Summary:

- Altria Group lags in transitioning to smoke-free products, with only 13% of revenue from non-combustibles compared to Philip Morris International’s 38%.

- Philip Morris International is expanding its US market share with IQOS and ZYN, showcasing promising goals and significant investments in manufacturing facilities.

- Altria’s oral tobacco segment shows slow growth, but its On! brand is gaining traction, though NJOY’s current impact remains negligible.

Hiroshi Watanabe

Altria Group (NYSE:MO) doesn’t need much of an introduction, as it’s been a key holding of many retail investors, including me. This leading US tobacco player has strongly benefited my portfolio over the years, and I cannot deny its meaningful impact. I’m a happy holder who continues to enjoy dividends.

Today, we’re going to examine one of the most prominent challenges MO is about to face in the upcoming years: Philip Morris International’s (PM) increasing activity in the US smoke-free space.

Since the last time I covered MO, assigning it with a ‘hold’ rating, the Company’s stock price has hiked for a while, reaching as high as $54 and has recently pulled back, constituting a return of 0.1% since the publication date.

Altria Group Is Already Lagging In The Most Prominent Trend

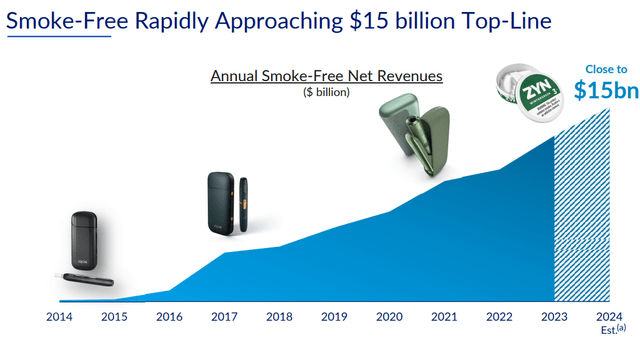

While Altria Group struggles to navigate the shift from combustible products to non-combustibles effectively, some players have found greater success. Philip Morris International is the leading example, as the company has invested over $12.5B in developing its smoke-free portfolio.

It’s relatively easy to spot differences across both companies when it comes to their smoke-free journey:

- PM’s smoke-free products accounted for over 38% of its revenue, while MO’s for just 13%

- PM still records double-digit growth rates of its smoke-free portfolio (Q2 2024 vs Q2 2023 – 16.4%) vs low single-digit growth rates of MO’s oral tobacco business (Q2 2024 vs Q2 2023 – 4.6%)

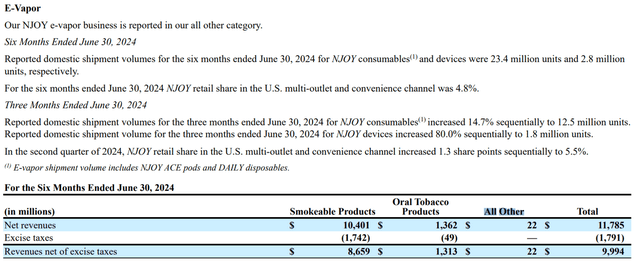

At the same time, while MO certainly makes progress on the NJOY front with optimizing the supply chain, shipment growth, etc., one has to remember that NJOY still accounts for a very small part of MO’s revenue, as it’s reported within ‘all other’ segment:

PM’s Journey Doesn’t Stop There – MO’s Business Is Likely To Take A Hit

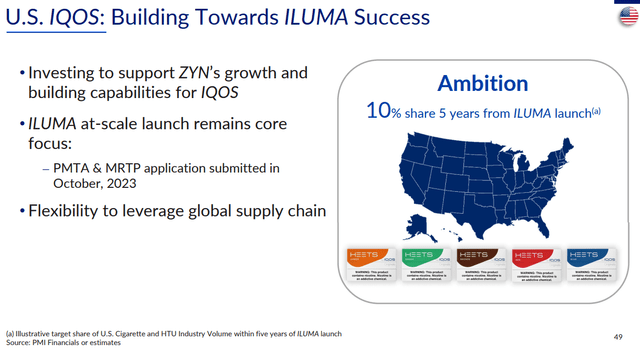

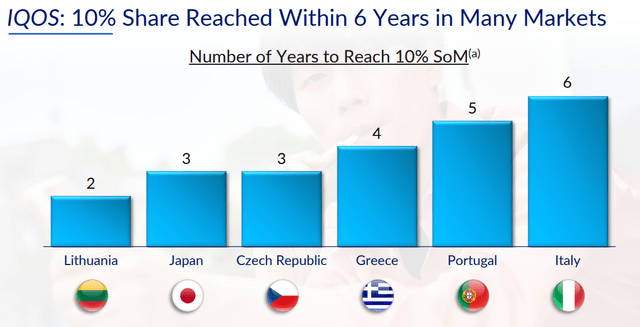

PM keeps on increasing its presence in the US, which will likely lead to further increases in its market share. The Company self-imposed a target of reaching 10% market share since the launch of its IQOS ILUMA series, which is getting closer and closer given the schedule summarized below:

IQOS owner, Philip Morris International (PMI), announced that consumer engagement is underway in Austin, Texas with the pilot IQOS launch planned in the last quarter of 2024 (October – December 2024). IQOS commercialization will be initially limited in scope and focused on direct activation of select legal-age smokers (“targeted consumer activation”) in a few cities in order to experiment with different elements of the commercial model. The main purpose of the initial launch with the old IQOS 3 system is to fine-tune the approach and readiness in anticipation of the at-scale launch of new IQOS ILUMA. PMI expects US FDA to authorize IQOS ILUMA in the second half of 2025.

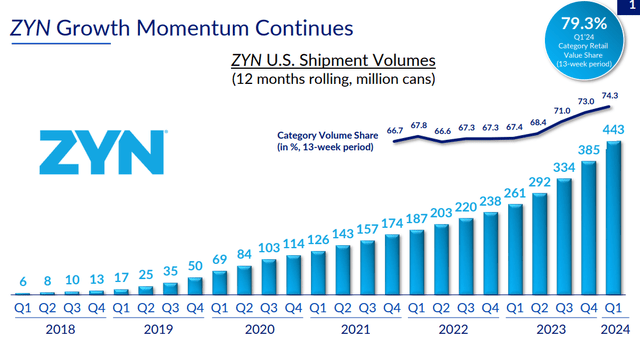

Naturally, PM is set to succeed in the US not just due to IQOS but also thanks to its impressive oral nicotine pouch – ZYN, which continues to show outstanding growth. ZYN continues to gain popularity and that’s not likely to change, as the demand keeps on growing.

Moreover, PM has recently announced two investments in its manufacturing facilities to grow its capacity further:

- investment of $600m in Aurora

- investment of $232m in Owensboro

The management provided a promising vision and clear insight into the growing demand for ZYN in the US that requires the Company to take action to meet the demand:

Ongoing investments in both Owensboro and Aurora are designed to provide sufficient capacity in the near and mid-term for the current adoption growth rate of ZYN with U.S. adult nicotine consumers, as well as capacity for exports.

Returning to IQOS, for those who doubt its potential to take over US-based consumers and help PM reach its 10% market share target, let’s keep in mind that PM has a track record of dominating many markets with its smoke-free products. Also, most of them are less susceptible to the ongoing changes in the tobacco industry and lag behind the US in terms of smoke-free product adoption. Therefore, I believe that IQOS’ success in the US may be even more prominent as consumers seek top-quality alternatives to traditional cigarettes.

PM Investor Presentation PM Investor Presentation

Altria Groups’ Smoke-Free Road Doesn’t Look As Bright

As mentioned earlier, MO’s smoke-free business accounts for just ~13% of its revenue, which doesn’t impress when compared to PM’s over 38%. The only non-combustible segment with a meaningful scale of revenue that currently exists in MO is its oral tobacco segment, led by brands like Copenhagen, Skoal, and On!

