Summary:

- Rivian’s 2nd Gen R1 platform will improve gross margins and grow deliveries.

- R1 Gen 2 sets the firm up well for its R2 launch in 2026 because they are based on the same tech.

- Rivian’s cost savings will come from increased scale, changing suppliers, recent declines in commodities prices, increased vertical integration, and redesigning/using cheaper parts.

- Rivian’s strong brand, high customer satisfaction, and strategic partnerships, like with Volkswagen, position it well for long-term growth and market expansion.

- I project 86.6% upside over the next 3 years and 5 months which is an IRR of 20.04%.

Moment Makers Group/iStock via Getty Images

At Face Value Rivian Looks Ugly

I think Rivian (NASDAQ:RIVN) is misunderstood, but recognize this is a high-risk investment. Specifically, Rivian lost $2.859 billion from operations in 1H 2024. The firm only has $7.867 billion in cash and short-term investments including the $1 billion convertible note purchased by Volkswagen (but not including the rest of the deal). Making the situation look even worse, a component supply shortage for the firm’s in-house manufactured motor caused Q3 deliveries to miss estimates of 13k, coming in at 10,018 (down from 15,564 in Q3 2023). Full-year deliveries are only expected to grow in the low single digits to just 50.5k to 52k due to the recent shutdown caused by the shift to Gen 2 and this supply shortage.

2nd Generation R1 Bull Thesis

I think now is a good time to invest in Rivian despite its recent high cash burn rate and Q3 delivery decline because the 2nd Generation R1 platform will increase the firm’s gross profit margin and deliveries. I think Rivian will prove it can get to gross margin profitability with the 2nd Gen R1. This will set the firm up for high delivery growth in 2026 from the cheaper R2 platform. The 2nd Gen R1 and R2 are based on some of the same technologies and utilize some of the same cost-saving initiatives.

Furthermore, a revitalization of R1 delivery growth due to ‘under the hood’ and software improvements will remind investors of the brand’s potential monetization via a cheaper SUV (R2). Investors who think we must wait until mid-2026 to see if Rivian will have long-term success have it wrong. The next 2 quarters will tell us where the business is headed. These are the high-leverage quarters that can provide significant stock price appreciation if management executes.

How Rivian Is Cutting Costs With 2nd Gen R1

Rivian is cutting material costs by 20% in the Gen 2 R1 compared to Gen 1. These cost savings are coming from increased scale, changing suppliers, recent declines in commodities’ prices, increased vertical integration, and a greater attention to detail on where costs can be taken out (redesign/cheaper parts).

Rivian initially made its supplier deals in 2018-2019 before its products (R1S, R1T, & van) launched. The company had no leverage with suppliers during these negotiations. Suppliers were taking a risk in partnering with an electric vehicle startup. The founder & CEO RJ Scaringe talked about how he flew to meet senior sales managers 6 layers down from the CEO.

The dynamic with suppliers has changed now that Rivian is expected to do $4.74 billion in 2024 sales and has a well-regarded brand. Just getting to this 2nd Gen product is a key milestone suppliers weren’t certain would happen 5-6 years ago. Now CEOs of suppliers are flying to Rivian’s plant in Normal, Illinois to pitch RJ to potentially be a component of Rivian’s products. The realization of this new leverage was delayed by the pandemic supply shortages from 2021-23, but now Rivian is benefiting from it.

The 2nd Gen products look similar on the outside, but they are completely redesigned under the surface. The vast majority of the supply base shifted to new suppliers. Rivian made these changes because they have greater optionality now that suppliers are pitching them. Plus, they can only work with suppliers who can meet their budget constraints. In discussing suppliers, RJ mentioned that Chinese components are often 20-30% cheaper. Rivian is choosing Chinese mechanical parts that are fungible to move, don’t have technical dependency, and represent significant cost centers for the vehicle.

Vertical Integration: Differentiation & Lower Costs

Vertical integration increases product differentiation. Initially, building parts of the vehicle in-house requires more spending because the products need to be developed. However, Rivian’s vertical integration cuts costs in the long-run.

