Summary:

- Affirm’s provides buy-now-pay-later services, appealing to younger consumers seeking flexible payment options.

- The company has shown significant growth potential, driven by strategic partnerships with major retailers and expanding consumer adoption with the largest GMV per customer among its competitors.

- Affirm is well positioned to grow in an underpenetrated BNPL market.

- Affirm’s operating metrics indicate strong revenue growth, and profitability with management committed to breaking even in Q4-FY2025.

B4LLS

Affirm (NASDAQ:AFRM), one of Buy Now Pay Later (BNPL) stalwarts and market leaders, had dropped to $38-$42 in the past 2 weeks, as the 10-year treasury yield rose from 3.75% to 4.07% before shooting up a huge 12% yesterday to $47 after Wells Fargo upgraded it to Overweight from Equal-weight. While still expensive as a start-up loss-making company, there have been enough improvements in cash flow and adjusted operating margins to buy the company at this price. I have accumulated between $39 and $41 in the past week and will continue to buy on declines. Affirm is still a decent bargain with a 30% revenue growth forecast for FY2025 and a 3-year revenue CAGR of 25% through FY2027 from Seeking Alpha consensus analyst estimates. Even at $47, and a market cap of $15Bn the P/S ratio is just 4.9, fairly reasonable given the 30% revenue growth in FY2025. The P/S to Growth ratio is just 0.2, which is low for a fast grower.

The BNPL and overall Fintech space is fairly crowded, with few discernible differences between competitors, such as PayPal (PYPL), Klarna, and AfterPay, owned by Block (SQ). This often prevents a single competitor from gaining large competitive advantages. Critically, it’s the strategic partnerships deals they strike and the inroads they make with e-commerce players or retailers that take them a cut above the competition.

Shopify (SHOP) owns 9.3% of Affirm and gives Affirm the competitive advantage of being offered as Shopify’s default BNPL option. Shopify’s massive reach and scale helped another strategic partner, Klaviyo (KVYO), of which it owns 15%, turn in a strong performance in 2023-2024 and a share price gain of 28% Year to date.

Affirm is up 134% in the past year but down 4% year to date and 10% lower than its all-time high of $52. I believe it is a good opportunity to buy now for investors with a long-term 3–5-year perspective.

Let’s take a deeper dive…

Affirm’s operating metrics and financials

Affirm Operating Metrics (Affirm, Seeking Alpha, Fountainhead)

As we can see from the table above, several metrics have improved in the last three financial years. The keys to its success are:

A) Their take rate – Revenue as % of GMV improved to 8.7% from 7.9% last year.

B) The average transaction per customer also increased from 3.9 to 4.9, a 26% increase on top of a 30% increase in FY 2023. This is an excellent metric because there is no additional customer acquisition cost for the extra transaction revenue – they’re retaining their customers and getting each one to spend more, ultimately increasing margins.

C) They also increased customers by 14% in FY2024, on top of a fairly large increase of 18% in FY2023.

D) Gross Merchandise Volume per customer or GMV increased from $1,109 to $1,227 in FY2023 and increased by a further 16% in FY2024 to $1,421. This is a very productive example of Affirm’s strong grip on its customers and the loyalty and stickiness of its brand. This is a very impressive statistic from a competitive measure also, close competitor Klarna had an estimated GMV per customer of only $513, and AfterPay an even paltrier $474. This is a very impressive difference of almost 3x.

E)) Affirm debit card transactions quadrupled from 2% of total GMV to 8% in FY2024. For Affirm and its competitors, the best way to grow and retain clients is to offer all services – all methods of payments, especially as BNPL has a smaller share of brick-and-mortar stores as compared to Online stores. Getting its Affirm card to grow is crucial to increasing market share in this segment.

F)) Client concentration – The top 5 clients accounted for 47% of GMV in FY2024, increasing from 42% in FY2023 and from 32% in FY2022. This is again another strength. The best way to improve your reach, keep operating costs down, and increase your bottom line is by scaling with massive retail operations, and Affirm getting 20% of its revenues through Amazon (AMZN) is a huge positive. Besides Amazon, and Shopify, Walmart (WMT), Target (TGT)and DICK’S Sporting Goods (DKS) are also large Affirm merchants.

Affirm Financial Forecast (Seeking Alpha, Affirm, Fountainhead)

The positives of the operating metrics are reflected in the improving financials above.

Increasing GMV, higher GMV per customer, more customers, and more transactions per customer led to Affirm growing its top line by a whopping 46% in FY2024. And operating margins improved by a huge 47 points from negative 73% to negative 26%. For the first time, Affirm had positive adjusted operating profits of $381Mn, a full 380% growth over the previous year. Building on this high base, management has guided to a 45% increase in adjusted operating profits of $554Mn and forecasted breakeven on a GAAP basis in Q4-FY2025 and staying positive thereafter. Given its outstanding performance in FY2024 and strong operating metrics, I believe that estimates of 30% revenue growth and 3-year revenue growth of 25% are reasonable and probably conservative, given that its partnership with Apple has just begun.

Operating Cash Flow generation was also excellent at $450Mn in FY2024 or 19% of revenue, a huge improvement over the previous year’s 1%.

Dilution has reduced to just 5% increases each year in the last 2 years from a high of 77% in FY2022.

Stock-based compensation was lower by a huge amount from $451Mn in 2023 to $344Mn in 2024.

