Summary:

- With interest rates higher, growing technology companies cannot continue to depend on endless supplies of cheap external financing.

- Unity Software has seen tremendous stock devaluation since 2021 as investors flee from unprofitable high-valuation companies.

- Despite Unity’s losses, the company continues to pay immense sums in stock-based compensation, diluting equity investors at an accelerating pace.

- Unity faces potential competitive, economic, and industry-specific risks due to oversaturation in the gaming market and a shift toward free-to-play models.

- Unity has moderate long-term bankruptcy risk, given rising financing costs and chronic losses.

imaginima

One of 2022’s strongest trends was the downfall of many significant “high growth, low profit” technology companies. This pattern began in late 2021, when inflation began to cause interest rates to rise. As interest rates spiked last year, the discounted value of firms with high future estimated cash flow declined substantially. Further, as the value of money effectively rose, many technology companies with no or negative profits lost access to cheap and easily obtainable cash.

Much of the 2010s was a goldilocks era for technology firms, particularly startups with high growth potential. Low inflation and interest rates created an environment of tremendous money supply and aggressive institutional efforts to invest in growth firms, as many traditional established companies were still struggling with significant recession losses. That era appears to be over, and with interest rates higher, many technology companies are being pressed to deliver high cash flow or lose access to capital. As such, the value of most of these firms has deteriorated tremendously, with the archetypal fund ARKK Investments (ARKK) losing over 75% of its peak value so far.

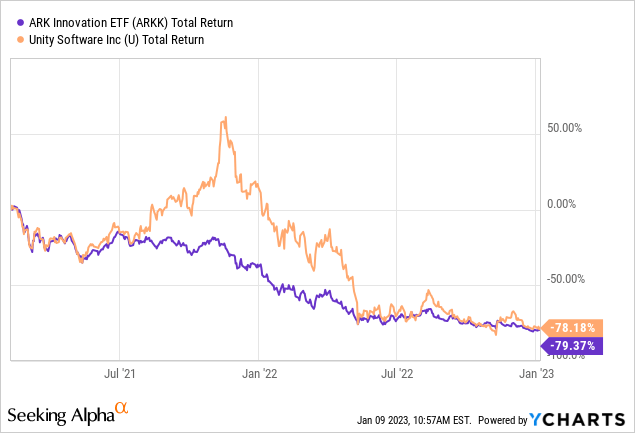

One interesting company caught in the “Great Tech Depression” is the gaming software giant Unity Software (NYSE:U). Unity has been a significant holding in ARKK and has fallen nearly as much since the technology bubble peaked in early 2021. See below:

Like many firms within the “ARKK Sphere,” Unity is now far cheaper than it was in the past. The stock faces relatively high short interest at 13.5%, so many speculators are betting against the company. Unity faces numerous risks, including competitive pressure, but predominantly economic risk, exceptionally high within the technology and gaming sector. That said, many may see the firm as a “growth at a reasonable price” opportunity given its high historical sales growth pace and depressed price.

Gaming Bust Threatens Unity’s Potential

Unity software develops and markets one of the most popular gaming engines, with its primary competitor being Unreal Engine. The two are comparable and popular among small and large game developers. Unity is seen as easier for new users but has a monthly pricing cost for its premium software, unlike Unreal Engine (which uses royalty sales above a threshold). Unreal Engine also released a new version, Unreal Engine 5, whereas Unity has not seen as significant an update since 2017 – potentially creating negative competitive risks. Still, Unity is preferable for individual game developers, while Unreal Engine caters to larger companies, so the two are not necessarily direct competitors.

In my view, Unity’s most considerable risk is the potential oversaturation of the gaming market. The past decade has seen immense growth in the gaming industry, particularly for smaller developers (Unity’s clientele). While gaming is often seen as “recession-proof,” it is proving somewhat exposed to current strain as the greater competition among new games leads to lower game prices. This trend is mainly independent of the broader economy and is particularly problematic for larger companies like Activision Blizzard (ATVI); however, the sharp rise in technology layoffs and a more general decline in consumer spending stability will likely worsen the trend.

Following the viral rise in Fortnite, free-to-play games have become an industry norm, potentially reducing demand for paid gaming engines. Unity’s leaders seem to be well aware of this trend and have shifted focus toward the advertising space. Late last year, Unity acquired the advertising tool ironSource. While the mobile gaming market may also be oversaturated, this focus may benefit the firm as developers look to monetize without directly charging customers.

At this point, I do not believe these economic and secular risk factors are so significant that they will significantly harm Unity’s sales or jeopardize the company. However, these factors seem likely to upset Unity’s growth over the coming years and are causing the company to shift its focus toward avenues of greater profitability. Despite the stock’s significant decline, it is still trading at a very high valuation, so any reductions in its growth outlook may dramatically lower its fair value today.

