Summary:

- Advanced Micro Devices, Inc.’s stock has stabilized after significant declines, with strong quarterly earnings and an improved A.I. outlook justifying a “buy” rating and higher price targets.

- AMD exceeded earnings and revenue estimates, with notable growth in A.I. processor sales, despite weaknesses in the Gaming segment.

- AMD’s forward price-earnings and price-sales valuations are reasonable within its peer group, suggesting limited risk for substantial share price declines.

- Key support and resistance levels indicate potential for significant price movements, with a bullish outlook unless critical support levels are breached.

JHVEPhoto

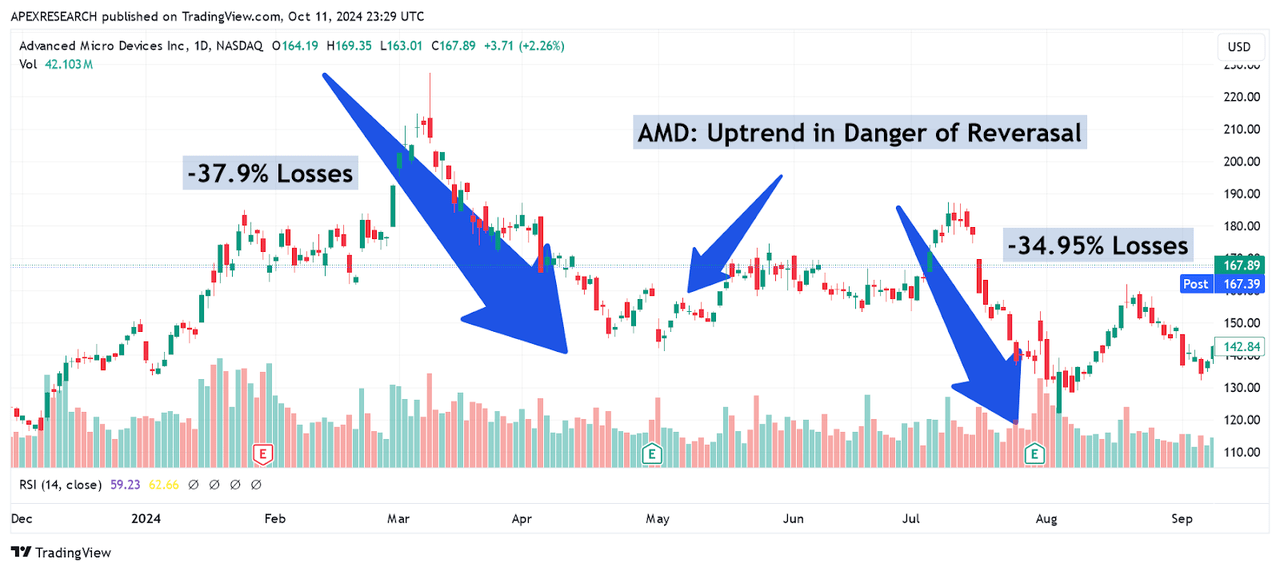

When I last covered Advanced Micro Devices, Inc. (NASDAQ:AMD) on May 2nd, 2024 with “AMD: Uptrend In Danger of Reversal,” the stock had experienced fairly dramatic declines of nearly -37.9% in less than eight weeks. As a result, I felt that the stock’s longer-term uptrend (which began in mid-October 2022) was in danger of breaking in the bearish direction and AMD share prices soon posted another wave of losses (falling again by nearly -35% in just 26 days):

AMD: Significant Prior Losses in Share Prices (Income Generator via Trading View)

Since then, the stock has managed to form a more sustainable base, and it looks as though AMD might be an attractive possibility for new long positions at current levels. Strong performances in quarterly earnings and an improved outlook within the competitive artificial intelligence computing space suggest that the severe share price losses that were encountered during the early parts of this year might have finally come to an end. As a result, I have raised my outlook for this stock to a “buy” rating to reflect my current long position and improved upside price target through the end of this year.

