Summary:

- Meta Platforms is expected to meet or exceed Q3 earnings estimates due to strong advertising trends and CPM growth, but Q4 guidance may be weaker.

- Building on strong monetization, negative DAU growth for Facebook and Instagram suggests potential over-monetization, which could impact long-term user experience and revenue growth.

- I think Meta’s growth outlook is increasingly challenged, with the two main revenue drivers showing stretched levels: slowing DAU growth and stretched DAU monetization.

- Meta shares have outperformed the market, up 67% YTD, and are now likely trading at a premium to fair value, suggesting it might be prudent to trim exposure. Hold.

Derick Hudson

Meta Platforms (NASDAQ:META) (NEOE:META:CA) is set to publish earnings for the September quarter on October 30th, after the market closes, and consensus estimates call for approximately $40.3 billion of revenues and $16 billion of operating profits. In my view, estimates for Q3 look reasonable, and I expect Meta to meet or exceed the consensus projections. My confidence for Q3 is based on the observation of an overall strong advertising backdrop, as well as strong monetization trends, with clear CPM acceleration vs. Q2 by about 10% QoQ. However, I see risk heading into the Q4, and I expect guidance to reflect this. According to data collected by Sensor Tower, Meta’s key advertising engines Facebook and Instagram show some notable signs of slowing DAU growth. In fact, DAU numbers likely shifted negative in Q3 QoQ for the first time since 2022. With this said, I think Meta’s growth outlook is increasingly challenged, with the two main revenue drivers showing stretched levels: slowing DAU growth and elevated DAU monetization.

For context, Meta stock has strongly outperformed compared to the broader market this year. YTD, META shares are up around 67%, whereas the S&P 500 (SP500) has gained approximately 22%.

Seeking Alpha

Shares are now trading at the upper end of the P5Y range on both EV/Sales and EV/EBIT, and accordingly, it may be a good idea to trim some exposure, taking profits.

Seeking Alpha

Strong Monetization Trends: Steady Improvements In CPM

With Meta being one of the world’s biggest advertising business, it is important to highlight that the overall macro backdrop for advertising in Q3 has been stable and supportive for Meta. Indeed, UBS research noted (emphasis mine):

Budget growth accelerates throughout 3Q24: Despite a slower start, ad budgets accelerated in Aug into Sep citing uplift from political, brand advertising recovery, and improved consumer sentiment; and while most verticals ramped through 3Q24, we note particular strength in auto and CPG. Meta/Instagram and Google/YouTube both benefited from political spend and optimization/efficiencies unlock from automation and a greater share of budgets moving through Performance Max and Advantage+. (Source: UBS research note dated 7th October: 3Q24 Online Advertising Preview – Rising Tide Lifts All Boats on the 2024 Outlook)

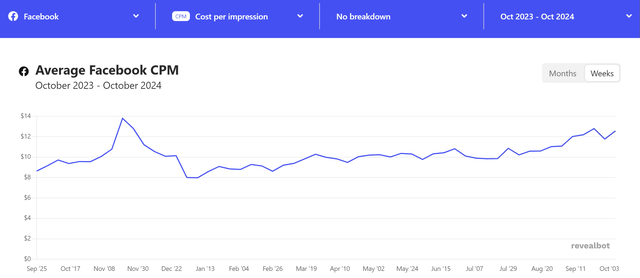

Building on this strong advertising backdrop, I highlight that Meta’s CPM has expanded nicely and steadily since the end of Q2. Indeed, according to Revealbot data, CPM for Facebook has jumped to a quarterly average of about $11, up >10% QoQ compared to $10 CPM in the June quarter.

Revealbot

A similar trend can be noted for Instagram CPM.

Revealbot

Instagram, Facebook DAU Growth Shifts Negative

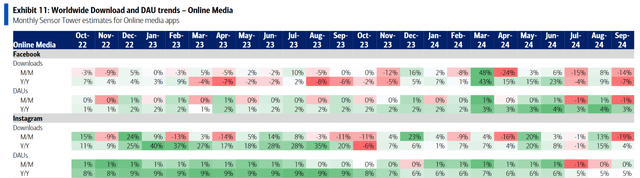

While expanding CPM may be good for shareholders eying Meta’s Q3 reporting, long-term effects may be more challenging for value creation. I argue that increased user monetization efforts may result in worsening user experience on the platform, resulting in slowing DAU trends. The first signs of this are already visible now. In fact, MoM growth for Facebook DAUs in June, July and September was -1%, 1% and -1%, resulting in a net negative DAU growth QoQ. Similarly, DAU growth for Instagram QoQ also shifted negative, with MoM growth for June, July and September being -1%, 0% and 0% (Source: BofA research note dated October 7th: Internet/e Commerce September app data: Mixed trends with Amazon DAU acceleration a bright spot). While negative DAU growth not necessarily results in negative revenue growth—it can be offset by higher revenue per DAU—I highlight that DAU trends may suggest that Meta is overstretching its ads-placements on the platforms.

BofA, Sensor Tower

Meta management likely has the issue of slowing user momentum on its screens as well, and I expect the company to work hard trying to reverse the negative DAU trends. However, two things stand out: Firstly, at Meta’s global scale, incremental DAU growth is simply difficult due to little upside in population/ penetration ceiling. Secondly, reversing negative DAU trends may likely require lower monetization per DAU for some time, to improve user experience. This may somewhat pressure shareholder value for some period of time, as revenue growth slows. And accordingly, I fear that Q4 guidance may come in weaker than expected.

Valuation: Now Likely Trading At Or Above Fair Value

In an earlier note on Meta Platforms, dated July 21st, I argued that Meta shares have upside—projecting a TP of approximate $550 vs. $485 trading at the time. My estimates were as follows:

For FY 2024, 2025 and 2026, I now expect EPS at around $21.5, $24.5 and $26.7, respectively. Notably, my EPS estimates are about 10%-15% ahead of consensus, mostly as a consequence of lagging expectations relating to Meta’s advertising momentum. At the same time, I continue to project a 3.5% terminal growth rate post-2026, while I lower my cost of equity assumption by 50 bps., to 8.5%, in line with equity costs for the broader Magnificent Seven group.

Heading into Q3, I still believe that my valuation estimates are reasonable, which continues to peg my target price at $550. With this, however, I now note that Meta shares are trading at a 10% premium to my target price. On a related note, I highlight that Meta shares are now trading at the upper end of the P5Y range on both EV/Sales and EV/EBIT. Overall, on valuation, I think it may be a good idea to trim some exposure, taking profits.

Investor Takeaway

Meta Platforms is scheduled to release its earnings for the September quarter on October 30th, after the market close. Analysts expect around $40.3 billion in revenue and $16 billion in operating profits. I believe these Q3 estimates are reasonable, and I’m optimistic Meta will meet or even surpass these projections. My confidence stems from a robust advertising environment and strong monetization trends, with a noticeable acceleration in CPM compared to Q2. However, I’m cautious about Q4 guidance. Data from Sensor Tower indicates that Meta’s key platforms, Facebook and Instagram, are showing signs of slowing DAU (daily active user) growth. In fact, Q3 may mark the first quarter of negative DAU growth since 2022. Given this, I believe Meta’s growth outlook is becoming more challenging, with its two main revenue drivers—DAU growth and DAU monetization—starting to show signs of exhaustion.

On valuation, I also highlight stretched upside: The stock is currently trading near the high end of its 5-year range in terms of both EV/Sales and EV/EBIT. Furthermore, Meta shares are now trading at a 10% premium to my target price. Overall, based on current valuations, it seems like a good time to lock in gains and reduce some exposure. I downgrade to “Hold”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.