Summary:

- Wells Fargo’s Q3 earnings exceeded expectations, and management is doing a great job despite regulatory constraints.

- Despite impressive Q3 results, I don’t see much additional upside over the next 6-12 months.

- Falling interest rates have a significant negative impact on profitability.

- While there is a longer-term argument for Wells Fargo, the short-term bullish case has played out, so I am moving to a hold rating today.

Wells Fargo & Company (NYSE:WFC) announced its Q3 earnings on Friday, and investors are enthusiastic, with shares jumping about 6% on the news. And that’s an understandable reaction. A quick glance at the results shows that Wells Fargo is doing an excellent job operationally, making the absolute most of the current operating environment despite facing significant regulatory constraints.

However, when taking a closer look at the core metrics, I see reasons for caution as we head toward 2025. To be clear, I’ve been a long-time Wells Fargo bull — my last 13 articles about WFC stock here at Seeking Alpha have all been bullish. That said, for the time being, I believe the bull thesis has largely played out and shares are no longer meaningfully undervalued. As a result, I am now moving to neutral on the stock. Here’s why.

Q3 Headline Numbers Dazzle

Wells Fargo’s Q3 report started off with a bang, as the company’s $1.42 of GAAP earnings came in far ahead of the analyst consensus, which was $1.29. This result was slightly down from $1.48 for the same period of last year, but a much smaller decline than expected. And the $1.42 headline figure includes a 10 cent loss due to repositioning of the firm’s debt securities portfolio; earnings would have increased outright year-over-year excluding that charge.

This is rather remarkable, given that the interest rate curve has turned significantly against Wells Fargo, with the bank’s net interest income falling 11% year-over-year. Net interest income constitutes about 60% of Wells Fargo’s overall revenues, so it shows impressive managerial skill for the bank to report such strong numbers even with such a pronounced unfavorable move in the interest rate curve.

What led to the bank’s strength? For one thing, Wells Fargo continues to deliver strong performance with its loan book. Credit losses were down this quarter, and the bank appears to be well-positioned with its risk exposures heading into 2025. The other big positive was on the investment banking side, where the bank’s fees jumped 37% to $672 million for the quarter. That, in turn, helped the bank’s overall non-interest income to rise 12% during Q3, almost entirely offsetting the decline in net interest income.

These Results May Be Hard To Repeat

CEO Charlie Scharf and the management team deserve a round of applause for these results. It’s impressive what the bank has been able to achieve, even in the face of significant regulatory restrictions and reputational damage stemming from the late 2010s fake accounts scandals. Despite higher overhead expenses tied to cleaning up those scandals, Wells Fargo has now grown earnings per share to well above pre-scandal levels. Specifically, $5/share of annual earnings was the previous high-water mark, and now the bank is trending closer to $6 annually going forward.

However, I think it will be much harder for Wells Fargo to grow earnings per share at a meaningful clip going forward. For one thing, the standout this quarter, investment banking, is likely closer to a peak than a trough in earnings power. While markets are unpredictable, it’s fair to say that investor sentiment is currently running strong, and there is healthy demand for IPOs, secondary offerings, M&A, and other such transactions which generate investment banking fees. If I had to guess, investment banking demand is likely to taper off in a weakening economy, particularly if an outright recession hits.

On a related note, Wells Fargo continues to enjoy a strong lending environment. Net loan charge-offs were just 0.49% of average loans in the most recent reporting period. Furthermore, allowances for credit losses were down slightly year-over-year. Given the rise in the unemployment rate and the signs of softness we’ve seen in markets such as housing and autos, I can’t help but wonder if consumers will have a harder time making their payments on time in 2025. Wells Fargo’s exposure to commercial real estate such as offices also remains a potential point of concern.

A bull could argue that falling interest rates will help alleviate these stressors on consumer balance sheets. Given the lag between when the Fed acts and when that tends to start making an impact in the real economy, I’m not sure the response will be fast enough to really make a difference within the next 6-12 months. That said, the rate cuts might be a positive as far as helping with credit performance.

On the other hand, falling rates will almost certainly ding Wells Fargo’s profitability going forward from an asset sensitivity perspective. We already see Wells Fargo’s net interest income down 11% year-over-year with an estimate for a 9% full-year decline. And we’re just at the beginning of the interest rate cutting cycle. Wells Fargo’s net interest margin rose from a low of 2% to 3.1% amid the prior rate hiking cycle. It has slipped back to 2.7% as of Q3, and there’s more room to slide here depending on the exact path of the rate cuts and yield curve going forward.

Shares Are No Longer Sharply Undervalued

For much of the past five years, Wells Fargo shares appeared to be trading well below fair value, making a compelling case for owning the stock while waiting for the company to clean up its reputational issues and return to growth. However, with the stock price jump, shares are no longer nearly as compelling.