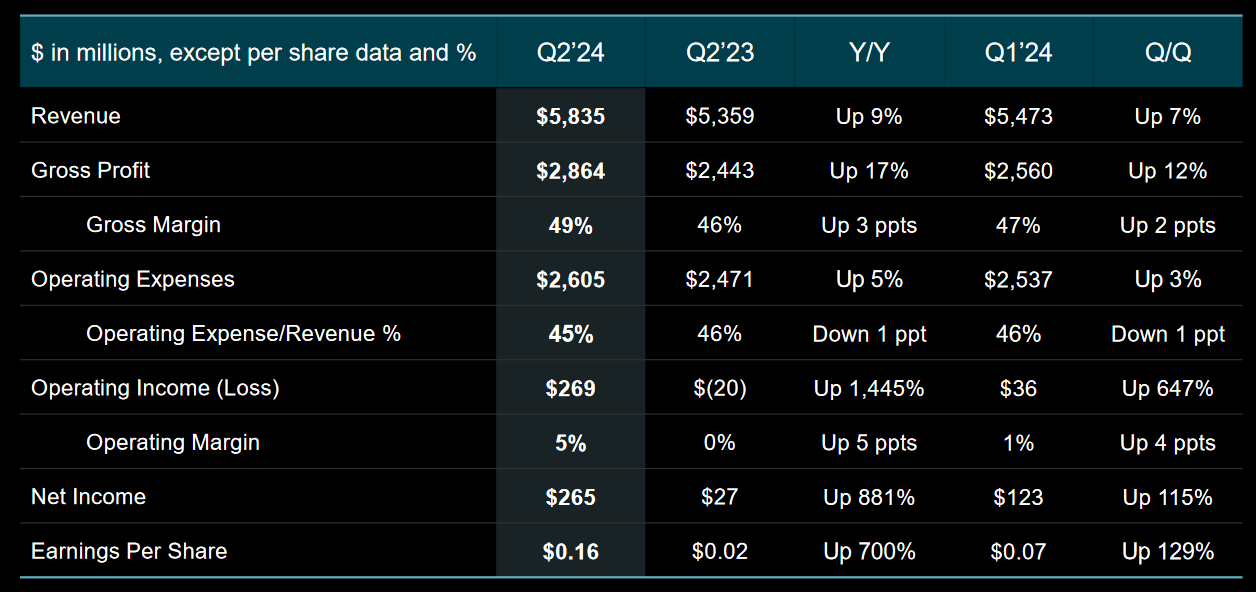

Advanced Micro Devices: Q2 2024 Earnings Figures (Q2 2024 Earnings Presentation)

For the second quarter period, AMD surpassed consensus estimates for both earnings and revenue, and the company provided solid evidence that sales growth for its A.I. processors is likely to continue at increasingly impressive rates. Overall, the company reported adjusted earnings of $0.69 per share (against expectations of $0.68 per share) and revenues of $5.84 billion (against expectations of $5.72 billion). Net income came in at $265 million, which marks quite a stark contrast with the $27 million net income figure that was posted during Q2 2023. Data Center figures (which includes the revenue portion generated from A.I. processors) came in at $2.8 billion and saw massive annualized gains of 115%.

Ultimately, this indicates tremendous growth rates for shipments of GPUs used for artificial intelligence processing, and these figures also surpassed consensus expectations for the period. On the negative side, revenue figures from the Gaming segment came in at just $648 million (which indicates annualized losses of -59%) and this missed consensus expectations of $676 million.

