Summary:

- Last year, I gave AT&T a buy rating because the stock was extraordinarily cheap and had a high, well covered yield.

- The rating worked out well, with AT&T stock having rallied some 40% since I covered it.

- Today, AT&T is at 10 times earnings with no growth.

- It still has comparatively low multiples, but isn’t the “deep value” play it once was.

- In this article, I explain why I’m downgrading my AT&T rating to hold.

jetcityimage

The last time I covered AT&T (NYSE:T), I rated the stock a buy on the grounds of its extremely cheap valuation and then-recent earnings beat. Since then, the stock has risen 27% and delivered a 33% total return. Despite the high returns since I last covered it, AT&T has not grown its revenue much, and its earnings have actually declined. Its free cash flow has increased, but only marginally.

AT&T does have something of a growth catalyst in the form of interest rate cuts: due to its high debt level, lower rates should increase AT&T’s profits somewhat. However, this is about the only catalyst that AT&T has right now, and it is not the kind of catalyst that will keep providing growth for many years to come: once rates hit a bottom, they will trigger ‘growth’ in AT&T’s earnings for about a year after that. In later periods, when the company has the effect of lower rates in both the current and base periods, there will be no further growth from the interest rate catalyst.

Apart from the Fed’s interest rate cutting, it’s hard to see what could spur growth at AT&T. The telco giants have little pricing power according to PwC, an observation that is corroborated by the decline in the cost of phone plans over time. AT&T and its competitors do have some room to gain revenue by taking customers from one another, but with a few large companies having saturated the market already, growth from that channel will be limited.

When I last covered AT&T, the stock was so cheap that it was worth the investment even in a 0% growth scenario. At that time, T traded at seven times earnings and 5.85 times free cash flow. The article published on January 4 of this year, meaning that the company had $2.85 in FCF per share in the 12 months prior to the publication date. $2.85 discounted at 10% is worth $28.50, and T stock traded at just $17.25 when I wrote about it. I felt that this level was far too cheap, given that the stock would be worth at least $28.50 if it could simply maintain its free cash flow with no growth. Incidentally, this fact still holds true: the current stock price of $21.30 is considerably less than the company’s free cash flow discounted at 10% with no growth assumed. However, the gap is smaller now, and AT&T’s top-line growth was negative in the most recent quarter. I did not foresee such negative revenue growth when I last covered AT&T; it calls into question whether the company can, in fact, maintain its current level of free cash flow. For this reason, I think that AT&T is less worth the investment today than it was when I last covered it.

With that being said, I don’t see AT&T as a clear sell today. I think that shorting the stock now would be a mistake, given that it has the interest rate catalyst and remains optically cheap. However, had I bought T shares around the time I last covered it, I would be trimming the position today, probably by as much as 50%. In the ensuing paragraphs I will explore why my thinking on AT&T has evolved the way it has.

Competitive Position

When analyzing any company, it helps to start with its competitive position because said position largely determines whether the company’s growth and profitability can continue into the future.

AT&T’s competitive position is mixed. Morningstar (MORN) gives it a narrow moat rating, but notes that it and its largest competitors Verizon (VZ) and T-Mobile (TMUS) control 90% of the prepaid and postpaid phone plan market in the United States. This fact indicates that the three of these companies have considerable market power. Indeed, the fourth place player, Comcast, has only 7 million mobile customers, compared to nearly 200 million for AT&T. So the big players in mobile have that business pretty well on lock. That hasn’t stopped phone plans from getting cheaper over time; however, AT&T recently hiked fees on its older unlimited plans by $10 to $20, indicating that perhaps it bucks the trend of low or no pricing power in the telecom industry.

One problem for AT&T in recent years has been its heavy spending on 5g and other network infrastructure upgrades. This spending has resulted in the company’s capital expenditure being greater than net income in most recent periods. Unfortunately, such infrastructure upgrades merely allow telcos to retain customers, they do not provide significant growth. On the other hand, if telcos skip out on such spending they risk losing customers as word of their competitors’ faster speeds gets out. This aspect of AT&T’s competitive position is not a positive.

