Summary:

- Alibaba faces challenges such as market share loss, increased competition, and regulatory scrutiny, but recent Chinese stimulus measures have boosted its stock by over 20%.

- Despite deteriorating fundamentals, Alibaba’s e-commerce and cloud segments show potential for recovery, driven by the stimulus package and improved consumer sentiment.

- Alibaba’s valuation remains attractive, with a share-repurchase program and potential for 28-30% annual returns, but political risks in China warrant a cautious “Hold” rating.

- I underestimated the impact of China’s economic stimulus, prompting an upgrade from “Sell” to “Hold,” while favoring investments in EU/US companies with Chinese market exposure.

maybefalse

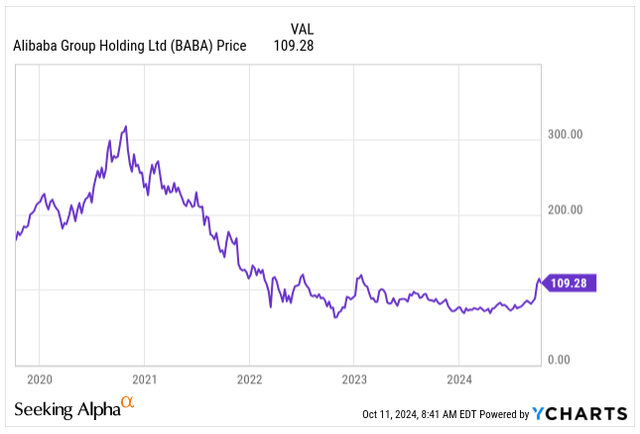

It’s been a volatile last 5 years for Alibaba Group Holding Limited (NYSE:BABA), casting doubt on the future of the Chinese tech juggernaut amidst the weaker-than-expected domestic economy, loss of market share in e-commerce, increased competition in cloud business and slow AI integration, prompting many investors to jump the ship.

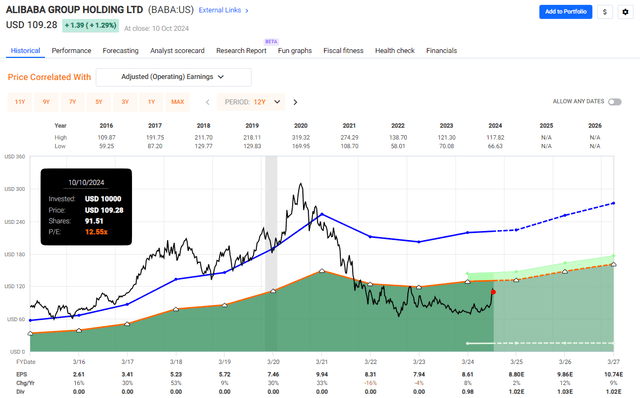

Price Development (Seeking Alpha)

Alibaba is the poster child for China’s crackdown on technology companies. In 2021, authorities fined the company a record $2.8B for alleged monopolistic behavior, which derailed its focus and growth trajectory.

Likewise, the economic challenges in China are negatively impacting consumer sentiment, prompting many shoppers to cut back on spending.

The last time I covered Alibaba’s stock was back in May this year. I rated the stock as a “Sell” as I argued the stock is set for prolonged pain due to e-commerce market share loss to PPD Holdings Inc. (PDD), which owns Pinduoduo and Temu, and internationally to the likes of Shein, which became popular for its ultra-low-cost offerings, particularly during a period of high inflation.

In my view, Alibaba was set to lose its competitive edge by the proposed spin-off of its six core businesses with, international firms valuing its cloud business at $25B, a far cry from the original $40B Alibaba was hoping for its IPO.

As China has been known historically for introducing stimulus measures in incremental steps, compared to the likes of the US or Europe, which announce large-scale packages, I failed to acknowledge the size and propensity with which the government will move this time to support the weakening economy. This has pushed Alibaba’s shares up over 20% in the last few weeks, with potentially more gains on tap, prompting me to revise my rating.

