Summary:

- Northrop Grumman offers a balanced investment profile with growth and income potential, boasting a strong backlog and impressive revenue growth across key segments.

- The company is well-positioned with a $83 billion backlog and favorable U.S. defense budget outlook, supporting sustained performance and growth.

- NOC’s valuation at a forward PE of 21 is justified by its solid fundamentals, growing global defense needs, and high single-digit EPS growth potential.

alxpin

Those who follow me may know that I like dividend stocks that lean toward +3% yields. That’s because recurring cash flows support my lifestyle needs and gives me flexibility in how I want to reinvest that cash, whether it be to acquire more of what I already own or to venture into new ideas.

However, I must admit that high yield investing isn’t for everyone, and for those who prefer to grow their portfolios in a tax-free or low tax strategic manner, growth stock may be a better choice for total returns.

This brings me to Northrop Grumman (NYSE:NOC), which offers a good middle ground in that it pays a dividend, though not a high yield, and carries plenty of growth potential.

I last covered NOC back in February of last year, highlighting its favorable industry dynamics and sizable backlog. The stock has done well for investors, with it giving a 24% total return in the 20 months since my last piece as lower interest rates and favorable growth have been tailwinds for the company.

In this article, I revisit NOC including recent business performance and forward outlook, and discuss why it deserves a spot on investors’ radars for potentially strong total returns from here, so let’s get started!

Why NOC?

Northrop Grumman is a global aerospace and defense company, providing technologically advanced systems and solutions in space, aeronautics, defense and cyberspace.

NOC is what I would consider to be a GDP+ company, which is defined one that has the ability to grow at faster rate than GDP, due to its moat-worthy assets and high value add. In fact, NOC generates 85% of its sales from advanced technology programs including space payloads, crewed and uncrewed aircraft, advanced weapons systems and communications.

NOC’s outperformance is best reflected by its besting the S&P 500 (SPY) over the past 10 years in total returns. As shown below, NOC has given investors a whopping 325% total return over this timeframe, far outstripping that of SPY and peers General Dynamics (GD), Lockheed Martin (LMT), RTX (RTX) and industry laggard Boeing (BA), which as been beset by a series of disastrous errors in its commercial arm.

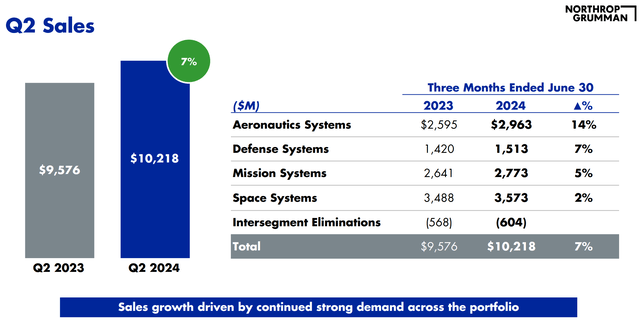

Meanwhile, NOC continues to deliver respectable performance, with sales growing by 7% YoY to reach $10.2 billion during Q2 2024. Also encouraging, operating income grew at a higher rate due to efficient cost management, at 13% YoY, and EPS grew by 19% over the prior year period. As shown below, NOC saw growth in all four of its business segments with Aeronautics and Defense Systems leading at 14% and 7% YoY revenue growth.

The strong results were driven in part by Guided Multiple Launch Rocket System, which saw an impressive 60% revenue growth in the first half of the year. Additionally, NOC was awarded over $500 million contract for ammunition that it expects to deliver in the third quarter.

Management raised its revenue guidance to $41.2 billion for the full year, representing a 5% growth rate at the midpoint of range, and also raised adjusted EPS guidance to $25.10 at the midpoint, representing 8% growth from the prior year, up from the original 6% EPS growth guidance.

NOC is well-positioned for the medium term, with continued growth in both the U.S. and international markets. This is supported by the U.S. defense budget increase for FY25 with a proposed $25 billion spending hike, including strong bipartisan support for the B-21 Raider and Sentinel production and modernization programs. The B-21 and Sentinel programs represent 2 of the 3 legs of the nuclear deterrent strategy, with B-21 being air and Sentinel being land-based.

Moreover, NOC received $15 billion in new awards during Q2, expanding its backlog to $83 billion. This represented a healthy book-to-bill ratio of 1.5x, representing more than 4 quarters of a book-to-bill of more than 1x sales.

