Summary:

- Morgan Stanley’s diversified revenue streams and innovative ecosystem have led to a 34% stock return since July 2023, outperforming the S&P 500.

- Strong 2Q24 earnings with a 50% increase in diluted EPS and 50% revenue growth in Institutional Securities highlight the company’s robust financial health.

- Wealth Management continues to grow, with client assets reaching $7.2 trillion and a 5% annualized growth in net new assets year-to-date.

- With a 3.4% dividend yield, a 55% payout ratio, and a $20 billion buyback program, Morgan Stanley remains a compelling investment.

Maria_Ermolova

Introduction

I regret not giving Morgan Stanley (NYSE:MS) stock a Buy rating when I wrote my most recent article on the company. On July 3, 2023, I went with the title “Morgan Stanley: The Better Financial Dividend Stock,” when I explained that:

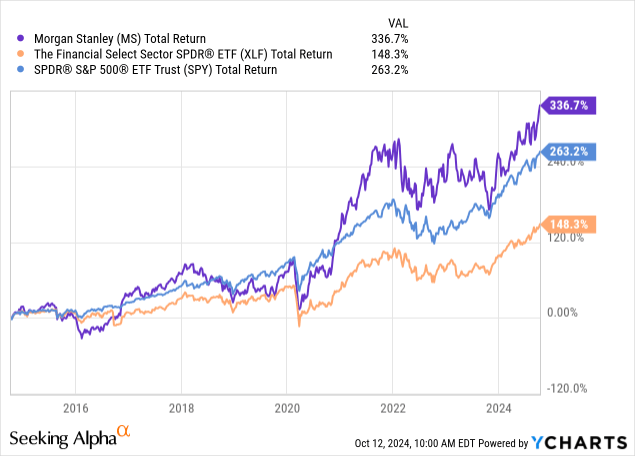

MS is less prone to economic downturns due to its diversified revenue streams. With a history dating back to 1924, the investment banking powerhouse has consistently outperformed the Financials Select Sector SPDR ETF, which underlines its ability to thrive in various market conditions.

Moreover:

A big part of MS’s success is its innovative ecosystem that integrates multiple channels and capabilities, enabling efficient coordination of processes and leveraging advanced machine learning tools.

Since that article, shares have returned 34%, beating the S&P 500’s impressive 31% return by roughly 300 basis points. Over the past ten years, the New York-based investment bank has returned close to 340%, more than twice the return of the Financial Select Sector SPDR ETF (XLF).

After more than a year, it’s time for me to update my thesis. The fact that MS reports earnings on October 17 is a perfect opportunity to assess the risk/reward.

So, let’s get right to it!

A Quick Look Back & A Very Juicy Dividend

Given its impressive stock price performance, the company must be doing something right.

What’s interesting is that most gains of the past ten years happened after the pandemic, when cheap money and new business opportunities fueled the investment banking industry. The same applies to private equity and related areas.

Then, the stock went sideways for roughly two years before resuming its uptrend, supported by a dovish Fed, looser financial conditions, and upbeat stock market sentiment.

It also helps that the company’s earnings were good.

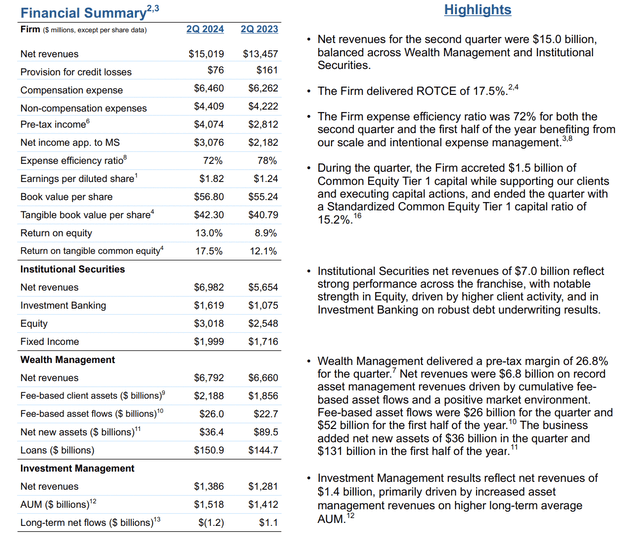

In 2Q24, the company reported $1.82 in diluted EPS. That was up almost 50% compared to the 2Q23 result of $1.24. The return on tangible common equity rose from 12.1% to 17.5%, which reflects a very healthy operating ratio. It also lowered its expense efficiency ratio to 72%, indicating a much more favorable relationship between interest expenses and revenues.

