Summary:

- Meta’s valuations are dirt-cheap relative to history, but you’re still looking at a business with a shrinking EBITDA and EPS profile through FY24.

- The industry outlook does not look great, and TikTok is gaining traction despite Meta’s initiatives in leveraging AI and making Reels more compelling.

- Buyback support is unlikely to be very strong, given the challenges with FCF generation.

- The spike in the volatility quotient to double-digit levels puts Meta in a difficult spot to generate ample excess returns relative to the risk-free rate.

- Whilst the stock may continue to see some upside, the risk-reward does not look ideal.

Kira-Yan/iStock Editorial via Getty Images

META Stock – Key Metrics

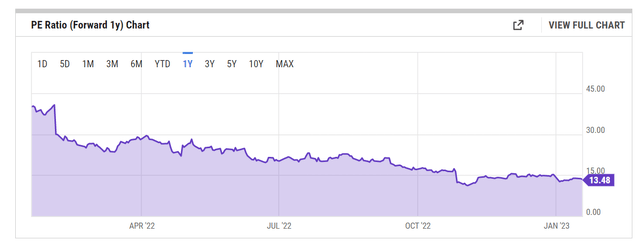

Sentiment towards Meta Platforms’ stock (NASDAQ:META), has inched up in recent months, and some investors are also encouraged by the fact that despite the recent uplift, forward valuations still remain very suppressed relative to historical averages; based on consensus estimates for FY24E, the stock currently trades at 13.5x P/E, which would translate to a sizeable discount of ~53% relative to its 5-year average forward P/E multiple.

With such an attractive valuation discount, I can understand the temptation to take a punt with META, but I’m not convinced there’s enough meat on the bone to jump in at this juncture.

Firstly, industry-wide prospects for the core digital ad business don’t look too appealing in FY23. A recent survey carried out by Market Research firm – Cowen showed that growth in digital ad spending in the US would likely slow from 7.5% in FY22 to just 3.3% in FY23, the lowest rate in five years! Meanwhile, the lingering headwinds from Apple’s ATT privacy initiatives continue to generate increased uncertainty in the industry, with 36% of the respondents expecting this issue to be a permanent crux (up from 30% a year ago).

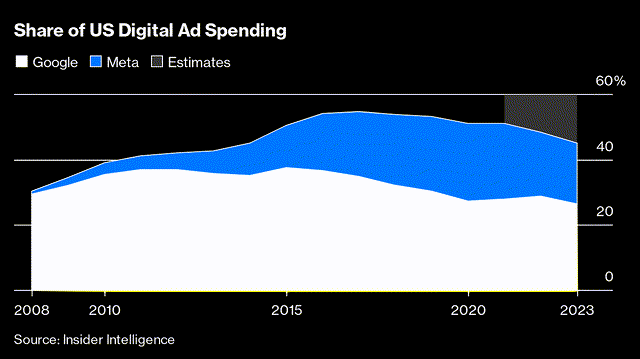

Then whilst the whole market isn’t growing as much as you’d want, the infographic below shows that META looks set to lose share for yet another year, and quite possibly all the way till 2024.

Over the recent earnings calls, Meta management attempted to wax lyrical about how their advancements in AI helped boost watch time on Reels. I’m not doubting how their AI investments have helped augment the positioning of some of their platforms, but in an environment where marketing budgets are tight, it’s questionable if that alone is sufficient to make a mark.

I bring up the case of TikTok, which has reportedly been undercutting Meta and garnering a greater proportion of digital ad spend. To garner 1000 impressions via video advertising on TikTok, advertisers need to spend only half as much as what is demanded by Instagram Reels. And it’s not as if TikTok is a bog-standard platform either. In fact, engagement rates are reportedly 10x higher there than Instagram Reels (Source: Blue Wheel Media). Even YouTube Shorts is believed to have a higher amount of user engagement with content than Reels (Source: Creatopy).

The other point to note is that even as Reels becomes more prominent in the business mix, you can’t write off the cannibalization effect on other more lucrative ad platforms such as Feeds and Stories for at least the next year and a half; with a ~$500bn revenue impact per quarter, you’re looking at a $3bn hit in total through FY24!

Besides that, the OPEX base will likely remain more challenged this year (core operating expense growth of 15%) in addition to $2bn worth of charges linked to the consolidation of their office footprint. All in all, according to consensus estimates, whilst revenue growth in FY23 will come in at the mid-single-digit levels, EPS growth will be deeply negative (13% annual decline). In FY24, one should see an improvement in the YoY growth numbers, but then again, investors should also consider that two years on, META’s EBITDA ($57.8bn) and EPS ($9.8bn) will still be 10% and 28% lower than what it was in FY21. In effect, what you have, is an unusual mega-cap with a forward P/E (13.5x) that is pricier than the trailing P/E (12.7x).

I understand that a lot of investors have pegged their hopes on the Reality Labs portfolio, which could go one way or the other. However, given the humongous near-term impact on Capex, you do wonder when the payback will take place. Capex has been trending up for four straight quarters now (Capex spending per quarter which was at $4.3bn in Q3-21 is now at levels of over $9.3bn), and whilst AI-related Capex could come down in FY23, the Reality Labs investments will only grow. Management now expects to invest another $34-$39bn next year, which means you’re looking at $9bn plus spend per quarter, for the foreseeable future.