What’s Happening in China

China’s economy has been facing significant challenges, with growth decelerating across key sectors. The World Bank projects that China’s growth will decelerate to 4.3% by 2025, lower than the previous forecasts. In H1 2024, Chinese GDP grew by 5% but already slowed to 4.7% in Q2, missing market expectations with more weakness expected.

The Chinese real estate sector is the single largest element in the Chinese economy, making up 30% of GDP, now operating at half capacity with property values falling as much as 20.5% in H1 2024. That’s particularly problematic as 70% of family assets in China are tied up in the property market, negatively influencing the wealth of the population, pushing retail sales growth to only 2.3% in April YoY , down from 3.1% in March as economic confidence remains low due to economic uncertainties.

Furthermore, structural issues, such as the Chinese aging population and sluggish productivity growth, weigh negatively on the economy.

But that’s not all.

External pressure, including a trade war with Western countries and reluctance from trading partners to accept higher deficits, is pressuring external demand. As the Chinese government faces challenges switching from the investment-led model to high-tech industries and a domestic consumption-driven economic model, the expected 5% annual GDP growth may be wishful thinking for now.

In response to domestic economic challenges, China rolled out a historically largest, 7.5T yuan, roughly $1.07T stimulus package, equivalent to 6% of its GDP, hoping to revive the economy with the key measures such as:

- The People’s Bank of China reduced the reserve requirement ratio for banks by 0.5%

- The key policy interest rate was lowered by 20 basis points to 1.5%.

- Interest rates on existing mortgages were decreased by an average of 0.5%

- Estimated 2T yuan worth of bond issuance to help consumers and boost local government spending with an additional 1T in capital for major state-owned banks

- To boost its property market, the Chinese government proposed looser property purchase rules, including lowering minimum down payments on new home purchases.

- 2 new 800B yuan lending facilities to support the stock market

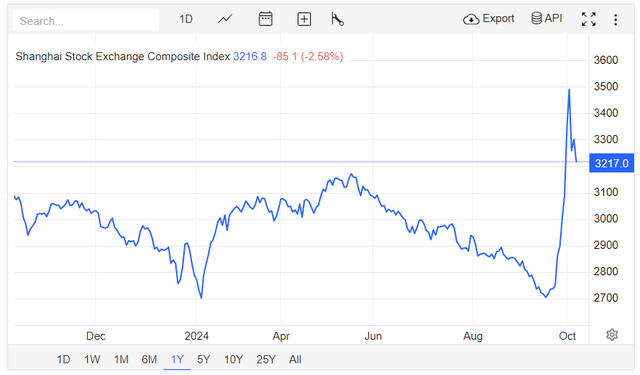

The major stimulus package aims to boost domestic demand, support small and medium-sized enterprises, provide liquidity to the domestic stock market, and stimulate consumer spending, all boding well for the Chinese stock market, fueling the market-wide rally we could have seen in the last weeks.

Shanghai Stock Exchange Index (Trading Economics)

What’s Happening With Alibaba’s Business

The last few years have not been the best time to own Alibaba’s stock amid the deteriorating fundamentals. With EPS still below its full-year 2021 of $9.94, expected to recover no earlier than in 2026, Alibaba is no longer perceived as the growth engine it once was, but the stimulus package aimed to boost consumer spending could, in return, drive slow revenue recovery over the next quarters, with more stock price appreciation on the horizon.

Back in August, Alibaba reported its Q2 FY24 earnings. Revenue increased by 4% from the previous quarter to $33.5B, and the EPS came at $2.26.

Earnings were relatively solid despite the weak economic landscape, with the full-year expected EPS at $8.80. However, management’s message of expecting higher future growth but higher AI-related CAPEX spending is sending a mixed signal, coupled with the uncertainty of turning around businesses outside of Cloud and e-commerce.

