Summary:

- TSMC investors likely expect a blockbuster Q3 earnings release as TSM nears its all-time highs.

- The challenges facing Intel and Samsung have strengthened TSM’s status as the preferred AI foundry.

- TSMC’s ability to deliver the much-needed AI chips for Nvidia and AMD is critical to sustaining its high capacity utilization and tech roadmap.

- I explain why TSM stock is still dirt cheap, as investors have likely reflected execution and geopolitical risks.

- With TSM closing in on its July 2024 peak, investors should consider adding more exposure in anticipation of a decisive breakout. Here’s why.

BING-JHEN HONG

TSMC: Outperformance Shouldn’t Surprise Investors

Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) investors have helped the stock of the leading semiconductor foundry to close in against its July 2024 all-time highs, outperforming the S&P 500 (SPX) (SPY). TSMC will deliver its third-quarter earnings release on October 17 as investors assess whether the AI growth inflection could be sustained further.

In TSMC’s recent September revenue report, the foundry posted a nearly 40% YoY surge in revenue, outperforming Wall Street’s estimates. Consequently, it should position TSM well to outperform its Q3 outlook, corroborating the revival of the AI infrastructure investment thesis. Analysts have upgraded TSMC’s estimates, bolstering its buying optimism (“A” momentum grade).

TSMC Remains the Preferred AI Foundry

Several critical developments have occurred since my TSM stock upgrade in July 2024. In my previous article, I emphasized the foundry’s capabilities to maintain high utilization in its advanced nodes, driven by the AI growth inflection. It has also committed to double its advanced packaging capacity to improve its supply chain resilience in delivering the most cutting-edge AI chips. Coupled with the challenges that have beset Samsung Electronics Co., Ltd. (OTCPK:SSNLF) and Intel Corporation (INTC), I assess that TSMC’s competitive advantages should gain even more traction. As a reminder, Intel’s turnaround is facing significant underlying difficulties. Therefore, I assess that INTC might not significantly threaten to gain more market share in AI chip production in the near- and medium-term.

NVIDIA Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) are locked in an intense battle to redefine leadership at the top of the AI chips hierarchy. However, Nvidia’s market dominance isn’t expected to be unhinged by AMD’s resurgence for now. Given the high demand for Nvidia’s Blackwell chips, AMD’s AI event has failed to overshadow Blackwell’s previous production delays. Therefore, TSMC and Nvidia seem to have resolved the most teething issues in Blackwell’s production. Hence, I assess that it should improve the clarity in TSM’s forward guidance, as the market anticipates the start of volume shipments of Blackwell chips.

Apple Inc.’s (AAPL) iPhone 16 launch event hasn’t led to a near-term AI smartphone upcycle. Recent indicators suggest buyers have remained cautious, given the staggered rollout of Apple Intelligence in its leading iPhones. However, investors must note that TSMC’s most promising growth driver should be predicated on high-performance computing, particularly in AI chips. As a result, I expect the market to scrutinize management’s commentary on potentially improved outlook and gross margin accretion in its upcoming Q3 report.

TSMC’s Profitability Expected To Stay Robust

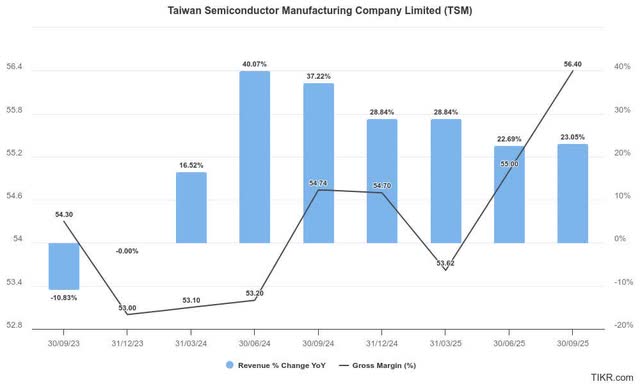

TSMC quarterly estimates (TIKR)

Given TSMC’s remarkable performance in its Q3 revenue update, analysts expect TSMC to deliver more than 37% revenue growth in the quarter. It’s well above the foundry’s midpoint outlook of $22.8B, corroborating the market’s optimism. In addition, its gross margins are also forecasted to be above the company’s midpoint guidance of 54.5%.

As a reminder, management emphasized that TSMC’s profitability growth drivers will depend on the improvements in its capacity utilization, even as it deals with rising operational requirements and costs. Therefore, investors will likely scrutinize management’s update on Blackwell’s supply chain visibility, including the capacity for advanced packaging. Given Nvidia’s constructive commentary on the “sold-out” status of its Blackwell chips, execution is critical for TSMC to mitigate the issues encountered in its previous delayed production.