Rivian’s direct-to-consumer model cuts out access to the dealer network, but saves it from the 10-15% cut they take. It’s hard to generate initial interest via direct-to-consumer. However, in the long run, if Rivian controls the relationship with the customer, it can sell services over the life of the vehicle with a model that is 1/10th the cost.

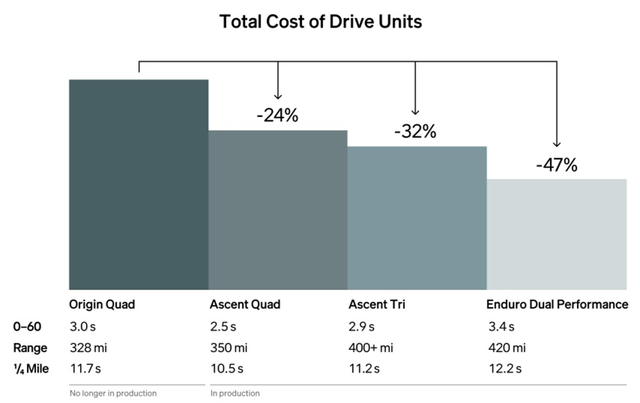

Rivian makes its own drive units and battery management system which helped it cut costs in the 2nd Gen product. The front cross-member of the battery pack went from 17 parts to 1. Die casting allowed for a 47%-piece cost decline. Rivian used to use Bosch motors. It came out with its own in-house dual motor in 2023. With the 2nd Gen R1, Rivian is producing its own tri and quad motors. The in-house drive unit has an inverter with 75% greater volume density at a 25% lower cost.

You can see below, Ascend Quad has lower cost, a faster quarter mile time, and greater range than Origin Quad. This is the differentiation and cost cutting that can come from vertical integration. Rivian’s investments that caused high cash burns have led to truly better products that can compete on costs and specs with the best products in their classes.

Rivian also builds its own high-density nickel battery packs. With Gen 2, Rivian came out with the option for a lithium iron phosphate (LFP) battery with a heat pump which cools and heats the vehicle. Lithium iron phosphate is safer, cheaper, easier to service, and has lower degradation (it’s used in its vans). However, it provides less range; the new LFP battery only offers the same standard 270 miles of range.

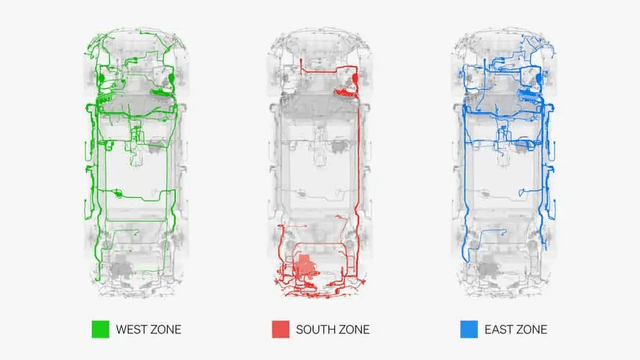

Rivian also developed its own electrical hardware that utilizes zonal architecture which limits electrical control units (ECUs) and allows the firm to control its own software stack which brings Over The Air (OTA) updates quickly. Traditional vehicles are designed with hardware in mind and software as an afterthought. These vehicles have centralized electrical architectures that use miles of wires and complex systems. They have 40-150 ECUs. There can be several ECUs just for the seat. This makes updating the system difficult because the automaker needs to get multiple 3rd party parts manufactures on board before anything is changed.

Just going from 17 to 7 ECUs saved Rivian 1.6 miles of internal wiring and 44 pounds of weight. Zonal architecture seen below allows for each ECU to control multiple components within a section of the vehicle. Software defined vehicles with limited ECUs have quicker diagnostics and servicing. Technicians have easier access to individual components without the excess wiring.

