Summary:

- So far the AI growth story has centered around data centers, with AMD being perceived as a peripheral winner in the shadow of Nvidia.

- In fact, following AMD’s ‘Advancing AI’ event where AMD demonstrated new chips, the stock fell by 4% as the market remains wary of the company’s ability to seriously challenge Nvidia.

- However, as the AI revolution evolves from data centers to edge device computing, AMD finally has an opportunity to come out of Nvidia’s shadow.

- We discuss AMD’s growth opportunities in the context of AI PC market trends and growth rate projections, as well as the company’s competitive positioning to capitalize on these market dynamics.

- AMD stock still remains attractively valued with a ‘buy’ rating.

David Becker

So far the AI growth story around Advanced Micro Devices (NASDAQ:AMD) has centered around its ability to catch up to Nvidia (NVDA) in the data center server GPU space. In fact, following AMD’s ‘Advancing AI’ event recently where AMD demonstrated new data center products, the stock actually fell by 4% as the market remains wary of the company’s ability to seriously challenge Nvidia.

Although the previous article on AMD offered a reality check on the dynamics of data centers’ chips demand based on how the AI revolution is playing out, and how the current state of affairs is creating opportunities for AMD to gain market share from Nvidia.

Now while data centers have been the initial AI-enablers, the story has recently been evolving towards the next AI-enablers, which are the edge computing devices such as smartphones and laptops. The release of Apple Intelligence this month, and the launch of Microsoft’s AI PCs, including its re-architected Windows 11 operating system for AI workloads, has inevitably spurred investor debate around the prospects of hardware upgrade cycles.

AMD’s opportunity around AI PCs is what we will be delving into in this article.

The AI PC revolution

Global technology market research firm, Canalys, projects a high-growth rate for AI PC sales over the coming years.

In 2028, the firm expects vendors to ship 205M AI-capable PCs, representing a compound annual growth rate of 44% between 2024 and 2028.

This expected growth rate falls roughly in line with projections from the International Data Corporation (IDC), which anticipates “a CAGR of 42.1% from 2023 to 2028” for the AI PC market.

A new market segment with an expected 40%+ CAGR certainly presents a lucrative new revenue growth opportunity for the leading PC chip vendors like AMD, Intel (INTC), Qualcomm (QCOM) and Nvidia.

While the focus in the data center market has been on the replacement of Central Processing Units (CPUs) with Graphics Processing Units (GPUs), the focus in the edge computing market has been on System on Chips (SoCs), which are a combination of CPUs, GPUs and Neural Processing Units (NPUs) working together on smartphones and laptops.

NPUs are also commonly referred to as “AI accelerators”, as they are only purposed for processing AI workloads, while CPUs and GPUs are designed to process a broader range of workloads as well. Over the past few years there has been growing industry-wide consensus that solely relying on GPUs for on-device processing can be detrimental to hardware performance and battery life, necessitating the need for a conjunct NPU for optimal AI-centric experiences.

So when you here about projections for AI PC sales from the likes of IDC or Canalys, they are only referring to PCs with NPUs, they do not include non-NPU PCs that rely on GPUs for AI processing.

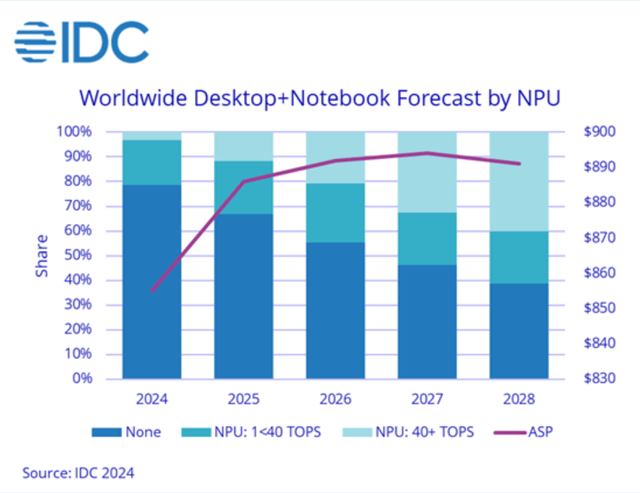

According to IDC, only around 20% of total PC sales are expected to be NPU-powered in 2024, but this is projected to increase to over 60% by 2028 as AI PCs become more affordable over time, starting from the $850-$860 range.

