Summary:

- I rate Alibaba stock as a “buy” due to catalysts like China’s $1.07 trillion stimulus, Alibaba’s international growth, and the end of regulatory crackdowns.

- Ant Group’s potential IPO is a major, overlooked catalyst, with Alibaba holding a 33.3% stake, despite regulatory changes since 2020.

- Ant Group’s evolving business model, including new regulations and restructuring, positions it for sustainable long-term growth and a future IPO.

- Alibaba’s intrinsic value, factoring in Ant’s valuation, suggests significant upside potential, making it an attractive investment for long-term investors.

Andy Feng

I rate Alibaba (NYSE:BABA) as a “buy” as the company is showing a list of catalysts that might boost the stock in the next quarters, such as i) the government’s stimulus estimated to be $1.07 trillion, or 6% of the country’s GDP of 2024, which includes measures to recover the property sector, stimulate consumption, and revive capital markets; ii) the AI developments that are being developed by Alibaba to improve the user’s experience while building new growth avenues for the future through a relatively new segment, Alibaba International Digital Commerce Group; and iii) the end of the regulatory crackdown after a 3-year process.

Even when I consider that these catalysts are strong reasons to buy the stock for the long haul, I notice that most investors are overlooking another factor that might be an even stronger catalyst: the Ant’s IPO. I’ve written an article in February 2023 about the potential changes in Ant Group after the halt of its IPO in 2020, and now, after more than one year of that article, some things have happened to Ant and Alibaba that are worth mentioning to infer in which point we are of a potential Ant’s IPO in the future.

Background

Currently, Alibaba must own more than the known 33.33% stake in Ant Group—I will explain why later, whose IPO was halted in 2020 when China began a heavy-handed crackdown on its big tech companies. In 2020, Ant Group was expecting to raise $34.5 billion in its IPO, with an estimated valuation for the company of around $350 billion. However, the new regulations of Ant’s operations triggered several doubts about its future valuation after that event. In this article, we’ll offer some information that will support our thesis that Ant Group still has some value to offer to Alibaba’s long-term investors even when Ant has experienced significant changes in its operations due to the new regulations and that a new IPO was not officially announced yet.

Ant’s business model has been changing since 2020

In July 2023, the regulatory crackdown on Ant Group ended after a 3-year process with a $1 billion fine. However, there is not much information about the changes in detail, so I had to infer them given the different and disconnected pieces of information released by the media in the last 3 years.

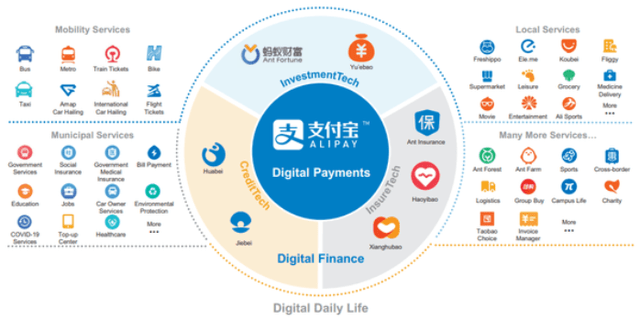

To understand how Ant Group was progressing since its halt of the IPO in 2020, we need to first understand how the company operated before that event. Ant built an ecosystem around its platform, offering different applications developed under a digital infrastructure for e-commerce and other services.

As we can see in the chart above, consumers had access to that ecosystem through Alipay, which is a payment processor that was created in 2004—in the first stage of e-commerce in China—to solve trust issues between buyers and sellers; however, Alipay ended up becoming an ecosystem platform that includes other services such as loans for consumers and small and medium-sized businesses (SMBs), investment funds, and insurance.

