Summary:

- Palantir’s technical indicators show potential consolidation at $46, with an optimistic target of $55.

- With an 80% chance of a positive return in October, Palantir’s seasonality trends support further upside.

- Palantir secured a major contract with the U.S. Army, expanding its defense sector footprint and AI capabilities.

- Over 100 organizations, including Aramark and L3Harris, have adopted Palantir’s AI platform, driving top-line growth.

- U.S. defense AI initiatives, projected to reach $1.8 billion in 2025, position Palantir for further government contract growth.

JulPo/E+ via Getty Images

Investment Thesis

In our August analysis, we emphasized why Palantir (NYSE:PLTR) could skyrocket soon, driven by its strong fundamentals, and accurately forecasted a price target of $39. The stock surpassed this target within two months, delivering a 28% return. Despite widespread market skepticism early on, Palantir has been among our highest-conviction picks.

Today, we remain bullish as the company continues to overcome challenges and solidify its market presence. Currently trading at $41, Palantir is on track to reach $46 by 2024, supported by robust momentum, strategic partnerships, and increasing demand for AI solutions in both commercial and government sectors. We maintain our confidence in its long-term growth potential.

Palantir Stock May Reach $55 By 2024 Based On Current Momentum

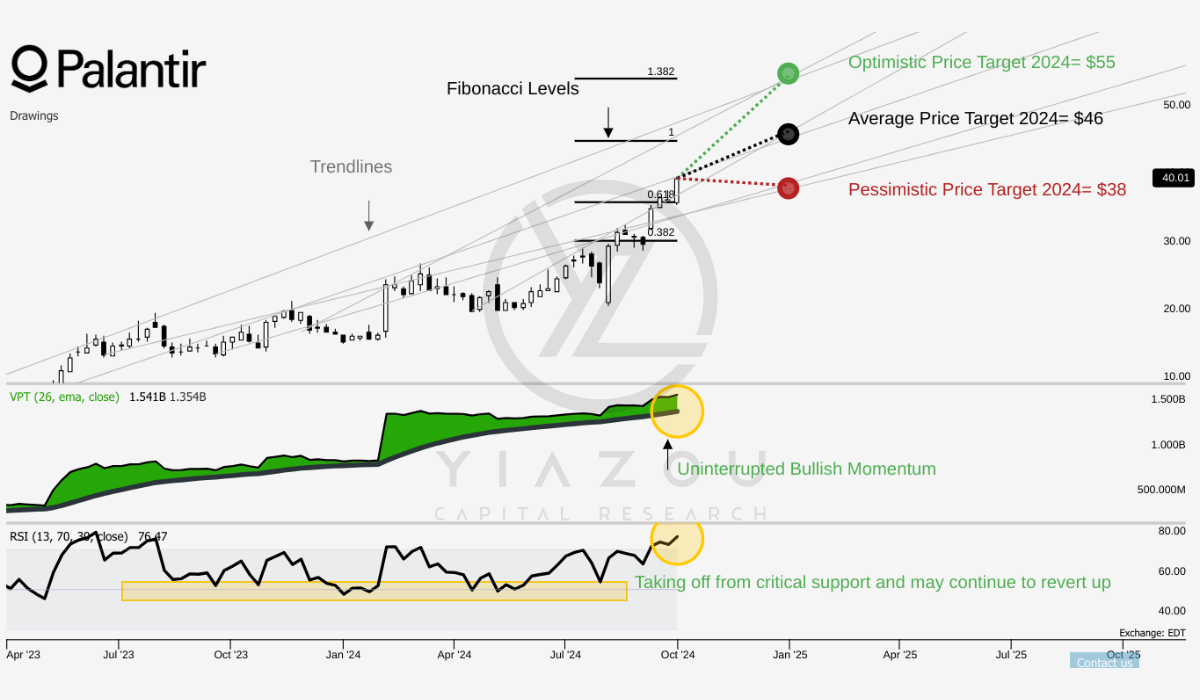

Palantir’s stock currently trades at $41, with the average price target for 2024 standing at $46. This correlates with the 1.0 Fibonacci level, a key point suggesting potential consolidation before further movement. An optimistic target of $55 aligns with the 1.382 Fibonacci level, a strong bullish signal indicating an extended upward trend, while the pessimistic target of $38.00 matches the 0.618 level. That reflects a potential correction before upward continuation.