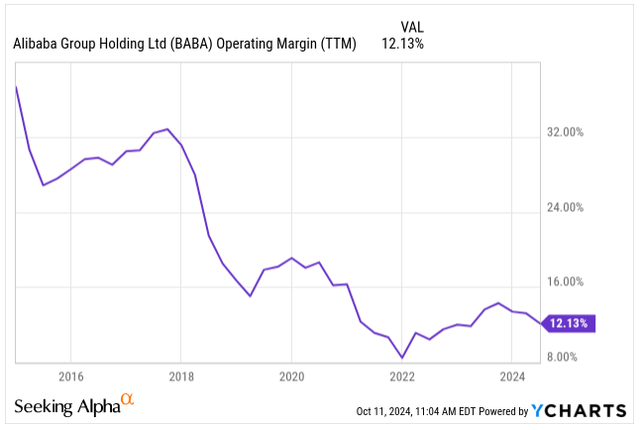

Alibaba’s shares remain relatively undervalued, similar to the analogy of my previous coverage, with a net cash position of 405B yuan, representing roughly 22% of its current market cap. If the company manages to regain its footing in e-commerce via Tmall Group and Taobao while reversing the course of its falling operating margins, Alibaba could stabilize its position in the ever-more competitive e-commerce market, challenged by JD.com (JD) and PDD.

Operating Margin (Seeking Alpha)

Commerce remains Alibaba’s “bread and butter” segment, representing 85% of its total revenue. China’s retail commerce makes up as much as 61% of the total revenue, with International Commerce contributing 7%.

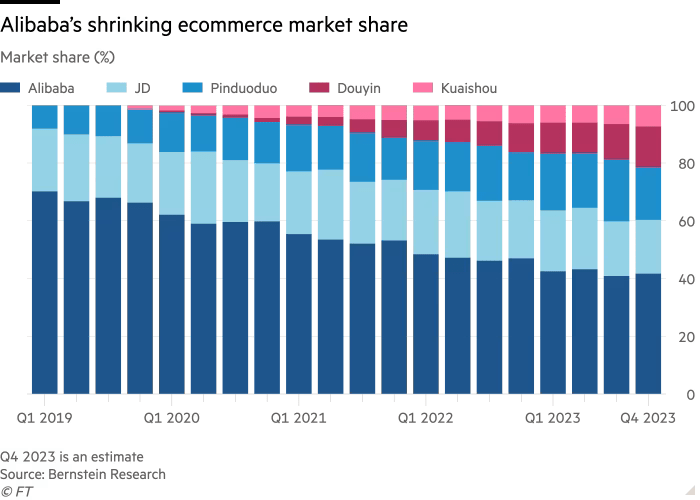

That’s why it’s particularly worrisome to see Alibaba’s market share loss of the past few years to PPD Holdings and Douyin in the China e-commerce market. PPD had already surpassed Alibaba’s number of active annual consumers back in 2021 when Alibaba was facing legal challenges. Meanwhile, Douying has become a more meaningful player in apparel and beauty at Alibaba’s expense.

I do not see a quick fix to Alibaba’s deteriorating market position amidst fierce domestic competition; rather, the opposite, but it’s not all doom and gloom as long as overall consumption in China increases, with the tide lifting all the boats.

Alibaba’s Market Share Q4 2023 (Bernstein Research)

In addition, Alibaba’s gross merchandise volume (GMV) and China’s online retail sales have fallen from 72% in 2022 to 62% in 2023. Analysts expect Alibaba’s marketplace monetization rate to decline due to mix switching towards Taobao, which has lower take rates than Tmall and more competition.

