Summary:

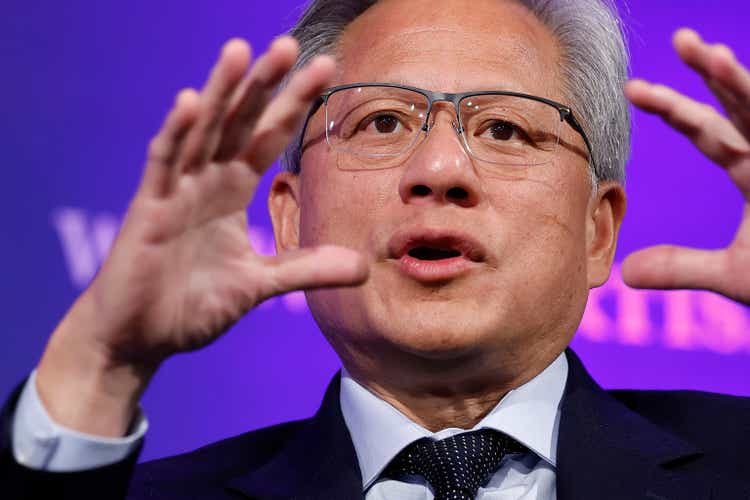

- Nvidia CEO Jensen Huang talks about AI’s potential on Arm CEO Rene Haas’ podcast.

- Hurricane Milton’s impact could reach $175 billion in insured losses.

- Loop Capital upgrades rating on home improvement retailers Home Depot and Lowe’s.

- “It’s time to fade Utilities” – BTIG analyst.

Chip Somodevilla/Getty Images News

Listen below or on the go on Apple Podcasts and Spotify

Jensen Huang says AI software will reflect on its own conclusions. (0:16) Hurricane Milton could have the biggest dollar damage amount. (1:03) Boeing could get cut to junk. (2:09)

This is an abridged transcript of the podcast.

Nvidia CEO (NASDAQ:NVDA) Jensen Huang says that the future of AI will be services that can “reason,” but the cost of computing needs to come down before we get there.

In a podcast hosted by Arm (ARM) CEO Rene Haas, Huang says next-generation AI tools will be able to answer questions by going through hundreds or thousands of steps and reflecting on their own conclusions.

This would enable the future software to reason, making it different from current systems such as OpenAI’s ChatGPT. Huang added that he uses ChatGPT every day.

He added that Nvidia will set the stage for these advancements by strengthening chip performance every year by two to three times, consuming the same level of energy and at the same cost. This would change how AI systems handle inference.

Inference is the process of an AI model being in action, wherein it produces predictions or conclusions.

Also in headlines, Hurricane Milton could be the most disastrous hurricane on record in terms of dollars.

Fed Watch Advisors says Milton’s impact will be “severe, and estimates are $100 to $175 billion of insured losses.” In 2005, Katrina incurred a loss of $65 billion, or just over $100 billion in 2023 dollars.

Investors will be watching the Procure Disaster Recovery Strategy ETF (NASDAQ:FIXT), which tracks a portfolio of companies engaged in recovering from natural disasters such as hurricanes, wildfires, floods, and earthquakes. FIXT is made up of a total of 44 stocks across the Industrials, Energy, Materials, Consumer Staples, and Info Tech sector.

Among active stocks today. Taiwan Semi (TSM) said revenue for September surged 39.6% year-over-year amid growing demand for AI chips.

The chip manufacturer saw September-quarter revenue of 759.69 billion New Taiwan dollars, about $23.6 billion. The average analyst forecast was NT$748 billion.

You heard about the stalemate in the Boeing strike on Wall Street Breakfast. The aerospace giant is also facing a potential credit rating cut to junk at S&P.

S&P estimates that the strike is costing Boeing $1 billion per month and projects the company will burn through $10 billion in cash in 2024, assuming the strike ends in Q4. The credit ratings agency anticipates that Boeing will end the year below its cash balance target of $10B. S&P also sees Boeing pursuing “incremental funding” and issuing additional equity.

Boeing currently has a “BBB-” rating.

Southwest Airlines (LUV) caught an upgrade off the bottom from Jefferies, which boosted the stock to Hold from Underperform.

Analyst Sheila Kahyaoglu said she is giving credit where credit is due and sees $2 billion of Southwest’s targeted $4 billion incremental EBIT being a reality. That’s seen as enhancing the risk-reward profile over the next 12 months in the backdrop of a U.S. domestic market that could grow low-end single digits in 2025.

Loop Capital Markets upgraded home improvement retailers Home Depot (HD) and Lowe’s (LOW) to Buy from Hold following recent store checks and management conversations.

Loop raised its price target on HD to $460 from $360 and on Lowe’s to $300 from $250 as the Fed moves to lower interest rates. It’s more bullish on Home Depot given the incremental growth opportunity it sees following the SRS acquisition.

In other news of note. Lenovo (OTCPK:LNVGY) (OTCPK:LNVGF) led the market for global PC shipments in the third quarter of 2024, followed by HP (HPQ) and Dell Technologies (DELL). That’s according to research firm Canalys.

The global PC market grew year-over-year for a fourth consecutive quarter, with total shipments of desktops, notebooks, and workstations rising 1.3% to 66.4 million units.

Apple (AAPL) rounded out the top five with 5.11 million Macs shipped, but saw a 17.5% decline year over year.

Ishan Dutt, principal analyst at Canalys., says: “Although growth in Q3 was modest, the PC market recovery is now well underway with a number of positive signals indicating stronger performance in the coming quarters.”

And in the Wall Street Research Corner. BTIG technical analyst Jonathan Krinsky says it’s time to fade Utilities.

He says: “XLU has been rising on a perfect trend since the summer, but it looks poised to break this uptrend soon. XLU has seen a -16%, -11%, and -7% correction over the last year. It looks ready for another similar correction in the 7-10% range.”

Utility stocks have seen significant gains this year, largely due to their potential as an AI play. The demand for AI processes has led to a need for huge amounts of data center power.

BTIG also pointed out that the Utilities ETF (XLU) is 13.7% above its current 200-day moving average, which is the fund’s widest spread since 2003.