Rivian has its own operating system called the Real-Time Operating System (RTOS). Using its own OS instead of Apple CarPlay/Android Auto allows it to control the customer’s experience and scale its service. Rivian’s OS has a charming Gear Guard character which gives the brand personality. Plus, Rivian’s partnership with Unreal Engines allowed for an imaginative, inspired image of the vehicle in real-time.

Finally, Rivian is using Nvidia chips to build its own in-house autonomy products. Its Lane Change on Command feature utilized its vertical integration with its sensors and software, making for faster development. The Gen 2 vehicle has 11 in-house cameras (55 megapixels is an industry-high) and 5 radars (imaging & front facing). The firm moving away from Mobileye’s radars allowed it to control the whole perception stack and fuse data as soon as possible.

The Nvidia Drive Orin chip has 10x the operating speed as the previous chip and increased the trillions of operations per second (TOPS) to 240-250. This is why RJ said Gen 2’s headroom for advancements is much greater than Gen 1’s. He said Gen 1 is currently about 75% as good as it can be and Gen 2 is only at 1%. This same platform will allow R2 to further develop its autonomy features. R1 Gen 2’s data will give R2 a 2-year head start. Rivian’s Gen 2 autonomy platform will enable hands-free driving by year-end.

The greater compute power allows for low-cost robust training. RJ stated it costs $3-$5 billion to build foundation models for autonomy. There won’t be many manufacturers willing to spend that much. Rivian’s competitive advantage in autonomy has come from an upfront expense. The investments are creating differentiation which the firm can monetize via partnerships with other manufacturers (VW) or by selling a more affordable vehicle (R2).

Fewer & Cheaper Parts Via Redesign

The best ways to lower material costs are to eliminate parts, redesign them, and use cheaper alternatives. The key is to do that while maintaining the premium feel and performance of the vehicle. After all, the R1S starts at $75,900 and the R1T starts at $69,900. The firm’s average selling price (ASP) is around $90k. These still need to be premium luxury products that provide a brand halo.

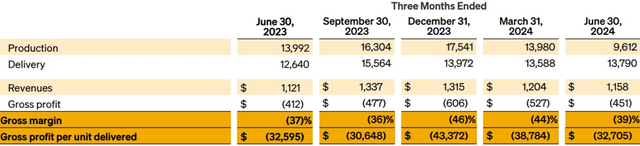

Munro & Associates felt the company was giving away too many features for the price. Rivian has a lot of room to cut features/expensive materials without falling behind the competition. That means not only did high fixed overhead expenses cause negative gross margins, but also the company just gave too much away. This implies even if demand was higher, losses would still exist. You can see the -39% gross margin in Q2 before Gen 2 was launched. In Q2, Gen 1 vehicle inventory was drained during the production shutdown to switch to Gen 2. Gross margin improvements will become visible starting in Q3.

Gen 2’s body reengineering eliminated 65 parts and almost 1,500 joints. High-pressure die casting helped decrease parts. This being Rivian’s 2nd attempt at a vehicle allowed the firm to use all its learnings in the past few years to make a better product. The 2nd generation of any product is usually going to have the most improvements.

Easier Assembly Lowers Costs

Labor costs and time to assemble are big expenses for automakers. Therefore, the design changes weren’t just about using cheaper parts; they were also focused on making the platform easier to assemble. These advancements will help the R2 platform which is starting production in 1H 2026. In Gen 2, there was a 30% line-improvement which decreases cycle times. This was due in part to retooling which includes the use of robotics. 600 assembly robots were added or changed. Easier assembly and lower materials costs will get the firm to gross margin profitability in Q4. The long-term goal is 25% gross margins for the R1 platform.

The more expensive tri-motor offering which launched in late-Q3 will help gross margins. The tri-motor R1T starts at $99,900 and the R1S starts at $105,900. Quad-motor pricing hasn’t been released, but it will be more expensive. Its launch in 2025 will further help margins. Showing positive gross margins in Q4 and into 2025 will give investors more confidence that Rivian can sell R2 at a profit. That’s important because in the long-term R2 will make up a much greater percentage of sales than R1.