For reference, the book-to-bill ratio represents bookings versus revenue in a certain quarter. Bookings is a leading indicator of future revenue, since revenue cannot be recognized until a product or service is delivered. As such, having a book-to-bill ratio of over 1x as in the case for NOC represents future revenue replenishment and growth.

Looking ahead to Q3 results, I would look for management to provide updates on its agreement to supply Ukraine with ammunition in early Q3 (July). This agreement makes NOC the first US defense company to make weapons inside Ukraine borders during the war, and involves NOC training a Ukrainian workforce. I would also look for any changes to the backlog and the book-to-bill ratio, as a ratio above 1x indicates potential for continued revenue growth down the line.

Meanwhile, NOC maintains a strong balance sheet with a BBB+ credit rating from S&P, $3.3 billion in cash and equivalents, and a reasonable long-term debt to capital ratio of 51%, considering the capital intensive nature of the business.

NOC is well on its way to becoming a dividend aristocrat, with 20 years of consecutive raises under its belt. Its current 1.6% dividend yield is well-protected by a 31% payout ratio and comes with a 5-year dividend CAGR of 9.3%. While NOC’s dividend yield isn’t high, it’s above that of the S&P 500 and comes with a higher growth rate.

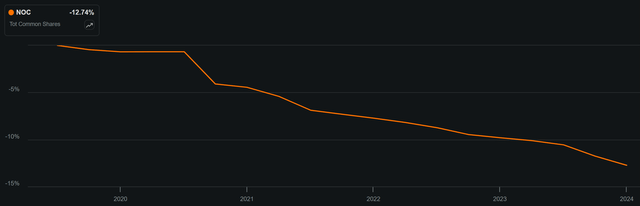

Plus, as noted earlier, NOC should be regarded more as a total return story that goes beyond dividends. As shown below, it’s reduced its share count by 13% over the past 5 years through share buybacks.

Admittedly, NOC isn’t cheap at the current price of $529 with a forward PE of 21. However, I believe the valuation is far from being excessive, and is backed by near term EPS growth potential in the high single digit, which I believe is reasonable considering the sizable backlog, improving profitability and geopolitical instability.

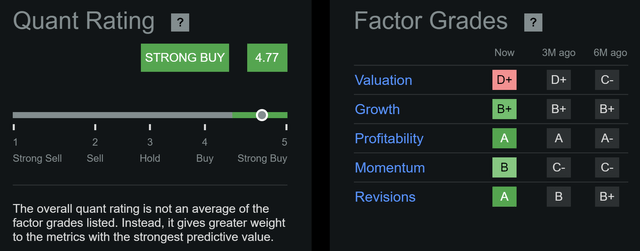

Analysts have an average price target of $531, which sits a couple of dollars above the current price and a consensus Buy rating on the stock, indicating potential for at least market-level returns from here. Moreover, Seeking Alpha’s Quant has a ‘Strong Buy’ rating on the stock with a score of 4.8 out of 5, with strong markets for Growth, Profitability, Momentum, and positive analyst price revisions on the stock.

Risks to the thesis include potential for lower geopolitical conflict, which could reduce demand for NOC’s solutions, although that does not seem to be likely for the foreseeable future. Other risks include budgetary concerns down the line, which could reduce funding for NOC’s defense-related programs. Moreover, NOC needs to continue to invest in R&D to stay atop of competition. This includes $1.8 billion in capital expenditures this year, representing 4.5% of revenue.

Investor Takeaway

Northrop Grumman presents a compelling total return investment opportunity for those seeking a balance between growth and income. Its impressive backlog of $83 billion, strong revenue growth across key segments, and favorable U.S. defense budget outlook position the company for sustained performance.

While its dividend yield of 1.6% may not attract high-yield investors, its 20-year streak of dividend increases and a low payout ratio offer long-term growth potential. Additionally, NOC’s disciplined cost management and share buybacks further enhance shareholder value. Though not cheap at a forward PE of 21, NOC’s solid fundamentals, supported by growing global defense needs, make it a strong candidate for total return-focused portfolios.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NOC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Read The Full Report on iREIT+Hoya

iREIT+HOYA Capital is the premier income-focused investing service on Seeking Alpha. Our focus is on income-producing asset classes that offer the opportunity for sustainable portfolio income, diversification, and inflation hedging. Get started with a Free Two-Week Trial and take a look at our top ideas across our exclusive income-focused portfolios.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.