Summary:

- Advanced Micro Devices, Inc.’s new AI accelerator, the Instinct MI325X, launching in Q1 ’25, aims to compete directly with Nvidia’s Blackwell GPU, potentially boosting AMD’s market share.

- Nvidia’s Blackwell GPU is already sold out, creating an opportunity for AMD to capitalize on the supply shortage and enhance its pricing power.

- AMD’s Data Center business surged by 115% Y/Y in Q2, and with new high-priced AI GPUs coming to market, AMD is poised for significant revenue growth and gross margin expansion.

- The chip company has a strong AI GPU pipeline, and FY 2025 could be a break-out year for AMD.

- AMD’s valuation is attractive compared to Nvidia, with the potential for substantial market cap growth and EPS upside, driven by strong AI accelerator demand.

BlackJack3D

Advanced Micro Devices, Inc.’s (NASDAQ:AMD) AI event last week indicated that the company is going all-in on the Data Center AI GPU opportunity. AMD announced a new AI accelerator, set to launch in Q1 ’25, that is meant to directly challenge Nvidia’s (NVDA) Blackwell GPU chip. Nvidia faces a massive catalyst moment in the fourth quarter, which is when the chipmaker is set to release its much-anticipated Blackwell GPU, its latest Data Center chip. Ironically, Blackwell’s GPU being sold out already (as per reports) could boost sales for AMD’s own AI accelerator, while any shortages are set to benefit AMD and Nvidia’s GPU pricing. In my opinion, AMD is set to see a significant gross margin up-lift in the upcoming quarters, and the company is also on the brink of growing its market share in the AI GPU market.

Previous rating

In my last work on the semiconductor company — “The AI Boom Is Just Getting Started For AMD” — I said that AMD was set to see a major acceleration of its revenues in the Data Center segment. AMD recently launched its AI chips — marketed under the MI300X brand — which are seeing rapid customer up-take. This has begun to fuel the company’s Data Center growth in Q2. With a new-gen AI accelerator coming to market in Q1 ’25, I believe AMD is set to see a massive gross margin expansion as well and the company has a much improved earnings picture as well. The fact that Blackwell GPUs are sold out for next year suggests that AMD could hit the ground running in Q1 and make massive inroads in the Data Center GPU market.

AMD set to benefit from Blackwell GPU shortage

On its AI Day last week, AMD announced its newest AI accelerator, the Instinct MI325X, which is set to go toe-to-toe with Nvidia’s Blackwell GPU. As we were informed last week, Nvidia said that its Blackwell GPU supply is already sold out for the next twelve months, which should benefit sales of AMD’s MI325X Data Center chip.

Further, AMD announced the Instinct MI350 series accelerators, based on AMD CDNA 4 architecture, which are going to hit the shelves in the second half of FY 2025. This series of AI accelerators is expected, according to AMD, to deliver a “35x improvement in inference performance compared to AMD CDNA 3,” therefore making the chip attractive to buy for hyper-scalers.

The MI325X AI accelerator is set to ship in the first-quarter of FY 2025 which would give AMD a powerful catalyst for its Data Center business. The MI325 chip “delivers up to 40% more inference performance” compared to Nvidia’s H200 Data Center chip, which is used for Meta Platforms’ (META) Llama 3.1 large language model (“LLM”).

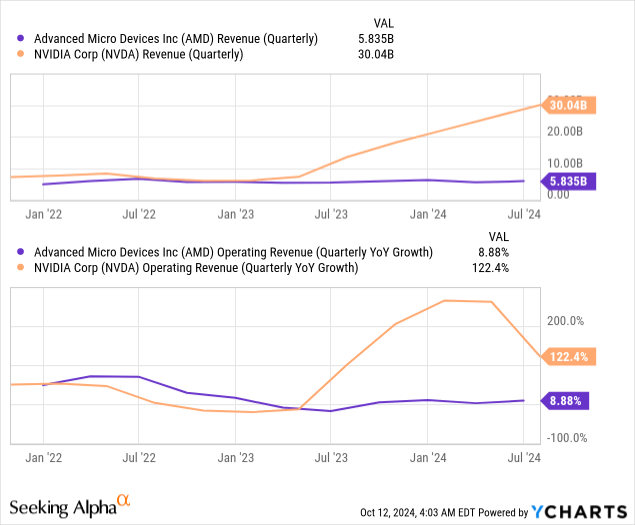

To recap, in the second-quarter, AMD’s Data Center revenues surged 115% year-over-year and AMD came closer to matching Nvidia’s top-line performance in its Data Center segment: Nvidia’s Data Center revenues grew 154% year-over-year in the August quarter (the last quarter for which financials have been released).

The launch of new high-priced AI GPUs is set to benefit AMD more than Nvidia, in my opinion. This is because AMD is still less dependent on the Data Center business as a whole, allowing for more upside through a growing percentage of Data Center revenue. In the last quarter, Nvidia generated 122% Y/Y consolidated top-line growth compared to AMD’s 9% Y/Y growth and Nvidia achieved 88% of its FQ2 ’25 revenue in Data Centers compared to just 49% for AMD in Q2 ’24.