AMD raised the TAM for AI accelerators to $500B by 2028, providing a “clear” runway for growth as it competes against Nvidia’s market leadership. Therefore, I assess it should bolster TSMC’s long-term revenue outlook of “slightly above the mid-20s,” strengthening its preferred AI foundry status. Samsung’s challenges against SK Hynix in the memory business have led to its recent stock underperformance. Therefore, it should bolster TSM’s appeal as the leading AI foundry for semiconductor investors, lifting its upward momentum further.

TSM Stock: Valuation Doesn’t Seem Aggressive Yet

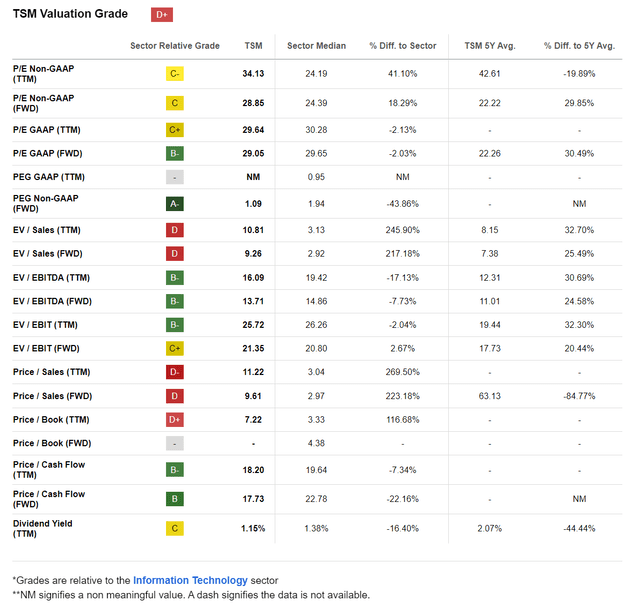

TSM valuation metrics (Seeking Alpha)

TSM’s forward adjusted PEG ratio is more than 40% below its tech sector (XLK) median, underpinning its relative undervaluation. However, it’s also crucial for investors to understand that TSMC’s free cash flow profitability could vary in response to more aggressive CapEx investments moving ahead.

Recent reports suggest TSMC could source more opportunities to grow its foundry exposure in Europe and the Middle East. While TSMC is expected to benefit from the long-term AI growth thesis, concerns about AI overinvestment risks cannot be understated.

Therefore, high long-term capacity utilization will be crucial to justify the potentially higher costs of setting up complete foundry supply chains out of its home base in Taiwan. Despite that, it could improve the market’s perception of improved diversification from intensified geopolitical headwinds between the US and China. Therefore, I expect the market to remain cautious about TSM’s valuation bifurcation (relative to its growth prospects), even as the stock attempts to scale new heights.

Is TSM Stock A Buy, Sell, Or Hold?

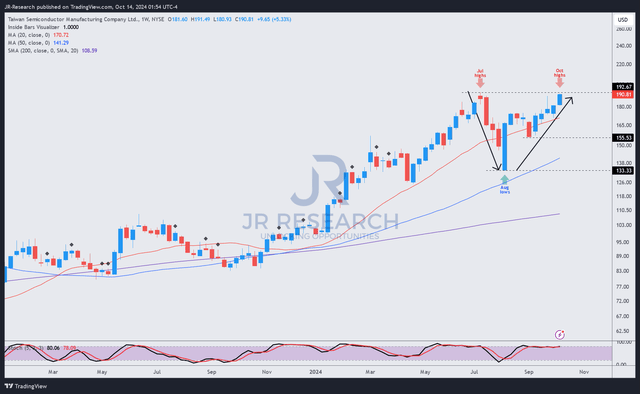

TSM price chart (weekly, medium-term, adjusted for dividends) (TradingView)

As seen above, TSM has nearly re-tested its July 2024 peak, recovering remarkably from its August 2024 lows.

Robust dip-buying has helped sustain its recovery momentum, as AI investors likely reallocated, notwithstanding the current geopolitical risks. TSM’s relatively attractive PEG ratio suggests investors are likely aware of the cyclical risks attributed to potential AI overhype risks. Despite that, the stock’s uptrend bias has remained robust over the past year, suggesting it could soon break out.

Near-term volatility is anticipated as investors anticipate the release of its Q3 scorecard. However, I expect recent buyers to remain on board unless management lifts its CapEx estimates significantly, potentially impacting its gross profitability. Moreover, a potentially more confident outlook by management could help TSM surpass its July 2024 highs as the AI thesis continues to gain traction.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSM, AAPL. NVDA, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!