Summary:

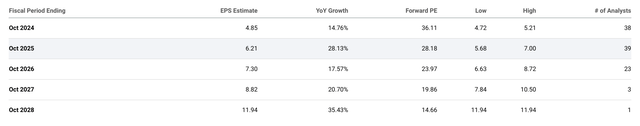

- Broadcom stock has boomed more than 100% over the last 12 months.

- The increase in AI infrastructure build-outs has benefited the company’s operating results.

- Revenue and earnings growth, strong free cash flow, best-in-class margins, and savvy management indicate further upside.

JHVEPhoto

Broadcom Inc. (NASDAQ:AVGO) shares have exploded higher over the last 12 months on the back of strong sales growth from the company’s AI infrastructure offerings and the ongoing integration of recently-acquired VMware into financial results. Despite a fairly lofty valuation, AVGO represents a unique play on the AI wave due to its other mature foundational business segments, robust cash flow, high margins, and prime positioning for upcoming secular trends. Despite some valuation and balance sheet risk, these positive developments make AVGO a Buy.

Broadcom is an interesting motley mashup of entities that have been acquired at various times since the company went public as Avago Technologies in 2009. M&A is not an exact science and many companies struggle to execute after the ink is dry, but Broadcom has been highly successful in targeting and integrating accretive acquisitions. After establishing these businesses as cash cows and taking a pause for a few years following the purchase of Symantec in 2019, Broadcom pulled the trigger on a mega-merger with VMware last year for $69 billion in cash and stock.

Overlapping with this acquisition, the AI wave took the market by storm, benefiting Broadcom due to its wide array of product offerings that enable AI infrastructure build-outs. This has created a sort of super-cycle for operating results where VMware is contributing to higher consolidated financials while growth in AI is spurring organic growth in tandem. If you were wondering where the 100%+ stock price appreciation over the last 12 months came from, I think this combo is the obvious culprit. Let’s dive into results from Broadcom’s Q3 2024 report last month.

For the quarter, Broadcom reported revenue of $13.1 billion, up 47% YoY and about 5% QoQ, and non-GAAP EPS of $1.24, up 19% YoY and 12.7% QoQ, both of which were records for the company and by fairly significant margins. And on the topic of margins, the gross margin was 68% for semiconductors, 90% for infrastructure software, and 77.4% overall. The company attributed the improved operating results to growth in AI demand, the integration of VMware, and the stabilization of some other semiconductor offerings that were facing headwinds.

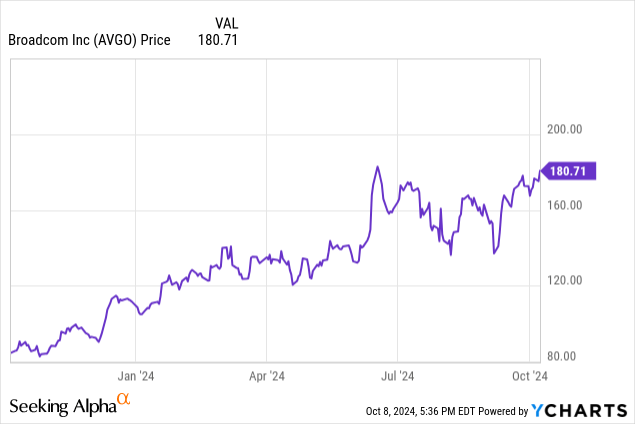

What I find most impressive about these results is how well Broadcom has been able to maintain extremely attractive margins even while ramping spending for AI demand and simultaneously absorbing VMware’s operations. In Q3 2023 (pre-VMware), the company reported a net profit margin of 51.7% and in Q3 2024 that number was at 46.8%. This may seem like a significant drop-off, but when you consider that a $69 billion merger comes with lots of potential efficiency and cost pitfalls and that overall expenses have increased to cover the AI ramp, maintaining this level of profit margin is further evidence of Broadcom’s operational excellence, in my opinion.

As further support for this excellence, CEO Hock Tan on the Q3 conference call stated this about VMware’s progress:

When we acquired VMware, our target was to deliver adjusted EBITDA of $8.5 billion within three years of the acquisition. We are well on the path to achieving or even exceeding this EBITDA goal in the next fiscal ’25.

In that vein, the integration of VMware led to an explosion in software infrastructure revenue from $2 billion all the way up to $5.8 billion, and at 90% gross margin for the segment, the earnings accretion is apparent. The speed at which Broadcom has gotten this acquisition up and running internally and generating a profit and cash flow should have investors optimistic about the future of this combined entity and whatever other companies are targeted down the road.

There has also been an ongoing sharp bump in operating expenses in anticipation of increased AI spending, as the following chart shows, but this is already paying dividends on the sales side:

Revenue for the networking sub-segment, where most AI-derived revenue is reported, came in at $4 billion for Q3, which was up 43% YoY and represented 55% of total semiconductor revenue. This was mostly driven by AI-related offerings including custom AI accelerators (+350% YoY), Tomahawk 5 and Jericho3-AI Ethernet switches (+400% YoY), and optical communication components (+300% YoY). Based on the strength of these offerings, Broadcom revised its projected AI revenue up by $1 billion to $12 billion for FY2024 or about 24% of the expected total revenue for the fiscal year.

It’s evident that Broadcom and the stock are riding a multitude of tailwinds including the accretive sales and earnings from VMware, management’s ability to execute a smooth, cost-minimizing acquisition, and secular trends towards ever higher AI spending. But what truly makes AVGO one of my favorite AI plays, is the balance between growth and the mature cash cow businesses that the company has cultivated over the years.