Moreover, the RSI of 76.47 is notably high, signaling that PLTR is overbought territory. However, the absence of bullish and bearish divergences suggests that the current upward trend may still have momentum. The rising RSI line trend confirms continued buying interest but flags potential overextension. However, the stock may face a pullback if overbought conditions persist.

Finally, the volume price trend (VPT) is rising at 1.54 billion, above the moving average of 1.35 billion. This indicates that higher prices are supported by increased volume, a bullish sign. However, the recent upward reversal suggests that momentum could be stabilizing.

Yiazou (trendspider.com)

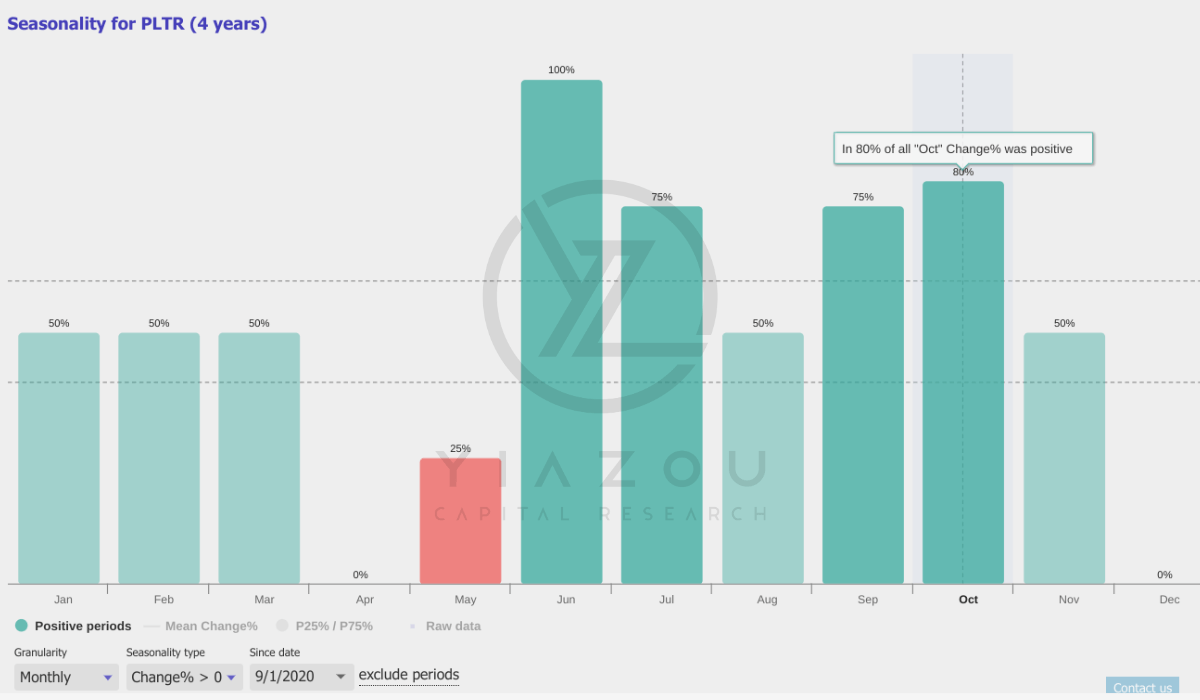

Based on data from the past four years, PLTR has a strong seasonality trend, with an 80% probability of delivering a positive return in October. Historically, October has been one of the best-performing months for the stock, showing consistent gains. This aligns with a positive outlook for PLTR in Q4, supported by solid market momentum and favorable seasonal trends. Other notable months include June and July, each with a 75% positive return probability, indicating that Palantir performs well during mid to late-year periods.

Yiazou (trendspider.com)

AI-Powered Surge: Strategic Partnerships Fueling Explosive Growth in Energy and Defense

One of Palantir’s primary strengths is its capability to secure multi-year + multi-million-dollar strategic partnerships with industry giants like BP and APA Corporation. These relationships point to Palantir’s market penetration in vital sectors such as energy and defense. Palantir’s decade-long collaboration with BP showcases the firm’s ability to deliver differentiated data analytics tech that directly improves operational edge. Palantir’s AIP software, leveraged by BP to create digital twins for its oil and gas operations, has transformed over 2 million sensor data points to support BP’s entire production chain.

