Summary:

- Microsoft stock has underperformed as investors have grown increasingly concerned about its AI monetization prospects.

- Microsoft must invest aggressively in AI CapEx now but faces intense competition from its hyperscaler peers.

- Its investment in OpenAI might not be profitable until 2029, lowering the opportunity for near-term earnings accretion.

- MSFT’s price action has remained incredibly resilient, suggesting dip-buyers have likely accumulated.

- I explain why investors should embrace the buy-on-weakness opportunity with both hands before its anticipated turnaround.

HJBC

Microsoft: Underperformance Likely Disappointed Investors

Microsoft Corporation (NASDAQ:MSFT) (NEOE:MSFT:CA) investors have been left disappointed over the past three months, as MSFT underperformed the S&P 500 (SPX) (SPY). Therefore, the stock remains well below its July 2024 peak, even as the S&P 500 surged to a new high last week. The Satya Nadella-led company also endured more pessimism from Wall Street as analysts reassessed their optimism on Microsoft’s AI growth inflection.

The King of SaaS will deliver its upcoming earnings scorecard this month. Given its recent underperformance, investors will likely scrutinize MSFT’s first fiscal quarter earnings on October 30. The AI infrastructure companies have experienced a robust revival recently, as seen with NVIDIA’s (NVDA) stock surge. Even Microsoft’s cloud software peers in the iShares Expanded Tech-Software Sector ETF (IGV) have surged to a new high in October. Hence, the de-rating in MSFT has likely been keenly felt, suggesting investors likely reallocated.

Microsoft: AI Thesis Remains On Track

In my previous bullish MSFT article, I highlighted why investors haven’t fled for the exit. While I acknowledged the possibility of the AI thesis going overboard, the market must weigh that against potentially improved opportunities for AI monetization.

Notwithstanding my optimism, I assess that the market’s caution is justified. Even as the AI infrastructure investments thesis has gained significant traction, the question of whether robust enterprise adoption could follow through remains to be seen. Notwithstanding Microsoft’s advantages and scale as one of the leading hyperscalers, Oracle (ORCL) seems to be gaining ground, given ORCL’s recent partnership with OpenAI. In addition, there are also concerns about whether Microsoft’s much-vaunted profitability margins could suffer in the near term, as it supports OpenAI’s loss-making endeavors through 2029.

Recent media reports highlighted the benefits of the Microsoft-OpenAI partnership. However, Amazon Web Services (AMZN) and Google Cloud (GOOGL) (GOOG) aren’t resting on their laurels, as developers have demonstrated a preference for using more than one LLM in their processes. Furthermore, Meta (META) has been making highly competitive gains on their open-source models, likely compelling OpenAI to keep scaling to maintain its competitiveness.

There are also more concerns about whether Microsoft is fully on board with OpenAI’s increased demands for more data center capacity. The AI software company’s cloud infrastructure partnership with Oracle suggests Microsoft seems increasingly cautious about aggressively adding infrastructure capacity ahead of demand. Despite that, Microsoft’s partnership with OpenAI allows the Redmond-headquartered company to continue benefiting from OpenAI’s revenue growth, opening a potentially critical growth vector in the medium- to long-term.

MSFT: Valuation Has Dropped

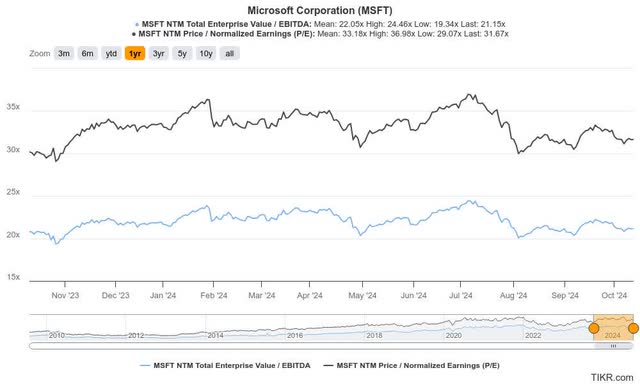

Despite that, investors have likely reflected higher execution risks on MSFT’s profitability trajectory, leading to its valuation de-rating over the past few months. As a result, MSFT’s forward adjusted EBITDA multiple has dropped closer to its August 2024 lows, markedly below its July 2024 peak. Despite that, MSFT is still valued at a marked premium (“D” valuation grade) over its tech sector (XLK) peers.

Wall Street has downgraded Microsoft’s estimates, underscoring its less optimistic forward outlook. Hence, its growth grade has also weakened over the past three months (from “B-” to “C”).

