Summary:

- Rivian’s stock is overvalued, particularly given the recent production forecast cut, and increasing competition in the light EV truck industry is likely to further hinder its revenue growth potential.

- RIVN stock is overvalued with an 18% premium over fair value and lacks signs of improving profitability.

- Intensifying competition from Tesla’s Cybertruck and Ford’s electric F-150 poses significant threats to Rivian’s market position.

hapabapa

Investment thesis

My previous bearish thesis about Rivian Automotive (NASDAQ:RIVN) aged not as well as I wanted, since the current share price is 10% higher compared to the time when my call went live. On the other hand, the stock currently experiences very weak momentum as there are several warning signs, including the recent production volumes guidance cut for 2024. This looks like a big problem, as the downgrade is significant compared to the previous guidance and FY2023 actual production levels. There are a few big other red flags as well: revenue growth deceleration, no indications of operating leverage, significant cash burn, and rapidly intensifying competition. Moreover, the valuation does not look attractive with a 30% premium over the fair value. All in all, I downgrade Rivian’s stock to “Strong Sell”.

Recent developments

According to the recent news, Rivian experiences shortage of parts, which means that it now expects to deliver less vehicles in 2024 than it was previously forecasted. The company now expects to produce between 47,000 to 49,000 cars in 2024. This is a notable decline from the previous 57,000 units guidance. What is also crucial is that the new range is significantly lower than the last year’s actual production levels of slightly above 57,000 vehicles. This is a big red flag in my opinion, as it makes the company’s potential to ramp up production questionable.

Seeking Alpha

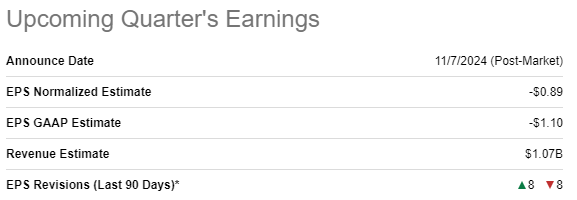

The company’s upcoming earnings release is scheduled for November 7. Wall Street analysts expect Q3 revenue to be $1.07 billion, indicating a 17.7% YoY decline. The adjusted EPS is expected to be -$0.89, which is an improvement compared to -$1.19 in Q3 2023. There was an equal number of consensus EPS revisions over the last 90 days, but I think there likely will be more downgrades after the production forecast cut.

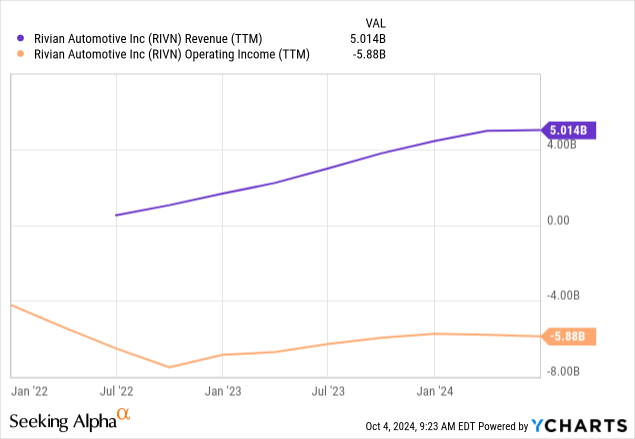

The above trends also look warning for investors. Rivian’s revenue started stagnating after a solid bull run in previous quarters, which was unlikely to make investors happy. Moreover, despite notable revenue growth in previous quarters, we see that the company does not demonstrate any operating leverage. The operating loss is still deep, and there is little correlation with revenue growth.

As a result of no improvements in profitability, Rivian’s financial position is melting down rapidly. Rivian’s cash and tangible book value per share has almost halved over the last year. The net cash position as of the latest reporting date was $5.2 billion lower compared to the end of Q2, 2023. The cash burn is still large, and there are no indications that the picture will improve soon.

According to the latest earnings call, the management expects FY2024 EBITDA to be -$2.7 billion. This will be around $2 billion better compared to FY2023, but the negative amount is still large. Moreover, the decreased production forecast will also highly likely adversely affect the management’s EBITDA guidance. If we look at RIVN’s cash flow statement, cash from operations during Q2 improved both QoQ and YoY. Readers should pay attention that the improvement was due to favorable movements in working capital, and not due to improved profitability.

These trends are especially warning if we consider rapidly intensifying competition. I think that Tesla’s (TSLA) Cybertruck is the main competitive threat to Rivian’s offerings. According to the source, Cybertruck registrations soared by 61% in July and “estimated production is reaching close to 2,000 vehicles per week”. With such a pace, the annual production run rate for Cybertruck is slightly above 100,000 cars, which is significantly beyond Rivian’s consolidated volumes. And Cybertruck is not the only competitor. For example, Ford’s (F) electric version of the iconic F-150 truck sales has doubled in Q3 2024.

To summarize, I remain bearish about Rivian. The production forecast cut is significant and suggests that the company will not be able to maintain the revenue growth pace of recent quarters. Moreover, there are no signs of improving profitability, and the cash burn is significant. There are also apparent competition threats as rivals ramp up production of direct competitors to Rivian’s models.

