Summary:

- Microsoft Corporation has underperformed the broader market by 12% since my last coverage, but a recent pullback makes it more attractive.

- Microsoft has showcased a strong 2024 performance, supported by the OpenAI partnership and Azure growth.

- Azure’s 29% YoY growth and expanding AI customer base position it as a key future growth driver, despite the business’s higher CAPEX expected in FY25.

- Management expects double-digit top and bottom-line growth in FY25, supported by a boom in enterprise spending.

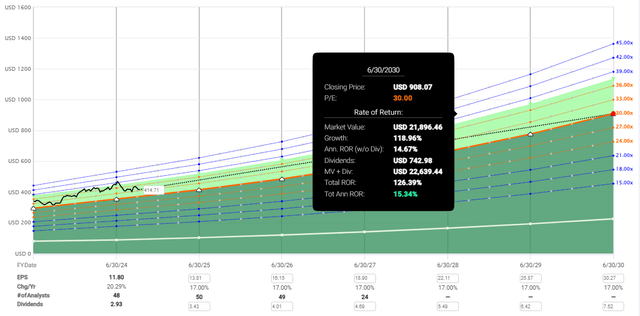

- The current stock pullback offers a long-term buying opportunity. I see $900/share by mid-2030 as the target price.

FinkAvenue

It’s been more than half a year since I wrote my last coverage of Microsoft Corporation (NASDAQ:MSFT), labeled “Not Worth your Money At Today’s Price.” Microsoft’s stock traded at close to 40x its Blended P/E valuation back then, prompting me to rate the stock as a “Hold.”

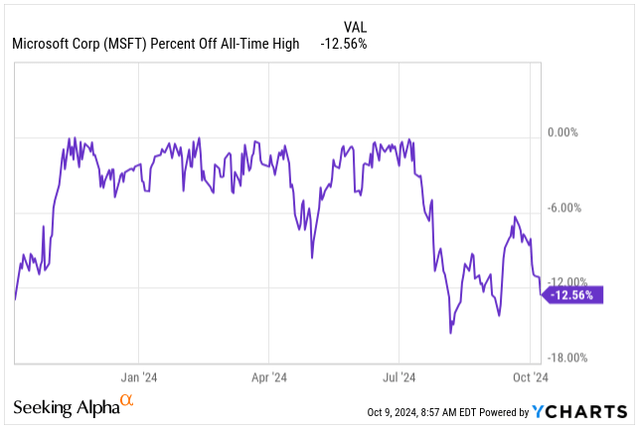

My rating has held up very well, as Microsoft’s 2% stock price appreciation has been lackluster, underperforming the broader market (SP500) by a margin of 12%.

In the meantime, Microsoft posted solid two-quarter earnings, improving the company’s fundamentals and thanks to the 12.5% pullback from its all-time high of $468/share, the stock is no longer in overpriced territory, prompting me to review my original thesis.

% off all-time high (Seeking Alpha)

Microsoft’s Superb Execution

So far, Microsoft has had a successful 2024, with their stock up 27% on a year-to-date basis, driven higher by the generative AI investment narrative.

Analysts often regard Microsoft as one of the top beneficiaries of AI, particularly due to its close partnership with OpenAI, which gives the company a perpetual license to all OpenAI IP except artificial general intelligence (AGI).

So far, OpenAI’s Chat-GPT 4 has established itself as a leader in the AI tool sector, accounting for 60% of traffic within the top 50 AI platforms, giving Microsoft the upper hand to incorporate the superior product into their software offerings, such as Bing, challenging Google’s (GOOGL) search dominance superiority.

But that’s not all; thanks to Microsoft’s access to OpenAI’s IP, Microsoft is at the forefront of AI-enabled application integration into Microsoft’s arguably most lucrative asset, Microsoft 365.

With over 345 million users of the Microsoft 365 suite, or roughly 5% of the world’s population, this provides a game-changing opportunity to seamlessly infuse AI into existing applications for businesses through Microsoft 365 Copilot that uses AI to assist users across Excel, Word, PowerPoint, Team and Outlook to generate content, analyze data and automate tasks, increasing productivity, while charging enterprise customers $30 per user and potentially attracting an even larger customer base.

But it’s not just executive talk — Microsoft’s Q4 results are a testament to Satya Nadella’s spot-on execution.

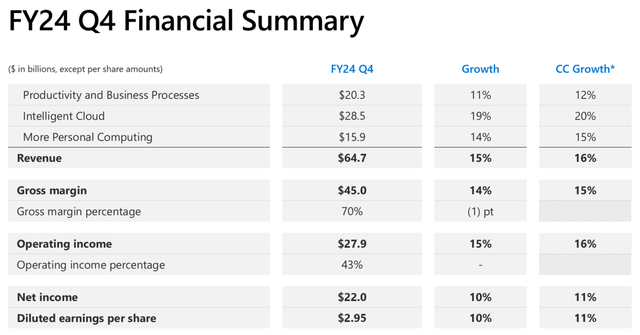

Microsoft’s Q4 earnings exceeded analysts’ expectations on both the top and bottom line, with revenue up 15%, reaching $64.7B, fueled by growth in all of its core business segments:

- Productivity and Business Processes: Revenue climbed 11% to $20.3 billion, driven by 12% growth in Office 365 and 10% growth in LinkedIn

- Intelligent Cloud: Revenue climbed 19% to $28.5B, driven by Azure and other cloud services revenue

- More Personal Computing: Revenue climbed 14% to $15.9B, driven mostly by the acquisition of Activision Blizzard, which is set for further growth and efficiency gains as Microsoft starts benefiting from the synergies of Xbox and subscription-based games.