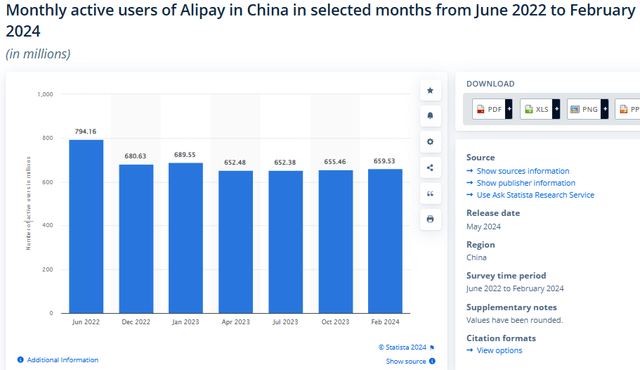

As such, Alipay is an opened door to other services, which implied the management of the data of its 711 million active monthly users (AMU) in 2020; nevertheless, according to the chart above, that number was actually declining, reaching only 652 million in April 2023. It seems that the AMU has already stabilized, as we can see that that number increased to 659 million in February 2024, which is positive news.

Most likely, the decline in Alipay’s AMU is a result of the regulations established in 2020. Now, if we see the chart above of the Ant’s ecosystem, we’ll notice that Alipay could open the door for other services such as CrediTech, InvestmentTech, and InsuranceTech. The CrediTech unit offered two products: Huabei, which allows users to get loans for daily expenses, and Jiebei, which enables users to get loans for larger consumption transactions. Also, this CrediTech unit served SMBs, offering different loan products according to their needs. In general, all these loans were flexible, unsecured with flexible terms and affordable rates with instantaneous drawdown.

The problem with the CrediTech unit was that 98% of the total credit balance was originated on Ant’s platform as loans underwritten by other financial institutions that worked as Ant’s partners. In this sense, these other financial institutions were under the supervision of the People’s Bank of China (PBOC), but Ant was not; so, that created an unbalanced situation since banks assumed most of the risks associated with the loans underwritten while Ant had all the incentives to deliver its platform services to these banks with the respective data without affording any of those risks.

For instance, if there was poor-quality data of individuals or SMBs provided by Ant, all these risks would be entirely afforded by the banks, not by Ant. Ant provided banks with a large database of potential borrowers who were not covered by those banks, so these data helped banks in making risk assessments of each individual or each SMB, for which banks paid Ant a fee as compensation for that service.

In regard to the InvestmentTech, I haven’t found material changes in that unit, but the name has changed to “Ant Fortune.” Nevertheless, the InsureTech unit might have experienced some changes since the crackdown in 2020 since we should remember that Ant was not subject to regulations, so the company had all the incentives to offer not-so-strict rules for insurance.

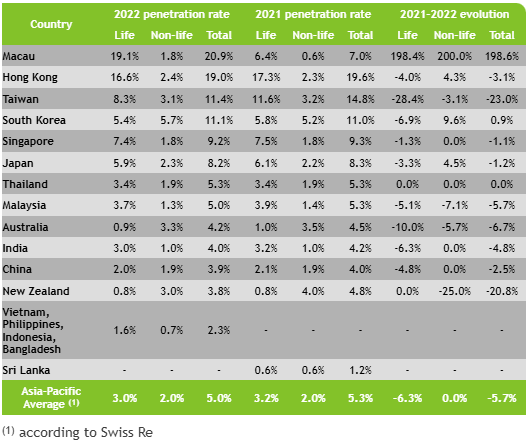

Swiss Re

The table above shows the penetration rate of insurance calculated as total premiums as percentage of GDP in China in 2021 and 2022 was 4% and 3.9%, respectively. I could not find more updated information about that metric, but it’s expected that the Chinese insurance industry grows 7.4% CAGR from 2023 to 2028, which means that the penetration rate is still low, giving Ant the opportunity to keep developing this business in the long term.

Also, I haven’t found information about the changes in the InsureTech Unit, but my guess is that as part of the regulations, it could have been implemented higher capital requirements to insure certain events for any individual. There are still factors to overcome in the insurance industry in China, such as high market concentration, lack of insurance product varieties, lack of sufficient depth and liquidity of asset markets, and lack of consumers’ risk awareness and insurance literacy.