Rivian Has A Great Brand & High Customer Satisfaction

Rivian’s goal was to create a halo effect with its expensive R1 platform to inspire everyday vehicle buyers to purchase the cheaper R2 model. The average new vehicle costs $47,870 according to Cox Automotive. It will likely be $48k-$52k when R2 comes out. R2 is expected to be priced from $45k-$55k depending on the option.

I think Rivian has built a strong enough brand with the R1 platform to monetize interested consumers who can only afford a lower-priced vehicle (or who want a smaller one). In Q2, Rivian had 14 Spaces & 60 service centers. Spaces are Rivian’s retail locations where it shows off the vehicles to create buzz. One opened in Boston in Q3. In Q2, the firm had 267k visitors and 24k demo drives. Many of these are potential buyers of the cheaper R2 platform vehicles.

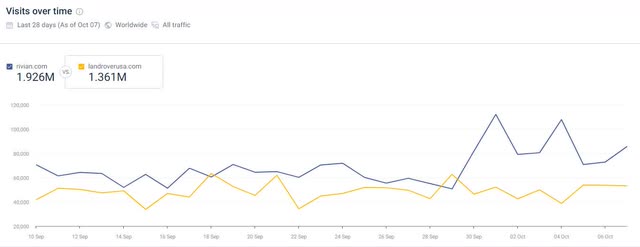

Rivian has a strong social media and web presence which is important for a new brand with a direct-to-consumer business model (vehicles sold on the website). Rivian’s subreddit has 103k members and its Instagram has 713k followers. Its website had 1.856 million views in September (down 13.3% from 2.14 million in August). As you can see below, the website had 1.926 million views in the last 28 days as of October 7th Rivian’s website ranks 253rd in the Similarweb “vehicles” category (includes content publishing websites like caranddriver.com).

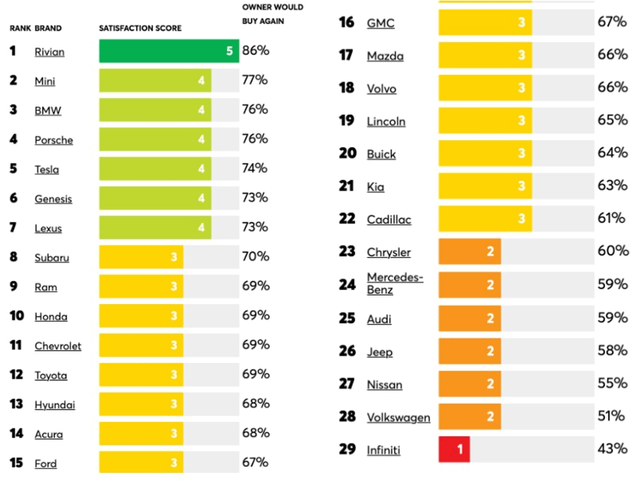

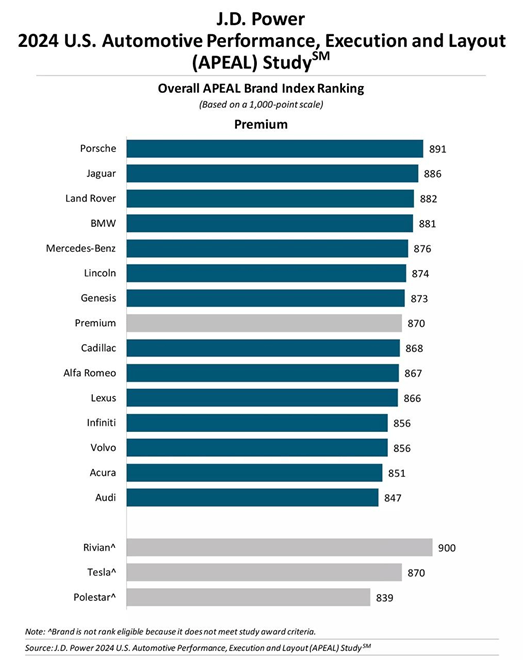

Rivian’s strong brand is underpinned by its high customer satisfaction scores. J.D. Power does a yearly APPEAL study which asks owners about over 40 attributes in 10 experience groups such as the interior, infotainment, and powertrain. Infotainment systems got among the lowest scores across brands with in-vehicle infotainment systems averaging 805 out of 1,000 (ones with Apple CarPlay & Android Auto got higher scores of 840 & 832). This is advantageous for Rivian which specializes in software and has its own OS. Although Rivian didn’t meet the study criteria, its 900 score in the index would have been the highest among all premium brands.

