Summary:

- Carnival Corporation has rebounded from COVID-19 disruptions, showing strong operational performance and debt reduction, making it a compelling buy.

- Despite past struggles, Carnival’s record operational results and debt refinancing prospects indicate significant future value.

- Risks include potential new pandemics and regulatory changes against cruise ships due to environmental concerns.

- With improving financials and upgraded guidance, now is an excellent time to invest in Carnival.

NANCY PAUWELS

Personally, it almost feels like a lifetime ago when COVID lockdowns heavily disrupted everyday life across the world. Few sectors were as severely impacted as the travel and leisure industry. Carnival Corporation & plc (NYSE:CCL)(NYSE:CUK) had to issue equity and debt capital to secure its future. Now, the share price is still far from its highs, but the tides seem to have turned for the largest cruise company in the world. With several positive developments in the near future, Carnival is a clear buy.

Company Overview

Founder Ted Arison started in 1972 with a single second-hand ship and managed to build out his enterprise at a rapid pace. Two years later he bought out his partners for 1 dollar and the assumption of $5 million in debt because the business was still struggling. From there on out Carnival went to acquire competitors such as Holland America Line, Costa Cruises and P&O Princess to become the largest global cruise company with 92 ships in service at the end of fiscal 2023. Besides the cruise ships, Carnival also owns and operates port terminals and hotels. It even owns a few private islands in the Caribbean.

The company went public in 1987 with a listing on the New York Stock Exchange and has since 2003 a second listing on the London Stock Exchange. So for investors who are looking to invest in pound sterling, the UK market is an option.

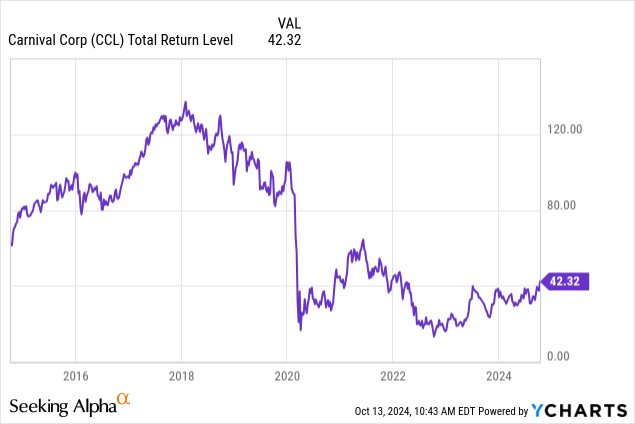

Looking at the chart below of the total return of the last ten years, it is pretty obvious what a wreckage Corona was for Carnival. I know that there are people who look at such a graph and say ‘horrible chart, not going to touch it’, but they might be missing out on an opportunity here.

Why Carnival? Why Now?

To be fair, until recently, I never looked at cruise vacations. And also cruise operators were largely off my radar. From a business perspective, operating cruise ships requires significant capital because, well, cruise ships are enormous and expensive. So much of the operating cash flow is simply going to go capex, if the company wants to keep the status quo. So it is far from an asset-light business model that allows for more optionality of the cash flow. There are other things that raise my eyebrows a bit such as the fuel consumption and emissions of a single vessel, which is enormous.

Also, I remember the initial phase of the pandemic when cruise ships seemed to be terrible to be on as a passenger. Many ports banned them from entering, and you were just stuck on board with a highly contagious disease going around. The word ‘quarantine’ actually comes from the Venetians. During the time of the Plague, they forced ships to stay out at sea for forty days before entering their ports. More recently the Venetians were again defending against ships. Cruise ships this time because they actually damage the lagoon on which the city is built. So they banned them.

