Summary:

- Nvidia Corporation’s upcoming Blackwell GPU is expected to drive significant revenue growth, potentially surpassing current market estimates, due to high demand from Data Centers and hyperscalers.

- Nvidia’s CEO highlighted “insane demand” for Blackwell GPUs, with supply already depleted for the next twelve months, indicating strong pricing power and revenue potential.

- My conservative estimate suggests Nvidia could generate $80-120B in incremental revenue from Blackwell in FY 2025, significantly higher than consensus forecasts.

- Despite risks from AMD’s competing AI chips, I believe Nvidia’s market is underestimating Blackwell’s impact, making Nvidia a strong buy in the Data Center GPU market.

BING-JHEN HONG

Nvidia Corporation (NASDAQ:NVDA) is set to release its highly anticipated Blackwell GPU in the fourth-quarter, which is leading to renewed buzz about Nvidia’s shares. Recent comments made by the company’s CEO, Jensen Huang, indicate that the market may still be underestimating the potential for the next up-leg in revenue acceleration for the chipmaker. Advanced Micro Devices, Inc. (AMD) also recently guided for a new AI accelerator, the Instinct MI325X, which is the latest AI chip meant to directly compete against Nvidia’s Blackwell.

I believe Nvidia could see much stronger Blackwell-related top-line growth than consensus estimates currently indicate, and I am warning against underestimating Nvidia’s upcoming revenue ramp (a mistake I made previously). While I recently overweighted AMD, I believe Nvidia remains a top bet for investors in the Data Center GPU market, as Blackwell could add $80B or more to Nvidia’s top line in the next year.

Previous rating

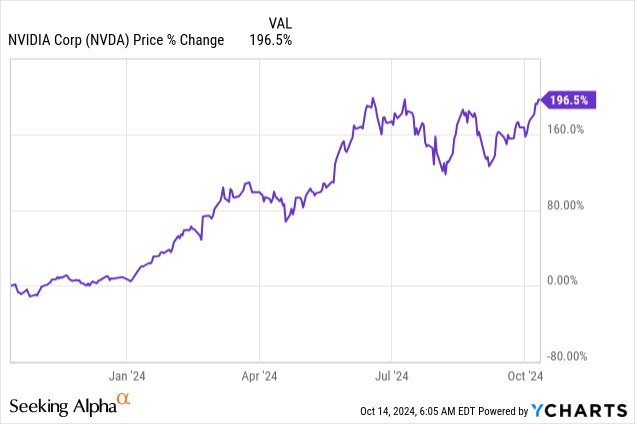

I upgraded shares of Nvidia to strong buy in my last work on the chipmaker in August — in “Why I Am Not Giving Up A Single Share” — as the company reported surging revenue growth in its Data Center business and was nearing the Blackwell launch catalyst. Nvidia also said at the time that it would buy back $50B of its shares as a means for the company to distribute more free cash flow to shareholders. I believe the market underestimates Blackwell’s potential for incremental revenue growth drastically, and I would not be surprised to see Nvidia add $80-120B in FY 2026 to its top-line due to the Blackwell launch.

Blackwell demand beyond expectations, massive revenue ramp ahead

Nvidia’s CEO recently stated that the supply of Blackwell GPUs for the next twelve months was already depleted, citing “insane demand” from hyper-scalers and Data Centers.

In my last work on AMD — Nvidia’s Blackwell Shortage Is AMD’s Gain — I mentioned that the AI GPU/Blackwell shortage is actually helpful to both AMD and Nvidia because it fundamentally improves the pricing landscape. AMD is getting ready to launch its next-gen AI chip, the Instinct MI325X in Q1 ’25 which is set to open up a massive opportunity for market share growth for the second-largest chipmaker. AMD’s MI325X AI accelerator, which is meant to compete against the Blackwell GPU, could therefore see significant market share gains in the Data Center market.

While AMD is more of an underdog in the AI GPU market than Nvidia, and the company only last quarter saw a massive revenue ramp related to its MI300X shipments, the GPU shortage is set to be a fundamental catalyst for top-line growth for Nvidia as well. I believe that the ramp of Nvidia’s Blackwell GPU is massively underestimated, and that even current consensus estimates don’t adequately capture the strength of the ramp that is ahead.