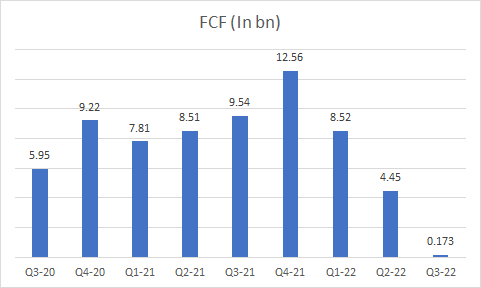

Some investors may point to roughly $17.8bn of buyback funds that could be used to prop up the META share price, but will the company generate ample FCF to fund those buybacks? Cash flow generation is unlikely to be huge, with pressures on both the topline and operating front. Then you have this huge CAPEX outlay, which then leaves you with minuscule FCF generation. Already in Q3, FCF had slumped drastically to less than $200m!

Quarterly presentations

Closing Thoughts – Is META Stock A Buy, Sell, Or Hold?

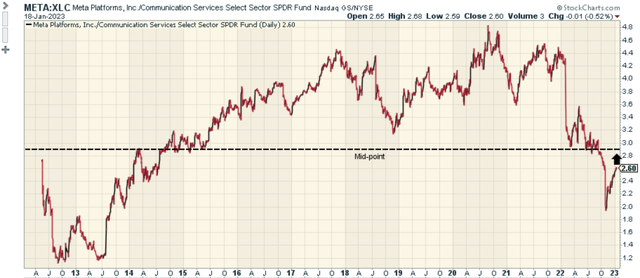

META stock’s resilience over these last few months has been heartening to note, and whilst we may see a bit more upside, it is questionable if it will last long enough to facilitate a V-shaped recovery. To get a sense of my concerns, you may consider looking at the price imprints on the weekly chart.

Firstly, note that from 2015 until Sep 2022, META had been trending up in the shape of a megaphone pattern. Between June 2021 and September 2021, it looked as though the stock was overextended to the upside. Since then, we’ve seen quite a persistent bout of selling in the shape of a descending channel, towards the lower boundary of the megaphone, followed by a breakdown from there in mid-September 2022. In November, the selling bottomed out, and we’ve seen a bounce to the $133 level.

If one were to consider a long position at this juncture, the risk-reward doesn’t look too compelling as the price is currently a lot closer to not just the upper boundary of the channel, but also the lower boundary or the breakdown point of the megaphone which may serve as a resistance point (around the $160 levels).

META could have also worked as a potential mean-reversion play within the communication services sector in Q3-22, but at current levels, that prospect is less alluring. As you can see from the image below, META’s relative strength versus the SPDR Communication Services Select Sector ETF (XLC) is not too far from the mid-point of its long-term range.

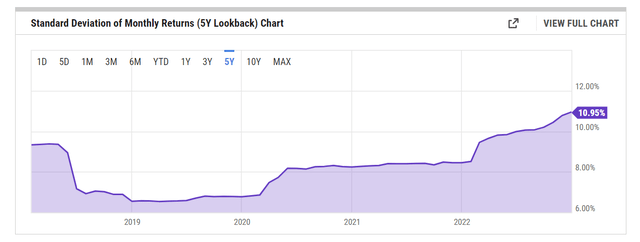

It also doesn’t help that Meta’s stock has become increasingly volatile of late, dimming its credentials as a useful portfolio stock. Note that the standard deviation of its monthly returns is now in the double-digit territory and is at its highest point in five years; just for some perspective, over the last five years, the average has been a lot lower at around the 8% levels.

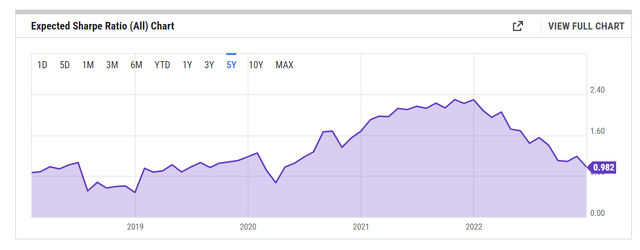

The elevated standard deviation profile puts the stock in a difficult position to generate ample excess returns (relative to the risk-free rate). In fact, data from YCharts show that the “expected” Sharpe ratio for Meta has recently dipped to less than 1x for the first time since May 2020 (the 5-year average works out to 1.34x); this means the stock is unlikely to generate appropriate excess returns that commensurate with the level of volatility it experiences.

To conclude, Meta’s core advertising business isn’t in a good place, and while the metaverse opportunity may look promising on paper, the cash burden and other execution risks cannot be cast aside lightly. Valuations look attractive relative to history but don’t forget that earnings attrition will persist this year as well (~13% decline in the 2023 EPS). Technically, the risk-reward does not look wholly compelling, and it’s hard to get too excited about the higher volatility quotient of the stock either. Considering all these factors, and the fact that the stock has already rebounded by ~40% since November, I concluded it wouldn’t be the best time to get on board. META is a HOLD.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.