Obviously, the launch of the MI325 chip is more than just a catalyst event for AMD’s top line. AMD has a unique opportunity here to see a significant gross margin up-lift in the coming quarters as higher margin GPUs come to market and can be expected to be met with high demand. Large tech companies so far don’t seem to be slowing their spending on AI infrastructure. The fact that Blackwell supply is already severely limited for the next year indicates that AMD’s next-gen AI chip could have a strong start.

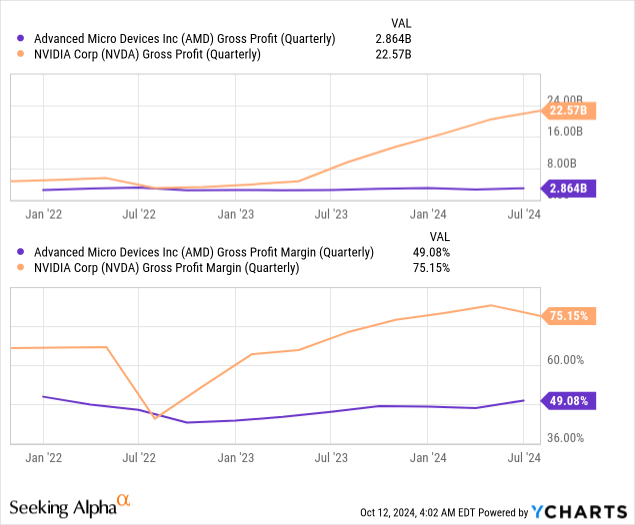

AMD’s gross margins are significantly lower than Nvidia’s currently, but as more revenues shift to high-price Data Center GPUs, AMD is not only going to see a revenue surge, but also a positive change in its gross margin profile. With AI chips for Data Centers costing $30,000 or more, I believe that AMD could grow its gross margins to the mid-50% range fairly quickly (up from 49% in the last quarter).

In the longer term, I would expect AMD’s gross margins to climb to the mid-to-high 60%-range. The MI325X chip, in my opinion, could realize market prices around $30,000-35,000 per-unit, and potentially more depending on how severe the Blackwell shortage will be. While AMD has stronger potential for gross margin growth (given its lower revenues in the Data Center segment), Nvidia remains obviously the top dog in the Data Center market. I wrote about this in “Nvidia Q2: Why I Am Not Giving Up A Single Share (Rating Upgrade).”

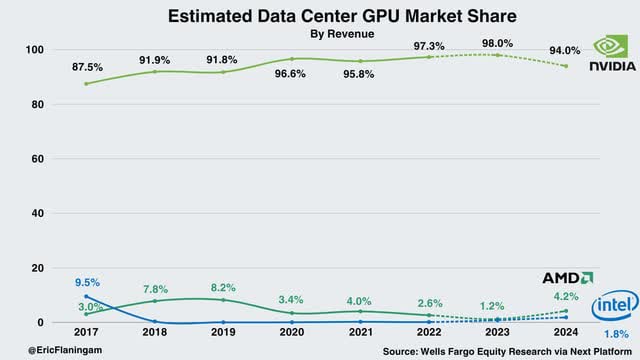

As a result, AMD also has a unique opportunity to grow its market share in an industry that is still very much dominated by Nvidia. The chipmaker had a market share of 94% in the Data Center GPU market in 2024, with AMD trailing far behind at 4% (although market share percentages differ depending on source). Intel (INTC) is lagging even further, but the company recently launched its own Gaudi 3-branded AI accelerator to compete with Nvidia and AMD. The MI325X and the MI350 series are the two best chances that AMD has had in years to take some market share away from Nvidia.

Wells Fargo, Eric Flaningam

AMD’s valuation

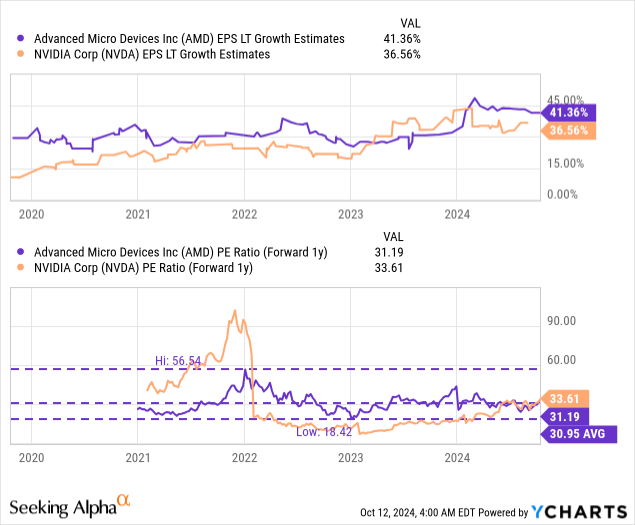

AMD is trading at about the same valuation level as Nvidia — in terms of next year’s forward P/E. However, both companies have serious catalyst events ahead which relate, as discussed, to the almost simultaneous launch of next-gen AI GPUs: Nvidia’s Blackwell is set to launch in the fourth-quarter while AMD’s Instinct MI325X is set to be available in Q1 ’25. Both companies have therefore significant revenue, free cash flow and margin upside… which should be reflected in incremental gains in valuation.

