Abstract Aerial Art

Short sellers have increased their bearish bets against S&P 500 oil and gas stocks in September, with crude futures down for the third month and hit a 52-week low of $65.96 in September.

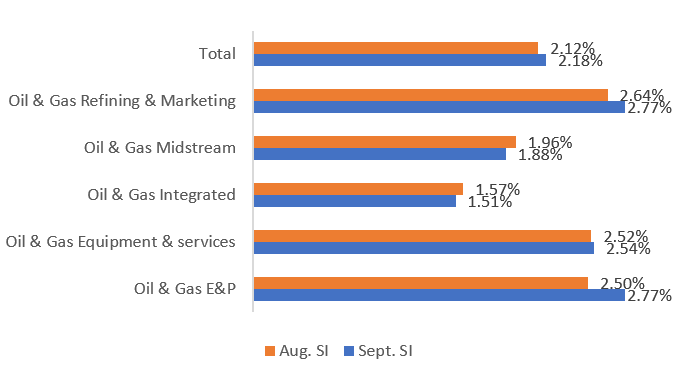

The average short interest in the S&P 500 energy sector stocks is up for the second month to 2.18% at the end of September.

The short bets, in which traders sell borrowed shares of companies with the aim of buying them back later at a lower price, rose to 446.57M from 434.71M in August.

Crude continues to extend losses in the third month, ending 7% lower in August, however, oil prices have reversed course and are up 10.5% in October on geopolitical tensions.

The S&P 500 Energy sector (NYSEARCA:XLE) was down 3.8% in August, compared to the 2% rise in the S&P benchmark index.

Stocks with the largest and least short positions (Ranked by short interest as a percentage of shares float)

Most shorted S&P 500 energy stocks

EQT Corporation (NYSE:EQT) 4.89% vs 4.64%.

APA Corporation (NASDAQ:APA) 4.81% vs 3.72%.

Valero Energy (NYSE:VLO) 4.22% vs 4.07%.

Occidental Petroleum (NYSE:OXY) 3.74% vs 3.52%.

Devon Energy (NYSE:DVN) 3.67% vs 2.82%.

Least shorted S&P 500 energy stocks

Exxon Mobil (NYSE:XOM) 0.99% vs 1.12%.

Marathon Oil (NYSE:MRO) 1.47% vs 1.75%.

Phillips 66 (NYSE:PSX) 1.56% vs 1.71%.

Targa Resources (NYSE:TRGP) 1.62% vs 1.51%.

ONEOK (NYSE:OKE) 1.66% vs 1.56%.

Energy sector in detail

Oil & Gas Refining & Marketing and Oil & Gas E&P are the most shorted industry within the sector, with 2.77% short interest as of September end.

Oil & Gas Integrated was the least shorted industry within the energy sector, with 1.51% short interest as of September end, a decrease of 6 bps from August.