Moreover, digging a bit deeper, we find that the company’s Institutional Securities division reported 50% year-over-year revenue growth. This was supported by a 70% growth rate in fixed-income underwriting.

Additionally:

- The Institutional Equity performance was also strong, as the company achieved $3 billion in revenue in this segment.

- Investment banking revenues rose by 51% to $1.6 billion due to capital market improvements and strong client engagement in sectors like healthcare, technology, and financials.

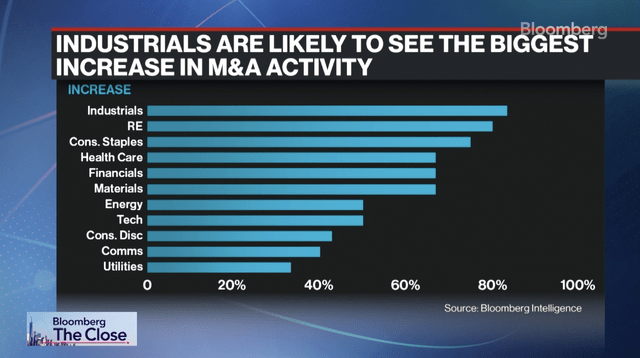

- M&A advisory revenues came in slightly above $590 million, supported by the comeback of M&A.

Speaking of M&A, which is a major source of revenue for investment banks, Goldman Sachs (GS) recently said it sees broadening M&A demand in an interview with Bloomberg. Goldman also expects private equity to be a major player, as it sits on roughly $1 trillion of dry powder. This money is increasingly pressured to be deployed. When adding leverage, the bank sees up to $4 trillion in M&A demand from PE firms. As I have extensively researched these companies in recent months, I agree with that assessment.

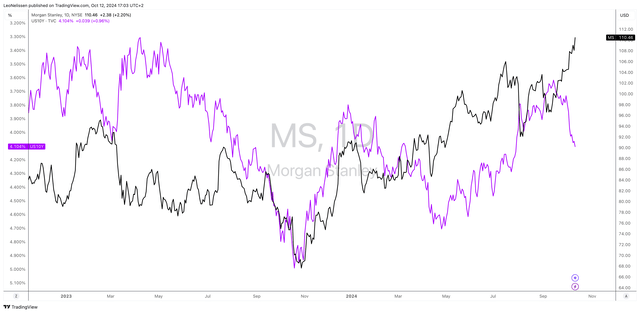

Moreover, it helps that interest rates have come down. The chart below compares the MS stock price to the (inverted!) yield on the U.S. 10-year bond (purple). When the longer end of the yield curve comes down, it becomes much more attractive for companies to take on debt.

TradingView (MS, U.S. 10Y Yield)

With that said, the company’s Wealth Management business also continues its impressive growth, with client assets reaching $7.2 trillion in the second quarter, as it benefits from real assets and secular growth – similar to private equity funds.

In Wealth Management, we continue to focus on aggregating assets and delivering strong advice. In Investment Management, we are investing in secular growth areas, including customization and real assets. Year-to-date, annualized growth in net new assets and Wealth Management is over 5%, with another strong quarter of over $25 billion in fee-based flows. – MS 2Q24 Earnings Call

Moreover, the company has a Common Equity Tier 1 ratio of 15.2%. During the second quarter alone, it built $1.5 billion of capital, which is great news for its dividend.

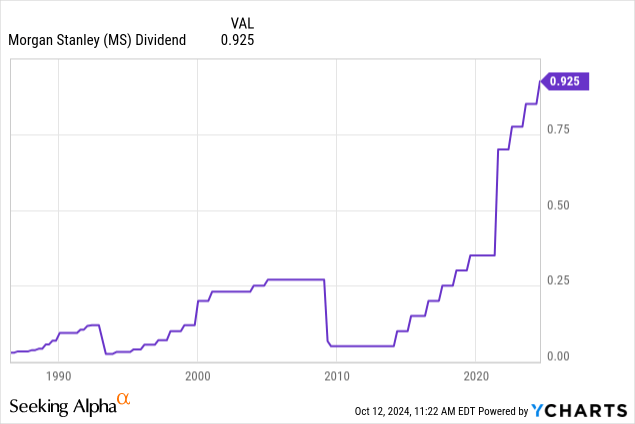

Currently, MS yields 3.4%. This dividend comes with a 55% payout ratio and a five-year CAGR of 23%!

Its most recent hike was 8.8%, announced on June 28. Back then, the company also announced that its Board (re)authorized its $20 billion buyback program, 11% of its market cap.