J.D. Power

Next, we have Consumer Reports’ annual survey of 330,000 drivers in the 2021-24 model range. As you can see below, Rivian was the only brand out of 29 with a 5/5 satisfaction score. A whopping 86% of owners would buy a Rivian again. This score shows Rivian’s potential to monetize its brand with a cheaper vehicle option.

Volkswagen Deal Helps Lower Costs

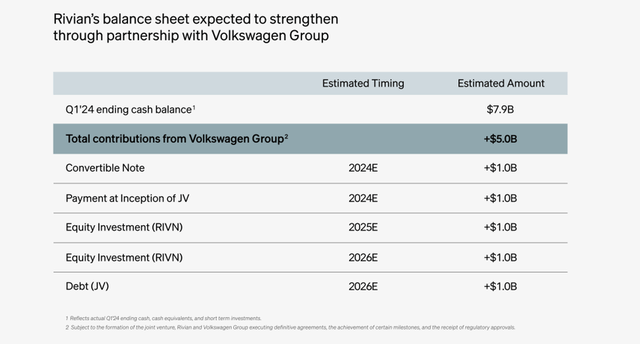

Most Rivian followers/investors are familiar with the Volkswagen deal which will help with Rivian’s liquidity needs. As of October, VW owned 7.7% of Rivian. The $2 billion equity investment, will further increase VW’s sake.

Besides access to capital, Rivian is gaining VW’s scale which will lower costs for components, chips (particularly ECU chips), printed circuit board assemblies, and associated content related to those hardware systems. In that way, this is the perfect deal for Rivian because its biggest challenges are access to capital and lowering supplier costs. Adding this to Rivian’s cost-cutting measures and declining commodity prices provides a nice tailwind to increasing gross margins.

Rivian’s Debt

Rivian owes no money under its asset-backed lending facility and has $188 million in letters of credit outstanding. This gives it $1.312 billion under the facility that can be borrowed.

The $1 billion convertible note VW purchased has a 4.75% interest rate. Half of it has a conversion price of $10.84. The conversion price of the other half hasn’t been determined yet. Excluding any new government funding, the firm has 2026 notes and 2 green convertible notes (2029 & 2030). In October 2021, the firm issued $1.25 billion in senior secured floating rate notes due in October 2026. As of June 30th, the interest rate was 11.4%.

The March 2029 green convertible note was issued in March 2023. The interest rate is 4.625% and the conversion price is $20.13. The net proceeds from the deal were $1.2861 billion. The fair value of the notes fell from $2.11 billion at year-end 2023 to $1.472 billion in Q2. The valuation of these notes likely declined in Q3 with the stock price.

The October 2030 green convertible note was issued in October 2023. This interest rate was a lower 3.625%. The net proceeds were $1.486 billion. Unlike the 2029 note, the fair value has fallen below the original money raised because the conversion price is $23.29. From year-end 2023 to Q2 2024, the fair value fell from $2.121 billion to $1.478 billion. Rivian paid $108 million in capped called transactions to increase the effective conversion premium to $31.06.

Rivian Producing R2 In Normal

The production disruption I referenced earlier caused Rivian to only produce 13,157 vehicles in Q3. The full-year production target fell from 57k to 47k-49k. The good news is the firm has successfully switched to producing Gen 2 vehicles. I think the switch to Gen 2 will make it much easier to scale up production of R2 vehicles because R2 utilizes a lot of Gen 2’s advancements.