Nvidia’s H100 chip is changing hands for $25-30k per-unit, as the AI chip is still the most efficient chip for Data Center operators. The Blackwell chip offers superior performance, however: the H100 has 3.375TB/s memory bandwidth, compared to 8TB/s for Blackwell. According to Nvidia, the “GB200 NVL72 provides up to a 30x performance increase compared to the same number of NVIDIA H100 Tensor Core GPUs for LLM inference workloads,” which makes the chip especially useful to hyperscalers.

Nvidia could sell, in my opinion, 4M Blackwell GPUs in the first full year after launch (FY 2026), given strong demand from Data Centers. Nvidia already sold tens of thousands of B200 chips ahead of launch, with Oracle snapping up 20,000 GB200 accelerators… which is only a minimal amount of total supply. News reports also said that Nvidia will price DGX B200 systems at $515k, showing a 40% increase to comparable (prior-gen) DGX H100 systems.

If Nvidia can sell 4M Blackwell chips in 2025 at an average price of $20k (my low-case estimate), which is a very, very moderate estimate considering that its predecessor chip, the H100 80GB GPU sells for $30k, then Nvidia could look at additional revenues of $80B in the year following the Blackwell launch. Since the latest AI chip offers customers massive inference performance gains compared to the prior-gen model, it is likely that Nvidia has considerable pricing strength and actually realized prices per-unit will be much higher. Further, the overall GPU supply shortage that seems to be getting worse, considering that Nvidia contracted out its entire supply for next year, indicates that the pricing landscape could generally be much stronger than in normal circumstances.

Further, AMD’s CEO Lisa Su said at its AI event last week that she sees the AI Data Center market to expand to a total addressable size of $500B by FY 2028, up $100B from its previous forecast of $400B (by FY 2027) as companies ramp up their AI investments. What this tells me is not only that the addressable market is expanding more rapidly than expected (Lisa Su increased the size of the Data Center GPU TAM by 25% compared to last year’s estimate), but that companies (Nvidia and AMD mainly) struggle to meet demand.

Assuming a $25k price for a Blackwell GPU (my mid-case estimate), Nvidia could be looking at incremental revenue potential of $100B in the first full year of sales (assuming a 4M Blackwell GPU shipment volume). This means Nvidia could be on track to massively out-perform consensus estimates and easily be on track to more than double its revenue base within the next two years.

If the Blackwell GPU sells for a price close to the H100, $30k per-unit (my high-case estimate), then Nvidia could be on track to achieve incremental revenue potential of up to $120B.

The table below shows what incremental revenue potential — solely related to Blackwell — Nvidia could have based off the average unit price.

|

Blackwell incremental revenue potential, based off average unit price and shipment volume |

4,000,000 units |

4,500,000 units |

5,000,000 units |

| $20,000 | $80B | $90B | $100B |

| $25,000 | $100B | $113B | $125B |

| $30,000 | $120B | $135B | $150B |

| $35,000 | $140B | $158B | $175B |

| $40,000 | $160B | $180B | $200B |

(Source: Author)

For context, Nvidia’s FQ2 ’24 revenues were $30B, the majority of which were achieved in the Data Center business. This puts Nvidia’s annualized revenues (without Blackwell) at about $120B.

According to my back-of-the-envelope calculation, Nvidia could potentially double its current run rate revenue base if the company were to sell 4M units for approximately $30k a piece. Adding $80-120B in top line to the current run rate revenue base of $120B in FY 2026 would be a pretty strong accomplishment and suggests that Nvidia has significant valuation upside as well. With H100 costing $30k already, Blackwell offering hugely better inference performance and a shortage seeming playing out right now, Nvidia could see a massive revenue upswing that investors don’t fully realize yet. This would put them back into a position of early 2023.

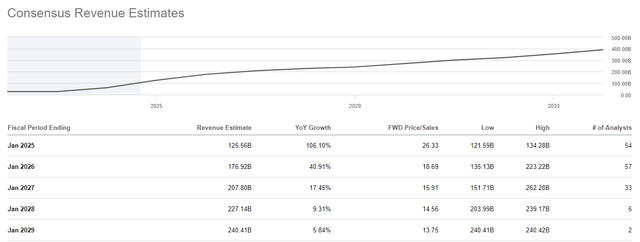

Nvidia’s valuation

Nvidia is expected to generate $176.92B in revenues in FY 2026 which, as I stated, could massively undervalue Blackwell GPU-related incremental revenue contributions. With Blackwell in the low-case scenario adding $80B in revenues in the next year, Nvidia could be on track to achieve more than $200B in total revenue in FY 2026, much more than current consensus estimates indicate. In the mid-range scenario of $100B in incremental Blackwell revenues (assuming a $25k average Blackwell sales price), Nvidia could achieve $220B in revenues, a massive ~$43B more than current estimates indicate. My high-case estimate implies total revenues of $240B which would beat estimates by ~$63B.