The strong results across all three business segments have translated into a 15% increase in Operating Income, reaching $27.9B, and diluted EPS, up 10% to $2.95.

Q4 Financial Summary (MSFT IR)

Altogether, Microsoft delivered a strong Fiscal 2024, with total revenue of $245.1B, up 16% YoY, and diluted EPS of $11.80, up 22% YoY.

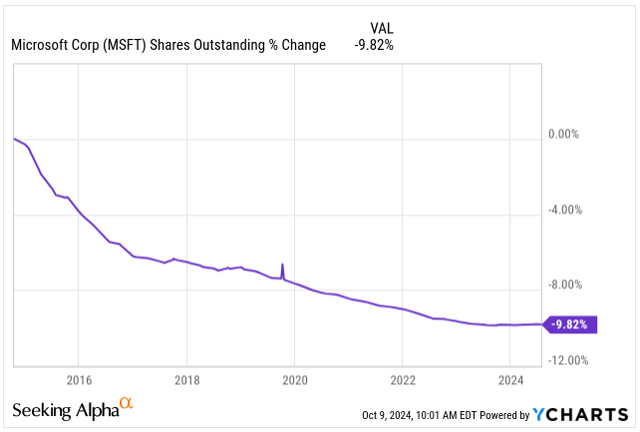

Microsoft’s shareholders, including me, had a lot to celebrate in 2024, as the company returned $8.4B via dividends and share repurchases.

As usual, the company has increased its dividend by 10% to $0.83. The current dividend yield is 0.8%, which is rather unattractive, but that’s due to strong price appreciation rather than a lack of dividend growth.

In fact, Microsoft’s shares compounded at an annualized rate of 22.85% over the past 15 years, and the dividend grew at 13.14%.

Moving forward, I expect Microsoft to maintain dividend increases of around 10%, which is good enough for aggressive dividend growth investors.

Likewise, the company has repurchased close to 10% of its share float over the last decade, with investors benefiting from the simple demand/supply dynamic.

Share Float (Seeking Alpha)

Before moving onto the fiscal 2025 outlook and Microsoft’s valuation, I want to return to Microsoft’s Cloud growth.

Microsoft’s Azure and other cloud services revenue grew 29% YoY, landing at the lower end of Microsoft’s guidance of 29-30% growth expectations when adjusting for the leap year. Azure’s growth now also included 8% points from AI services where demand exceeded available capacity, distancing Microsoft’s AI leadership from the pack.

Azure remains Microsoft’s key growth driver, and the trivial hiccup of not coming at the top of its guidance is nothing to spook investors with Azure’s growth rates; instead, the company is capacity-constrained with Azure.

Given the business’s substantial $22B run rate, I want to see more than 30% growth rates. With AI services contributing 3% to Azure’s growth in the September quarter, 6% in the December quarter, 7% in the June quarter, and now 8%, Microsoft is in a great position to keep growing the business, particularly as Azure AI customers grew nearly 60% YoY to over 60,000, strengthening the AI demand argument.

Here are some stats to put Microsoft’s Azure growth into perspective with other cloud providers in their latest quarters:

However, with each business’s different market share, each one has a different starting base:

- AWS Market Share: 32%

- Microsoft Azure: 23%

- Google Cloud: 11%

Contract renewals remained strong during the last quarter, which in my view is driven by the high interest in AI applications and good execution of Microsoft.

Overall enterprise spending on cloud infrastructure services increased 21% YoY, reaching $79.8B with more growth in the future expected, particularly as public cloud is widely expected to be the future of enterprise computing and Azure alongside AWS are two leading services to capture most of the opportunity.

I expect continuous earnings strength from Microsoft as AI-application integration continues well into Fiscal 2025, as more businesses endorse the use of AI and more use cases come to light, even as Microsoft has not broken up Copilot revenue, which might suggest an initial lack of enthusiasm by enterprises to justify the extra cost of the software.

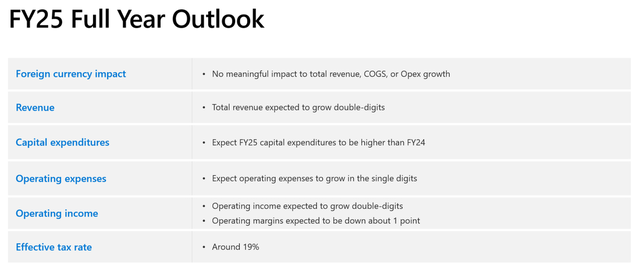

Management has provided an upbeat outlook for the following year, expecting double-digit top-and bottom-line growth, with the CAPEX expected to be higher in FY25 compared to the $55.7B spent in FY24 as the company continues investing in new AI infrastructure.