In detail, Palantir’s AI software may continue to improve operational efficiency by reducing downtime in BP’s offshore oil production systems. According to industry averages, downtime in offshore oil platforms costs operators between $38 million and $88 million annually per platform, even at the base level (2016 as the base). Considering the size of BP’s expansive portfolio, even a 5-10% efficiency gain through Palantir’s tech may lead to savings of hundreds of millions of dollars.

Similarly, Palantir’s AI software has helped APA Corporation identify anomalies in invoicing and contract documentation, potentially reducing contract mismanagement costs by millions of dollars. According to the World Commerce & Contracting Organization, poor contract management can cost companies 9%-15% of annual revenues. Again, by identifying these inefficiencies, Palantir’s AI solutions could save APA tens of millions in lost revenue annually.

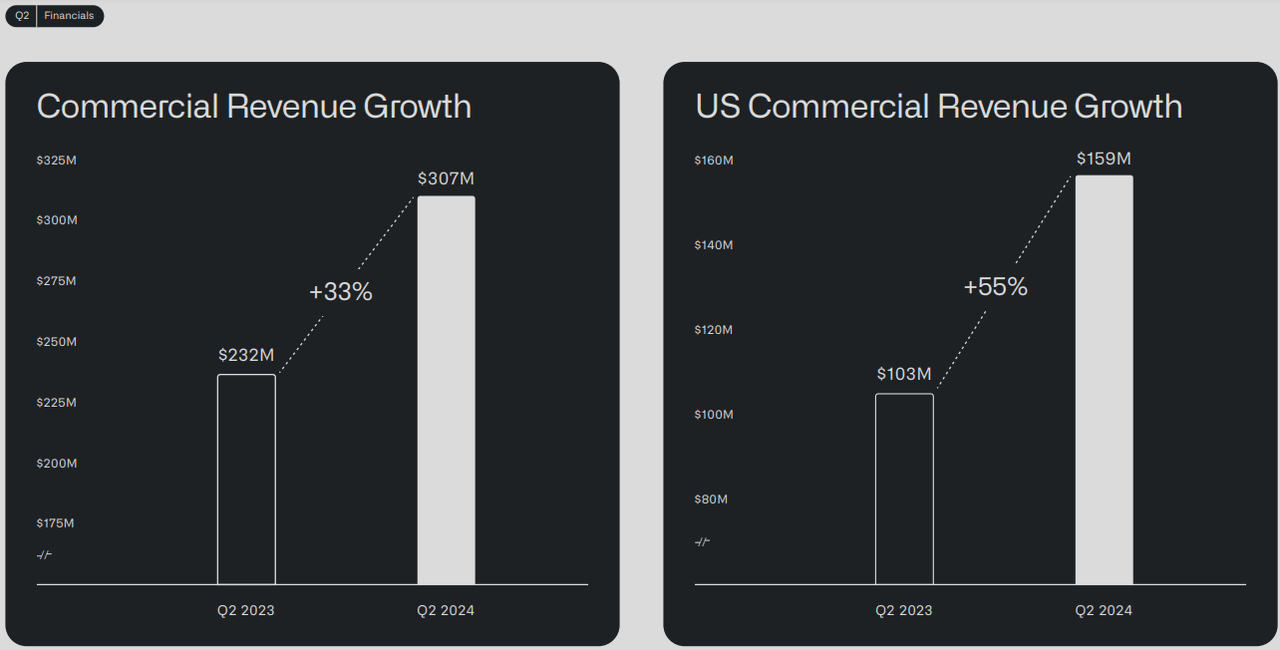

In the commercial sector, Palantir’s AI platform’s lead is underscored by its growing client base, as seen through the participation of more than 100 organizations at its AIPCon event. These organizations include major names like the National Geospatial-Intelligence Agency, Aramark, and L3Harris, which rely on Palantir to integrate AI into their operations. The core fundamentals of Palantir’s top-line growth are that the company can expand its client base on scalability and broad applicability.

Therefore, the more industries integrate Palantir’s AI/ML systems, the more diversified and stable its top line becomes. The diversity of client industries, from defense to consumer goods, means Palantir is less exposed to cyclical market conditions in any sector.

Palantir Q2 2024 Earnings Presentation

Each new enterprise contract with a customer such as Aramark or L3Harris is estimated to be worth millions of dollars annually. If Palantir continues penetrating various industries at this rate, the incremental annual revenue could compound significantly. This factor supports and elevates PLTR stock’s valuation beyond average multiples and price targets.

