Summary:

- Tesla’s robot event was a disappointment, lacking crucial details on robotaxi launch timelines and regulatory approvals.

- The event showcased impressive products like the Cybercab and Robovan but failed to provide confidence in the launch timing or path to regulatory approvals.

- Tesla risks falling behind competitors like Waymo, with the robotaxi concept delayed to 2026 and no clear market-leading service.

- Investors should move to the sidelines due to the lack of short-term catalysts and strong questions on Tesla’s ability to meet future targets.

AdrianHancu

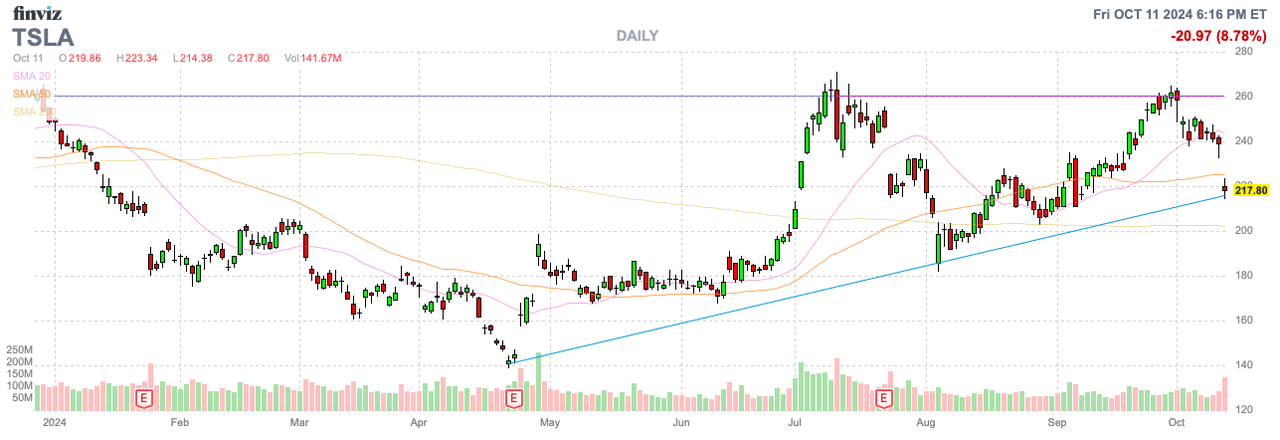

Tesla (NASDAQ:TSLA) (NEOE:TSLA:CA) has suddenly turned into a show-me story, with the EV manufacturer again failing to deliver on big expectations. The company held a big robot event last week with limited details on launch timing while presenting a global audience with impressive products. My investment thesis is more Neutral with the limited short-term opportunity and worries Tesla may watch the opportunity slip away with any more robotaxi delays.

Event Flop

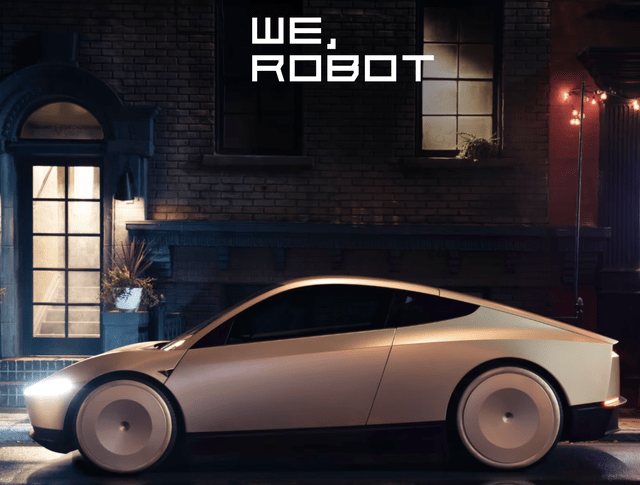

The big “We, Robot” event ended up being nothing more than a demo of robotaxi and robot prototypes. The event was held on a controlled Warner Bros. studio lot, providing a limited test of the more intricate technology capabilities of unsupervised FSD.