While I also own Nvidia, I have over-weighted AMD in the last several months. This is in part because I feel that the revenue growth curve in the Data Center segment is only starting for AMD, and the company has significant FCF upside. With AMD now also being able to launch a direct Blackwell rival fairly shortly after Nvidia’s own chip launch — which uniquely sets up AMD to benefit from a Blackwell GPU shortage — I believe AMD has very significant gross margin upside as well.

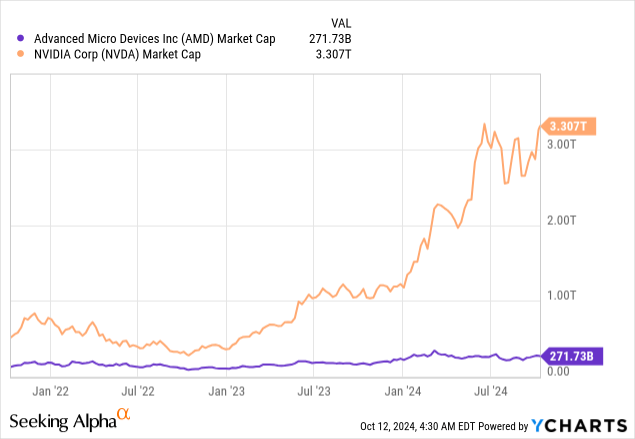

Further, AMD has a much lower market capitalization than Nvidia, indicating, at least theoretically, better odds of doubling or tripling its market cap in the upcoming years. AMD currently has about one-twelfth the market valuation of Nvidia.

Shares of AMD are currently trading at a forward P/E ratio of 31.2X, which compares against a valuation ratio of 33.6X for Nvidia. Both companies are expected to generate similarly strong long term EPS growth rates: analysts expect Nvidia to grow its earnings 41% annually, compared to AMD’s 37% growth rate.

In my last work on AMD, I calculated a fair value of up to $200 per-share, based off a fair value P/E ratio of 36X. After the AI event last week, I believe AMD is set for an even bigger break-out year in FY 2025, which is directly tied to the company’s improving AI GPU product line-up.

I believe AMD could see 50% revenue growth next year due to the launch of both the MI325X and MI350 series AI accelerators. This is because they are set to come to market at a time of what appears to be a severe Data Center GPU shortage. This should fundamentally boost AMD’s pricing power and support AMD’s revenue acceleration. Therefore, I believe the market widely underestimates the company’s revenue and earnings potential for next year. I believe AMD could earn ~$6-7 per-share (rather than a consensus estimate of $5.38) in FY 2025 on strong AI accelerator demand and growing pricing strength, which implies a fair value between $216 and $252 per-share.

Risks with AMD

The biggest risk for AMD is a weak reception in the market of its Blackwell rival chip, the MI325X. If the market does not perceive the chip to be a reasonably fair competitor to Nvidia’s Blackwell GPU, sales may disappoint and pricing may not be as strong as expected, which could weigh on gross margins. However, the odds of this are low, in my opinion, as multiple companies (like Microsoft and Oracle) have already partnered with AMD to get their hands on much-need GPU supply. What would change my mind about AMD is if the company were to see weak gross margin improvements and disappointing top-line growth related to Data Center sales.

Final thoughts

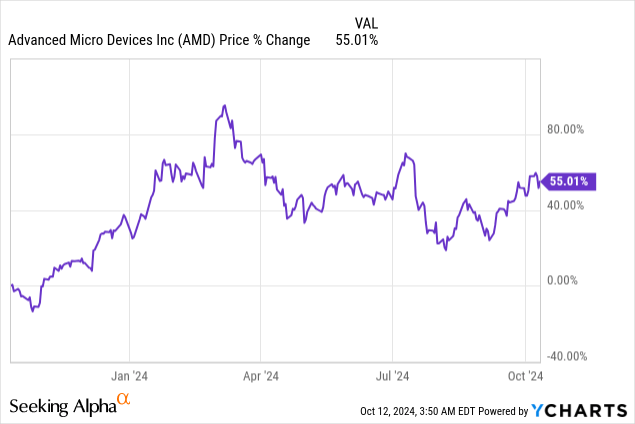

The market did not react overly enthusiastic to AMD’s new AI chip release and its AI event in general (which I used to add a few more shares on Thursday at ~$167). AMD is now my second-largest investment position in my portfolio, after Bitcoin (BTC-USD), which is entirely due to AMD’s improving AI GPU line-up.

I believe the market’s reaction to AMD’s AI event was short-sighted last week, as the chip firm has improved its AI game dramatically: AMD is set to launch its Blackwell rival just months after Nvidia’s brings to market its latest-gen AI GPU. AMD is therefore set not only for a revenue and free cash flow upsurge (as indicated last time), but also for a potentially significant gross margin up-lift driven by a larger percentage of Data Center revenues and surging sales of high-price, high-margin GPU products.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD, NVDA, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.