International Data Corporation

While some PCs and workstations with powerful GPUs have the capability to run AI workloads, IDC has excluded these non-NPU systems from the AI PC category for taxonomical clarity. – IDC

For context, TOPS stands for “Trillions of Operations Per Second” and is simply a metric measuring the computational performance of NPUs. The higher the TOPS, the greater the chip’s ability to process complex AI workloads efficiently. The IDC classifies AI PCs as per TOPS performance ranges.

Hardware-enabled AI PCs include an NPU that offers <40 tera operations per second (TOPS) performance and typically enables specific AI features within apps to run locally…

Next-generation AI PCs include an NPU with 40–60 TOPS performance and an AI-first operating system (OS) that enables persistent and pervasive AI capabilities in the OS and apps…

Advanced AI PCs are PCs that offer >60 TOPS of NPU performance… This IDC forecast does not include advanced AI PCs, but they will be incorporated into future updates.

While shipments of hardware-enabled AI PCs will ramp up quickly over the next two years, next-generation AI PCs are forecast to dominate the market by the end of the forecast. IDC believes shipments of Next-generation AI PCs will be double that of hardware-enabled AI PCs by 2027.

– IDC (emphasis as per original source)

If this projection actually materializes, whereby the demand for higher-performance AI PCs outpaces the demand for lower-performance devices, it would be great news for AMD, which currently holds a lead over competitors when it comes to NPU TOPS performance.

Moreover, AMD’s Ryzen AI 300 series that launched a few months ago boasted NPU performance of 50 TOPS, outperforming the 48 TOPS of Intel’s NPU as part of its Lunar Lake AI PC chip, and the 45 TOPS of Qualcomm’s Hexagon NPU. Further building upon this lead, on October 10th AMD introduced the next generation of its AI PC chip “Ryzen AI PRO 300 Series”, which can deliver NPU TOPS as high as 55, thereby widening the lead over its rivals. So relative to competition, AMD is currently better positioned to serve high-performance computation needs.

Furthermore, the greater projected demand for high-performance AI PCs with 40-60 NPU TOPS going forward means higher Average Selling Prices [ASPs] for PC vendors like Dell Technologies (DELL), Hewlett Packard (HPQ), Acer and Lenovo, which subsequently translates to stronger pricing power for chip suppliers like AMD and Intel.

In the short term, Canalys expects a 10% to 15% price premium on AI-capable PCs versus PCs without NPU integration…

By the end of 2025, over half of PCs worth $800 and above will be AI-capable, with the share increasing to over 80% by 2028. PC shipments in this price range will increase to form over half the market in four years

So AMD’s revenue growth opportunity here is not just driven by a PC replacement cycle over the coming years, but is also expected to be complemented by higher ASPs.

Risks to the bull case for AMD

Now while these growth projections from leading market intelligence and data providers paint an optimistic picture for the AI PC market going forward, it is important to acknowledge that they are simply estimates after all. For these expectations to actually materialize, the industry would need to overcome key hurdles.

Perhaps the biggest obstacle that could hinder AI PC adoption by enterprises and consumers is the lack of compelling, generative AI-powered software applications that would encourage people to upgrade their hardware devices for optimally running new, AI-centric apps.

applications ultimately drive the success of tech cycles, and we have yet to identify AI’s “killer application”, akin to the Enterprise Resource Planning (ERP) software that was the killer application of the late 1990s compute cycle, the search and e-commerce applications of the 2000-10 tech cycle…The AI cycle is still very much in the infrastructure buildout phase, so finding the killer application will take more time, but I believe we’ll get there

– Kash Rangan, Senior Equity Research Analysts at Goldman Sachs

Until we actually get the “killer application” for the AI era, AI PC adoption could be slow and underwhelming.

Furthermore, there have been reports of companies experimenting with generative AI to assess whether it is worth the heavy investment and replace their traditional technology with. The new technology is not always the optimal solution for various IT tasks and processes.

for three years Mr. Cooper [the name of a mortgage servicing company] has been using nongenerative AI to spot whether information, such as a signature, stamp or notary date, is missing from a given document. The company has also tested whether generative AI might have solved the problem more effectively—and found that it couldn’t.

…

Generative AI is great for generating content, but of less compelling value for things like demand forecasting, anomaly detection, predictive maintenance and churn prediction, according to Sameer Maskey, founder and chief executive of enterprise AI company Fusemachines. – The Wall Street Journal

This is not to imply that generative AI will never prove valuable, as simultaneously there are also examples like fintech Klarna successfully deploying generative AI to boost productivity. But actual materialization of projections from IDC and Canalys, predicting that high-performance AI PCs will witness substantial demand growth over the coming years, could be difficult without worthwhile “killer software applications” arising.