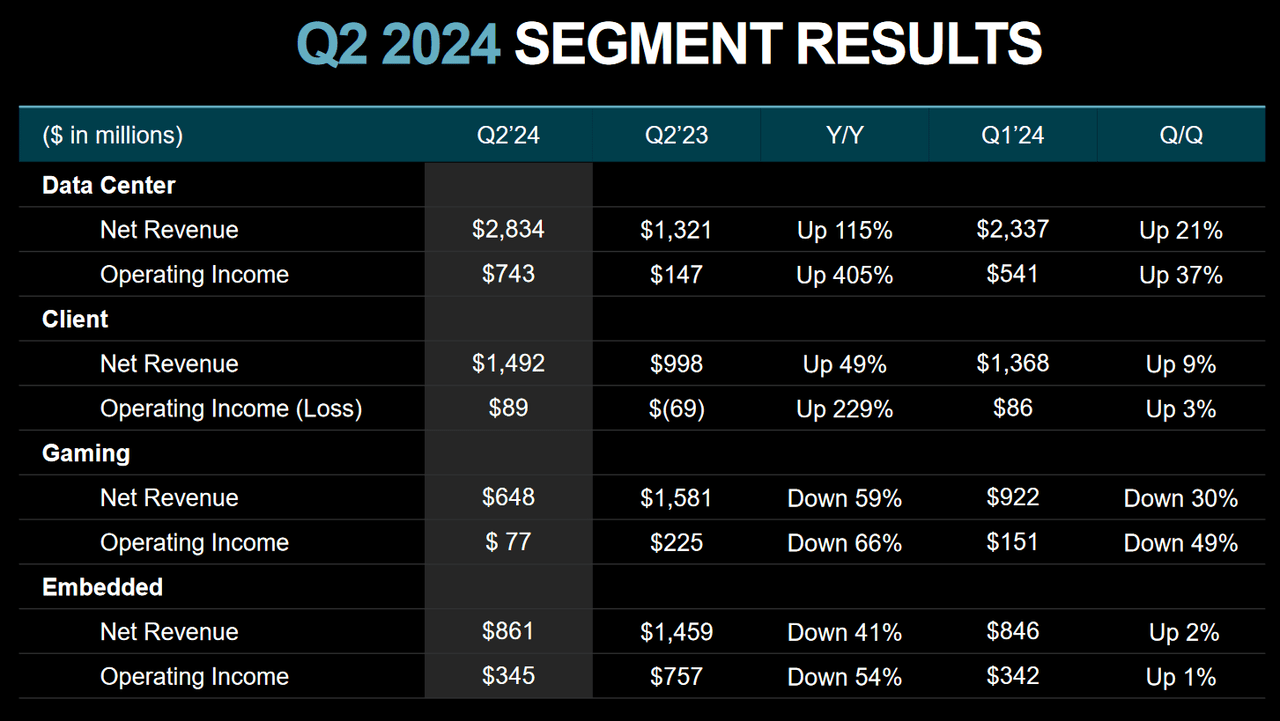

Advanced Micro Devices: Q2 2024 Earnings Figures (Q2 2024 Earnings Presentation)

Fortunately, revenue figures from the Client category (which includes PC sales) came in at $1.5 billion (beating estimates calling for $1.43 billion) and this indicates sizable annualized growth rates of 49% for the period. Given the prior sluggishness we have been seeing in PC sales following the coronavirus pandemic period, I think that these figures are highly encouraging in light of clear weaknesses in the company’s Gaming segment. Going forward, AMD now estimates revenue for the third quarter to be seen at $6.7 billion (marking a slight improvement on the prior consensus estimates calling for $6.61 billion in revenue for the period).

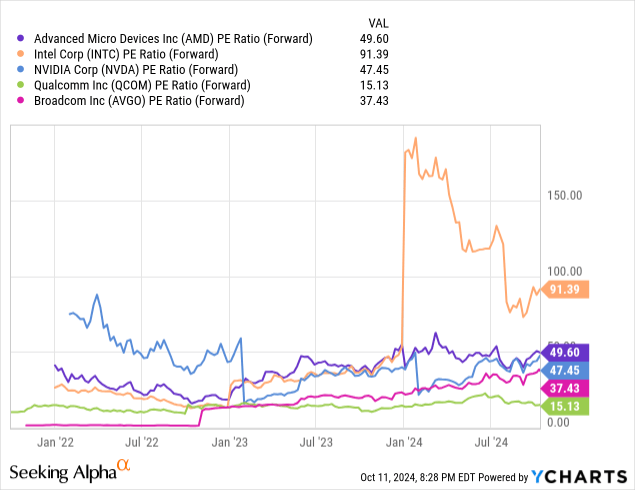

Comparative Forward Price to Earnings Valuations (YCharts)

When we are looking at the forward price-earnings valuations for the company (49.6x) in relation to key competitors within AMD’s industry group, we can see that both Intel Corp. (INTC) and Nvidia Corp. (NVDA) are currently trading at more expensive valuations (at 91.39x and 47.45x, respectively). However, Broadcom, Inc. (AVGO) is a bit cheaper at 37.43x and Qualcomm is currently trading at much lower valuations (at just 15.13x). Thus, from the forward price-earnings perspective, we can see that AMD is currently trading near the middle of the pack as a stock offering exposure to the artificial intelligence computing space.