So, perhaps I should now repeat the subtitle: Why Carnival? Why now? Well, things are finally looking up. Perhaps it is best summed up by one of the first pages of their most recent earnings release:

Source: Carnival Corporation 3rd Quarter Presentation

The seven-fold use of the word ‘record’ hinted that Carnival is actually operating rather well. One should note that it does not mention record net profit or EPS. Because here the result of the pandemic comes into play, when Carnival issued a large amount of new shares and took on billions of extra debt on the balance sheet. The denominator effect of these new shares together with the interest payments make the bottom line per share not that impressive yet. But there are a few tailwinds for the shares, which makes now a good time to get onboard. Besides the fact that operations are doing really well, CEO Josh Weinstein has commented that bookings for both 2025 and 2026 are at record starts. Another factor that should contribute relates to debt. The FED seems on a path of lowering rates and this should help refinance Carnival at lower rates at some point. Together with the reduction of net debt over the last few years and the recent credit rating upgrades, interest costs can be expected to be on a steady decline. This should be by far the biggest value driver for Carnival in the coming years.

Financials

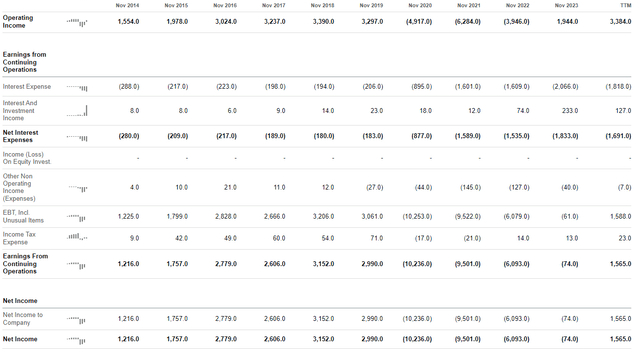

To explain why the key to future performance lies with the debt story, first let’s have a look at how the current income statement stacks up to the pre-COVID situation:

Source: Seeking Alpha

As can be seen above, operating income is almost at the record level for FY2018 (not adjusted for inflation). The big difference really lies in the net interest expense. This ballooned by about a factor ten and now reduces operational income by around 50%. Now, my expectation is that the combination of increased operation performance together with the reduction of net interest expenses will be a massive boost over the coming few years. Of course, as long as no new pandemic hits. Now let’s move on to some important numbers on the balance sheet:

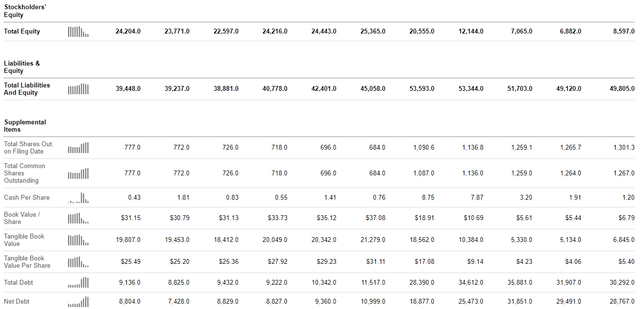

Source: Seeking Alpha

For me, this snapshot really summarizes what I already wrote before: new shares were issued and massive assumption of debt took place at the start of this decade. The most important thing here is the fact that over $3 billion in debt has been reduced since Carnival’s peak net debt and that the amount of equity is growing again. The reduction in net debt so far is not that impressive, but again, that makes now such a good opportunity since the signs are there that it should come down more quickly from this point on. The fact that Carnival is already becoming less risky, makes it less of a speculative opportunity than it was just a few years ago.

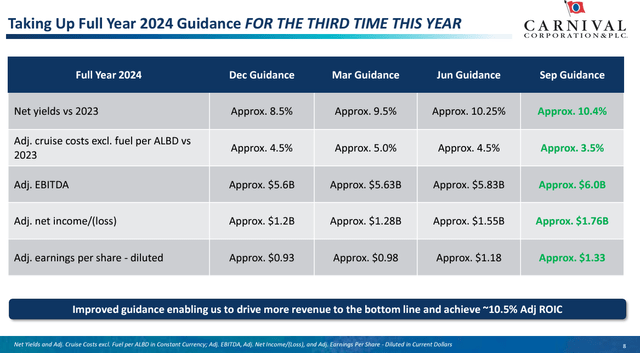

The performance is now such that management can upgrade its guidance for this year every single quarter:

Source: Carnival Corporation 3rd Quarter Presentation

Valuation

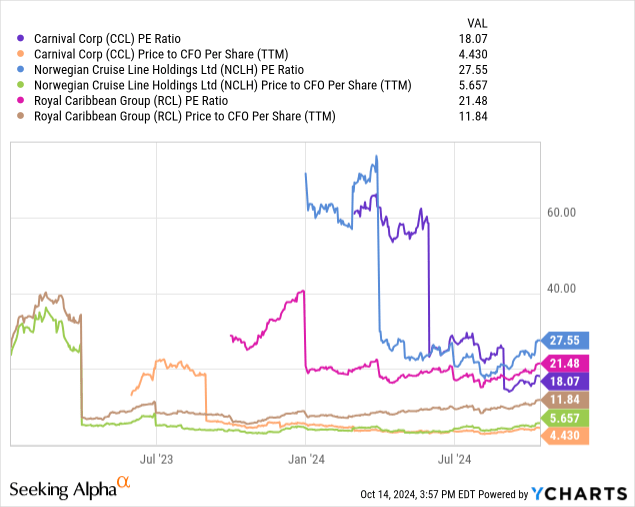

Hopefully, at this point it has become clear that the thesis of this investment case very much depends on the improvement of operations and the reduction of the debt burden. Given the recent history of Carnival, comparing it to previous years has limited use because the capital structure has changed so drastically and there were large losses during COVID. Comparing Carnival to its nearest peers Norwegian Cruise Line Holdings Ltd. (NCLH) and Royal Caribbean Cruises Ltd. (RCL) seems to be fitting.

Based on the above it becomes clear that in terms of the selected ratios, Carnival is somewhat cheaper than its peers. I would add that the balance sheets of both other cruise liners are also not in great shape since they went through similar experiences.

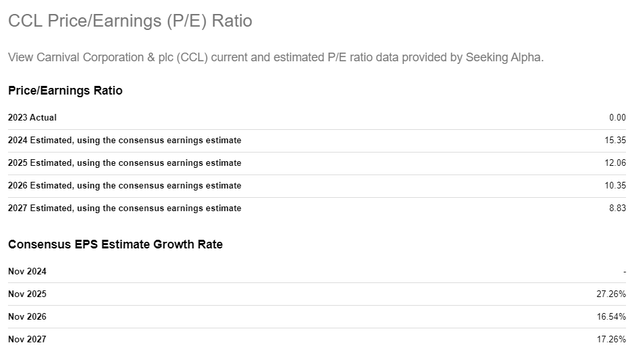

The forward-looking picture is from my perspective what makes Carnival a value pick at its current price:

Source: Seeking Alpha

If these earnings estimates hold true, Carnival is trading at 8.8 times its November 2027 earnings. Without multiple suppression, the stock can trade at double its current price by then if the earnings develop accordingly. Given the fact that management has raised its guidance so far each quarter this year, and they indicated bookings look really good for 2025 and 2026, I am assuming that earnings can top these estimates.

Risks

The start of this decade clearly showed that a pandemic can be a significant risk factor to the travel and leisure industry. It wreaked havoc on Carnival and its peers. If something similar occurs within the next few years, it might be the end for Carnival if it has not yet recovered.

What also could be a major risk factor is regulation against climate change. Cruise ships are highly pollutive and only function as a form of entertainment. Popular opinion could make politicians take steps against them. And if not for climate reasons, there can be other reasons such as the prevention of over-tourism, which is becoming a real issue in places such as Barcelona for example. Being ships, they could then just dock somewhere else.

Conclusion

The effects of COVID were devastating for Carnival. It suffered massive losses and needed to attract significant capital. This has to this day reduced their bottom line. However, they have turned a corner. Operationally it is producing record results and the efforts to reduce the debt burden are paying off. Management can now keep boosting their guidance. The share price has still been somewhat muted, but with the business improving like this it will surely follow. With the current guidance for the coming two years, it seems to be smooth sailing. Now is therefore an excellent time for an entry. For that reason, I rate Carnival a buy.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 14. With cash prizes, this competition — open to all analysts — is one you don’t want to miss. If you are interested in becoming an analyst and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of CCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.