Nevertheless, there is a lot of room for future growth in this Ant’s business unit given the low penetration rates in China, while the government is currently working to promote greater market openness, integrate technologies, and prioritize consumer protection.

Regulations to the lending business unit

There is no official information about how Ant is changing its business model, so I needed to take different pieces of information to complete the puzzle while inferring how these changes and regulations are impacting Ant’s business model.

Some months before the supposed IPO in November 2020, the fintech was required to set up a consumer finance unit, Chongqing Ant Consumer Finance Co. (CACF), which is already licensed to manage all the financial services offered under the former CrediTech unit that included loans to consumers. This new Ant’s subsidiary is allowed to lend to individuals, issue bonds, and borrow from domestic financial institutions.

CACF does not belong to Ant entirely, as it only has 50% of the ownership, as the prospectus of Ant’s IPO in 2020 on page 596 mentions:

The China Banking and Insurance Regulatory Commission granted an approval on September 14, 2020 to commence the preparation for the establishment of Chongqing Ant Consumer Finance Co., Ltd. By the end of September 2020, the amount of registered capital the Group subscribed to was RMB4 billion, accounting for 50% of its registered capital.

Even when it was not mentioned who was the owner of the remaining 50% of ownership, we should assume that it belongs to some state-owned institution. It seems that this new consumer unit does not include the Ant’s investment funds and insurance business units, but I expect that they will be subject to regulations associated with those industries.

I think that the purpose of the CACF’s creation was to allow the participation of the Chinese government through its state-owned companies within this important Ant’s unit. This is a common practice in the Chinese banking sector, in which the government has a stake in each of the most important banks in the country. I will mention later what Ant requires to be a financial entity.

It’s very clear that Ant Group as a fintech just disappeared in the 3-year regulation process, so it should have become more like a bank. For instance, the consumer unit, CACF, now would be required to allocate provisions for loan losses whenever a loan is offered like any other bank, which means that the margins have reduced substantially.

In addition, the regulators asked Ant Group to set up an independent credit score company through a joint venture with state-backed partners; this joint venture, called Qiantang Credit, is 35% owned by Ant and the rest is owned by state-owned financial institutions. With this company, Ant would have a third-party company delivering credit-scoring services.

Now, probably an investor would feel discouraged about the Ant’s growth prospects, but I would say that these changes are positive for the Ant’s long-term sustainability.

Ant Group requires a license for being a Financial Holding Company (FHC)

In the process to become a bank, Ant Group is required to hold a license for being a fully regulated company, which is a very important step to aspire to an IPO 2.0; in this sense, in June 2022, Ant’s application for being an FHC was accepted by China’s Central Bank.

Unfortunately, in June 2023, different news sources said that Ant would not get that license any time soon as China keeps restructuring its financial regulatory system. However, it’s clear that China is advancing gradually toward that aim, as on May 20, 2023, the National Administration of Financial Regulation (NAFR) was officially established to replace the former China Banking and Insurance Regulatory Commission (CBIRC) while taking over specific consumer/investor protection responsibilities from other regulators.

In my view, it’s a rather complex restructuring as we are talking about changes in the entire financial system, so it might take some time to end all these changes that would enable Ant to get a license for being FHC, which would be a tremendous advance toward an IPO 2.0.

In addition, it seems that in order to keep advancing in the process of getting the license, Ant needs to separate its non-core assets, such as its blockchain and database management services, as well as its international business, from its core financial operations in China. As a result, as of March 2024, Ant has already restructured its business, reorganizing three of its divisions, Ant International, OceanBase, and Ant Group Digital Technologies, having independent operations with separate boards each while implementing a CEO accountability system under the leadership of each board.

In July 2024, OceanBase, which develops the database technology for Alipay, was already spun off, giving 35 companies a stake, among them Alibaba. It seems like Ant is in the middle of all these tasks to aim for an eventual IPO.