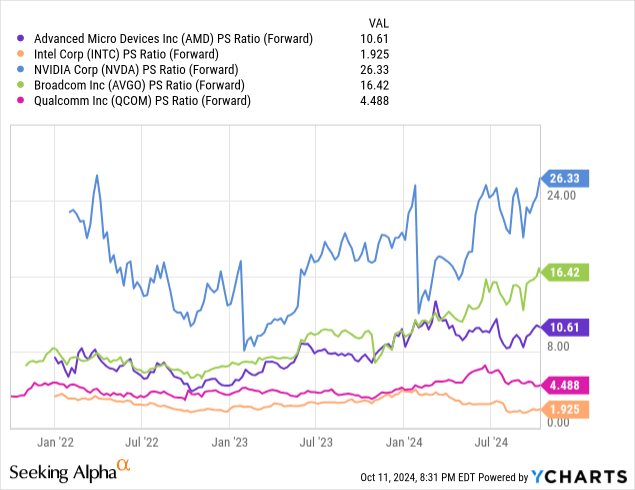

Comparative Forward Price to Sales Valuations (YCharts)

Interestingly, if we view AMD from the perspective of forward price-sales valuations, the picture actually looks quite similar. Specifically, AMD is currently trading with a forward price-sales valuation of 10.61x, which is firmly below Broadcom (at 16.42x) and far below Nvidia (at 26.33x). However, AMD is still trading at more expensive valuations when compared to Intel (at 1.93x) and Qualcomm (at 4.49x). As a result, we can see that AMD is currently trading at reasonable valuations within its peer group and is not showing significant risks for substantial declines in share prices.

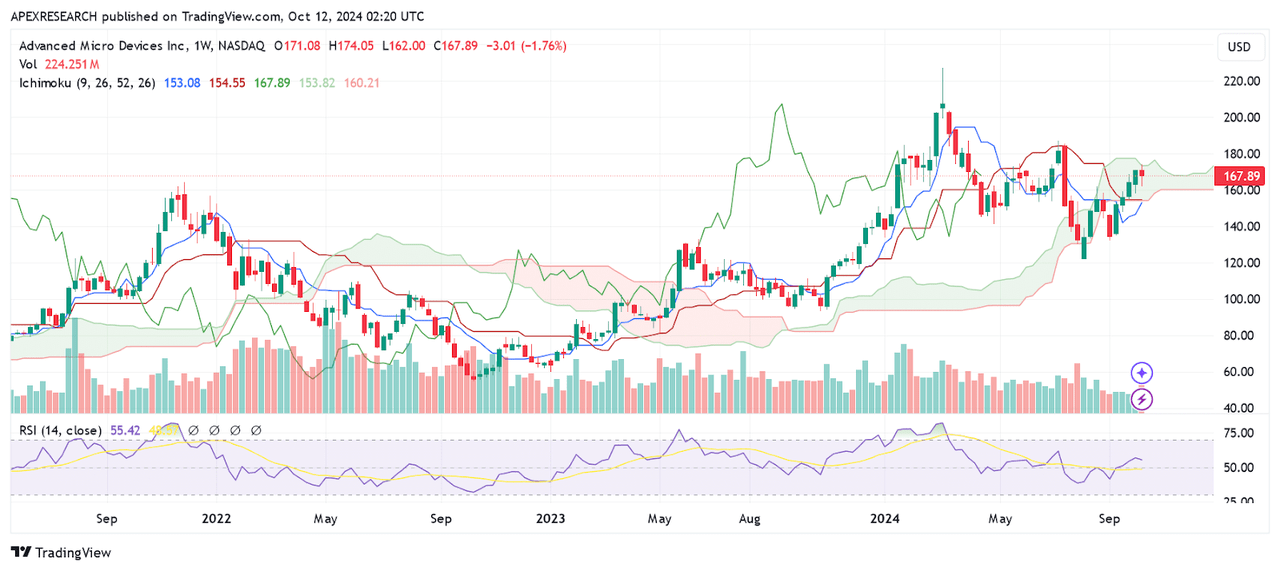

AMD: Signfiicant Levels of Support and Resistance (Income Generator via Trading View)

Looking into the weekly price charts, we can see that several important support and resistance levels have started to develop for this stock. Specifically, significant support zones have formed near the August 5th, 2024 lows of $121.83 and the September 6th, 2024 lows of $132.11. Conversely, major resistance levels can now be found near the July 8th, 2024 highs at $187.28 and the March 4th, 2024 highs at $227.30.

