Summary:

- I expect Meta to deliver $40.5 billion in revenue in Q3, with a Reality Labs loss upward of $4.5 billion.

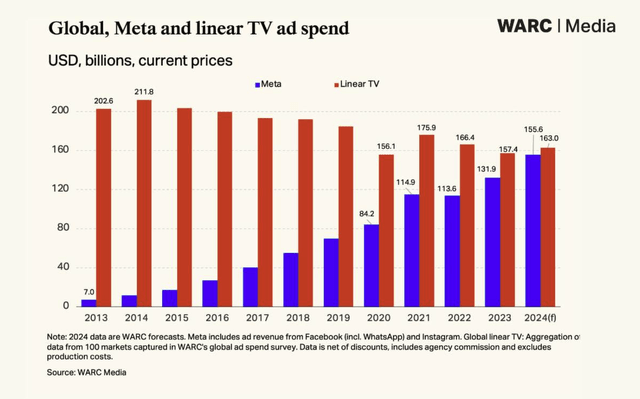

- Based on data from WARC Media, I estimate Meta could overtake global linear advertising spending in 2025.

- My valuation analysis and growth forecasts indicate that the company’s market cap will contract by 4.3% in 12 months in a base case. This counters my previous bull-case prediction.

- In the medium to long term, Big Tech valuations are vulnerable. We could be on the cusp of a major long-term Western recession, compounding geopolitical risks and making diversification prudent.

MicroStockHub/iStock via Getty Images

I recently covered a significant operational development for Meta Platforms, Inc. (NASDAQ:META), which included its unveiling of Orion at Meta Connect 2024. In addition to this, we also have Meta’s Q3 earnings approaching on 10/30/24. In my pre-earnings analysis here, I identified trends in Meta’s advertising growth which were very strong, including a likely takeover of linear TV annual advertising spending in 2025. Meta’s Q3 is likely to be marked by high total revenue growth and ‘family daily active people’, but expect potentially the highest losses for Reality Labs so far and increased capex to support the company’s long-term position in AI as it competes with Microsoft for the Big Tech AI lead.

Q3 Earnings Expectations: Strong Total Growth Amid High Capex and Reality Labs Losses

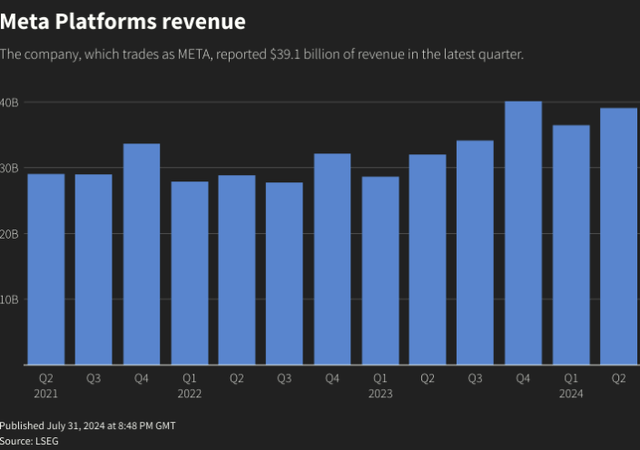

Meta’s Chief Financial Officer, Susan Li, has forecast Q3 2024 revenue to be between $38.5 billion and $41 billion, representing a 12-20% increase year-over-year. The analyst consensus is $40.18 billion. Based on my outlook, Meta is having a very strong year, beating estimates in every quarter this year so far. I expect this trend to continue in Q3, and my own estimate is that the company will achieve revenues of $40.5 billion for the quarter. It will also be crucial to analyze Meta’s capex in Q3, as the company has estimated $37-40 billion in capex for the year, which was revised up from $35-40 billion estimated for the full year in Q2. I expect Meta may come in at the higher end of this band, as the company has been aggressively investing in its AI positioning, ensuring that it gains a leading position alongside Microsoft Corporation (MSFT). I believe we could see capital expenditures of $9 billion in Q3.

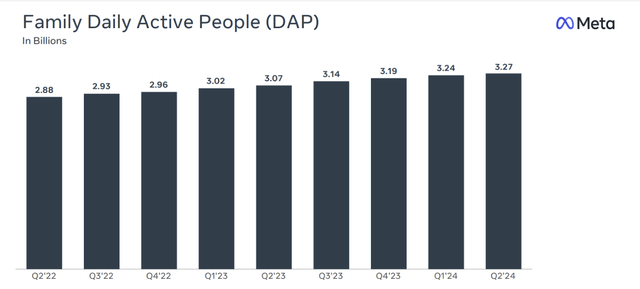

Based on information from Meta’s Q2 earnings call, the company had reached over 3.27 billion daily active users of at least one of its core products (Facebook, WhatsApp, Instagram, or Messenger). WhatsApp also surpassed 100 million monthly active users in the U.S., signifying key growth in a core market. I expect both of these trends will continue in Q3, where I believe we are likely to see ‘family daily active people’ of 3.31 billion.