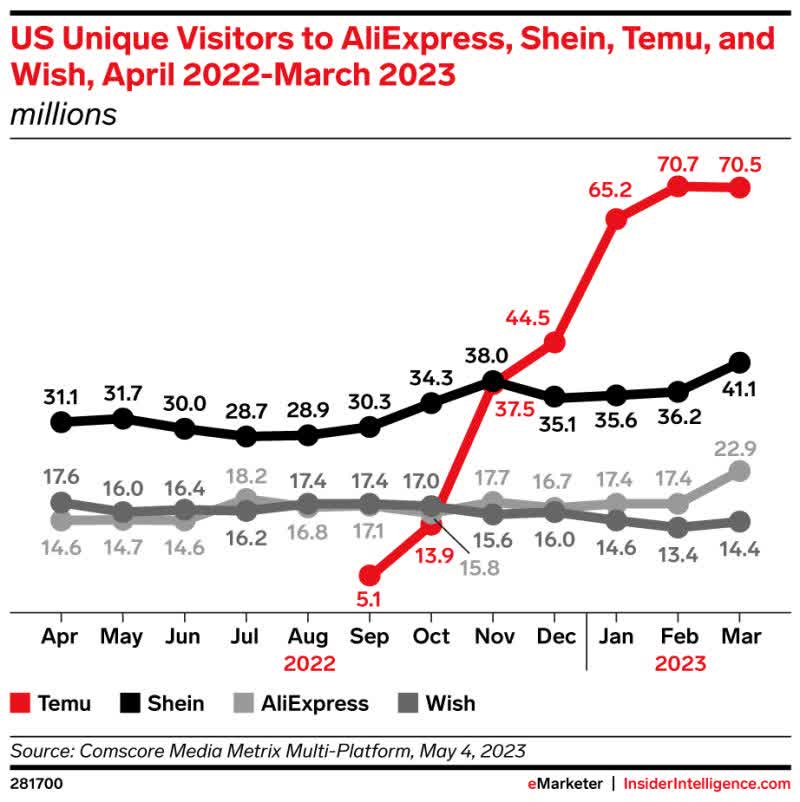

Likewise, on the international playing field, we can see the rise of Temu and Shein, while not necessarily at the expense of AliExpress. Yet, the increased competitive landscape may pressure margins in the future.

Unique Visitors US (Comscore Media Metrix )

Taobao and Tmall remain the crown jewels of Alibaba’s business, and their success is paramount to the whole company. That’s why it’s great to see the cash-cow business’s GMV achieve high-single-digit growth rates in Q2 2024, well above the market’s negative 4% contraction over the same period.

Speaking of Alibaba’s international operations, the business has seen robust YoY Revenue growth, driven by the expansion of AliExpress’s cross-border business. However, this growth comes at the cost of rising losses in the near term as the business expands, which keeps pressuring the operating profitability of the business.

No analysis of Alibaba’s business is complete without touching on its Cloud unit. When speaking of cloud, we have four major players worldwide: Microsoft (MSFT), Amazon (AMZN), Google (GOOGL), and Alibaba, with the following market share as of Q2 2024:

- Amazon’s AWS, with a market share of 32%

- Microsoft’s Azure: 23%

- Google’s Cloud: 12%

- Alibaba’s Cloud: 4%

Whereas the Cloud business in the West is primarily driven by private enterprises, in China, the investment comes from government and state-run enterprises. Alibaba’s AliCloud is still in investment mode, facing domestic competition from Huawei and Tencent, who are gaining market share, with AliCloud now expected to return to double-digit growth in H2, following a single-digit growth of a few quarters as the economy revives. That’s in contrast to the Western cloud providers firing on all cylinders, delivering growth above 20% quarterly as of Q2.

Despite the challenges faced on the e-commerce front and in the cloud business, I am more optimistic about Alibaba’s growth prospects, mainly thanks to the stimulus that will most likely unlock opportunities in the domestic market, with Alibaba potentially once again revisiting the plan spinning off some of it’s non-core assets, returning more capital to shareholders following the divestment.

Alibaba’s management has already announced an increased share-repurchase program by $25B, raising it to $35.3B, roughly 14% of its market cap over the next three years. In my view, given the undervaluation, this is a smart move.

However, a few headwinds remain, including potentially slower-than-expected recovery of the Chinese economy, larger CAPEX deployment into AI, and continuous concerns over regulatory scrutiny, which cost Alibaba dearly in the last few years.