The stock market wanted to hear more details on the robotaxi launch timelines and regulatory roadblocks. All CEO Elon Musk provided the market was limited details on the potential launch of existing Tesla 3 and Y models in California and Texas in 2025 followed by the Cybercab in 2026. Musk even greatly reduced the confidence in the $30K vehicle without a steering wheel and pedals with the follow-up statement “by 2027”.

The product demos were impressive. The Cybercab was sleek and well received, and the Robovan was futuristic with a capacity for 20 passengers. Tesla mostly skimmed over the Optimus humanoid robots, with the focus geared towards attendees taking a robotaxi ride around the big studio lot.

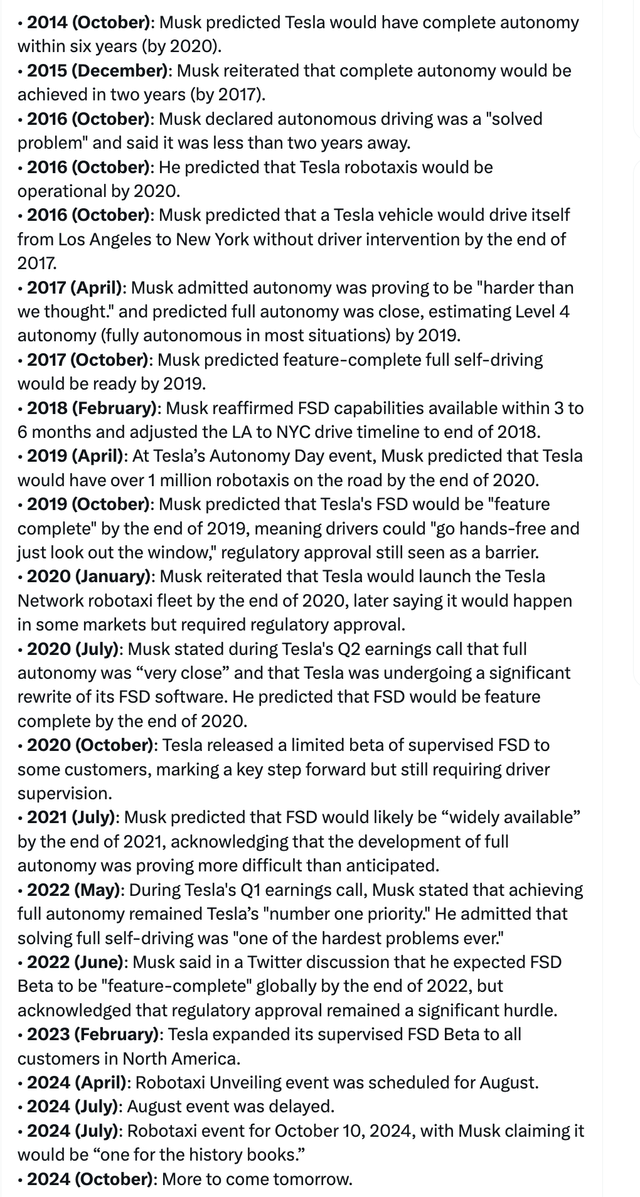

What Musk left investors with is limited details, other than likely hollow predictions. The market really needed very specific details about regulatory testing considering Deepwater Asset Management detailed this long list of robotaxi promises going back a decade as follows:

Even worse, the holy grail robotaxi promise is the ability to turn on existing vehicles, providing Tesla with a ready-made large fleet of robotaxis. Musk provided indications the launch focus was limited to cities in existing states with robotaxi service.