However, it is worth putting Q3 expectations into context. Over the long term, the company is inevitably going to encounter saturation in user growth. I wonder whether the company could reach a platform size where half the world’s population uses one of its apps every day. In my opinion, there are currently significant barriers to this, including the heavily diversified social media landscape. I believe we are also likely to see a trend away from social media in the coming years due to heavy saturation (a reversion to the mean on social trends back toward organic, human-led interaction, primarily a result of the effects of AI proliferation). This is why I believe Meta’s AR glasses initiatives are so vital because they provide a source of long-term revenue growth that is not dependent on screen time. I will be looking carefully at management’s discussion of its hardware device pipeline on the Q3 earnings call.

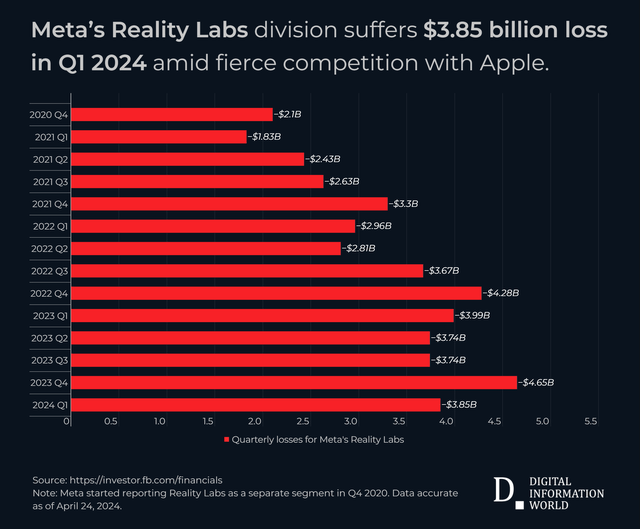

Although I am long-term bullish on Meta’s AR glasses, at the moment its Reality Labs unit, focused on VR and AR technologies, continues to incur significant losses. In Q2 2024, Reality Labs incurred a loss of $4.5 billion, a much worse result than the -$3.85 billion in Q1 2024 and -$3.74 billion in Q3 2023. I expect a bigger loss in Q3, potentially upward of $4.5 billion, as the company has been investing heavily in AR glasses, like Orion, recently. While there is a lot of skepticism in the market about the viability of Reality Labs, I do believe in its long-term prospects. However, I think the investment thesis related to this segment is going to take a lot of time. That being said, I have mentioned previously that Meta’s agility is important to maintain in this division because too much attachment to vision without the right demand is a risk. I see this risk more acutely in its VR products than its AR products due to limited use cases for headsets in social environments.

In terms of advertising, this continues to be the core revenue generator for Meta. In Q2 2024, the company reported that 98% of its revenue was derived from advertising, primarily on Facebook and Instagram. I find strong growth in advertising in Q3 likely, especially given AI enhancing its advertising capabilities, like optimized placement and personalizing content. Meta is having a particularly good year, so I believe its Q3 advertising revenue growth could be 25% year-over-year. Notably, the company is rapidly catching up with linear TV annual ad spending and is likely to pass this in 2025, according to my estimate based on data from WARC Media.

Overall, expect a strong Q3. Furthermore, as interest rates drop in 2025, expect continued strength. However, it is worth being cautious in 2026 and beyond, as I believe we could enter a period of very high inflation, curbing demand and potentially leading to a period of stagflation. In late 2026 and 2027, the geopolitical environment could get very tense, given the potential for a long-term macroeconomic recession in the West and current threats from China over Taiwan, Iran in the Middle East, and Russia over Ukraine. At this time, big tech valuations could become very volatile. This is primarily why my rating is a long-term Hold for Meta right now.