Once getting the license for being an FHC, Ant would be closer to an IPO 2.0; this new scenario means that Ant would have a much lower percentage of loans provided by financial institutions using the Ant’s platforms as it was usual in 2020 while increasing substantially the loans offered by Ant directly through the CACF. I don’t have numbers yet, but, as I said before, it would be expected to see provisions for loan losses in the Ant’s income statement as in the case of any regular bank.

My perception is that Ant is working and advancing gradually toward that aim, so long-term investors might be handsomely rewarded if they are patient enough.

Some implications of the Ant’s regulations

Subject to a new credit score system under an independent company, Qiantang Credit, and with a new consumer finance unit, CACF, which would be, jointly with the investment funds and insurance businesses, an FHC sooner or later, where there is a participation of the Chinese government, Ant Group would have much higher supervision but, at the same time, a way more sustainable business model for the long haul.

Ant is offering financial products to unserved and underserved sectors such as SMBs and consumer segments, which need a higher penetration in China, so I would expect sustainable growth over the years supported by the aforementioned changes in the entire Chinese financial system. For instance, as per the National Bureau of Statistics, 99.8% of the businesses in China are SMBs; as such, it’s clear that these SMBs, which are not adequately served by traditional banks, will need more sources of financing for their operations.

As per UBS, the penetration ratio in private banking services in China was estimated to be only 31% in 2019, expecting this ratio to be 50% by 2025. However, given the different abrupt changes that took place from 2020 to 2023 in the Chinese financial system, that forecast might not be so accurate. I would say that 50% of penetration of private banking services might happen beyond 2025, as the forecast was made in early 2021 before the regulatory crackdown, but still, there is a lot of room for long-term growth in this sector.

Now, we know that, in 2024, China launched a very aggressive stimulus to boost Chinese consumption through a broader-than-expected package offering more funding and interest rate cuts. I know that it’s too early to say if those measures would turn out to have better-than-expected results in the Chinese economy, but I would say that China is making efforts to go in the right direction.

Thus, despite the growth potential in different sectors where Ant operates, we should expect Ant’s lower revenue growth and lower net margins in a hypothetical IPO 2.0 due to the inclusion of provision for loan losses and more capital requirements in the Ant’s income statements and balance sheet, respectively, compared to the Ant’s performance and financial metrics in 2020.

As a result, the market would assign lower multiples for Ant stock and a way lower market cap than that of 2020. However, regulations are created to make the financial system more resilient in scenarios with high uncertainty; thus, we see these regulations as something positive despite the abrupt changes that caused so much fear among investors. In this sense, we expect a more sustainable long-term growth not only for Ant but also for the Chinese financial system, as there are more conservative policies established by regulators.

Other signs that indicate that Ant’s IPO 2.0 is not ready yet but closer than before

In March 2023, Alibaba announced that it would split its business into 6 business units to make them public through IPOs. It was supposed that this Alibaba’s strategy would enable the market to unlock value in each of these business units, as each of those businesses would have its own CEO and board.

As soon as I read that information, I was sure that this strategy would be very positive for Alibaba, as all the CEOs in each business unit could be compensated with their respective stocks of their business units, so the incentives to outperform would have been triggered.

In addition, these new IPOs would trigger more confidence in the Chinese regulators to be closer for an eventual Ant’s IPO. However, in the next months of the announcement of the launch of those IPOs, in November 2023, Alibaba decided to suspend the Cloud Intelligence Group IPO, and then, in March 2024, Alibaba suspended the IPO of the Cainiao Smart Logistics unit.

In addition, Alibaba planned to launch an IPO of another subsidiary outside the 6 business units, Freshippo, but the IPO was also delayed. Apparently, these delays were more related to the fact that those businesses were not performing as expected, so their shares in an eventual IPO might have experienced a significant drop. Aside from all these events, the CEO Daniel Zhang announced his departure from Alibaba in June 2023.