Recent Earnings

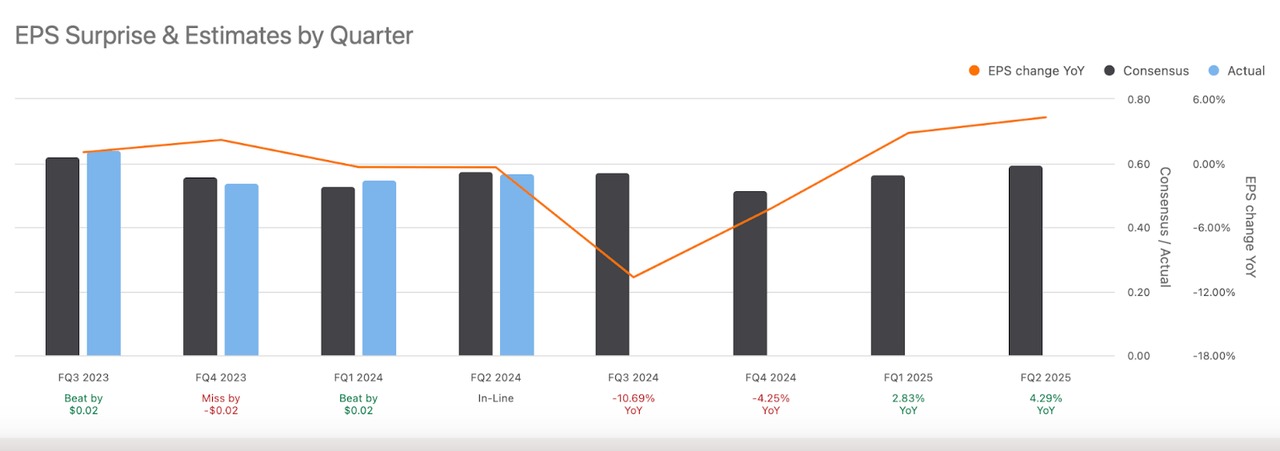

AT&T’s recent earnings performance has been mixed. The company scores a ‘C’ on revisions in Seeking Alpha Quant, with slightly more beats than misses in recent quarters. That’s not bad but not especially good either.

AT&T Revisions (Seeking Alpha Quant)

As for the content of these releases, it has been underwhelming. The most recent quarterly earnings release showed a decline in revenue and earnings, but a slight increase in free cash flow. The interest expense declined somewhat from the prior two quarters–that was a definite positive, but like I said at the beginning of the article, earnings improvements from lower rates can only take a company so far. Guidance was for $17 to $18 billion in full-year free cash flow, which would be essentially unchanged from 2023 free cash flow. So, investors have been told not to expect any growth, essentially.