Valuation Analysis: My Base-Case Outlook Is a 12-Month Market Cap Contraction of 4.3%

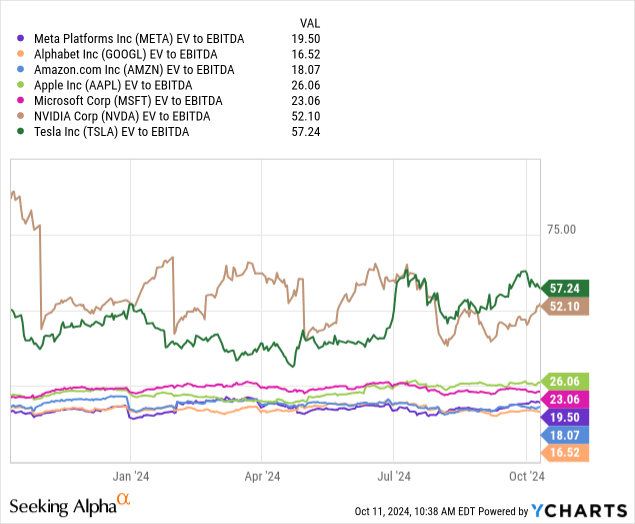

Meta is one of the cheapest stocks in the Magnificent Seven based on the companies’ EV-to-EBITDA ratios. This is a very good sign, but it still doesn’t mean that the stock is worth buying right now because historical sentiment for Meta stock independently shows that a near-term contraction is likely coming, even without pressure from macroeconomic weakness that could manifest in the medium term. This is outlined in the data following the chart below.

- Meta has a historical five-year average forward long-term EPS growth (three-to-five-year CAGR) estimate of 17.6%.

- Meta has a future five-year average forward long-term EPS growth (three-to-five-year CAGR) estimate of 17.8%.

- Meta’s forward P/E GAAP ratio is 16.6% higher than its five-year average.

This indicates that Meta is vulnerable to near-term volatility right now despite a strong long-term growth horizon. For investors who already own Meta stock, I would Hold. For those who are looking to add to their positions or initiate their first position in Meta stock, I would wait, as I believe there will be better entry points in 2026.

To further support my thesis that Meta is currently overvalued, consider that its forward EV-to-sales ratio is 41.7% higher than its five-year average. Moreover, its forward price-to-sales ratio is 36.8% higher than its five-year average.

While Meta has the third-lowest EV-to-EBITDA ratio of the Magnificent Seven, this only means that it is less vulnerable to downside volatility in the case of future macroeconomic weakness and geopolitical upheaval. In the interim, I see a significant overvaluation in Meta stock right now, with much of this caused by the fact that the company has delivered year-over-year EPS GAAP growth of 73.1% and year-over-year revenue growth of 24.3%, a trend unlikely to last given the company’s period of efficiency can only drive so much growth. I estimate that over the next 12 months, Meta may deliver revenue growth of 17.5% on its TTM total revenues of $149.784 billion. If this is so, and the company has total revenues of $177 billion in 12 months and is priced at a P/S ratio of 8 (closer to its five-year average of 7.45), the company’s market cap will be $1.416 trillion. This is a 4.3% contraction from the current market cap of $1.48 trillion. This is an update on my bull-case price target from my Meta Connect 2024 analysis, which focused on Wall Street estimates rather than my independent forecast, which is now provided here as a base-case outlook.

Risks Review

- Meta’s valuation is currently too high, given that in 2025, the company is likely to deliver slower growth than in 2024 as tailwinds from the company’s focus on efficiency taper. Furthermore, higher levels of capital expenditures and a focus on long-term development in AI, AR, and VR are likely to have a medium-term strain on its free cash flow and net income.

- In three to five years, I see it likely that the West could enter a protracted long-term recession if the Federal Reserve adopts a period of low interest rates in 2025, contributing to inflation. If this is the case, I think Meta has a vulnerable valuation in the medium term. I think investing in Meta right now is a bad near-term and medium-term investment based on value. However, if one is already a Meta shareholder, I think this will be a valuable long-term investment worth holding on to, as I believe Meta will be an AI leader alongside Microsoft.

- Meta’s Reality Labs division continues to operate at a compounding loss. I estimate it will deliver the biggest loss yet in Q3. However, over time, I have a strong outlook on the success of its AR and smart glasses initiatives, but I am less convinced that its VR and Horizon Worlds projects will be as successful as Zuckerberg currently expects.

Conclusion

Meta is excelling at the moment, but the market is well aware of this. Therefore, value investors will be careful about not allocating to the company at the present valuation. Long-term investors who already have a stake in Meta would be wise to Hold because the company is likely to be a leader in AI and is pioneering the AR field. That being said, holding an excessive amount of Big Tech stocks is inherently risky right now because we are likely on the cusp of a long-term recession in the West. Therefore, geographic diversification is a prudent strategy to adopt.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.