All these events created high uncertainty for the market; maybe all this 3-year process of regulatory crackdown had an impact on the morale of most of Alibaba’s staff, who were not motivated enough to perform at their best as Alibaba’s performance was not as good as that of before the regulatory process in 2020. That’s why I was not surprised by the letter sent by Jack Ma to all Alibaba’s staff in April 2024 to remind them of the company’s core values.

However, Alibaba has a new CEO, Eddy Wu, supported by one of the Alibaba’s founders, Joe Tsai, who is beginning a new leadership with new energy considering the events that are happening now once the regulatory crackdowns of Alibaba and Ant Group are already finished, coupled with a very strong and recent government’s stimulus to boost consumption in China; therefore, I am more positive about an eventual Ant’s IPO 2.0 in the future.

I am not saying that this could happen in the short term, but I think that there are fewer obstacles ahead to that IPO. It’s imperative that Ant achieves to get the license for being an FHC and that Alibaba achieves to launch the IPOs of its 6 business units, or at least some of them. Both events could help Ant gain the regulators’ confidence, more like an inertia to finally announce Ant’s IPO 2.0, which might substantially boost Alibaba’s stock.

Ant Group’s valuation and its contribution to Alibaba’s intrinsic value

The first step that I’ll take is to find an approximation of Alibaba’s intrinsic value, and then I’ll add the Ant’s valuation to see how it impacts Alibaba’s valuation to know how strong might be a catalyst driven by the Ant’s IPO.

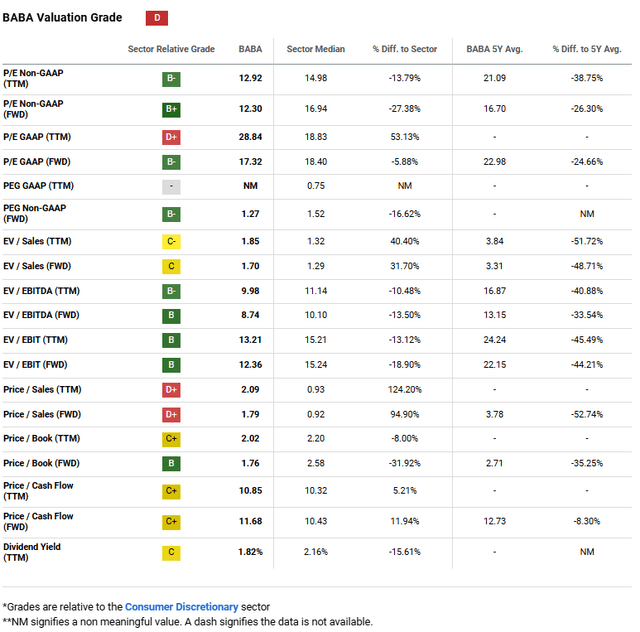

Exploring the different valuation metrics, it seems that Alibaba is not cheap given the valuation grade “D,” though there are some metrics that indicate that it’s cheaper than its peers:

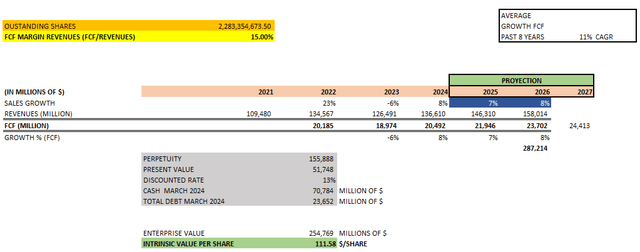

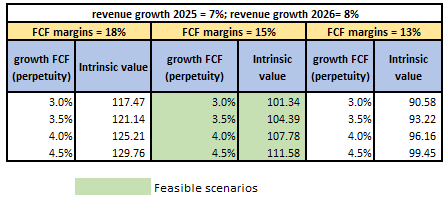

As such, I’ll use the DCF to incorporate some assumptions that would enable us more flexibility. I’ve made the following assumptions for a base case scenario:

- Revenue growth annual projections for 2025 and 2026: 7% and 8%, respectively, according to consensus.