Moreover, even once meaningful software apps arrive, gaining trust from end-users and deployers could take time. For example, AI agents that promise to complete multi-step tasks and processes on behalf of users are likely to require high-performance AI PCs, but these agents are not going to be perfect on arrival, and will likely require numerous iterations before wide-scale adoption becomes reality. As a result, the continuous iterations on the software side may slow down the pace at which AI PCs are deployed over the coming years, undermining the revenue growth rates AMD could deliver to shareholders.

In fact, in spite of the launch of AI PCs this year, it has barely moved the needle on PC market growth so far.

The worldwide traditional PC market is expected to remain flat in 2024, with shipments reaching 260.2 million units, despite economic improvements and a new category of PCs with onboard neural processing units (NPU) colloquially dubbed AI PCs – IDC

In fact, on the Q2 2024 AMD earnings call, CEO Lisa Su seemed to acknowledge the slow start to the AI PC wave, while striving to offer an optimistic outlook ahead (emphasis added):

Our view of this is the AI PC is an important add to the overall PC category. So overall, I’d say, the PC market is a good revenue growth opportunity for us. As we go into the second half of the year, I think we have better seasonality in general, and we think we can do, let us call it above-typical seasonality, given the strength of our product launches and when we are launching. And then into 2025, you’re going to see AI PCs across sort of a larger set of price points which will also open up more opportunities.

Lisa Su’s “add to the overall PC category” remark suggests that AI PCs are currently not as revolutionary to the PC market as previously hoped. The implication here seems to be that not everyone will necessarily need AI PCs at the moment, and that traditional PCs could continue to remain in demand for day-to-day computing tasks for now.

On a brighter note, however, her comments about “larger set of price points” suggest AMD will introduce simpler, less expensive chips for running AI workloads on PCs, to make them more accessible and broaden the total addressable market. Corroborating this with IDC’s projection that AI PCs will start from a price range of $850-$860 in a few years’ time, capturing the lower-end of the market would certainly be a welcome, additional source of revenue growth for AMD.

However, competition is indeed tight. While AMD currently holds the lead in NPU TOPS performance, rivals like Intel and Qualcomm are not too far behind, and in fact could find greater success than AMD at selling to the lower price range of the market.

Furthermore, it is very important to remember that the projections from market data providers like IDC and Canalys only consider PCs with NPUs as “AI PCs”, and their sales projections exclude computers that rely on GPUs for AI processing.

As a result, the growth estimates for the AI PC market often exclude computers powered by Nvidia’s RTX systems, wherein AI workloads are primarily processed by GPUs, and do not include any NPUs. Nvidia’s approach indeed stands in contrast to the industry-wide consensus that NPUs are essential for running complex AI processes. Time will tell which approach will prove superior in terms of delivering optimum price-performance for end-users.

Every PC with RTX is an AI PC. RTX PCs can deliver up to 1,300 AI tops and there are now over 200 RTX AI laptops designs from leading PC manufacturers.

With 600 AI-powered applications and games and an installed base of 100 million devices, RTX is set to revolutionize consumer experiences with generative AI. – CEO Jensen Huang, Nvidia Q2 2024 earnings call (emphasis added)

The key point to note is that Nvidia should certainly not be overlooked as a formidable rival to AMD in the AI PC market just because it is excluded from NPU-based market projections.

The investment case for AMD stock

Now despite the underwhelming start to the AI PC race, AMD still delivered notable growth last quarter amid the broader PC market recovery, and the company also offered upbeat Q3 guidance for its Client segment, which makes chips for desktops and notebooks.

CFO Jean Hu

Client segment revenue was $1.5 billion, up 49% year-over-year and 9% sequentially driven primarily by AMD Ryzen processor sales. Client segment operating income was $89 million or 6% of revenue compared to operating loss of $69 million a year ago.

…

CEO Lisa Su

We are launching Zen 5 desktops and notebooks with volume ramping in the third quarter. And that’s the primary reason that we see above-seasonal [growth]. The AI PC element is certainly 1 element of that, but there is just the overall refresh. Usually, desktop launches going into a third quarter are good for us, and we feel that the products are very well positioned.

Nonetheless, the AI PC growth story has yet to play out over the coming years, and the Client segment currently only makes up about 26% of total revenue for the company. Though this revenue contribution is likely to grow as the AI PC wave slowly gains traction.

