Summary:

- Nvidia’s high valuation faces risk as growth slows, similar to Tesla’s past stock performance despite strong revenue growth.

- The stock’s sales multiple is contracting due to slowing sales growth, impacting Nvidia’s ability to maintain its high market cap.

- Analysts’ price targets may be unrealistic without either multiple expansion or significant revenue upgrades, which seems unlikely given current trends.

- Future stock performance hinges on Nvidia exceeding lofty expectations amid slowing growth, making current valuations challenging to justify.

BING-JHEN HONG

While Nvidia (NASDAQ:NVDA) remains all the rage these days, with investors hoping to see continued strong growth and soaring revenue with the release of its news Blackwell GPU, most investors forget the most critical piece of a stock price: what the market is willing to pay for it.

Tesla (TSLA) is a perfect example. Despite massive revenue growth, its stock price has fallen sharply from its peak because its growth rate slowed. This led to lower valuations as the market became less willing to pay high multiples.

High Valuation Faces Slowing Growth

Nvidia faces a similar risk as the production cycle matures. Because the market has assigned such a high valuation to the stock, it is highly probable that, over time, growth slows the sales multiple contracts.

Many investors today tend to think that things like fundamentals do not matter. On a day-to-day basis, they do not. But over more extended time frames, they do tend to matter. Tesla has been a prime example of this, and Nvidia could face a similar fate.

Revenue Is Just A Number

The expected revenue outlook isn’t currently driving the stock price. Plenty of companies in the S&P 500 are projected to have revenue of about $200 billion per year, yet not all have a roughly $3 trillion market cap.

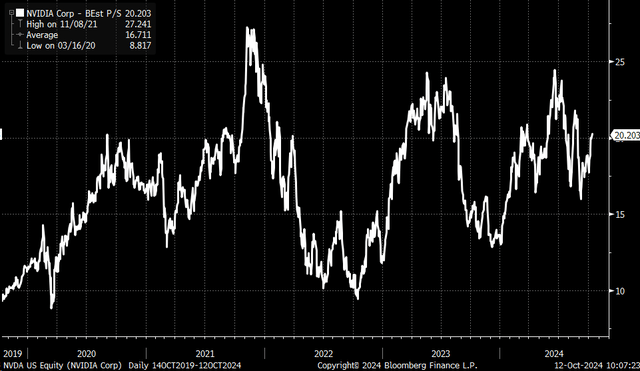

Ultimately, what makes Nvidia worth $3 trillion is the amount investors are willing to pay for that revenue—currently, based on sales estimates over the next twelve months, the stock trades at roughly 20 times sales. This multiple is lower than what investors were willing to pay in August when it was almost 22, and June when it was around 24. So, one reason the stock hasn’t advanced since June despite some positive news and hopes of higher revenue growth is that the sales multiple is starting to contract.

The Growth Rate Drives The Valuation

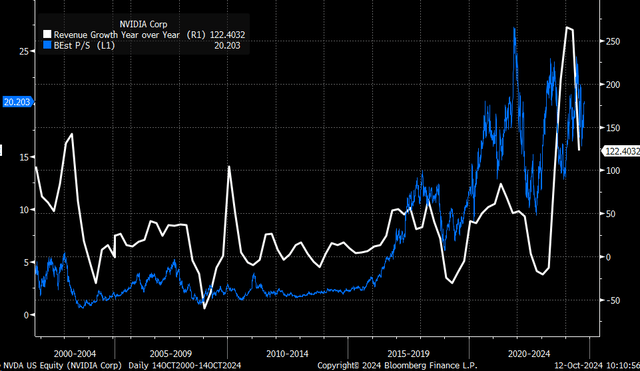

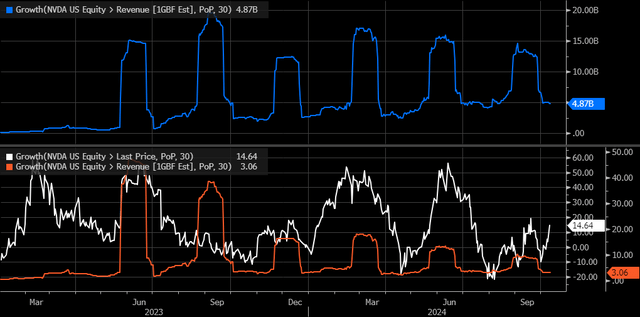

The sales multiple is starting to contract because the sales growth rate appears to be slowing. We have seen this time and time again in this stock over time. It happened in 2018 and 2021, even going back to the mid-2000s. Historically, when the sales growth rate has increased, the price-to-sales multiple has expanded, and when the growth rate slows, the multiple contracts.

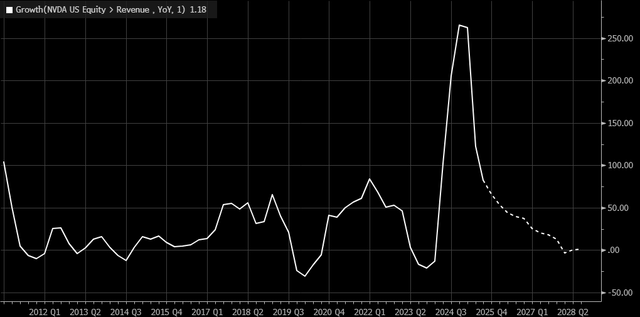

Based on current analysts’ estimates, growth is expected to slow dramatically in the coming quarters, which would likely suggest that sales multiples will continue to contract over time. Therefore, even if the company reaches all of the targets that analysts have laid out for futures and sales estimates are active, the stock price may not only not rise but could even decline.

