Summary:

- Palantir’s Q2 results show impressive 27% YoY revenue growth, driven by AI boom and accelerated sales through AIP Bootcamps.

- Despite strong financials, stock-based compensation poses dilution risks, and share repurchases may not sustain current stock price levels.

- New product Warp Speed aims to revolutionize customer software, potentially boosting growth assumptions.

- With this mixture of positives and negatives, I maintain my Hold rating until a better price cancels out the risky aspects.

Klaus Vedfelt

Palantir (NYSE:PLTR) is a stock I’ve twice covered. First I rated it a Sell, skeptical of what, I thought, was a nebulous AI-driven thesis and a lack of profitable history. Later, I re-rated it to a Hold, concluding the following:

Palantir is an amazing company with red carpets rolling themselves out for it, as LLMs have unlocked the vast potential of their product, well ahead of almost anybody else.

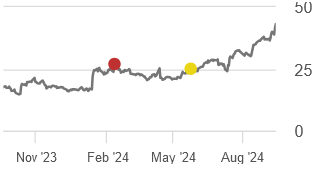

Since then, the price of PLTR is up more than 70%.

PLTR Price Changes (Seeking Alpha)

Q2 2024 results have also come out, so it’s worth another check-up, to see how favorable the risk and reward are for an investment in PLTR. I maintain my Hold rating, but I do so from a place of greater caution, which I’ll explain below.

Q2 Results

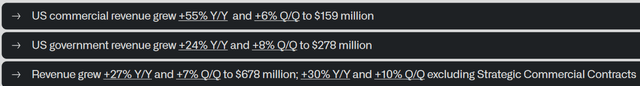

The second quarter continued to show growth in the wake of the AI boom, of which Palantir has been one of the clearest beneficiaries.

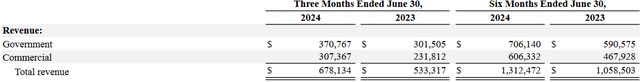

Revenue across the board grew 7% over the last quarter and 27% over the last year, an impressive result.

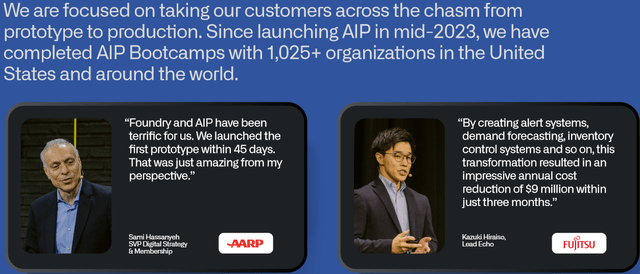

The growth is supported by the continued benefit of the AIP Bootcamps, a newer sales experience that has greatly accelerated the sales process by allowing customers to see, more immediately, the material possibilities of Palantir’s software. The timeline of the sales process has thus decreased from being many months down to, in some cases, days.

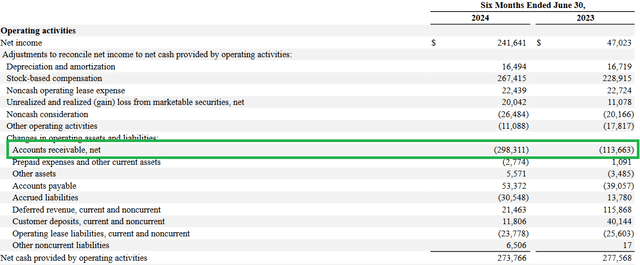

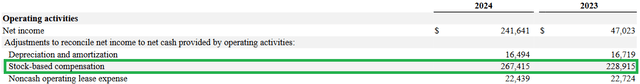

Cash Flow Statement (Q2 2024 Form 10Q)

Looking at the cash flow statement, operating cash flows are about equal to the same period last year. One might wonder if Palantir’s cash generation should look like this with so much revenue growth, but it’s worth noting that significantly more Accounts Receivable have been booked. I trust that we will see most of this difference realized as cash generated within the near future.

Altogether, growth is strong, and the company is in great financial shape.

Valuation and Risks

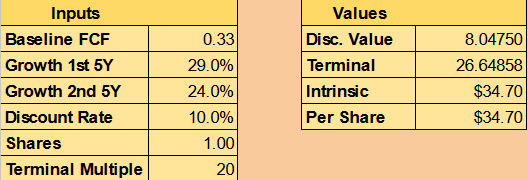

In my previous article, I gave a range of valuations to illustrate the possibilities for a fair value at a 10% discount rate (typical return of the market).

Author’s calculation

The above was based on the free cash flow per share, calculated based on 2023’s total FCF, divided by the number of shares outstanding. The growth rates reflected the potential from the double-digit revenue growth that Palantir is currently experiencing.

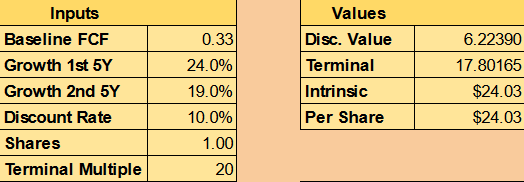

Author’s calculation

For the lower range, I offered a decreased CAGR of FCF of 5% for both halves of the decade, in light of the high levels of stock-based compensation (more on that later). Based on the updates from Q2, I don’t see any compelling need to update the calculation, so I will let this stand.