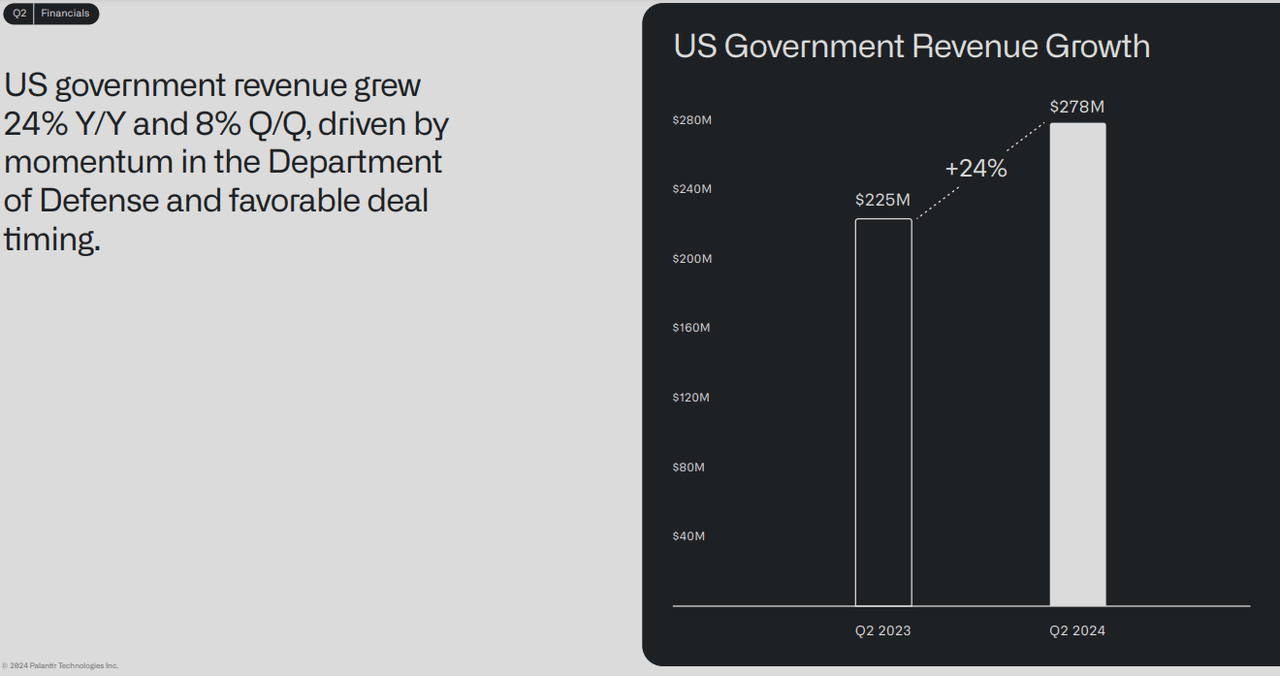

On the government side, Palantir’s recent $99.8 million contract with the DEVCOM Army Research Laboratory represents another major milestone. This contract expands access to Palantir’s Maven Smart System across US military services, pointing to Palantir’s differentiated market position in delivering AI solutions to mission-critical operations. The continued investment in Project Maven by the Department of Defense and its projected expansion through various military departments mark the strong continued demand for Palantir’s services in the government segment.

US defense spending for AI initiatives may be $1.8 billion in fiscal 2025. This ongoing budgetary allocation indicates sustained government demand for AI solutions, representing a significant revenue driver for Palantir. Considering the size and influence of the Department of Defense, Palantir’s ability to win contracts of this magnitude strengthens its long-term competitive moat and provides stability to the stock market valuation.

Palantir Q2 2024 Earnings Presentation

Is Insider Selling Signaling Trouble for Palantir’s Future Growth?

