Summary:

- JPMorgan Chase reported strong earnings.

- Future growth will occur primarily through accretive acquisitions.

- Declining interest rates pose challenges to the matching system that is so important to the banking business.

- The consumer business provides a cushion during interest rate changes because the margins are a “mile wide”.

- Businesses like wealth management, third-party mortgage services, and credit card business management provide diversification for periods when it is “tough to make a buck”.

danielvfung

The first statement by JPMorgan Chase (NYSE:JPM) CFO, (on the earnings call transcript) sums up the current string of earnings reports:

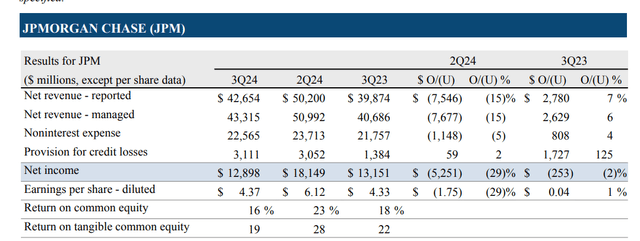

Starting on page one, the firm reported net income of $12.9 billion, EPS of $4.37 and revenue of $43.3 billion with an ROTCE of 19%.

Of course, like a top-notch football coach, management is warning about future prospects. If you did not know any better and believed half the warnings, you would think that at some point in the future, this management would settle for average results. Now there could be that possible quarter when nothing works. Even the best management has that quarter sooner or later. But long term, this is one of the best managements in the business and investors can likely expect this management to remain nearly the best in the business as long as Jamie Dimon, CEO, continues to be in charge of the bank. Therefore, some more of those “overearnings” (as management puts it) are invariably part of the future.

Last Article

The last article touched upon why good management is so important. Good management tends to outperform investor expectations. Good management is also so diligent that there are far less surprises than would be the case with “good enough management”. That makes the investment less risky. Now, admittedly, management evaluation is a very tough assignment. But it is also a part of the investment decision that can materially lower the investment risk when mastered.

Future Growth Strategy

Now, the other thing to consider is that JPMorgan Chase is so large that earnings growth is far more likely to come from accretive acquisitions than it is from organic growth. It is not that management will not grow the banking business. Instead, it is more about the bank being so large that management probably can only manage single digit organic growth. But opportunistic acquisitions (probably distressed acquisitions) are likely to make for lumpy but significant growth.

Declining Interest Rates

Banking is all about matching and holding to maturity. What can happen is that the matching process may need a little adjustment when (as is happening now) interest rates decline. The Federal Reserve posted the first decline not too long ago, and this topic came up either indirectly or directly during the conference call.

The direct topic would have been the effect on CDs when the answer from management was that CD rates would come down pretty much “lock-step” as renewals happened with that interest rate drop. Since for the bank, this is a cost of funds, that is a positive.

But there are other considerations, like mortgages and car loans. The public is similar to the bank in that they want the best deal. Therefore, when interest rates decline, there will be those lower interest rates and lower auto loan rates that will cause some consumers to shop for a better loan.

This likely marks a change in the original lending assumption that led to the match. Therefore, the bank has to move quickly to re-establish a profitable gap between funds cost and funds income to continue to make money on the spread. This is one reason why the banks have a lot of statisticians and economists. There is a formidable attempt on a statistical basis to re-establish that match based upon some formal studies so that the bank continues to make money as interest rates decline.

The source of the money, for ((say)) car loans and mortgages, likely loves the interest paid. But the people with the mortgages and car loans are “voting with their feet” and taking their business elsewhere.

This is the source of management’s future warnings about some quarters where earnings are not quite up to the usual “overearnings” standard. Clearly, right now, management has this covered. This management likely will have the future well covered, too. If this bank suffers a return on equity decline, the investor can bet that much of the industry will be in far worse shape.

Earnings

Investors need to remember that the previous quarter had a one-time gain from the sale of stock.

JPMorgan Chase Third Quarter 2024, Earnings Summary (JP Morgan Chase Third Quarter 2024, Earnings Press Release)

Other than that one time bulge in earnings for the second quarter, earnings are holding up rather well. Banking is so much easier if interest rates remain the same (whether high or low). It is when interest rates rise or come down that the matching becomes challenging. There is always one party to the match that becomes dissatisfied when interest rates move.