The Future Remains Bright

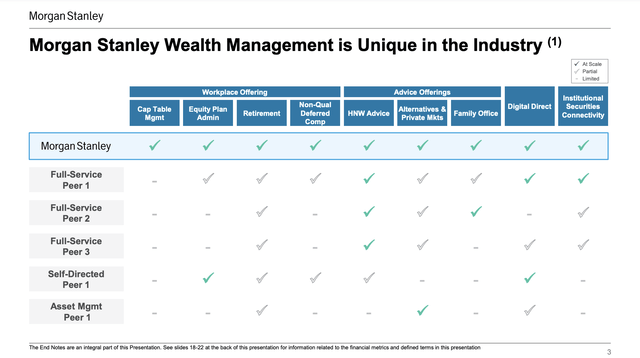

During last month’s Barclays Global Financial Services conference, Morgan Stanley elaborated on its strategy and advantages. One of them is the fact that it is the number one player in its industry, supported by the fact that it does not diversify into unrelated businesses.

Its footprint in the advisory business allows it to operate more effectively, including close cooperation between Wealth Management and Institutional Securities, two areas that did really well in 2Q24, as we just briefly discussed.

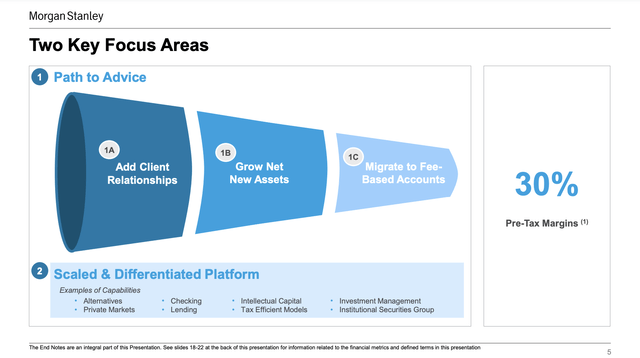

A big driver of growth is the company’s workplace focus. These efforts enjoy the tailwinds from Morgan Stanley’s strong relationships with corporations, which caused 8x growth in the household count it serves.

The first one is the workplace. So the workplace has been the primary driver in taking our U.S. wealth management household count from 2.5 million to 19 million households. And that access point that we have is really unique. Again, the only other firm that has scaled access into the workplace does not have, one, financial advisers and, two, they don’t have corporate CEO advisory relationships. So if you think about the workplace as being the funnel to all those households, it’s at a corporation. These are corporations that our investment banking division has relationships with. – MS at Barclays Global Financial Services Conference

As we can see below, these relationships are the first part of the funnel the company uses to eventually grow its business to 30% pre-tax margins.

Another huge benefit is its global scale in both private and public markets.

During the aforementioned conference, the company discussed its ability to partner with asset managers on a global scale, especially in areas like private equity and private credit.

Its deep relationships with sovereign wealth funds, asset managers, and private credit managers allow it to offer advanced product developments and deal flow capabilities that others just cannot compete with.

In a world where private and public markets are booming, that’s a huge benefit.

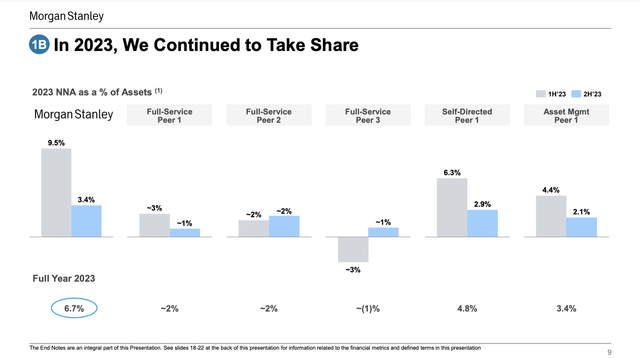

As we can see below, in 2023, it took significant market share, beating all of its peers in the first and second half of the year.

Moreover, these improvements were made during challenging times, as the company noted that its clients see uncertainty from the upcoming elections, economic volatility, and central bank interest rate decisions that impact every aspect of their business.

Despite these headwinds, the investment banking revenues in the first half of this year were up 30%, which bodes well for the next few quarters if sentiment improves. In general, the company believes that as interest rate cuts continue, private equity monetization will accelerate in the coming years.

Looking ahead, the company expects growth to come from three key areas:

- In investment banking, the company expects to capture more market share by investing in talent and lending.

- In wealth management, the aforementioned workplace strategy and ability to deliver financial advice on a large scale are expected to provide significant growth opportunities.

- The company’s global markets and asset management businesses are expected to benefit from increased demand for multi-asset class solutions, private equity, and private credit.