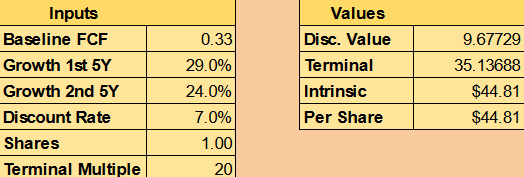

Author’s calculation

If one wants a fair price for something closer to a 7% return, then all they would need to do is modify the discount rate accordingly. Doing so gets us much closer to the current price. Again, this means the risk of accepting a lower return if one buys today.

PLTR Price History (Seeking Alpha)

Shortly after the PLTR IPO, there was the 2021 bull market that peaked at $39 per share and a market cap of $67.94B. The price fell through 2022 and 2023, going below $7. The excitement for the stock died down.

In 2021, I recall that many of PLTR’s fans were just as convinced that the company would change the world, prior to all this talk of AI. Yet, confidence quickly petered out. Only very recently have those who bought at the 2021 peak started to break even and come out ahead.

The fundamentals have since improved, as I’ve discussed over these three analyses, but the sensitivity of this stock to changes in information is apparent because this company’s future is so mysterious. I would guess that many of PLTR’s sternest believers have never actually had a chance to use the product that they make.

There’s another thing to consider as well. Thursday’s closing price is $43.52 per share and a market cap of $96.59B. If we compare that to the peak in 2021, PLTR the stock is up 11.6%. The market cap, however, is up 42.2%. This is the risk posed by the stock-based compensation that I mentioned earlier.

Cash Flow Statement (Q2 2024 Company Presentation)

If we look at the cash flow statement again (this time focusing on stock-based compensation), we see that the value of it is similar to the level of operating cash flows for the period.

Cash Flow Statement (Q2 2024 Form 10Q)

Notice also that the exercise of these stock options occurs, and I believe they will likely continue into the future. Additionally, the company has begun repurchasing shares, a first in its public history, and the stock gains over the course of the year may be influenced by that.

As the valuation is getting into their higher ranges, one has to consider what could happen if those buybacks were to abate. I worry that this could result in depreciation, for which some investors may not be prepared.

Mitigating Factors

Having said that, there’s a lot going well for this company, a lot of value-creation, that is likely to support my high-growth assumptions going forward. I technically mentioned some in reviewing Q2 results, but I want to highlight an announcement they made, a new product offering called Warp Speed. I’ll quote Chief Technology Officer Shyam Sankar from the Q2 earnings call:

…we conceive of it as an operating system for the modern American manufacturer. It touches not just ERP, but also MES, PLM, PLCs, it’s interacting with the factory floor. We think there’s an opportunity to reimagine this. I think the kind of congenital defect for most of this software, it was designed historically in the 70s for the CFO. Why would you do that? If you’re starting over today, you would build software that was designed for the Head of Production…if you go to new manufacturers, the ones that are powering the reindustrialization of the country, they all know this. They’re all alumni of the Tesla, SpaceX world where they built their own systems from scratch, principally because the other stuff doesn’t work at all.

As they elaborated further throughout the call, Palantir believes it’s positioned not only to provide better data analytics to its customers to improve operations; they believe entirely new software is needed. They believe the standard OS is used by several of the same companies, often with tremendous inefficiencies. Industrial capacity improves when the software fits the nature of the operations (a nature that Palantir’s data analytics have unlocked for many customers).

It’s difficult to imagine the potential here, but if they can sell customers on the idea of it, I suspect it would cause my growth assumptions, which are already quite large, to increase significantly. If a company’s operations can be fundamentally reimagined, the value of those contracts would likely be in the cards.

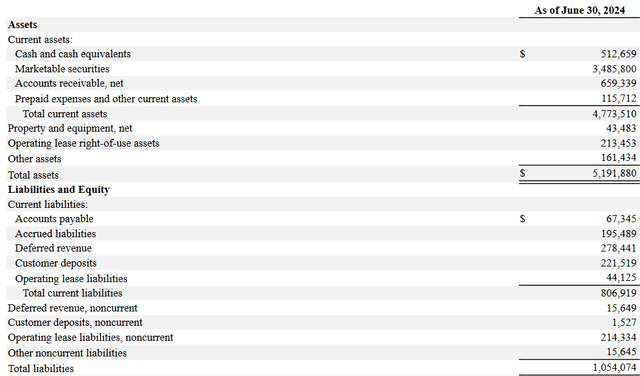

To add to that, Palantir maintains an incredibly healthy balance sheet, with about $4B in cash and marketable securities and no debt. This sucker ain’t going bankrupt.

Revenue Breakdown (Q2 2024 Form 10Q)

As government contracts still make up a majority of revenues, this also protects against the downside of Palantir’s future cash flows. Government contracts are less constrained by macroeconomic woes, and as trust is an important factor (many of these contracts pertain to military defense), I expect Palantir is unlikely to have competitors who enjoy a similarly healthy relationship.

So in spite of the risks I mentioned, total loss doesn’t appear to be among them.

Conclusion

Palantir continues to grow and stay one step ahead with innovation. It keeps growing each quarter and setting new records. The Warp Speed announcement is an exciting one, and it’s not surprising the share price is up afterward.

The long-term returns are what matter, however. A significant amount of share-based compensation continues to occur, threatening high levels of dilution as stock options are exercised in the future. Similarly, the company has recently started repurchasing shares, and a period where they see fit to cease this could be met with a major correction in price.

Palantir can still give positive returns over time, but it’s becoming much more a game of risk management. As I would like a better price to accomplish this, I maintain my Hold rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.