Valuation update

RIVN plunged by 46% over the last 12 months and its YTD performance is even worse with a 55% share price drop. Valuation ratios are mostly unavailable due to generating losses. However, Price/Sales ratios are substantially above the sector median, which likely means overvaluation. I recommend readers to ignore Price/Book ratios because RIVN burns cash with a rapid pace and its balance sheet is poised to deteriorate within several next quarters.

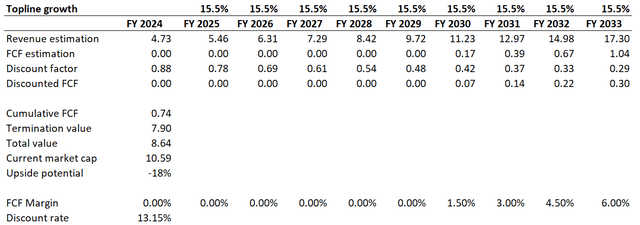

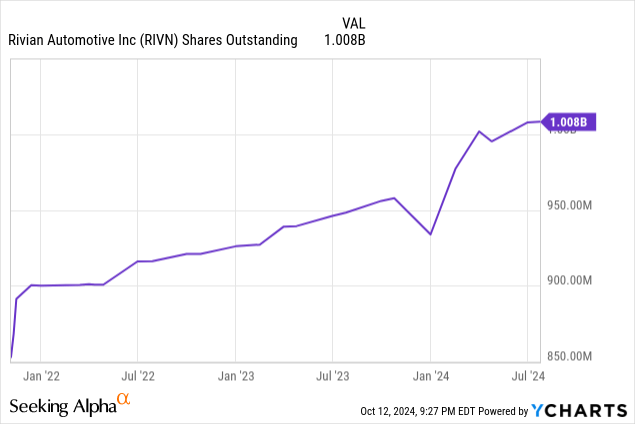

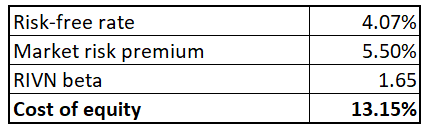

Looking only at multiples is never sufficient for me, and I want to proceed with a discounted cash flow [DCF] simulation. In the below table, I outline my cost of equity calculation under the CAPM model. All variables are easily available on the Internet. Rivian’s cost of equity is 13.15%. I rely only on the cost of equity and ignore the cost of debt because of Rivian’s substantial cash burn and notable reliance on issuing more shares, which we can see from the above chart.

Author’s calculations

I rely on consensus estimates for FY 2024 revenue and project a 15.5% CAGR for the next decade. I do not expect Rivian’s FCF margin to become positive earlier than FY 2030, the year when consensus estimates project the adjusted EPS to become positive. Therefore, I incorporate zero for years prior to FY2030. I am not incorporating negative FCF margin for years 2024-2029 because this will apparently make the fair value negative. Moreover, RIVN has been successful so far by raising funds by issuing additional shares to fund growth.

I expect the FCF margin expansion to correlate with revenue CAGR, which means a 150 basis points yearly expansion. I ignore RIVN’s substantial net cash position because there is a large cash burn every quarter.

The business’s fair value is $8.6 billion, according to my DCF simulation. This indicates a notable 18% overvaluation. Considering all the fundamental red flags, RIVN certainly does not deserve such a premium over fair value.

TrendSpider

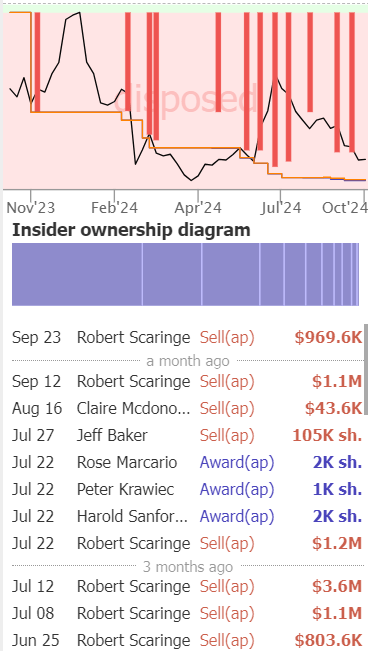

An additional indication that RIVN is highly likely overvalued is the fact that insiders were only selling the stock over the last 12 months. Robert Scaringe, the CEO, has been very active in selling his RIVN shares over the last few months.

Risks to my bearish thesis

RIVN is an extremely volatile stock, and it swings sharply in both directions. For example, after I wrote my previous bearish call about the stock in May, the share price was $9.51. Despite all the red flags, the stock price has doubled by mid-July, which made my thesis look quite poor. Therefore, investors should be aware that the stock might demonstrate sudden spikes in the share price, which might be caused by some positive headlines. Rivian’s investors might also enjoy a short squeeze, since there is an 11.8% short interest.

Apart from Amazon (AMZN), behind its back, Rivian has also recently applied for a federal loan to resume Georgia plant construction. While it is still uncertain whether the loan will be granted, the U.S. Department of Energy [DoE] has acknowledged that supporting the project will have positive long-term effect by “reducing overall national emissions of air pollutants”. That said, if Rivian is granted with the federal loan, this might be a big positive catalyst for the stock.

Bottom line

To conclude, the stock is now a “Strong Sell”. The stock is unattractively valued, especially in light of the recent production forecast cut. I also expect the competition in the light EV trucks industry to intensify, which will continue weighing on Rivian’s revenue growth potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.