Furthermore, according to Morgan Stanley, over the next 8-10 years, the total investable assets in the U.S. are expected to grow from $60 trillion to more than $100 trillion. The number of high net-worth households (with more than $1 million) is expected to double.

When Morgan Stanley reports its earnings, I am looking for comments on all of these growth trends. If the company sees a stronger-than-expected recovery in sentiment, I believe we could see much higher growth in the future.

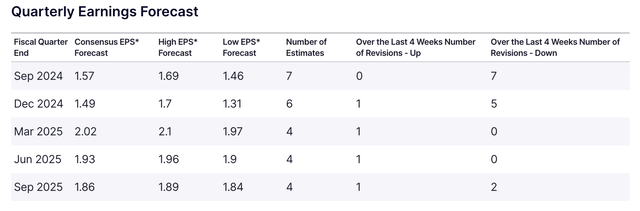

With regard to earnings, over the past four weeks, all seven analyst estimates have been downgraded, which lowers the bar. Currently, the market expects MS to report $1.57 in EPS, 14% above the 3Q23 result.

In general, analysts have adjusted their S&P 500 3Q24 earnings expectations, which explains why giants like Morgan Stanley are expected to see slower growth as well.

Strategists are predicting that companies in the S&P 500 Index will post their weakest results in the past four quarters, with just a 4.3% increase in third-quarter profits compared with a year ago, Bloomberg Intelligence data show. In mid-June, projections were for an 8.4% rise, and in the second quarter growth soared to 14%. – Bloomberg

Valuation

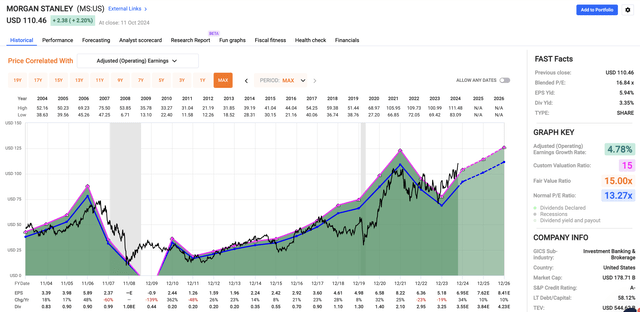

Using the FactSet data in the chart below, we see that analysts agree with the company’s rosy comments. This year, EPS is expected to rise by 34%, potentially followed by 10% growth in both 2025 and 2026.

Needless to say, these numbers are subject to economic developments. However, if the Fed is able to achieve a “no landing,” I expect the actual growth rates to be substantially higher.

Applying a 15x multiple to these numbers gives the stock a total return outlook of roughly 10%.

Since 2003, the stock has returned 5.3% per year. That return is so low because of the massive impact of the Great Financial Crisis. For many financial institutions, that crisis ruined the total return picture.

It is also one of the reasons why I am very careful when it comes to cyclical corporations.

Having said all of this, I believe Morgan Stanley has room to run. The business looks solid and dividends should play a major role in the company’s total return.

Takeaway

Morgan Stanley has proven itself as a very resilient and innovative financial powerhouse, outperforming its peers and the S&P 500.

Looking back, I regret not issuing a Buy rating last year, especially given the stock’s 34% rally since then.

With strong fundamentals, including impressive growth in key segments like Wealth Management and Institutional Securities, and a juicy 3.4% dividend yield, Morgan Stanley remains in a great spot for future success.

As we go into the company’s upcoming 3Q24 earnings report, I’m optimistic about its ability to capture more market share and look forward to its comments regarding the health of its industry. As I care about the “big picture,” I expect the earnings call to be a fantastic source of intel.

Pros & Cons

Pros:

- Diversified Revenue Streams: Morgan Stanley’s ability to generate income in investment banking, wealth management, and institutional securities makes it less vulnerable to economic downturns.

- Strong Dividend Growth: With a 3.4% yield, a healthy 55% payout ratio, and aggressive buybacks, investors are in an increasingly good spot when it comes to distributions.

- M&A Boom: With private equity sitting on trillions in dry powder, MS will likely benefit from increased M&A activity and capital market improvements.

Cons:

- Cyclical Exposure: Despite its diversification, MS remains very prone to economic downturns. A slowdown in financial markets could hurt its revenue and stock price.

- Interest Rate Sensitivity: While falling rates benefit M&A and lending, unexpected rate hikes could do the opposite.

- Heavy Market Competition: Despite being a leader, Morgan Stanley faces fierce competition from other financial giants like Goldman Sachs.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.