MSFT: Likely To Be Bottoming

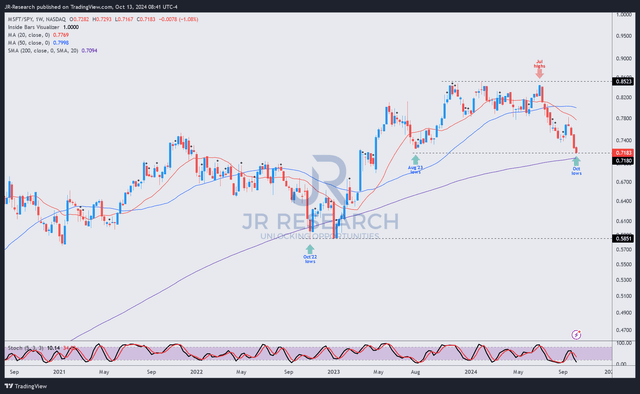

MSFT/SPY price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Notwithstanding the relative caution, investors must note that MSFT/SPY has dropped markedly below its July 2024 peak to levels last seen in August 2023. As a result, it nearly re-tested its 200-week moving average (purple line), potentially attracting more robust dip-buying sentiments to return.

As seen above, the stock’s bottom in October 2022 (two years ago) was robustly defended as MSFT fell to the 200-week MA. While I have not assessed a bullish reversal, I expect MSFT’s long-term outperformance to regain momentum, given its fundamentally strong thesis.

Microsoft Investors Must Remain Patient

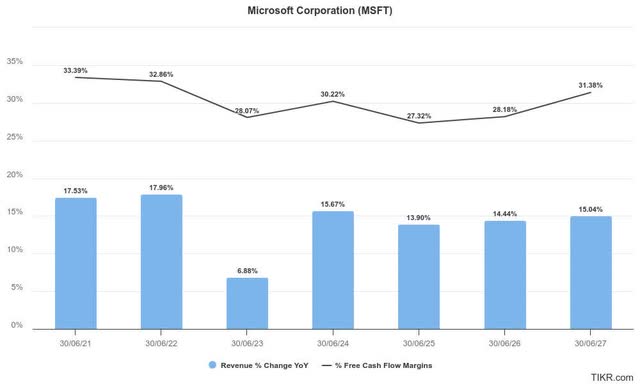

While Microsoft’s profitability estimates are expected to be impacted over the next two FYs, the impact isn’t likely structural. Given its enterprise software exposure, I assess that the AI monetization thesis is expected to benefit Microsoft.

The market’s concerns over its AI CapEx are justified. However, the company’s decision to partner with Constellation Energy (CEG) to restart the Three Mile Island nuclear reactor represents its belief in the sustainability of the AI thesis. I assess that the leading hyperscalers have likely assessed the need to secure the necessary power requirements to colocate with their data center expansion plans. Hence, MSFT should benefit as it scales its infrastructure while anticipating more robust enterprise AI adoption.

Despite that, concerns over possible AI overinvestment cannot be ruled out. MSFT’s relative premium over its sector peers behooves the need to execute well. Therefore, a less robust enterprise adoption could affect the market’s optimism on MSFT’s AI thesis, leading to further de-rating over time.

Is MSFT Stock A Buy, Sell, Or Hold?

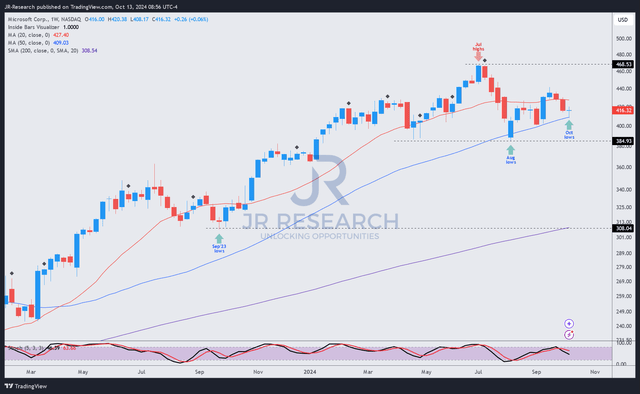

MSFT price chart (weekly, medium-term, adjusted for dividends) (TIKR)

MSFT’s price action has remained incredibly resilient, notwithstanding its recent underperformance. Therefore, I assess that its August 2024 lows have held up convincingly, suggesting dip-buyers have likely accumulated.

Therefore, although MSFT’s momentum has weakened, I’ve not assessed a structural shift in investor sentiments. Investors should consider it a buy-on-weakness opportunity to add exposure to its well-diversified thesis as it seeks to monetize AI to recover its much-prized margins.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, IGV, GOOGL, AMZN, META, NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!