Summary:

- Rivian Automotive recently reported a disappointing 3Q deliveries result and guided a weak full-year production outlook due to supply shortages.

- The company’s revenue growth slowed to 3.3% YoY in 2Q and is expected to decline significantly in 3Q, remaining subdued in the near term due to weak production outlook.

- The gross profit is expected to reach breakeven in FY2025, driven by the shift to R2 models, although this transition will create production downtime in 2H FY2025.

- Elevated debt levels and increased capex needs, raising concern for investors, as the company faces growth headwind amidst negative gross profit.

- The market has been lowering its revenue consensus in the near term over the past few months due to ongoing challenges, and I do not see an inflection point anytime soon.

hapabapa

Investment Thesis

Rivian Automotive, Inc. (NASDAQ:RIVN) recently experienced a +40% pullback, reversing all its gains from early July. RIVN remains deeply unprofitable, with increasing debt levels on balance sheet, and is not expected to reach profitability in the near or even midterm. Its gross profit still remains negative. Therefore, the stock’s sentiment largely depends on its top-line growth. However, RIVN recently significantly reduced its full-year delivery guidance due to supply shortages from one of its component suppliers, which will impact its revenue growth outlook. In particular, revenue consensus indicates a potential YoY decline over the next 12 months. Therefore, I have initiated a hold rating on the stock, citing a lack of near-term growth catalysts, while forward revenue estimates have been trending downward over the past six months.

Total Productions Headwind Persists into FY2025

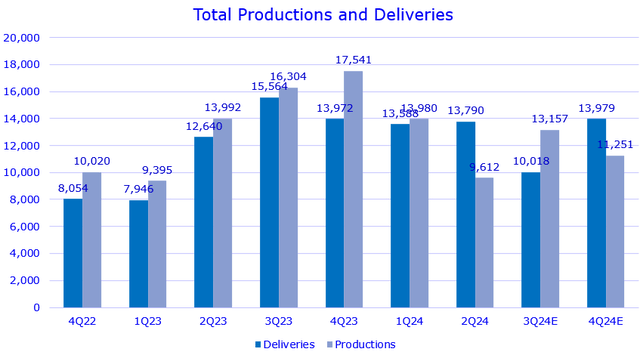

RIVN announced a disappointing 3Q deliveries report on October 4th, underscoring the near-term challenges posed by supply shortages that are impacting production growth. The company delivered 10,018 vehicles in 3Q, reflecting a -36% YoY decline, marking its first YoY slowdown since its IPO. Despite this, the company guided for “low single-digit growth” this fiscal year compared to FY2023. Assuming the midpoint of 2.5% YoY growth for FY2024, this implies 13,979 delivered units and nearly 0% YoY growth in 4Q FY2024.

For total production, RIVN lowered its guidance to between 47,000 and 49,000 units for FY2024, down from its previous target of 57,000 units. Using the midpoint of 48,000 units as the consensus, this implies that only 11,251 units will be produced in 4Q, representing a -14.5% QoQ decline and -36% YoY drop. This would mark the third consecutive quarter of negative YoY growth since 2Q FY2024.

During the Goldman Sachs Communacopia and Technology conference, in early September, the CFO highlighted “acute” supply related challenges, which, I believe, will continue to affect production into early FY2025. The company previously stated that the R1s’ potential output with its current two-shift operation is 56,000 units per year. Now I believe the FY2025 production could fall short of this capacity. Additionally, despite supply chain issues, management indicated that the company expects “significant downtime” in 2H FY2025 to integrate the R2 model into their facility, aiming to start R2 production in 1H FY2026, which could further impact overall production in FY2025.

Financials Could Get Worse Before Improving

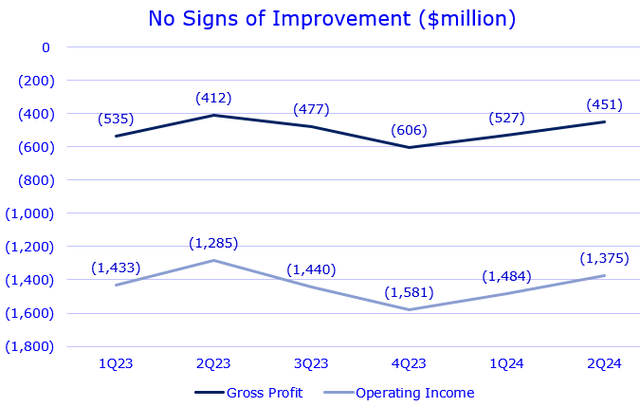

RIVN was once viewed as a hyper-growth EV company, achieving triple-digit revenue growth in FY2023 despite negative gross profit and operating income trends. However, in 2Q FY2024, the company’s revenue grew by just 3.3% YoY, which dampened the stock’s bullish sentiment. I believe the company’s 3Q revenue consensus will be revised lower following its weak delivery guidance, and I expect negative YoY revenue growth to continue into 1Q FY2025. The company had previously expected a modest positive gross profit in 4Q FY2024, but I believe this is now more challenging. Additionally, with downtime in 2H FY2025 due to the R2 integration process, RIVN’s revenue growth outlook for FY2025 may remain muted, similar to this year. However, its gross margin could start improving in FY2025 as the company benefits from a roughly 20% reduction in material costs with the shift from R1 to the lower-cost R2 models. The market currently anticipates gross profit breakeven in FY2025.