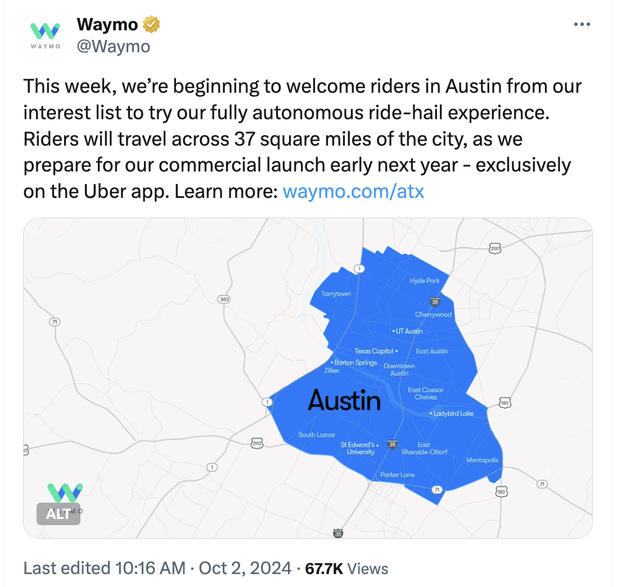

In essence, Tesla appears headed into the same cities with perfect weather as Waymo, owned by Google (GOOG, GOOGL). The robotaxi service already offers autonomous rides in San Francisco, Los Angeles, Phoenix and is launching service in Atlanta and Austin.

If Tesla is only replicating the geo-fenced service of Waymo, the company will be far behind by next year. The big robotaxi promise was limited restrictions, allowing 7+ million existing Tesla vehicles to launch service with an FSD software update only.

Tesla would leapfrog existing services and quickly become the global leader. All the company provided were the products with the potential to lead, but the timing is still very uncertain with zero details to provide any confidence of an actual timeline.

Massive Opportunity Still Exists

The massive opportunity is to turn a vehicle into a recurring revenue stream, making a $30K Cybercab or a $40K+ model S/Y into a vehicle producing up to $1 million in lifetime revenue and around $100K annually. The key is to change the car value from a one-time purchase driven 100K to 200K miles to an asset reaching 1 million miles and charging passengers $1 per mile.

Ridesharing services currently charge $2+ per mile, with the driver accounting for the majority of the costs. The holy grail of a robotaxi service is stripping out the drivers’ cost in addition to increasing miles per vehicle due to the current attachment of 1 driver to 1 vehicle.

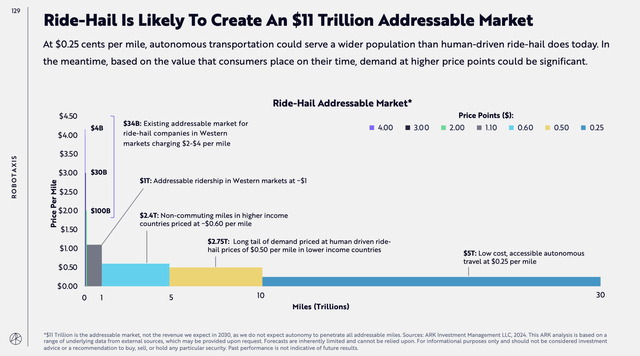

Source: ARK Invest Big Ideas 2024 presentation

The robotaxi market potentially becomes a $1+ trillion market opportunity, reducing the cost to $1 per mile. Ultimately, the size of the market grows as costs reduce closer to current cost of vehicle ownership.

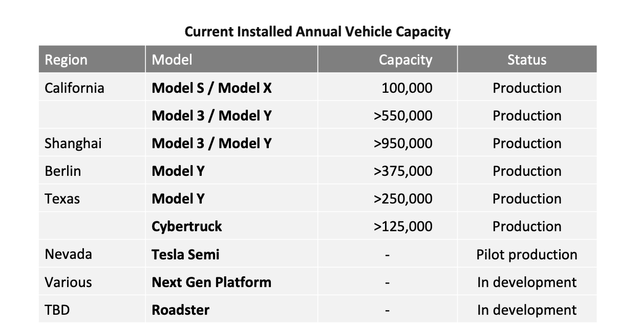

Tesla only has spare capacity in 2025 for up to 1 million vehicles, beyond current EV demand at nearly 2 million vehicles. Even if the company makes an affordable $30K Cybercab version, Tesla would still have to tie up $30 billion in capital to build 1 million cars and launch them on the robotaxi service.