Although the higher-than-expected CAPEX has to be eventually justified by extra revenue growth from AI; otherwise, a lack of investor patience and negative sentiment may weigh over Microsoft’s shares.

FY25 Outlook (MSFT IR)

Microsoft’s Stock Is Not Cheap

Even as Microsoft’s fundamentals have improved significantly, with EPS up 111.5% in the last five years alone, the stock price has increased by 105%, not leaving much opportunity to buy the shares at a cheap valuation.

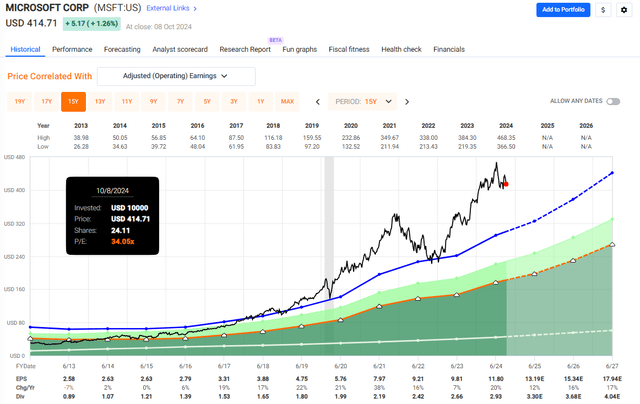

Microsoft’s stock currently trades at a Blended P/E of 34.05x, contracting from close to 40x its earnings back in July when the valuation was very stretched.

MSFT Valuation (Fast Graphs)

By no means am I going to say Microsoft’s stock has become a bargain as a result of the 12.5% price correction since reaching its all-time high, but we certainly need to acknowledge the company’s quality and stability of its earnings despite being in the inherently more volatile technology sector.

As per FactSet, Microsoft is expected to grow its earnings over the next 2.5 years in the double-digit range:

- FY25 EPS: $13.19E, YoY growth: 12%

- FY26 EPS: $15.34E, YoY growth: 16%

- FY27 EPS: $17.94E, YoY growth: 17%

That’s, in fact, an acceleration from Microsoft’s 15Y average of 13.2% EPS growth, implying a higher valuation might be justified.

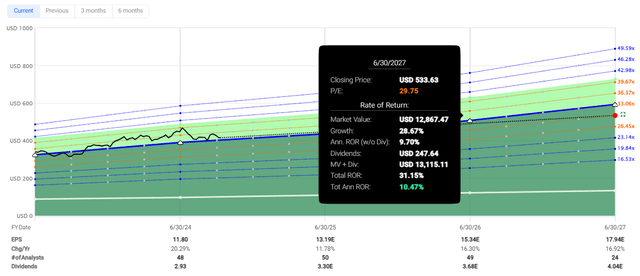

Over the past 15 years, the stock has traded on average at 24.6x, but if we account for the extra 3-4% of EPS growth, we could reasonably assume Microsoft’s forward valuation could be around 28-30x its earnings.

That would imply a potential return of around 10.5% annually, including the dividends, which is somewhat on the lower side, but acceptable for such a wide-moat business.

Potential Returns (Fast Graphs)

Let’s look at the forward valuation:

- FY25 Forward P/E: 31.5x

- FY26 Forward P/E: 27.1x

- FY27 Forward P/E: 23.1x

Based on the forward valuation of the next few years, Microsoft’s shares are not as overpriced as they may seem at first glance. If one is looking to add this quality name to their holdings, investors have the opportunity to capitalize on the stock price pullback.

I have added a few extra shares to my portfolio, and I am looking to add more on continuous weakness without diluting my cost basis too much, as I am sitting on +50% gains.

My primary accumulation target is around $395/share, at 30x its expected FY25 earnings.

If Microsoft manages to keep up the roughly 16-17% EPS for the remainder of the decade thanks to the strong demand in Azure and more revenue flowing from Microsoft 365, supported by the introduction of Copilot AI applications, we could see a share price of around $900/share by the mid-2030, valued at 30x its earnings.

Price Target Mid-2030 (Fast Graphs)

Takeaway

Microsoft showcased a strong financial performance in Fiscal 2024, driven by strength in all of its core segments, with revenue up 16% and EPS up 22%.

All core segments contributed to growth, but particularly Azure has proven to be the star of the show, with its AI customer base increasing by 60% in a span of 12 months, driven by integration of new applications.

Despite Azure’s 23% market share, behind AWS’s 32% market share, Azure is the key future growth driver as spending is booming, and the public cloud is widely expected to be the future of enterprise computing.

Microsoft’s management is optimistic about FY25, expecting double-digit top and bottom line growth, with CAPEX coming in higher compared to FY24, driven by further investment into AI infrastructure, which is coming under increased scrutiny.

The share price is on the premium side, but thanks to the 12.5% correction since it’s July all-time high, now might be the time to add Microsoft’s shares into one’s portfolio, capitalizing on the weakness.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.