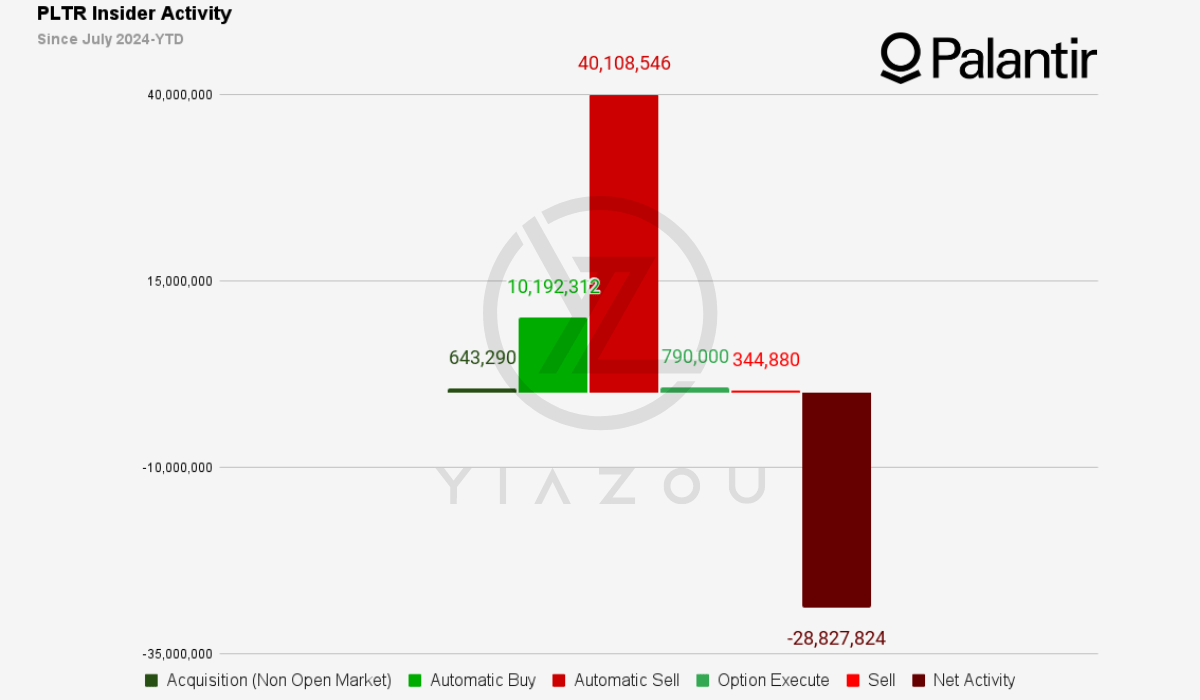

One of the visible fundamental weaknesses of Palantir’s stock market price is the consistent pattern of insider selling activity. Over the past 12 months, insiders executed 129 open market sell transactions, significantly higher than the 53 open market buys. This imbalance suggests a lack of insider confidence (those closest to its operations) in the company’s prospects. A high level of insider selling may push external investors to expect the stock price to stagnate or decline in the short term. Moreover, there were 45 insider sales over the past three months, compared to only 13 buys. In this market, insider activity has persisted even more strongly in the short term.

In terms of shares traded, there is also a similar imbalance. Over the past 12 months, insiders bought 21.86 million shares but sold nearly 69.38 million. The net insider activity for the last year stands at a negative 47.52 million shares. This discrepancy raises concerns about whether insiders believe that Palantir’s stock is overvalued at current price levels or there are potential headwinds that may negatively affect the company’s stock performance. Over the past three months, the net insider activity has been aggressively negative at over 29.62 million shares and may further reinforce the bearish sentiment in the street.

In detail, between July 2024 and the year-to-date (YTD) period, Palantir insiders collectively executed various types of transactions, such as acquisitions (non-open market), automatic buys, automatic sells, option exercises, and regular market sells. Specifically, the total acquisition of shares through non-open-market transactions is 0.64 million shares. Meanwhile, automatic buys stood at 10.19 million shares. However, these acquisitions are vastly overshadowed by a significant volume of automatic sales, 40.11 million shares sold. The automatic sell volume of 28.59 million shares by Peter Thiel is particularly significant. Thiel’s sales account for approximately 71% of the total insider sell volume.

Here, “automatic sell” refers to pre-scheduled stock sales by insiders under a trading plan following the SEC rule that allows company insiders to set up a prearranged plan to sell a predetermined number of shares at specific intervals (regardless of insider knowledge/company performance). Therefore, there may be nothing to panic about, as these sales are “automatic” because they are executed without the insider’s direct involvement at the time of sale. In Palantir’s case, the shares sold under “automatic sell” by Peter Thiel likely followed such a plan. However, large-scale automatic sales can still create negative market perceptions despite this compliance measure.

Yiazou

Takeaway

With a solid foothold in critical sectors like energy and defense, Palantir’s AI capabilities are unlocking significant operational efficiencies for clients. As the company continues to expand its market presence, it is well-positioned to reach $46 by 2024, offering continued long-term growth potential.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.