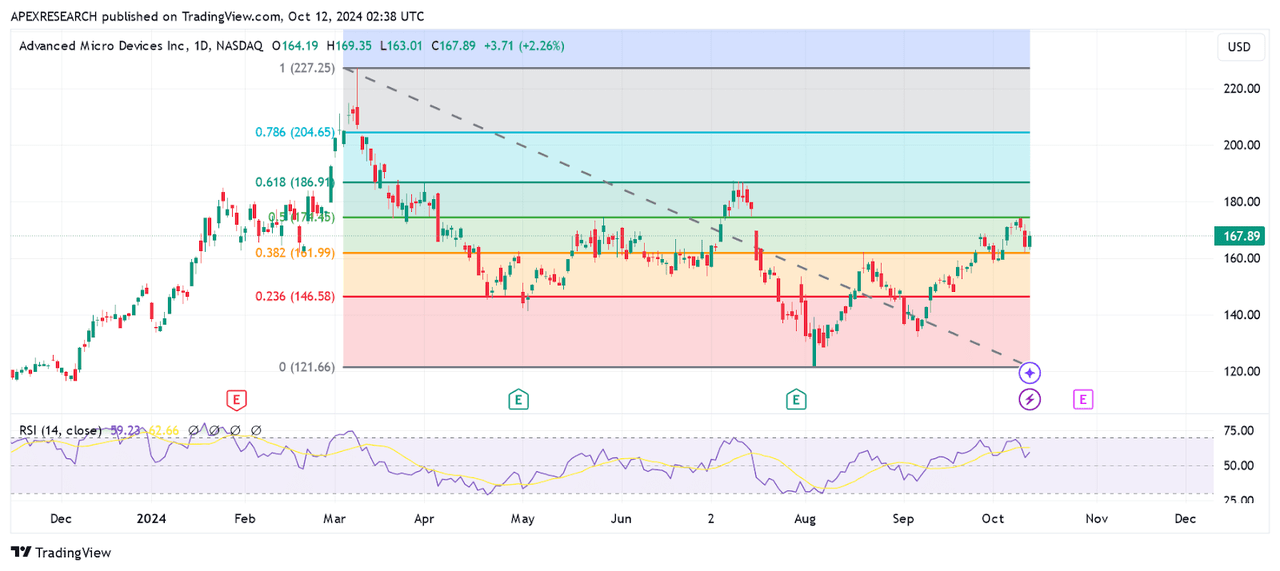

AMD: Key Fibonacci Retracement Zones (Income Generator via Trading View)

Here, we can see that the prior highs at $187.28 align quite closely with the 61.8% Fibonacci retracement of the declining move from $227.30 to $121.83 (which is located near $186.90). The combination of these two chart formations strengthens the possibility that we will begin to see selling pressures develop in this area. However, this also means that any upward price breaks through this area would be expected to be forceful as well. In many instances, an upward price break through the 61.8% Fibonacci retracement zone will often target a full retracement of the prior trending move (which would that the next sequential bullish price target is located at the all-time highs of $227.30). Currently, daily indicator readings in the relative strength index are holding below the 59 level, which shows that share prices still have a significant amount of room to extend before reaching overbought regions. In my view, these factors suggest that a re-test of the March 4th highs appears to be fully attainable.

AMD: Trend Line Break Suggests End to Downtrend Period (Income Generator via Trading View)

Finally, we will take a look at the original trend line breakout that led to AMD’s most recent bullish reversal period. Specifically, this upward price move occurred during the September 26th, 2024 trading period and this event ended the series of lower highs that had remained in place since March of this year. As confirmation of this bullish breakout, we can see that share prices re-tested this downtrend like from the topside and bounced off this formation during the October 2nd trading session. Overall, this does help to strengthen the validity of this breakout and sets the next upside target for share prices at the July 8th, 2024 highs of $187.28.

For me to reverse this bullish outlook and begin to expect weakening trends in share prices, I would first need to see AMD break below the September 18th, 2024 lows of $148.01. I would then alter my view to a more consolidative stance, with sideways trends expected. Under the most bearish scenario, a break below the aforementioned price lows at $132.11 would indicate that the September 26th downtrend line break was actually a false breakout and re-focus my attention on the ultimate $93.12 price lows from October 26th, 2023.

So, in the absence of these more negative scenarios developing, I upgrade to a “buy” rating on this stock and hold my current long position in AMD through the company’s next quarterly earnings release.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.