Summary:

- Tesla, Inc.’s robotaxi event left a lot to be desired, which, as discussed by CEO Elon Musk, means you shouldn’t be an investor in the stock. The robotaxi event was underwhelming, pushing shares down 9% and raising doubts about its autonomous driving technology and competitive positioning.

- Tesla’s robotaxi strategy lacks verifiable progress, with competitors like Waymo significantly ahead in full self-driving technology and revenue generation.

- Tesla’s 3Q 2024 vehicle sales indicate stagnation, with growth flat lining and margins declining, suggesting the company is hitting a peak.

- Valuation analysis shows Tesla is overvalued, with its vehicle and energy storage businesses worth significantly less than its current market cap.

Eli Wilson

Tesla, Inc. (NASDAQ:TSLA) dropped 9% today and sits almost 50% below its 52-week highs after debuting its robotaxis at an event that included Optimus robots bartending drinks. This event was hotly anticipated after comments by CEO and largest shareholder Elon Musk, including:

People who don’t believe in Tesla’s ability to conquer the obstacles to fully autonomous driving “should not be an investor in the company,” Mr. Musk said in April. – NYT.

As we’ll see throughout this article, the lack of a sustainable and competitive robotaxi strategy combined with struggles in the core business will lead to minimal long-term success for Tesla versus its current share price.

Robotaxi Vision

Tesla announced the long-awaited robotaxi at the event.

Cathie Wood, a well-known Tesla bull, has the majority of its model based on its view of Tesla’s robotaxi success, which it defines as a multi-trillion dollar opportunity. The company has said that it hopes to be producing the cybercab by 2027, for less than $30k. Details, of course, on how it would manage to do that were incredibly scarce.

However, there are 2 things to note.

(1) Tesla is behind on a full self-driving (“FSD”) vehicle. The company announced that it plans to have unsupervised full self-driving in the next year in Texas and California. The company’s robotaxi fundamentally relies on the premise that the company can build a FSD vehicle that’s road legal across the country. Keep in mind this is a decade behind Elon Musk’s original promises, and once again this was light on details.

Keep in mind this is also the same company that is having customers complain about “Phantom Braking” which is happening with a customer behind the wheel. The company that can’t solve Level 2/3 self-driving with issues for months isn’t a year away from Level 5 self-driving.

However, Google’s (GOOGL) (GOOG) Waymo has had FSD taxis running in SF for 3-years and the company recently opened up access to anyone. The takeaway? Not only is Waymo several years ahead of Tesla, by Tesla’s own admission, but Waymo is actually proving it through earning revenue today from their positioning. Tesla has a history of missing its targets, but even with its targets it’s behind.

As analysts said:

TSLA did not provide verifiable evidence of progress toward L3 autonomous technology, which makes it difficult to assess feasibility of the targets outlined at the event given there is no precedent for achieving higher levels of autonomy using a vision-only approach (instead of a sensor-fusion approach) – CNBC.

(2) The second part is the cost of this taxi.

The company has announced it’s building an all-new vehicle to launch in 2027 at <$30k. This is the same company that is now >4 years behind the announced Roadster, and is behind on the semi as well. This is also the same company that abandoned plans for building a lower cost vehicle initially after it couldn’t compete with Chinese companies.

As analysts said:

Musk provided few details about the actual costs of the vehicle, he added, and gave an “underwhelming” answer when asked about timing of the rollout. – CNBC.

The company, which has a history of being wrong on its vehicle forecasts, we expect to be wrong again.

Tesla’s pre-3Q Results

In parallel, Tesla has given an initial indication of the company’s 3Q 2024 results.

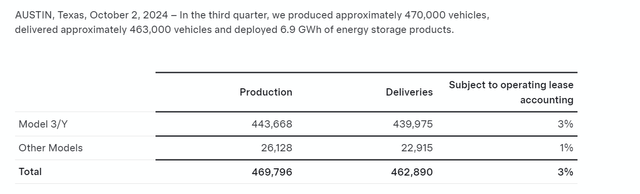

The company continues to see its business primarily carried by the Model 3/Y with 444k vehicles produced and 440k vehicles delivered. Other model production was 26k, with deliveries at 23k. While it’s a relatively strong quarter for the company, it’s below both 2Q 2023 and 4Q 2023 for the company and represents how the company has effectively flat lined.

The company that was once forecasting 40-50% a year in growth to 5+ million vehicles. Now it’s going to be a tossup on whether 2024 represents growth over 2023. In our view, the company seems to be hitting a peak with both EV demand and new competition. It has lost the market leader position in China, and Americans are less interested in owning an EV.

This combination could represent a cap on the company’s future. We discussed the company’s last quarter earnings in more detail here. However, a key highlight was the company’s margins flat lining in recent quarters, with a YoY decline. That is a sign of the company regressing to the mean.

Valuation

Tesla, in our view, effectively has two businesses worth caring about.

The first is vehicles. It makes and sells almost 2 million vehicles/year with a positive gross margin. That’s nothing to scoff at. A giant like Toyota has slightly higher operating margins, and sells 10 million vehicles/year. The company has an ASP ~$31k USD, versus ~$46k for Tesla. That means Tesla is at ~30% of the revenue, which would value the car business at $80 billion.

Let’s be generous and say Tesla has much larger future growth opportunities, and give it a semi-arbitrary 50% premium ($120 billion).

The other business is energy storage, at ~7 GWh in the most recent quarter. That’s ~$2 billion in a growing business. The growth rate of the business is double-digits, which highlights its strength. The sector has higher margins than vehicles, even though before the company would direct batteries from energy storage towards vehicles.

However, with the business 10% the size of vehicles, even 20%/year growth for the next decade won’t get the business valuable enough. Still, we can model 1/10 the vehicle business * 1.5x margins * 5x (generous multiple for growth potential). That values the business at ~$85 billion, putting Tesla’s total value at just over $200 billion.

That’s less than a third of the company’s market cap, and highlights how Tesla is overvalued.

Thesis Risk

The largest risk to our thesis is that Tesla has shown an ability to get involved in new markets. The company used its battery technology to move into megapacks. Additionally, there’s strong government pressure to increase EV adoption and the company is a major player. That could impact future growth potential.

Conclusion

Tesla had an underwhelming robotaxi event, pushing the company’s share price down by almost 10%. We’re not surprised, Elon Musk himself has said the company is not worth investing in if you don’t believe in its robotaxi goals. Last night showed that the company’s robotaxi goals are questionable. It has yet to prove the technology.

On top of not proving the technology, it has issues with existing FSD, and it’s behind competitors such as Waymo especially, and General Motors’ (GM) Cruise. The company’s vehicle sales for 3Q seem to have shown its growth petering out, and the company’s megapack business is strong but fairly minimal. As a result, we expect Tesla to continue its struggles.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.