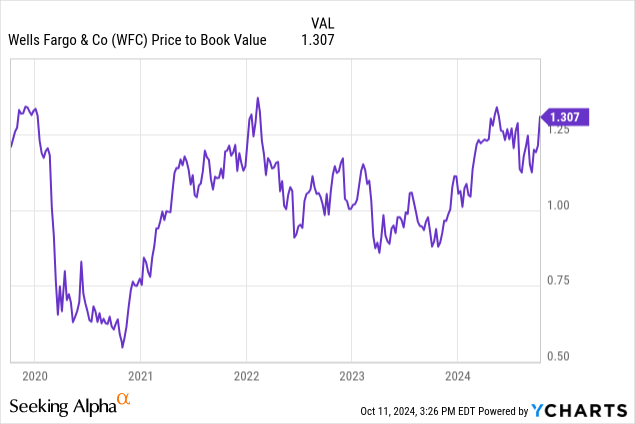

From a price-to-book value basis, the stock is nearly as expensive as it has been over the past five years:

Importantly, shares are now well above book value, meaning that the buyback is considerably less attractive than when the bank could retire its stock at book or even a discount to that valuation.

On an earnings basis, Wells Fargo should be approaching $6 of annualized earnings power going forward. And, this is closer to the bank’s long-term earnings power, as it has benefitted from a stronger net interest margin, higher investment banking income, and a benign lending environment recently. So earnings are much closer to their long-term potential than they were a couple of years ago.

I think you could argue that WFC stock might be worth 12-13x earnings in a normal banking environment, suggesting a valuation in the mid-$70s on a current run rate earnings basis. That still gives us some upside from today’s $61 level, but it’s no longer such a favorably skewed risk/reward picture. And in an economic slowdown, I could easily see WFC stock trading at a P/E multiple closer to 8-10x, implying that shares are fully valued today.

There’s one other thing that has moved me to a hold rating today. A huge piece of my bull thesis for Wells Fargo was that the company was getting to retire stock at an unusually cheap price because of the overhang from the fake accounts scandal.

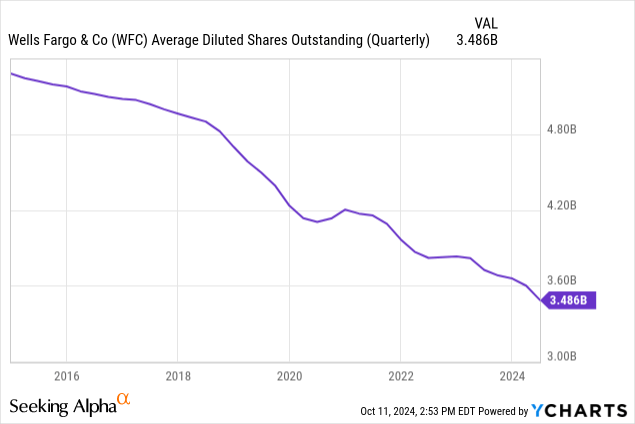

Over the past decade, Wells Fargo has taken its total outstanding share count down from more than 5 billion to less than 3.5 billion today:

And, as you can see, the share buyback sharply accelerated in speed around 2019 as management rushed to take advantage of the sharply discounted price of the company’s stock.

The issue now, however, is that Wells Fargo will have to pay more than $60 per share going forward to operate its buyback program, whereas stock was available for closer to $40 per share for much of the past five years. Needless to say, the buyback will carry less of a punch going forward. And with the asset cap in place, Wells Fargo largely can’t reinvest its profits into the business either, reducing its options for capital allocation at present.

WFC Stock: Bottom Line After Q3 Earnings

There is still a long-term bullish case to be found here. Wells Fargo is in a multi-year rebuilding process. Its legal fees will continue to drop over time as it puts its past scandals behind it. And there will be more regulatory relief in due time, with Wells Fargo finally being able to return to asset growth eventually. These are long-term positives, but not necessarily anything that can drive more positive stock price performance over the next 6-12 months.

And to head off any confusion over my disclosure, I own WFC stock in a buy-and-hold portfolio from a lower-cost basis and intend to continue holding that position. However, given the bank’s falling net interest income and the likelihood of more challenging macroeconomic conditions going forward, I do not see WFC stock as an attractive place to deploy new capital with a price above $60 per share.

I think Q3 earnings may end up representing a high-water mark for the bank in the near term. This is a solid operating environment for the bank, and management is making the most of the opportunity. But there are risks on multiple fronts, and the valuation now has more optimistic expectations baked into it. As such, I’m moving to a hold on WFC stock for the time being.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of WFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you enjoyed this, consider Ian’s Insider Corner to enjoy access to similar initiation reports for all the new stocks that we buy. Membership also includes an active chat room, weekly updates, and my responses to your questions.