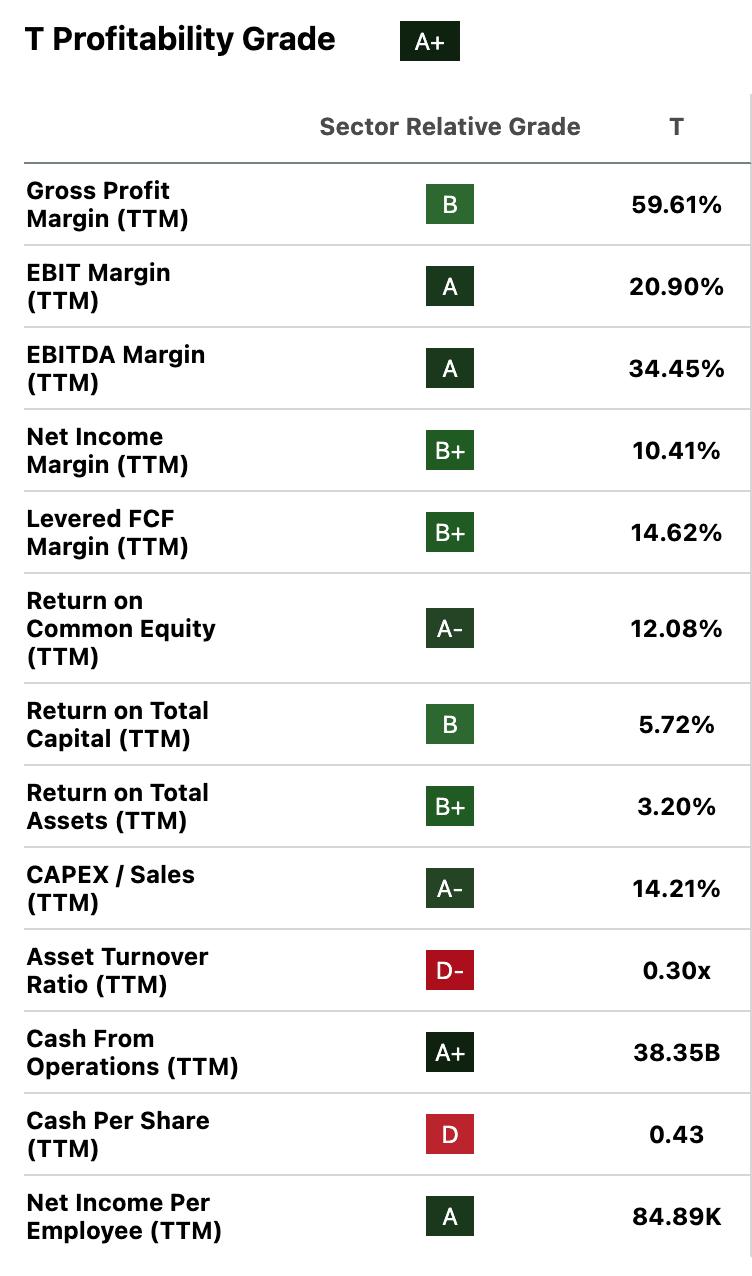

Profitability

One factor that AT&T has going for it is profitability. T stock scores an A+ on profitability, with higher margins and returns on equity than its sector across the board. Granted, margins in the telecom space are not usually extraordinarily high. However, AT&T’s 14.6% free cash flow margin and 12% return on equity are pretty good by the standards of most industries. So I’d say that AT&T scores well on profitability.

AT&T profitability metrics (Seeking Alpha Quant)