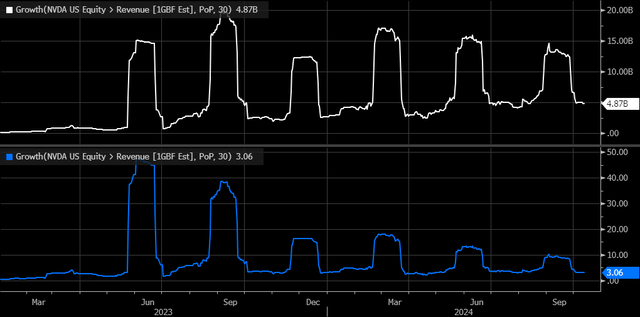

The revenue growth rate must accelerate for the stock price to continue rising. This will allow the multiple to grow again and, more importantly, drive higher revenue targets. But what has been happening is that revenue revisions on a rolling 30-day basis have been seeing positive revisions slow, and as a result, the growth rate in those revisions is falling.

More importantly, the stock price fluctuates with the rolling 30-day sales estimates changes. The sales multiple is falling because the change in those sales estimates is slowing. Despite the positive revisions, the stock price has been moving sideways because the positive revisions aren’t enough to lift the growth rate presently.

However, as we continue to move forward, sales growth slows further, and the revisions potentially become smaller simply due to the law of large numbers; the rising sales estimates will no longer offset the contraction in the multiple.

Analysts Expectations Seem Misaligned

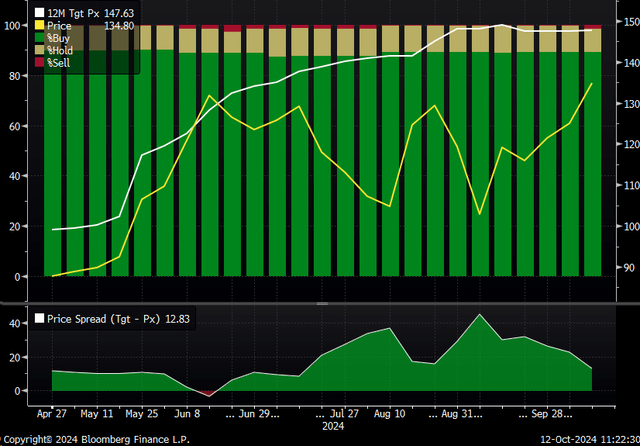

Analysts have a 12-month price target on the stock of about $148 per share, an increase in value of about 10% of its current price, implying that the stock’s market cap will rise to around $3.6 trillion from its current $3.3 trillion. However, analysts estimate show revenue rising to around $164 billion, but at its current sales multiple of 20.2, to reach that valuation, the multiple would need to expand to around 22, or the company would need revenue to climb to $178 billion, or about 9% higher than current estimates.

With this price target, it isn’t clear if analysts are expecting the multiple to expand or forecast revenue upgrades.

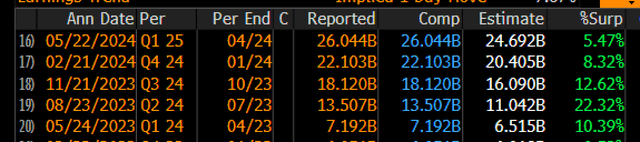

It is possible that there could be an upside to analysts’ current revenue estimates. After all, Nvidia has consistently beaten analysts’ forecasts over the past number of quarters and then raised future guidance. But even the beat rate has been slowing in recent quarters, which is something else that will affect future valuations.

Plus, with a slowing growth rate, it isn’t clear that the price-to-sales multiple should be expanding now; the more likely case is that it should be contracting. For the stock to achieve the path analysts have laid out, Nvidia must exceed those estimates.

It is also noticeable that shifts in valuation occur around earnings releases, which again is a sign that the market is using the company’s guidance and results to plot a path for its projected growth rate. That would mean the next opportunity for a change in the stock’s valuation may come in November. If the beat rate were to slow again, and revisions that followed resulted in a lower revision rate, it would strengthen the case for a lower multiple on the stock.

It is quite possible that even if the company achieves all of the lofty expectations that have been placed on it due to its recent success, the stock may struggle to rise from its current levels. Not because it has fallen short or because the business isn’t good, but simply because the growth rate is slowing from a very high level, resulting in a lower valuation.

This means that to be a buyer of Nvidia at current valuations implies that you think the company will be able to meet expectations and, more importantly, exceed them.

It is not an easy game.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Charts used with the permission of Bloomberg Finance L.P. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Reading The Markets

Reading the Markets helps readers cut through all the noise, delivering daily video and written market commentaries to prepare you for upcoming events.

We use a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and determine where a stock, sector, or market may be heading over various time frames.