The Normal plant became more important to Rivian when the firm decided to use it to produce the first tranche of R2 vehicles, saving the company $2.25 billion. This catalyzed the construction pause of the firm’s $5 billion Georgia plant. The Georgia plant will eventually have two phases of 200k vehicle production, bringing-long term production to 400k per year.

The Normal plant will shut down in 2H 2025 to set it up for production of R2 in 2026. Therefore, next year’s sales growth will be minimal. This will put an intense spotlight on gross margin targets which I previously mentioned I believe will be hit. The Normal facility currently has 150k units of capacity; it is producing the R1 platform and its commercial vans it sells to Amazon. The reconfiguration will allow for 215k of production. The potential production will be up to 155k R2 vehicles, up to 85k R1 vehicles, and up to 65k vans. That adds up to 305k vehicles which implies the firm is going to flexibly respond to demand. Most likely, in the first couple years after R2’s launch, Rivian will produce near the max of 155k vehicles, while R1 runs well below its capacity.

Initial Demand For R2 Is High (Monetizing The Brand)

Given Rivian’s strong brand, high customer satisfaction, and elevated social media presence, it’s no surprise the firm’s announcement of the R2 platform along with the R3 & R3X received a lot of attention. The reveal video on YouTube has 396k views. This broad positive attention got the R2 68k $100 reservations in less than a day and 100k as of the 3rd week in July.

The R2 will be Rivian’s first consumer-facing foray into Europe given its much smaller dimensions than the R1. The firm will use its experience with selling vans to Amazon in Europe to help this launch go smoothly. Rivian is far from launching vehicles in China and may decide to avoid the country entirely due to high competition. Some Chinese EV automakers operate at negative gross margins on purpose to gain market share (with government subsidies). The Chinese government treats Chinese EV automakers more favorably than foreign EV brands.

I have not discussed R3 much in this note because the platform won’t launch until late 2026/early 2027. Rivian needs R1 gross margins to increase and R2 to scale before it can launch R3. R3 is a crossover that’s smaller than R2. R3 is estimated by Car and Driver to start at $37k. This would plant a strong flag in the battle to make EVs affordable for the masses. The performance version which is R3X is estimated to start at $47k. R3X is a great way to get enthusiasts excited about the brand. Even though the R1 platform aims to be a brand halo, R3X provides extra anticipation. It could create a cult-like following of owners once it launches.

Other Business Lines With Higher Margins (Services & Autonomy)

Rivian’s direct-to-consumer model and autonomous development provide potential for the firm to make additional sales at higher margins. Firstly, I must mention regulatory tax credits. The firm expects to earn about $200 million in credits this year. These sales fall directly to the bottom line. With the recent EV slowdown, some automakers are pushing their plans to transition their fleet from ICE to EV back which will help increase Rivian’s credit sales. It will be especially beneficial when Rivian starts producing more vehicles in 2026 via the R2 launch.

Rivian has vertically integrated servicing vehicles. It utilizes mobile service vans to cut costs and add convenience. Specifically, Rivian only has 60 physical service centers. It has 590 mobile vans. The firm’s software and AI capabilities allow the vehicle to self-diagnose problems and help the service intake representative support the customer. It’s particularly beneficial for mobile vans to know the problem ahead of time to make sure they can solve it (they have fewer resources).

Rivian has its own charging network called the Rivian Adventure Network (RAN) which is powered by 100% renewable energy. I counted 86 working sites in the map below. RAN has over 500 DC fast chargers which have about 99% uptime. Uptime is the entire reason Rivian is developing its own network because, outside of Tesla’s network, 3rd party network uptime is too low. It’s very frustrating to get to a charger that’s not working because the vehicle might run out of battery before it can get to the next one.

The goal is to get to 600 sites and 3,500 DC fast chargers in North America. Rivian is taking a page out of Tesla’s playbook by opening up its network to all EVs in Q4. When non-Rivians use the network, they will be charged more. Increased usage and higher prices will make the network profitable, funding its growth.