Given the above discussion, there are some cushions that exist as shown below:

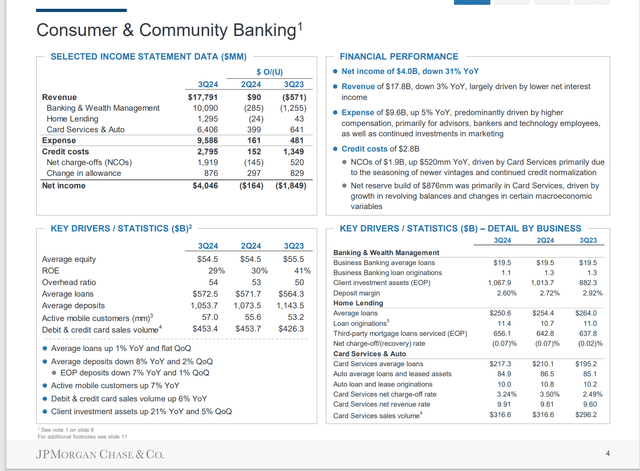

JPMorgan Chase Summary Of The Consumer Business (JP Morgan Chase Third Quarter 2024, Earnings Press Release Supplemental Documents)

One of these “cushions” is the consumer business. During an interest rate change period, the consumer lending business can have margins that contract quite a bit and still remain profitable.

Some things are forerunners of things to come. For example, the climbing credit card reserves, and charge-offs is a statement by management that at some point there will be a rough period for the consumer. That is cyclical, like so many other parts of the business. But the overall tendency of that part of the business for “overextended customers” has been well documented for a long time.

On the other hand, along with this business comes low-cost sources of cash like checking accounts. So, this business is extremely important to the bank.

Note that there are some businesses that essentially do not require cash to exist. Mortgage servicing for third parties, for example, is a business that requires no cash to get going. As a result, there is a low asset demand (relatively speaking) and lots of profits.

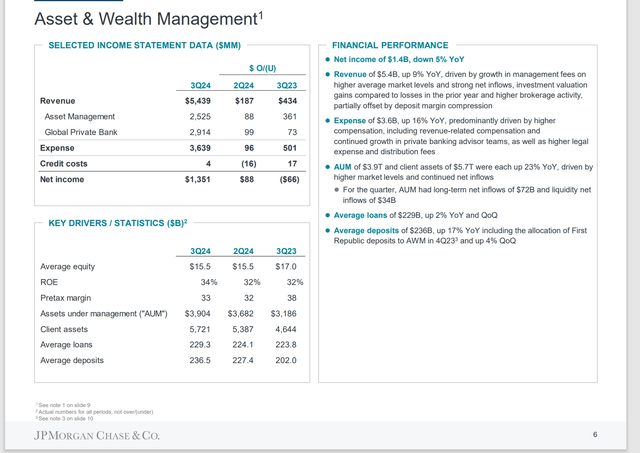

JPMorgan Asset & Wealth Division Summary Of Results (JPMorgan Chase & Co Third Quarter 2024, Earnings Press Release Supplemental Documents)

This is one of the divisions that distinguishes a money center bank from a lot of smaller banks in the industry. This part of the business can be the source of quite a bit of income that tends to be recession resistant. Smaller banks often do not have a business like this. Therefore, they get hit by the full force of a recession in the areas that they operate.

In fact, much, if not all, of this business may well qualify as a nonbank business which many larger banks keep separate from the main banking business. This is the kind of diversification growth that is important to offset the cyclical nature of the main banking business.

Summary

JPMorgan Chase had another darn good earnings quarter. Future growth is likely to depend more and more upon opportunistic (and accretive) acquisitions than was the case in the past. In between those acquisitions, the organic growth will likely be single digits due to the size of the bank.

The beginning of interest rate declines will mark a challenging period for the industry because the matching is harder to maintain during periods when interest rates change. However, this management will likely outperform much of the industry during that period.

Therefore, the strong buy remains as long as Jamie Dimon remains as CEO of the bank. Very few can manage the track record established here. Yet the market often sours on any idea when there is some uncertainty or challenges ahead. Therefore, that is likely to be the time to buy because if the stock will be relatively cheap, the uncertainty period is the time the stock will be on sale.

Risks

Any unforeseen interest rate volatility can make banking extremely challenging. Money center banks often have other businesses to offset some of the banking challenges. But Mr. Market may still not like the results.

The loss of key personnel could materially change the outlook of the firm.

This company is worldwide and therefore can be affected by political events beyond its control.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and JPMorgan Chase in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.