Summary:

- Nvidia Corporation’s stock surged by nearly 8% recently, but this doesn’t warrant a downgrade or selling the stock.

- The new Blackwell architecture, announced in early 2024, significantly outperforms previous architectures and competitors.

- The strong Blackwell demand materialized with GPUs booked for another 12 months, setting Nvidia for a bright future.

- Nvidia remains a strong investment due to its leading position in the AI space, which is not just a story, as there are ever-increasing numbers behind it.

BING-JHEN HONG

For anybody even barely interested in the ongoing AI revolution and technological sector, Nvidia Corporation (NASDAQ:NVDA) doesn’t need an introduction, as it’s the business that, I believe, is the most capable of capitalizing on these secular trends (as I stated within my latest article covering the company).

Not long after the publication, NVDA’s stock price increased by nearly 8%, making an entry point a bit less attractive. However, is that a reason to downgrade my previously assigned rating or consider selling? I don’t think so.

Blackwell Brings AI Computing Into New Era

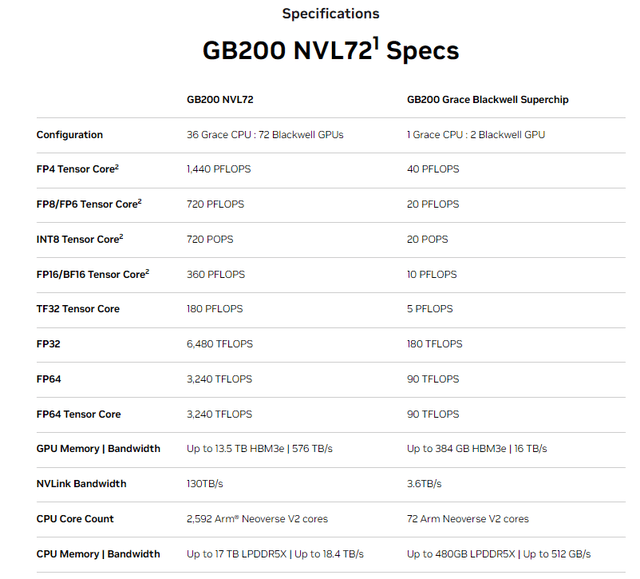

For those unacquainted with the “Blackwell” term — it’s the newest Nvidia architecture announced in early 2024. Blackwell brings about a massive upgrade in the computing era, significantly outperforming not only NVDA’s peers but also its own previous architecture (Hopper), with GB200 NVL72 featuring:

- Speed: four times as fast model training speed

- Throughput: thirty times as much real-time throughput

- Energy efficiency: 25 times higher energy efficiency.

Blackwell sets a new standard for the computing era regardless of the key metric we consider, whether floating-point operations for different tasks or memory bandwidth. If you are willing to get a better grasp of Nvidia’s competitive edge in the GPU market and, thus, the computing/AI space, please review the article linked in the beginning.

Nvidia Is Breaking The Bank With Blackwell

Nvidia’s journey with Blackwell wasn’t all roses. A few months ago, the company informed its customers that the Blackwell rollout would be delayed by at least three months due to some design flaws. Fortunately, those issues were solved quickly, allowing the company to get back on the previous schedule and ramp up production in Q4 2024.

Since then, CEO Jensen Huang provided several comments indicating his positive outlook on Blackwell’s schedule, demand, and future impact on the data center space. Let me quote one of my favorite statements truly presenting the power that Nvidia has over its customers:

Blackwell is as planned, and the demand for Blackwell is insane. Everybody wants to have the most, and everybody wants to be first.

Does that surprise me? Not at all. Despite what AI skeptics claim, the revolution and increasing adoption of generative AI solutions are not just a story; continuously rising numbers are standing behind it. There is no need to limit yourself to examining Nvidia’s results; the demand for such solutions is evident even within the results of Nvidia’s most prominent clients, including Microsoft (MSFT) and its ever-growing demand for Azure and Copilot.