As for now, the Data Center segment remains in the driver’s seat, constituting 49% of the company’s total revenue last quarter.

AMD stock fell by 4% following its ‘Advancing AI’ event where it demonstrated its latest data center GPU for AI workloads, “Instinct MI325x”, as well as new EPYC CPUs.

At the Advancing AI event, AMD reiterated its commitment to the GPU roadmap, which includes MI325X in 2024, MI350 in the second half of 2025, and MI400 in 2026.

However, the product revelation and roadmap failed to convince the market that AMD can aggressively challenge Nvidia’s leadership position.

Analysts said investors may have been looking for clearer signs of competition with AI investor darling Nvidia, an outlook boost, or a new customer announcement.

That being said, regardless of the fact that AMD’s accelerators are not as powerful as Nvidia’s GPUs, AMD’s chips have proven sufficiently potent for major inferencing workloads like Microsoft running first-party Copilot workloads on MI300X chips, as well as other enterprises running Meta Platforms’ (META) increasingly popular Llama models on AMD’s chips. Moreover, in the previous article we discussed the current dynamics and trends of the generative AI wave, and the fact that not all forms of workloads necessarily require Nvidia’s ultra-powerful chips, subsequently enabling AMD to carve out a slice of market share for itself.

Now in terms of AMD’s valuation, the stock currently trades at over 50x forward earnings, seemingly expensive and well above its 5yr Forward PE average of around 43x.

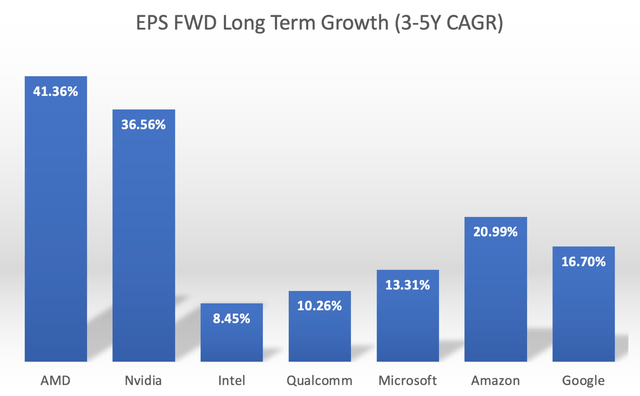

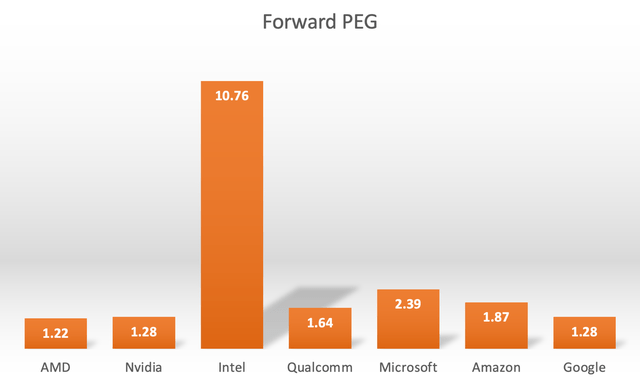

However, Forward PE multiples do not factor in the pace of expected earnings growth going forward. Hence, the Forward Price-Earnings-Growth (Forward PEG) ratio tends to be a more comprehensive valuation metric, as it adjusts the Forward PE by the anticipated EPS growth rate.

Nexus Research, data compiled from Seeking Alpha

Relative to the key semiconductor competitors and the major cloud provider stocks, AMD currently has the highest projected EPS growth rate at 41.36%. Although it is worth noting that this expected growth rate is a mark-down from the 44% projection just a few months ago, reflecting the market’s slightly diminishing expectations for AMD to take market share in the data center segment, while the AI PC wave has yet to prove its viability.

Nevertheless, when we adjust each stock’s Forward PE multiple by their anticipated EPS growth rates to derive the Forward PEG ratios, it reveals just how attractively AMD is valued relative to other key AI players.

Nexus Research, data compiled from Seeking Alpha

For context, a Forward PEG of 1x would implicate that a stock is trading around its fair value, and out of the stocks listed above, AMD trades closest to its fair value, and is the cheapest out of the lot.

So while there is indeed the risk of the expected EPS growth rate further declining, buying the stock at such an inexpensive Forward PEG multiple of 1.22x subdues the risk of paying too much for future earnings.

At the current valuation, AMD stock remains a ‘buy’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.