High Cash Burn and Rising Debt Levels

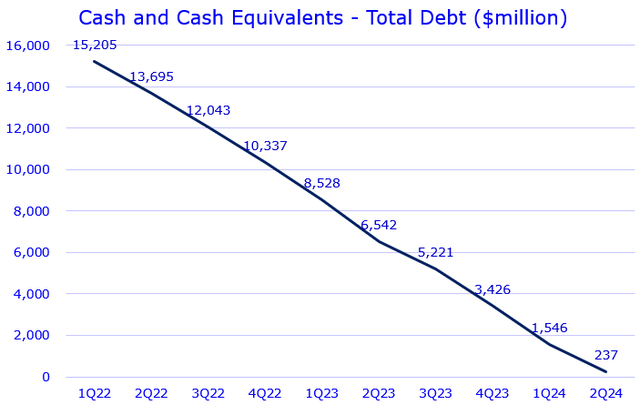

The company’s focus on top-line growth has led to an increase in long-term debt over the past two quarters. In 2Q FY2024, RIVN’s long-term debt surged 103% YoY to $5.5 billion, while its cash and cash equivalents declined by 38% YoY, impacted by the ramp-up of R2 production in Normal and the Volkswagen investments. This left the company with a net cash position of just $237 million, raising concerns for some investors, as RIVN is not expected to reach operating income breakeven for several years. Additionally, this week’s hotter-than-expected CPI report suggests that if inflation expectations remain elevated, the Fed may not aggressively cut interest rates. This could create a headwind for RIVN, given its elevated debt levels and need to fund ongoing operations. Meanwhile, the company is expected to increase capex in FY2025, which will put further pressure to its FCF. I do not expect RIVN to achieve FCF breakeven anytime soon.

Analysts Have Been Slashing Revenue Consensuses

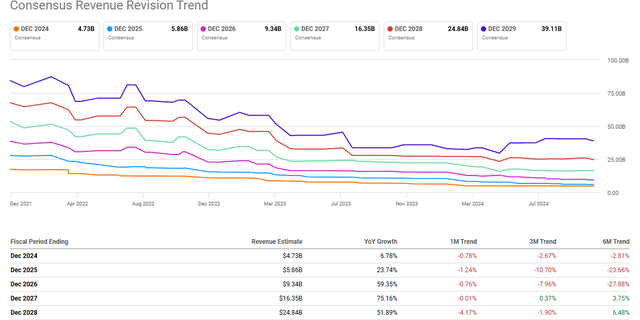

RIVN’s stock momentum has been bearish, as the market believes the company is unlikely to experience significant growth acceleration until at least FY2026. According to Seeking Alpha, RIVN’s revenue consensus has been steadily declining over the next three years, particularly over the past six months. The $5.86 billion revenue estimate for FY2025 was made before the 3Q deliveries report, so FY2025 and FY2026 revenue forecasts are likely to be revised lower due to unexpected cuts in production outlook caused by supply shortages. Additionally, the stock is currently trading at 2.24x P/sales fwd, higher than its 2.04x TTM basis, which is a bearish signal for investors as weak growth outlook pushes the valuation multiple higher. Therefore, due to the growth headwinds extending into FY2025, I believe the stock’s recent selloff is justified and did not present an attractive buying opportunity.

Upside Risk

Nevertheless, there are a few key points investors may want to focus on during the next earnings call. First, if supply shortages can improve in 1Q FY2025, management could raise production guidance for FY2025. Second, if the R2 integration proves more efficient with shorter downtime in 2H FY2025, it could improve gross profit and potentially shorten the breakeven timeline. Lastly, it’s important to monitor the company’s inventory levels and “days inventory outstanding,” as these figures have been rising in recent quarters, indicating a growing backlog. These factors could be the potential positive catalysts, impacting the stock’s bullish sentiment.

Conclusion

In conclusion, RIVN faces significant growth headwinds as it navigates supply shortages, leading to cuts in production and delivery guidance in the near term. Revenue is expected to decline on a year-over-year basis in the coming quarters, and the persistent negative gross profit trend, combined with rising net debt levels, raises concerns for investors. With analysts continually revising revenue estimates downward, I believe it’s still too early to call the stock’s bottom following the recent pullback. Therefore, I have initiated a hold rating on RIVN, given the lack of immediate growth catalysts and the ongoing uncertainty surrounding supply shortages in the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.