As a result, big techs keep racing to provide the best hardware that could facilitate their innovative solutions based on large language models (LLMs). Microsoft expected to have up to 65-thousand GB200 GPUs in Q1 2025 a few months ago. And Microsoft, one of the leading AI players, wasn’t the only one striving for the Blackwell hardware:

Google (GOOG), Meta (META), and Microsoft are among those betting billions on Nvidia’s GPUs amid an AI arms race. Google has ordered more than 400,000 GB200 chips, The Information reports, in a deal valued well north of $10 billion.

Meta also has a $10bn order, while Microsoft was expecting to have 55-65,000 GB200 GPUs ready for OpenAI by the first quarter.

The latest intel on the schedule and demand

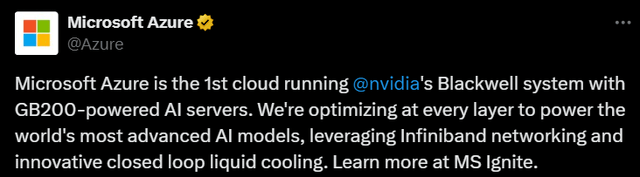

Well… It’s just like Jensen stated: Everybody wants to be first. So does Microsoft, which recently posted that its cloud solution (Azure) is the first cloud environment utilizing the Blackwell architecture:+

And here’s the big one: how does the order pipeline for the upcoming 12 months look? It’s IMPRESSIVE, as Blackwell processors are sold out.

That’s the insight that Data Center Dynamic has recently shared. While it paints a bright picture for Nvidia’s future results, it wasn’t surprising to me, given the giant technological leap Blackwell provides.

According to Moore, the product rollout is on schedule and Nvidia’s Blackwell GPUs are “booked out 12 months,” meaning customers who have not yet placed an order with the company won’t receive any Blackwell products until late 2025.

The Blackwell architecture sets a new stage for the whole AI revolution theme, heavily increasing computing power for major technological players. That only leaves me wondering what this field will look like and how the leading solutions will evolve in the upcoming years.

Investment Thesis and Valuation Outlook

As an M&A advisor (a fancy name for advising on buying and selling businesses), I usually rely on a multiple valuation method, which is a leading tool in transaction processes. It allows for accessible and market-driven benchmarking.

Nvidia’s current forward-looking EV/EBITDA stands at ~40.4x, which may seem high for investors accustomed to more stable and less innovative sectors (e.g., consumer staples).

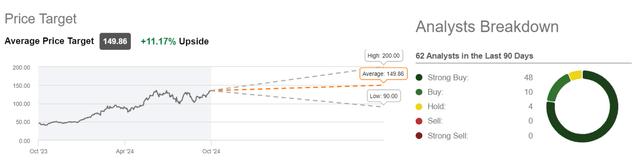

However, investors have to keep one thing in mind. We don’t invest for past results — we invest for the future. I believe that Nvidia’s future keeps on getting brighter and brighter. I recently assigned it a “strong buy,” and recent insight into Blackwell’s demand and schedule led me to reiterate this thesis.

Nvidia is the best business capable of capitalizing on the AI revolution. Even its Hopper infrastructure was state-of-the-art, and the Blackwell is a considerable leap forward. Specifications reflect that the demand reflects that, and enthusiasm expressed by the most prominent figures in the field reflects that.

For reference, Wall Street Analysts’ average price target implies a ~11% upside potential, with most analysts expressing a “strong buy” rating during the last 90 days.

While the upside potential story, as well as the numbers behind the ongoing AI revolution and Nvidia’s rightful place driving the process, paint an optimistic picture; investors have to be aware that there are market and company-specific risk factors to consider, which include:

- any technological issues leading to delays or below expectation performance of Blackwell GPUs

- supply chain disruptions resulting from increasing geopolitical tensions

- uncertainty regarding the economy and interest rate environment

- high stock price volatility driven by a good deal of news surrounding the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information, opinions, and thoughts included in this article do not constitute an investment recommendation or any form of investment advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.