Source: Tesla Q2’24 shareholder letter

The EV company ended Q2 with a cash balance of $23 billion. One has to wonder how much Tesla would want to take on debt to build the robotaxi business.

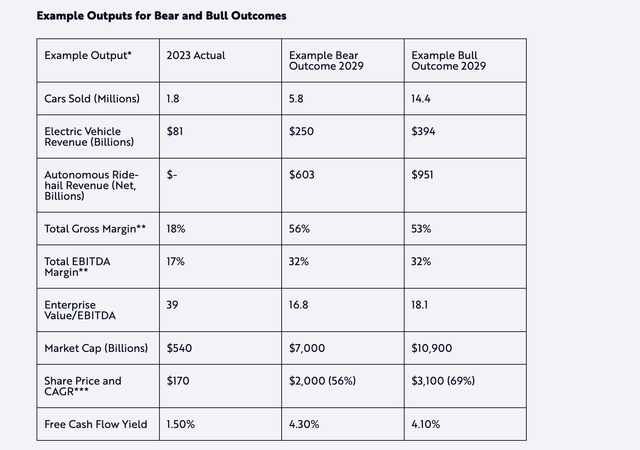

ARK Invest (ARKK) placed a bullish view on Tesla based on only a 58% chance the robotaxi service commercialization starts in 2025. The odds of a start in 2026 were 38%.

The Cathie Wood firm estimates a Tesla robotaxi take rate of up to 80%, which doesn’t appear logical with other firms owning and maintaining a fleet on the Tesla network. Tesla has suggested a cost to operate a robotaxi fleet in the $0.25/mile range with a fee of $1/mile providing a very high margin, but the company would have to own the vehicles for this full margin.

Such vehicle dynamics would have very quick paybacks, letting Tesla accrue all the profits by owning the robotaxis. Over the short term, the company benefits from shifting as many existing vehicles offering robotaxi service to fend off competition, but over the long term, Tesla would benefit more from vehicle ownership.

The ARK Invest investment thesis clearly grabs a nearly $11 trillion valuation in 2029 based on a split business plan. The autonomous revenues in 2029 far exceed the revenues for selling EVs to the public by nearly 3x, and the higher gross margins make the business far more valuable than the tough auto sales business.

Source: ARK Invest presentation

In reality, Tesla only needs 1 million owned robotaxis reaching the $100K annual revenue target to reach the $100 billion revenue threshold. The consensus analyst estimates are for 2024 revenues of just $100 billion.

The big question and worry is whether the $1/mile target is achievable. If the average passenger drives 15/K miles annually, one probably doesn’t spend $15K on auto-expenses annually. The customer would have to replace a $1K+ monthly car payment, or expensive parking fees, for the robotaxi service to be economical to consumers.

In essence, the market dynamics now suggest a consumer would far better off just owning the $30K Cybercab and utilize self-driving technology. Unfortunately, Tesla hasn’t provided a lot of financial details on how the service will ultimate run, other than suggesting any Tesla robotaxi will have to use their network and revenues will be split.

Tesla has some impressive product concepts. The biggest risk to the story is the constant robotaxi delays to where Waymo, along with Uber Technologies. (UBER), is already offering the planned service for the next few years. Tesla might lack the ability to collect higher margin revenues without a market leading service.

Due to the lack of short-term catalysts, the stock has been downgraded to Neutral. As Tesla lets the robotaxi concept slip into 2026, the company will be vastly trailing the market and Elon Musk has given no confidence in the launch timing, or the path to regulatory approvals.

The stock trades at 6x 2025 revenue targets and nearly 70x 2025 EPS targets, with strong questions on whether Tesla actually hits these targets. The major robotaxi concept has been delayed too far to guarantee the future massive trillion dollar opportunity is actually a catalyst anymore.

Takeaway

The key investor takeaway is that the Tesla robot event was a major flop, in my opinion. Musk needed to come to the event with major details on the timing of the robotaxi service launch, and the lack of details suggests Tesla is actually falling far behind a market already offering autonomous rides.

Investors should move to the sidelines for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market to start October, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial to started finding the best stocks with potential to double and triple in the next few years.