- Outstanding shares (ADRs): 2,253,354,673.

- Free Cash Flow (FCF) margins: 15% Before the regulatory crackdown, the FCF margins were higher than 26% each year.

- Discount rate of 13%

- Cash on hand: $70.7 billion as of March 2024 (including short-term investment).

- Total debt: $23.6 billion as of March 2024.

- FCF growth in perpetuity: 4.5% CAGR (11% CAGR average in the past 8 years)

- Buy & hold strategy, long-term orientation, holding the stock for more than 5 years.

To find the perpetuity, we used the formula:

Perpetuity = FCF 2027/(discounted rate – g), where g = FCF growth in perpetuity, which was assumed to be 4.5% annual, which is very conservative as that growth was 11% CAGR in the last 8 years. In addition, I am not even considering how “g” would be potentially impacted by the recent Chinese stimulus that aims to boost consumption.

With perpetuity, we calculate the present value of all the FCFs beyond 2026. Then, we calculate the enterprise value using the following:

Enterprise Value = Present Value of FCF (from 2025 to 2026) + Perpetuity + Cash – Total Debt.

Finally, the intrinsic value is calculated by taking the enterprise value and dividing it by the outstanding number of shares (ADRs). Taking very conservative assumptions without considering the possible effects in the long term of the recent stimulus package, I got an intrinsic value of $111.58 per share.

Now, I wanted to make a sensitive analysis changing two assumptions: i) the FCF margins, and ii) the “g,” or FCF growth in perpetuity.

Author

As such, keeping our very conservative revenue growth projections for 2025 and 2026 constant, we can see in the table above how the intrinsic value changes as we change the FCF growth in perpetuity from 3% to 4.5% while assuming FCF margins of 15%, in other words, the green shaded area. If Alibaba keeps developing new businesses that enable it to increase those FCF margins from 15% to 18%, the intrinsic value would increase in a range between $117.47 and $129.76 per share.

In this article, I am not incorporating long-term drivers for Alibaba such as AI developments, the Chinese stimulus’ package, or the impact of the eventual IPOs of Alibaba’s 6 business units; conversely, I am taking a very conservative approach for Alibaba’s intrinsic value since I want to show that even in that scenario, the price is not expensive.

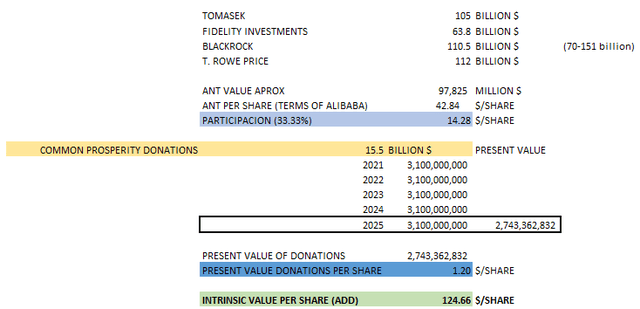

Now, I want to include Ant’s valuation in Alibaba’s intrinsic value in order to see what the potential upside is if Ant’s market value is included once an IPO takes place. There are some institutions that were launching their estimates of Ant Group’s intrinsic value, considering the changes in its operations due to the Chinese crackdown. In January 2023, Fidelity assumed a valuation close to $64 billion, while BlackRock is way more bullish, estimating $151 billion of valuation as of April 2022, and T. Rowe Price estimates $112 billion as of May 2022.

In December 2023, a global investment fund, Temasek, wanted to divest its entire position in Ant Group as an investor with a 7.6% stake after 3 years holding those shares. The transaction between Temasek and Ant Group implied a valuation of $105 billion. So, I took the average of all those valuations:

As such, according to that information, Ant is worth, on average, $97.8 billion currently, which means that Ant’s valuation in terms of Alibaba shares is worth $14.28 per BABA share considering the Alibaba stake of 33.33% in Ant.