Unity is Still Extremely Overvalued

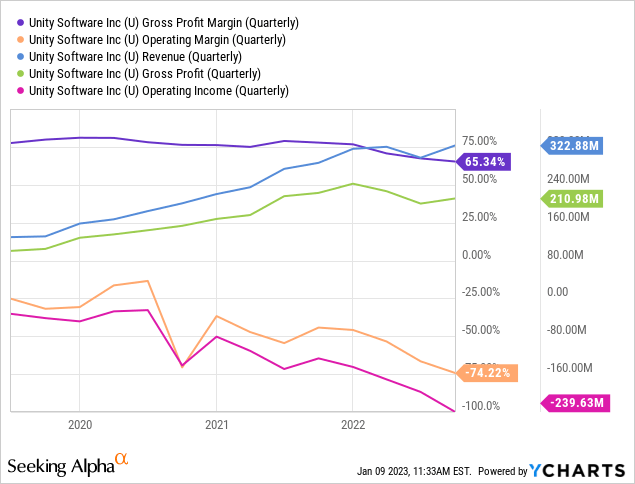

The “digital asset sector” has been one of the fastest growing over the past 10-15 years. However, companies selling non-physical assets have a habit of not being profitable. Unity is no exception, with the firm burning more money the more it sells. Problematically, Unity’s gross margins and operating margins have decreased since the stock went public, signaling a long road toward profitability. See below:

Put simply, Unity Software is a cash-burning machine with extreme net losses every quarter. To me, the fact that this trend has worsened over time is a major red flag as it signals a non-working business model and potential misalignment of corporate and shareholder interests. Additionally, it puts the company at risk of bankruptcy as, in today’s higher “value of money” environment, it will be challenging for Unity to maintain financing flows.

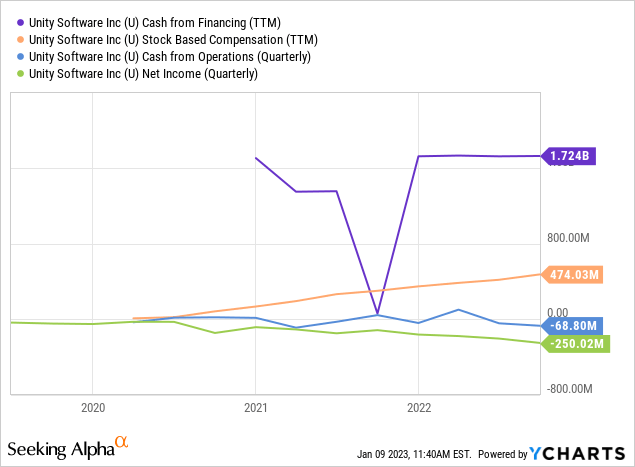

There is a relatively large discrepancy between Unity’s income and operating cash flow due to immense stock-based compensation. Despite tremendous market-cap losses, Unity’s stock-based compensation rate has surged since the stock went public. With cash from financing over ~$1.7B per year, vast sums are effectively being transferred from investors (via equity dilution) to employees with equity incentive plans. See below:

While employees should be rewarded, Unity’s stock-based compensation rate is exceptionally high and is immensely deleterious for equity investors in my view. This threat grows as Unity’s stock price declines since more shares must be created to make the same total value of shares. Essentially, equity investors are likely to be diluted at a faster pace the further the stock falls, potentially creating a negative feedback loop.

Unity’s market capitalization is currently around 10X higher than its annual sales. The company has seen its losses worsen over time and is entirely dependent on outside financing. With about $1.2B in cash, the company would likely not survive for more than 18 months without new funding. Unity’s valuation is still high enough that the company can probably sell equity to secure sufficient financing, but at the expense of more equity dilutions.

The Bottom Line

Unity is a top-rated software tool for game developers and has seen strong sales growth since the stock went public. While there are material risk factors within the gaming industry, I do not believe they are large enough to upset Unity’s sales. However, Unity faces immense risk from its lack of financial security. For the company to be profitable, it will likely need to raise the price of its products significantly (likely enough that many would stop using it) or rapidly expand its advertising monetization segment. While the company is making efforts to pursue the latter, it is certainly not guaranteed the company will become profitable soon enough to offset its hemorrhaging.

Overall, I am very bearish on U and believe the stock will decline in value over the next twelve months. In my opinion, its valuation is insensibly high compared to its annual sales, particularly given its negative path to profitability and rising stock compensation. While Unity may offer a great product, I do not believe the company has substantial shareholder value. I do not think companies should place shareholder value in front of long-term goals, but Unity’s financial situation seems problematic enough to create “Going Concern” risks in my opinion.

Years ago, when low-interest rates allowed for cheap and accessible capital, Unity could operate with losses almost indefinitely as long as growth remained strong. Today, there are many higher-yielding, more secure assets to invest in, so I do not believe Unity can continue to rely entirely on outside financing to offset significant losses. If the company continues to dilute at the current pace, its stock price could continue declining, likely worsening the core issue. However, if Unity stops using external financing, its existing cash reserves are not large enough to offset its current losses over the long run, creating material bankruptcy risk. To avoid this, Unity will need to become consistently profitable quickly – a seemingly unlikely maneuver.

With a higher short interest of ~14%, I would not personally short the stock due to the associated risks of short-squeeze or dead-cat-bounce. However, I believe it will continue to decline this year unless vast improvements are made to its business model and stock-based compensation is reigned in. If the stock were to rise substantially (20%+) on a short-squeeze, I would be more willing to bet against the firm as I believe the company is likely to face restructuring over the next three years.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.