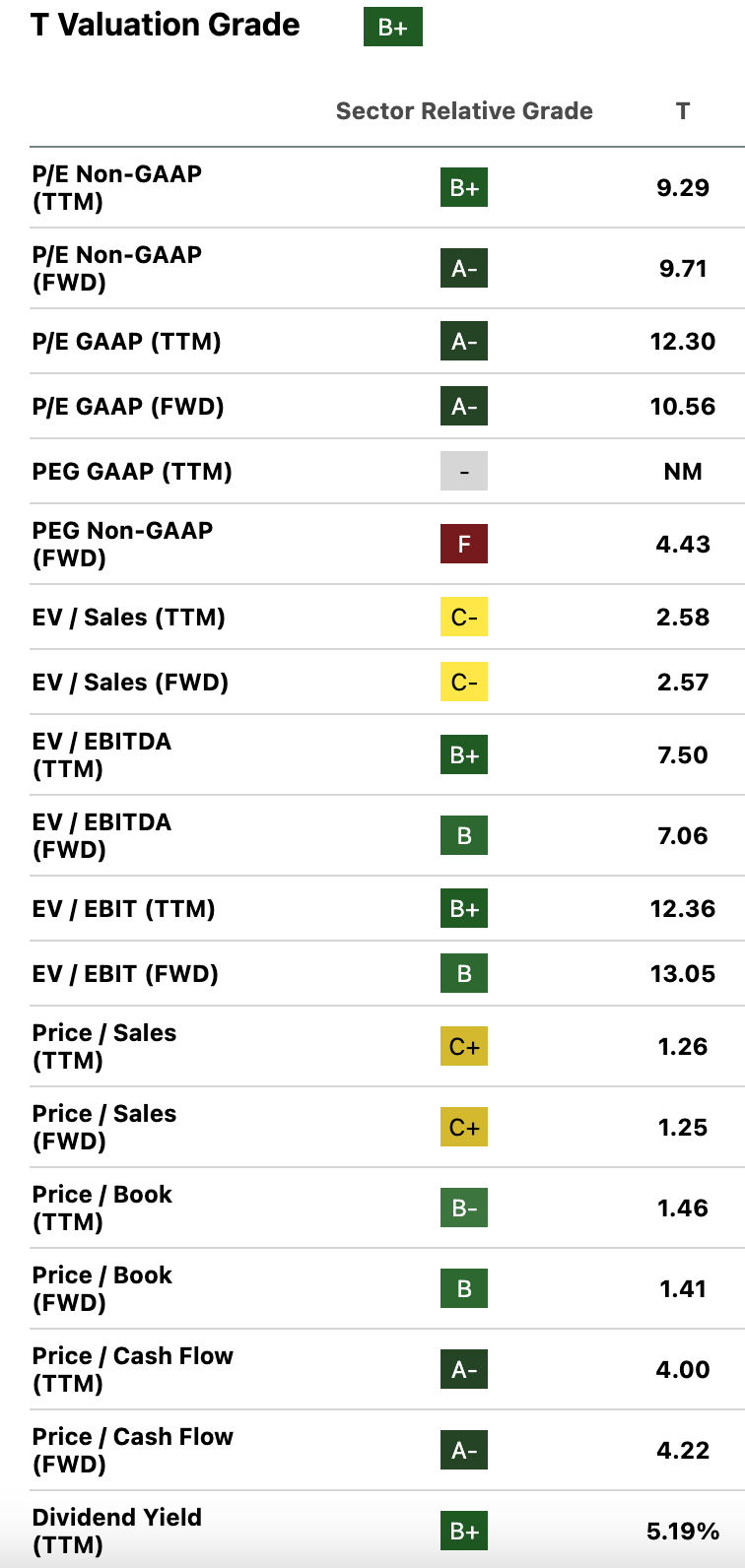

Valuation

Having looked at AT&T’s competitive position, earnings results and profitability, we can now proceed to value the stock. First, let’s look at the multiples that Seeking Alpha Quant has on file.

AT&T multiples (Seeking Alpha Quant)

These multiples are generally pretty low. However, they aren’t as low as they were when I last covered AT&T. At that time, the stock traded at a mere seven times earnings. It has gotten pricier in the interim period, which is a big part of why I’ve downgraded my rating.

However, the stock is not so pricey that it is necessarily a sell. The trailing 12-month free cash flow ($2.92) is worth $29.20 discounted at 10% and assuming no future growth. As I said near the beginning of the article, the fact that T’s revenue is declining calls into question whether the company can even maintain its free cash flow at the current level long term. However, the interest rate catalyst should produce a moderately positive impact on free cash flows in the near term. So I’d expect the company’s FCF to flat line in the next year or two, which is all it needs to do for its shares to be worth owning.

Over the longer term, I wouldn’t rule out AT&T’s cash flows declining. Lower interest rates can only take a company so far; once rates hit a bottom, they can’t reduce interest expenses and increase earnings/cash flows any further. So while I think AT&T can maintain its current level of profitability for another year or two, I can’t forecast the same over the long term with any confidence. For this reason, I’d be trimming my AT&T position now if I had bought the stock at the time I last covered it.

The Bottom Line

AT&T stock is relatively cheap. However, it has no growth, has guided for no future growth, and has no sustainable growth catalysts. It’s still worth having a bit of money invested in the stock, but those sitting on large gains would be wise to take some profits and invest the resulting funds elsewhere.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.