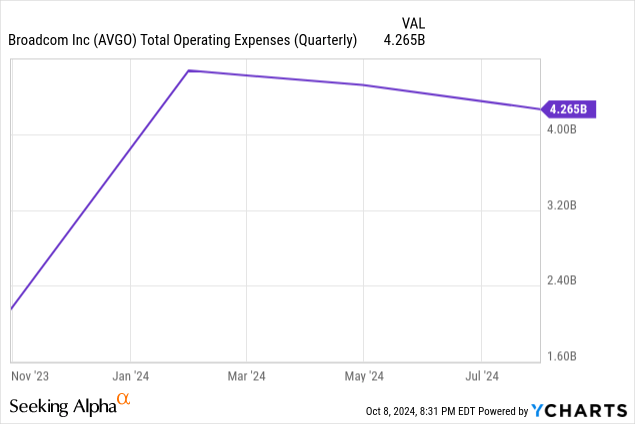

For Q3, Broadcom generated $4.8 billion in free cash flow, good for 37% of revenues. Excluding costs from the VMware acquisition, those numbers are $5.3 billion and 41%, respectively. The only company that comes to mind with a better FCF margin is the AI king itself, Nvidia, with a 45% margin, but 37%/41% is still sterling. And this is important because Broadcom’s propensity towards M&A has translated to a fairly levered balance sheet — a risk that healthy FCF works to offset.

While this ratio has worsened due to the acquisition, FCF remains robust enough to cover debt servicing. Broadcom has additionally been proactive in getting high-interest debt off its balance sheet, which is currently $19 billion in floating rate debt with 6.7% coupon and 3.1 average years to maturity compared to the lower-interest $53 billion in 3.6% coupon and 7.1 average YTM. In Q3, the company exchanged $5 billion in floating rate for fixed rate debt and used $4.2 billion from the sale of VMware’s End-User Computing business to pay down existing floating rate debt, demonstrating a commitment to de-levering the balance sheet and improving valuation multiples. The start of monetary easing by the Fed should further relieve some of this pressure as well.

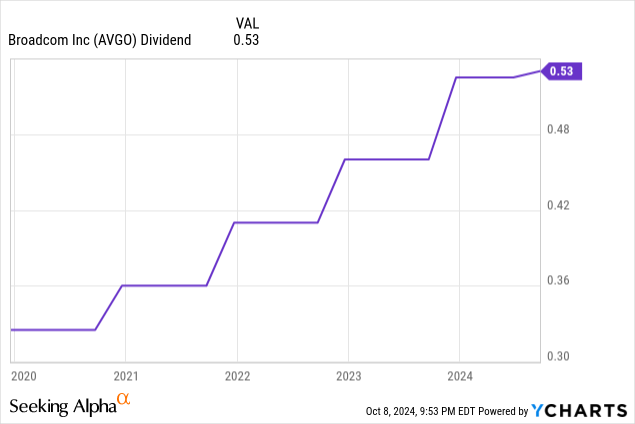

Lastly, also a rarity among AI stocks, Broadcom pays a modest dividend that has grown consistently over the years:

The per share number tallies up to an overall $2.5 billion cash payout to shareholders for Q3, which comes out to a payout ratio of around 0.52 for the quarter, which is well within the green zone that will enable continued dividend increases for the foreseeable future.

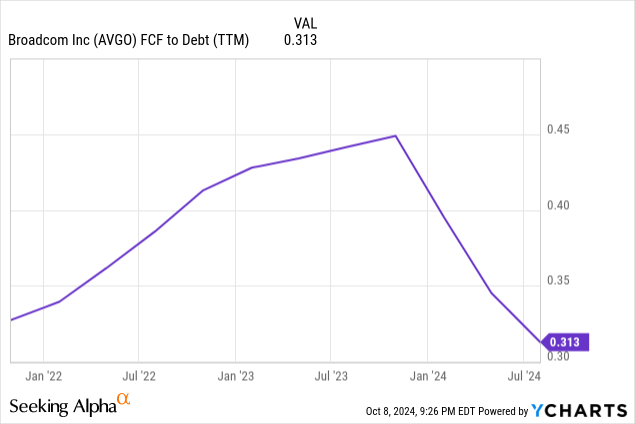

From a valuation standpoint, AVGO is fairly rich with a forward P/E of 36, but increases in AI revenue are expected to drive earnings substantially higher over the next few years:

Accelerated growth rates paired with best-in-class margins, burgeoning free cash flow, and an increasing dividend with room to continue higher all point towards a company that will continue to succeed and reward shareholders. In the long-term view, Broadcom has consistently demonstrated the ability to find and integrate companies that are accretive to earnings and cash flow, and that fit into its broader strategy. AI is the current growth driver, but management has evidently shown an ability to identify future growth drivers as well, whatever they may be.

Investor Takeaway

Broadcom is benefiting from a combination of a successful integration of its VMware acquisition and growing demand for the company’s chips, which are key to building out and operating data centers for AI applications. Revenue and earnings are growing both organically and from M&A, while margins remain stout and cash flow continues to roll in despite increases in expenses.

AVGO is certainly not cheap relative to current results, but continued strength in AI spending, robust FCF, and deleveraging the balance sheet should continue to drive shares higher in the short term. In the long-term, Broadcom has shown a commitment to dividend increases, savvy M&A to bolster earnings and cash flow, and the ability to capitalize on secular trends while avoiding significant margin erosion. On these strengths, I rate AVGO a Buy for both short-term and long-term investors.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.