Strengths

The choice of a new generation (with apologies to Pepsi)

BNPL Users (eMarketer)

The Trend is their friend: BNPL is a heavy favorite with the new generation. Millennials and Gen Z, the two segments that should continue to power the economy as Baby boomers age are the biggest users of BNPL – a combined 60%. This augurs really well for the industry in the future and given the ease of use with mobile payments such as the iPhone, I see BNPL continuing to increase its market share of customers’ wallets and Affirm, one of its leading players also benefiting strongly.

The customer-friendly lender

Affirm doesn’t gouge the borrower, it doesn’t charge late fees, or deferred interest to its customers, which is a big product differentiator in a very cutthroat and competitive environment.

Embedded with the big platforms

The Shopify and Amazon strategic partnerships are key catalysts to Affirm’s growth and having two huge platforms is a big positive along with a big bite of Apple. With Apple integrating Affirm directly into Apple Pay BNPL, this penetration will only increase, especially as BNPL starts getting popular in brick-and-mortar stores. Apple exited from the BNPL business in Q2-2024, a decision that will only benefit Affirm and other FinTechs. In recognition of the rising allure and competitiveness of BNPL, Apple announced at its June developer’s conference that financial intermediaries and banks could offer these plans to their customers via Apple Pay and Apple Wallet. Affirm would be directly integrated into Apple Wallet, enabling Apple customers to open an Affirm account seamlessly. While management has downplayed this for FY2025, it could be a nice kicker for a business already growing at 25%.

Underpenetrated growing market

I believe BNPL is an underpenetrated market in the US. As we can see below, even in its key demographic of ages 18-34, only 18% use it regularly, with just 21% having used it before but not regularly. This demographic, which uses BNPL more than any other is still under-penetrated with 61% not having used it — leaving ample room for growth for the 25% who are interested in using it. The numbers are even larger for the next generation ages 35-54 with 67% having never used it before but 21% showing interest in using it.

I also believe that one of the key reasons for the under-penetration is the lower usage of BNPL in brick-and-mortar stores – 74% of in-store payments are card payments, but with increased usage of the Affirm card and integration with iPhone, this is likely to increase.

BNPL Demographics (e-marketer)

The overall BNPL market size is estimated to be $95Bn in GMV in 2023 and is expected to grow at a CAGR of 9.5% to $172Bn by 2029.

Weaknesses and challenges

To be sure all other stalwarts are offering the same, every competitor has to offer all the features to not fall behind, that is critical and Affirm for its part is doing an excellent job increasing revenues in all possible ways.

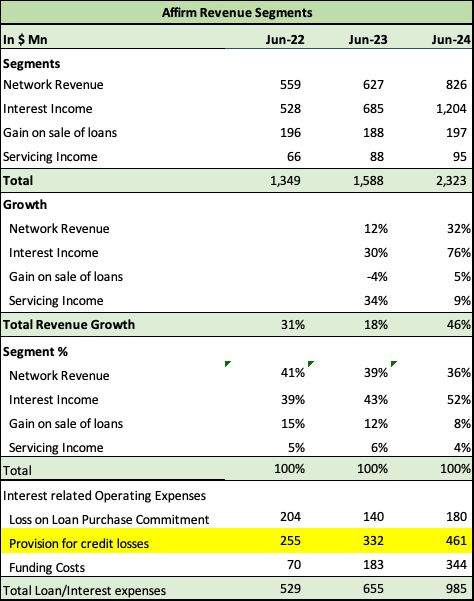

Over the last few years, Affirm’s largest income stream has been interest income and as we saw from the table above, FY2023 saw only 18% revenue growth in a high interest rate environment, which cut into customers’ wallets. As such, while interest income comes with excellent margins and high growth a weaker economic environment with high interest rates doesn’t help Affirm. The Fee-based income is significantly lower as we see below.

Affirm Revenue Segments (Affirm, Fountainhead)

Also with interest income the exposure to credit losses becomes wider as Affirm does keep a portion of outstanding customer loans on its books and provides for the same. While the size of the loan is not high given a transaction value of only 1.4K per customer, it is a risk and challenge for Affirm to stay on top of.

Interest rates and the strength of the consumer are now crucial to its success, adding an element of cyclicality to its business, which could hurt it in two ways. While Interest-bearing installments are growing the fastest and have the highest GMV share, Affirm is increasingly dealing with longer maturity revenues, which of course constitutes a steady, sustainable revenue stream, it does increase its risk profile, especially if loan losses increase. If this continues and as the business matures, a cyclical business will give it a lower multiple than a fee-based recurring revenue business, i.e. multiples could come down to that of lending companies and banks, mitigated with an added layer of protection being that the size of the loan is limited to smaller purchases.

Affirm is a buy on declines

I own Affirm and will continue to add it on declines. This is a great company to buy on declines for the following reasons:

- The forward P/S multiple is reasonable at 4.9 with a revenue growth of 30% and a 3-year revenue CAGR of 25%. The P/S to growth ratio is just 0.2.

- Affirm has guided to growing adjusted operating profits by 45% to a record $554Mn in 2025, an excellent margin of 18%.

- It has also guided to GAAP break-even in Q4-FY2025 and positive GAAP earnings after that.

- The strong strategic partnerships with Amazon, Shopify, and now Apple ensure continued secular growth in an underpenetrated market.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AFRM, SHOP, KVYO, PYPL, APPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.