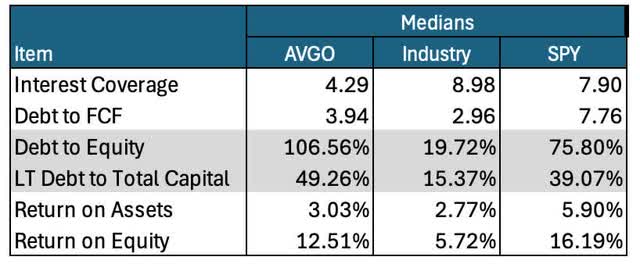

Here’s are key fundamental comparisons.

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

(I prefer medians since these aren’t impacted by wild distortions often caused by unusual data items, even in big companies that can dominate weighted averages.)

When I was managing junk bonds, I was happy to see interest coverage in the 1.25-1.50 range. Anything above 2.00 provoked ecstasy. AVGO is way better than that.

Clearly, there’s no reason to worry that AVGO might fail financially. In fact, it pays a dividend and raises it regularly.

What to do About AVGO Stock

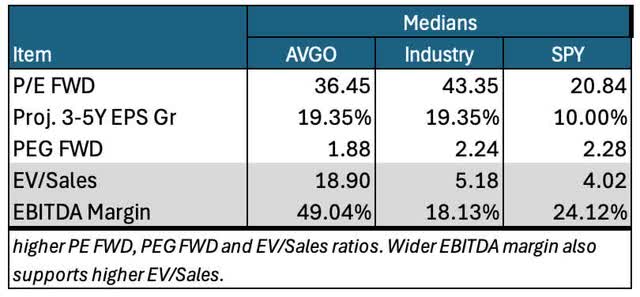

This stock definitely is not cheap.

Analyst’s computations and summary from data displayed in Seeking Alpha Portfolios

But the PEG FWD is reasonable. And I give credence to the PROJ. 3-5Y ES Gr on which it’s based. (AVG’s number is the industry median … meaning it ranks right in the middle of the highest-to-lowest sort.)

Investors get the expected growth for which they pay.

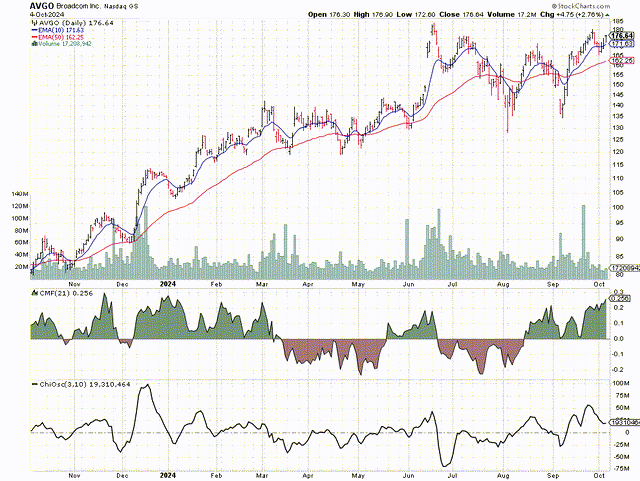

Technically speaking, at least the way I apply it, AVGO has a terrific price chart.

I like how the rising 10-day exponential moving average (EMA) is strong relative to the also-rising 50-day EMA.

Consider, too, Chaikin Money Flow (CMF) and the Chaikin Oscillator (CO). Both measure which party to trade is more motivated. CMF does it for institutional investors. CO does it for the market in general.

Both indicators are well above neutral, especially the CMF. That means buyers are more motivated than sellers. That exerts upward pressure on stock prices.

Few charts can look this good all the time. But to me, it’s relevant to show that the Street now sees AVGO in favorable terms, as do I.

As I’ve said before, my investment stance depends mainly on whether I think a stock will be better than, in line with, or worse than the market.

Here’s how I apply that to the Seeking Alpha rating system:

- “Strong Buy” means I see the stock as being better than the market, and I’m bullish about the direction of the market.

- “Buy” means I see the stock as being better than the market, but am not confident about the market’s near-term direction.

- “Hold” means I see the stock as moving in line with the market.

- “Sell” means I see the stock as being worse than the market, but am not confident about the market’s near-term direction.

- “Strong Sell” means I see the stock as being worse than the market, and I’m bearish about the direction of the market.

Based on this scale, I’m rating AVGO as a “Buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in AVGO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.