My positive estimates about Nvidia’s Blackwell shipment growth have massive implications for Nvidia’s valuation, for obvious reasons: if Nvidia can indeed achieve much higher revenues than the consensus estimates indicate, Nvidia has a much lower forward P/S ratio as well. Shares of Nvidia are currently trading at an 18.7X forward P/S ratio (based off consensus estimates). My mid-case estimate implies a modified P/S ratio of 15.0X (20% below the forward P/S) based off consensus estimates.

| Nvidia Consensus Estimates Vs. My Estimates ($B) | |

| Market Cap | $3,310.0 |

| Est. Consensus Revenue FY 2026 | $176.9 |

| Y/Y Growth | 40.91% |

| P/S Ratio (FY 2026) | 18.7 X |

| Low-Case Estimate Revenue FY 2026 (@4M shipments, $20k average price) | $200.0 |

| Y/Y Growth | 59.24% |

| P/S Ratio (FY 2026) | 16.6 X |

| Mid-Case Estimate FY 2026 (@4M shipments, $25k average price) | $220.0 |

| Y/Y Growth | 75.16% |

| P/S Ratio (FY 2026) | 15.0 X |

| High-Case Estimate FY 2026 (@4M shipments, $30k average price) | $240.0 |

| Y/Y Growth | 91.08% |

| P/S Ratio (FY 2026) | 13.8 X |

(Source: Author.)

With sales set to ramp much more drastically than estimates indicate, I believe the market could be in a similar kind of situation it was in back in early 2023, before Nvidia’s Data Center GPU-driven revenue acceleration was fully understood. In my last work on Nvidia, I raised my fair value estimate to $148/share, which has been almost reached.

After taking a second look at my estimates, I believe Nvidia is going to see a much more drastic ramp in earnings as well. A 40-50% stronger EPS ramp compared to consensus estimates seems likely, based off my mid-case estimate of 75% Y/Y revenue growth in FY 2026. Applying a 35X P/E ratio (as I discussed last time, this is my fair value P/E ratio for Nvidia) implies a mid-point FY 2026 estimate of $5.80/share (compared to a $4/share consensus). This in turn calculates to a fair value estimate of $203/share, implying 45% upside revaluation potential.

Risks with Nvidia

The biggest risk is that the chipmaker may not be able to fully realize its Blackwell revenue potential. This may be because AMD’s chips are capturing share in the AI GPU market or because other companies are developing better AI accelerators as well, increasing competition in the marketplace. What would change my mind about Nvidia is if the company were to issue a weak outlook for Q4 ’24 revenues, which will include Blackwell revenue projections.

Final thoughts

I will make the controversial (and maybe risky) call at this time and state on record that I believe that the market currently massively underestimates Nvidia’s incremental revenue upside related to the launch of its Blackwell chips. Just like the market (and I) underestimated Nvidia’s H100 ramp in the past two years, I believe the market is poised to make the same mistake again. This is in part because it may be more cautious with its estimates after Nvidia’s explosive market cap growth.

However, based off Nvidia’s statements about its contracted supply for the next twelve months as well as pricing strength related to DGX B200 systems, I believe we are seeing a continual Data Center GPU shortage that is set to massively benefit both Nvidia and AMD. The pricing landscape is set to strengthen as well, meaning my estimates may be conservative even if Blackwell chips go for more than, say, $30k a piece. In my opinion, the market drastically underestimates Nvidia’s Blackwell-related top-line potential. Even a relatively moderate 4M Blackwell shipment volume and a modest price of $25k is set to add $100B in revenues to Nvidia’s business in the twelve months following the release of the Blackwell GPU. Investors should not make the same mistake they made in early 2023: the GPU shipment ramp is just getting started.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.