Besides the used vehicle platform I mentioned earlier, Rivian offers financing, leasing, and insurance. It also offers FleetOS for its vans. This is a subscription-based fleet management platform for supervising the vehicle’s health and performance among other data. Amazon pays for FleetOS in all its vans. Rivian has a contract with Amazon to deliver 100k vans by 2030. Last November, Rivian ended its exclusivity deal with Amazon to diversify its customer base. In 2H 2025, Rivian will begin converting pilot fleets into large-scale orders from new customers.

For consumers, Rivian started offering Connect+ which is a bundle of streaming/connectivity services via a monthly or annual subscription. The services listed in the bundle are Apple Music, Audible, Google Cast & YouTube, and previously integrated apps like Spotify. Furthermore, Connect+ adds a vehicle hotspot for up to 8 devices and Rivian Premium Audio with Dolby Atmos spatial audio. Investors love paid subscriptions because of their consistent recurring revenue.

Software and services are great businesses because their gross margins approach 65% which is much better than 25% vehicle gross margins. The most exciting features are in AI and autonomy. Simple conversational AI can be added, allowing the driver to talk to the vehicle like it’s a person. The driver tells the vehicle they are hungry. The vehicle responds by asking what they are in the mood for and suggesting restaurants. Some AI features can differentiate the vehicle from competitors and some can be paid services.

Gen 2 is Rivian’s first end-to-end autonomy platform. Hands-free driving is projected to launch by year-end. In 2025, the firm will start charging for Rivian Autonomy Platform+ which is an expansion of automated driver assist support. Once this launches, Rivian will get much needed high-margin cash flow. Plus, I predict investors will start to value the stock as an autonomy play similar to Tesla which will give it a higher multiple.

Global Legislation Promoting EVs

According to Cox, auto sales in the US fell 2.1% in Q3, but EV sales rose 8%. While that is solid outperformance, it’s less than it has been in recent years. Despite this growth decline, I think most vehicles will be electric within the next decade due in part to government policies.

The Inflation Reduction Act includes a qualified commercial clean vehicle tax credit that lets the $7,500 tax credit pass to leases. It’s a loophole because it doesn’t have the price limits, annual income limits, assembly location mandate, and battery sourcing restrictions that the new vehicle credit has. With this loophole, consumers making more than $150k ($300k for couples) can lease EV sedans over $55k and SUVs over $80k and still get the tax credit. It helps Rivians which have a ~$90k ASP. This new loophole pushed leases to 35% of EV sales in Q1 2024 from 12% in 2023.

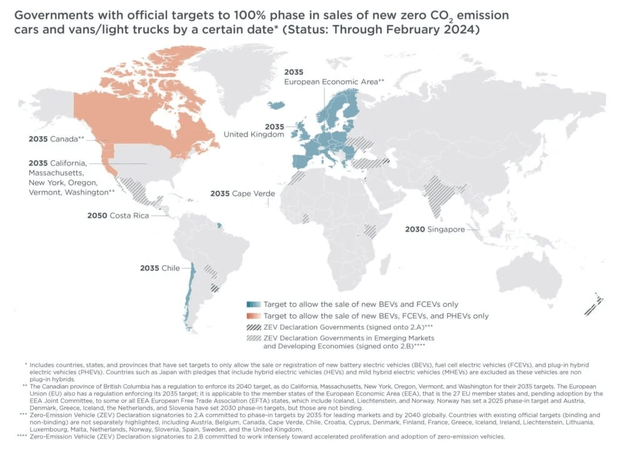

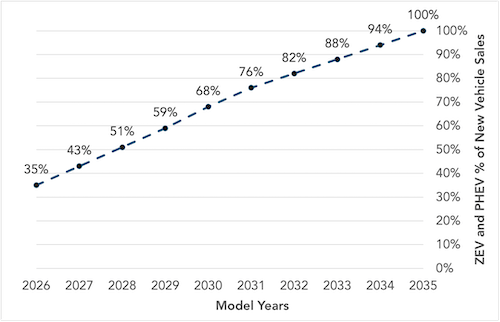

As you can see from the map above, by 2035 all new cars and vans/light-weight trucks in the EU & the UK will be EVs or fuel cell EVs. 11 US states have similar plans except they allow for plug-in hybrids. These states will issue fines if ICE cars are sold after 2035. California, Vermont, New York, Washington, and Oregon signed on to Advanced Clean Cars II (ACC II). The chart below shows ACC II’s targets. We will get a window into the success of these programs in the next few years.