We need to consider that I am assuming that Alibaba owns a 33.33% stake in Ant Group, but that stake is higher as Ant started a $6 billion repurchase program in July 2023 where Alibaba did not want to participate, which means that the Alibaba stake actually increased. Nevertheless, for simplicity, I will assume that the 33.33% stake has not changed.

In addition, I add the last installment to be paid for the common prosperity policy, in which Alibaba was demanded by the government to invest $15.5 billion in five installments since 2021.

Thus, we can find the final Alibaba’s intrinsic value having incorporated the Ant’s valuation:

Intrinsic value per share (with Ant’s valuation) = intrinsic value per share (without Ant’s valuation) + Ant’s valuation per share – last installment common prosperity per share.

In the end, we get a total intrinsic value of $124.6 per share, having incorporated Ant Group’s valuation; however, I would say that this intrinsic value could be boosted way higher than $124.6; for instance, if Alibaba pushed its FCF margins from 15% to 18%, under the leadership of new management, that move could boost the total intrinsic value to $142.8 per share. Before the regulatory crackdown in 2020, Alibaba was able to generate more than 26% of FCF margins in previous years.

Another scenario that might boost the intrinsic value is if Alibaba pushed its FCF growth in perpetuity to 7% through the development of more successful services, more AI developments, and more efficiencies achieved by the new management, the total intrinsic value would reach $153 per share, keeping the other variables constant. Remember that Alibaba was able to grow its FCF by 11% CAGR in the last 8 years.

In addition, I wrote an article in April 2024 about a potential valuation of Alibaba if the company launched the IPOs of the 6 business units using the sum of the parts (SOTP) method, finding an intrinsic value of $174 per share including Ant’s valuation.

As such, I would say that there is limited downside in Alibaba stock but a lot to expect under different scenarios, so the risk-reward ratio seems very interesting for long-term investors.

Risks

I think that the main risk of the thesis is that Ant’s IPO 2.0 is delayed by some factors that are not considered in the article, such as more geopolitical risks than expected in the future or some tasks to get the Ant’s license for being an FHC that might be harder to solve than expected.

However, I think that there is a serious desire from regulators, Alibaba, and Ant Group to achieve that goal. Some people think that the government is not interested in an eventual IPO 2.0, or even worse, they think that the Chinese government does not want Ant Group to succeed; nevertheless, Chinese regulators have approved in January 2023 a raise of capital for Ant Group, particularly for its consumer finance unit CACF, of RMB 10.5 billion, considering that in the prospectus for the IPO in 2020, Ant already had a registered capital of RMB 4 billion.

On the other hand, another step taken by regulations in 2023 that is helping advance the ongoing process for a potential next Ant’s IPO is that the indirect control of Jack Ma over Ant has been reduced from 50% to only 6%. This change assuaged regulators and the Chinese government, as Jack Ma had very important control over a critical company like Ant that was growing without any supervision and competing with the most important state-owned banks that are the foundation of the Chinese economy.

Another event that makes me feel comfortable is the fact that Alibaba itself sees its stake in Ant as a future catalyst for an IPO, opting not to participate in Ant’s $6 billion repurchase program in July 2023 as Alibaba considers Ant an important strategic partner. As a result, Alibaba has a higher stake than 33.3% in Ant Group.

Final Thoughts

As you’ve seen in the article, I showed several steps taken by Ant Group to finally achieve an IPO 2.0. If Ant or Alibaba were sure that this IPO is impossible, neither of them would have used energy and time to keep working on different tasks demanded by regulators for this endeavor.

I think that most investors are overlooking this long-term catalyst, as most analysts are focusing their efforts on assessing drivers that are easier to assess since there is clear information about them; however, there is not much information about the Ant’s progress and the changes in its business model with detail as a result of the regulatory crackdown in the last 3 years.

In this article, I’ve made the effort to connect the dots to see how this potential catalyst is evolving, and I would say that I am very hopeful that sooner or later, that IPO will take place, which, in the end, would turn out to be a very important catalyst for long-term Alibaba investors.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.