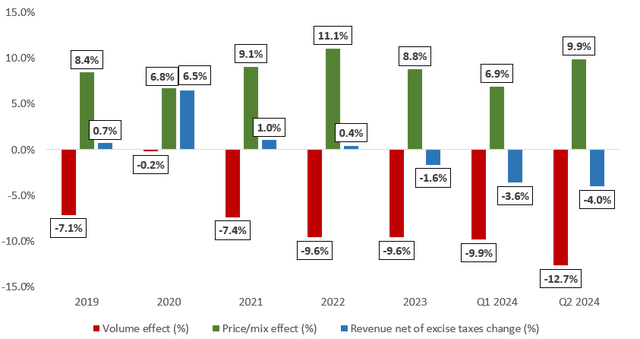

However, the segment records relatively slow growth, showcasing single-digit growth rates in recent quarters, as it was hurt by declining Copenhagen and Skoal volumes (-9.6% and -12.0% in Q2 2024 vs Q1 2023, respectively).

Nevertheless, it’s not all doom and gloom in MO’s oral tobacco business. Its On! brand records double-digit growth rates (shipment volume increase of 37.3% in Q2 2024 and 32.1% in Q1 2024), keeps gaining popularity, and is the only brand recording even comparable growth to ZYN.

Naturally, MO’s journey beyond smoking may shift drastically with the further development of NJOY, as the brand could become one of the leading players in the US e-vapour market. Regardless, Altria Group still has a lot to catch up to its peers regarding the portfolio transition.

Moreover, due to its focus on the US market (heavily susceptible to smoke-free trends) MO’s cigarette business performs worse than PM’s, which benefits from global operations. While PM recorded 4.8% organic growth in its combustible segment, MO has struggled with dynamically decreasing volume with no ability to offset it with a price/effect mix. For details, please review the chart below, which depicts MO’s smokeable portfolio performance over the years.

Valuation Outlook

As an M&A advisor, I usually rely on a multiple valuation method, a leading tool in transaction processes. This method allows for accessible and market-driven benchmarking. Numerous metrics are available for valuing a company, with EV/EBITDA being a rule of thumb for most sectors, especially mature ones.

That said, the forward-looking EV/EBITDA stood at:

- 8.9x for MO

- 14.9x for PM

- 7.2x for British American Tobacco (BTI)

- 8.7x for Japan Tobacco (OTCPK:JAPAF)

As we can see, PM trades at a premium valuation, which I consider justified given its leading position in the secular trends accompanying the field. MO’s valuation is quite attractive, and I don’t expect much upward movement until we see more progress on the smoke-free business front. For those willing to bet for MO’s future success with NJOY, that could be considered an attractive entry-level, but it will undoubtedly take time to get back on track with adjusting to the ever-changing world.

For now, the market receives intel on MO’s progress in the smoke-free business. Still, it has no significant financial results, as NJOY’s current impact is negligible, and the oral tobacco segment is growing slowly. At the same time, each quarter showcases increasingly hostile data on the cigarette front, leaving very little space for potential multiple expansion.

Investment Thesis: I’m Holding Onto Altria Group, But Reinvesting Proceeds In Philip Morris

There’s a saying that MO stands for ‘must own’. I somewhat agree with that, as Altria Group has been a part of my portfolio for a long time now and I cannot deny its meaningful impact on its satisfying performance. However, many aspects, especially related to the transition into the smoke-free world, lead me towards further investments in the PM, who many claim to stand for ‘perfect manufacturer’.

With that in mind, I don’t intend to trim my position in MO. I will hold onto it and continue collecting dividends. Moreover, should Altria Group provide us with some more substantial updates on its moving beyond the smoking path, I would certainly consider adding. For now, I put MO on hold, as I consider PM better positioned to capitalize on these major trends.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MO, PM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.