Coltura

Push To Profitability + Valuation

Rivian is projecting it will reach adjusted EBITDA profitability in 2027 while approaching 200k vehicles produced at Normal. The long-term gross margin target is 25% with adjusted EBITDA margins in the high teens and a 10% free cash flow margin. The first step to profitability is improving gross margins. I have discussed at length how the firm plans to do this over the next few quarters. SG&A + R&D expense leverage from the increased sales base will help operating margins.

The main premise that you must believe in to accept the firm’s profitability goals is that most of the big investments to build out the vehicle platforms, software stack, propulsion system, and electrical hardware are complete. There’s always more work to be done, but the Gen 2 R1 platform and the R2 platform have been built to scale. It’s easy to look back at the Gen 1 platform and criticize all the points where costs could have been taken out, but Gen 1 needed to exist first to get to Gen 2.

Rivian needs to show it can get to gross margin positive with a $90k vehicle before investors will come close to believing it can do so with a $45k vehicle. I think the software, propulsion, and electrical hardware advancements in Gen 2 will transfer well to R2. To generate gross profits on R2, the firm just needs to take out some features along with benefiting from the cost advantage of building a smaller vehicle at a higher scale. A nice example of monetizing an investment is the launch of Rivian Autonomy Platform+ in 2025.

If in 2027 Rivian sells 145k R2s at an ASP of $50k, 35k R1s at ASP of $95k, and 35k vans at an ASP of $80k, that gives the firm $13.375 billion in sales. That’s not including the monetization of its entire fleet with services, the launch of R3/R3X, and regulatory credits. I believe these portions of the business will be more than enough to bridge the gap to the consensus of $16.35 billion in 2027 sales.

I forecast $900 million in tax credit sales and $1.04 billion in R3/R3X sales (22.5k vehicles produced in Georgia at an ASP of $46k) in 2027. By the end of 2027, I believe the fleet will be 588k vehicles (54k in 2025, 177k in 2026, 235k in 2027). If the firm can sell each vehicle $2,750 in services per year (maintenance/repair, FleetOS, Connect+, charging, and Rivian Autonomy Platform+), that’s $1.29 billion in sales. This all adds up to ~$16.6 billion in sales, which is slightly above the consensus.

I don’t think Rivian will get to a 10% FCF margin in 2027 because it won’t be at maturity. Therefore, I will model a 5% margin. This equates to $668.75 million in FCF without services, R3/R3X, & regulatory credits and $830 million in FCF with them.

At a 30x FCF multiple (using $830 million in FCF), the market cap is $24.9 billion. I believe this multiple is warranted because Rivian will have room to double its margins and R3/R3X will be just getting started. There are currently 1.001 billion diluted shares outstanding. With 1.3 billion shares outstanding (estimating convertible impact) in 2027, the share price will be $19.15. That’s 86.6% upside over 3 years and 5 months which is an IRR of 20.04%.

Rivian Is A High-Risk Investment

There are numerous risks to investing in Rivian. I’ll focus on the company-specific ones here.

The firm could burn more money than it projects before getting to R2 production which could cause a dilution event, since missing goals wouldn’t motivate anyone to lend the firm money. Scaling manufacturing is difficult which could delay production of R2 and the launch of R3/R3X. The firm might not be able to refinance its 2026 notes at a favorable rate or at all if gross margins don’t improve and the R2 launch doesn’t go well. This could lead to more dilution.

Rivian might not reach its autonomy goals. They aren’t as expansive as Tesla’s, but it’s still difficult for a new company to leap ahead of incumbent players and solve such a complex problem. Rivian could help VW build up its new EV light-weight truck brand called Scout as part of the deal which could take market share from Rivian.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.