Even though Alibaba can drive shareholder returns in the near term with the recovery from the dirt-cheap valuation as investors pour money into Chinese equities, the reputational damage by the Chinese Communist Party has been done.

There are no guarantees that similar pressures won’t be exerted on private Chinese enterprises in the future, hindering the long-term growth trajectory and competitiveness of domestic companies and making Chinese equities uninvestable due to the ever-present political risk.

What’s next for Alibaba and Shareholders

For most of its history, Alibaba has been viewed as a growth stock, and it traded like one.

Since it went public back in 2014, the average valuation has been around 25.4x its earnings, compared to today’s Blended P/E valuation of 12.6x.

If we exclude the outlier 3,100% EPS growth in 2015, Alibaba’s EPS grew at an average annual rate of 13.91%.

Certainly, Alibaba has been benefiting from its monopoly-like position in China with its grip on e-commerce, helping propel its stock price ever-higher, particularly during the COVID-19 pandemic, when the company delivered 30% EPS growth in 2020 and 33% in 2021.

However, as the e-commerce tailwinds faded and the company was put under increased scrutiny by the Chinese authorities, Alibaba’s EPS plummeted, falling 16% in 2022 and another 4% in 2023. A slow bottom-line recovery is starting now.

If I look back at my forecasting data, when I owned shares of Alibaba in 2019/2020, I was expecting the company to deliver around 20-25% annual EPS growth for the remainder of the decade.

However, this shows that I underestimated the local political grip on power and did not anticipate economic challenges of this magnitude in China.

As per FactSet, analysts are expecting the following EPS growth:

- FY2025: EPS of $8.80E, 2% YoY growth

- FY2026: EPS of $9.86E, 12% YoY growth

- FY2027: EPS of $10.74E, 9% YoY growth

These figures already included the revised data following the stimulus package announcement. The revisions point to an extra 6% growth this year and an additional 2% next fiscal year, compared to the analysts’ forecast back in May.

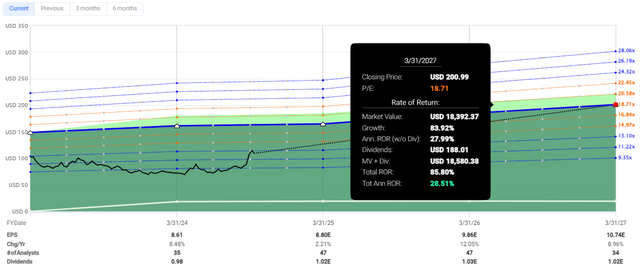

Given the improved clarity on its growth path and improving domestic macroeconomic landscape, I am upgrading Alibaba’s shares to “Hold.” I expect that we could see Alibaba’s shares trading again around 18-20x their P/E over the next 2-3 years as the bottom-line growth accelerates, driven by consumer sentiment and improved operating margins.

This would imply a return of around 28-30% annually for investors buying the shares today, which is indeed very attractive.

Perhaps you are wondering why I do not upgrade the shares to “Buy,” but as somebody born and raised in a totalitarian regime, I am fully aware of the inherent political risk investing in China brings.

That’s why I am staying on the sidelines, instead playing the China reversal through exposure to EU/US-domiciled companies with a considerable % sale exposure in the Chinese market.

Potential Returns (Fast Graphs)

Investor’s Takeaway

All in all, my bearish call on Alibaba from May this year has proven to be incorrect. I underestimated the effects of the unforeseen massive financial stimulus to boost the Chinese property market and increase consumer confidence.

While inherent risks remain from investing in China, Alibaba’s shares are poised for potentially more returns in the mid-term as its e-commerce business recovers.

Analysts have now raised the bottom-line growth expectations for this year and beyond, prompting me to upgrade my rating despite Alibaba’s market share loss and continuous challenges in the Cloud business.

Even though I am not inclined to buy Chinese equities, I am playing the China-reversal investment narrative through EU/US-domiciled companies with significant revenue exposure to the region.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.