Summary:

- Mastercard possesses a sustainable competitive advantage through their leading presence in electronic payment infrastructure.

- Pandemic fallout looks to be clearing up, and a full recovery is likely to drive strong growth in the near term.

- Profitability metrics suggest impressive margin growth boosted by industry tailwinds.

- Despite valuation measures suggesting Mastercard is trading over value, analyst estimates are much more optimistic.

- The business model provides a sustainable revenue base, which, coupled with Mastercard’s moat, makes Mastercard a secure hold.

shaun

Investment Thesis

Mastercard (NYSE:MA) is the second-largest payment processor behind Visa (V), processing trillions of dollars in transactions each year and operating in over 200 countries. The firm has demonstrated its ability to maintain financial success even after its 2020 setbacks and is on pace to grow at a significant pace in the coming years. I cautiously recommend a buy in Mastercard for the following reasons.

Valuation

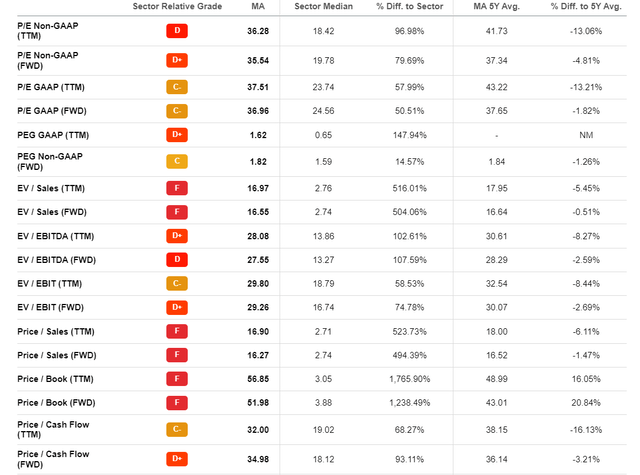

First, I’d like to deal with the elephant in the room. Seeking Alpha gives Mastercard’s sector-relative valuation an F rating, and they are not without cause.

Yes, yes, it’s a lot of red. However, I don’t think these metrics tell the whole story, and still think Mastercard warrants a buy. Here’s why.

Moat

Mastercard’s competitive advantage is compelling and sustainable. Their network within the financial service industry is incredibly broad, spanning millions of merchants across hundreds of countries. Their intangibles, such as their reputation, are solid due to their brand recognition and history in the industry.

As you’ll see below, projected growth in the electronic payment industry benefits Mastercard over its competitors due to its well-established network. Mastercard and Visa are by far the most well-established in terms of merchants and institutions. This network advantage enables the two firms to limit future cost of revenue increases, boosting margins at a superior rate compared to their competitors.

Industry Tailwinds Likely to Boost Earnings

Fundamentally, consumer spending habits increase by about 1.5-5% annually (excluding some abnormal economic downturn, such as after the 2008 crisis or 2020). This provides a healthy baseline level of growth for companies in the payment industry and essentially gives Mastercard (and companies like it) a built-in measure of inflation protection.

Adding onto this, electronic payments specifically have become increasingly relevant in recent years, with Forbes stating, “The digital payments market is set to grow globally at 19.4% CAGR between 2021 and 2028”. It is my prediction that even if the developed digital payment market becomes saturated, the advent of electronic payment in developing markets should yield healthy growth beyond the 2028 benchmark.

Mastercard stands to benefit greatly from these industry developments. A majority of its revenue share lays its foundation in transaction processing, domestic assessments, and cross-border volume fees — all areas that benefit from an improvement in the electronic/digital payment space. Therefore, I anticipate industry tailwinds to significantly improve revenue and margins in the future. This unique industry position helps to explain Mastercard’s high price.

Competition Analysis

A chart comparing Mastercard’s financial metrics to its competitors is shown below (all measures in 1000s of $)

| Price/Book TTM | Return on Equity TTM | EBITDA TTM | Total Revenue TTM | Price(daily)/Earnings | EV(daily)/EBITDA | Operating Margin TTM | Primary Industry | |

| Mastercard (NYS: MA) | 44.6 | 145.68% | 12,673,000 | 21,636,000 | 36.73 | 27.21 | 57.19% | Other Financial Services |

| Visa (NYS: V) | 11.48 | 43.48% | 19,535,000 | 29,310,000 | 31.11 | 23.09 | 67.15% | Other Financial Services |

|

Western Union (NYS: WU) |

11.63 | 202.08% | 1,251,400 | 4,668,400 | 6.64 | 5.43 | 22.49% | Consumer Finance |

| Fidelity National Information Services (NYS: FIS) | 0.99 | 2.03% | 5,094,000 | 14,486,000 | 45.29 | 10.56 | 10.71% | IT Consulting and Outsourcing |

| Global Payments (NYS: GPN) | 1.26 | 0.41% | 2,240,464 | 8,916,512 | 438.21 | 17.71 | 17.81% | Other Financial Services |

| Fiserv (NAS: FISV) | 1.93 | 6.89% | 6,225,000 | 17,363,000 | 32.13 | 13.56 | 17.66% | Financial Software |

| PayPal Holdings (NAS: PYPL) | 5.03 | 11.01% | 4,449,000 | 27,063,000 | 38.82 | 19.51 | 14.15% | Financial Software |

| American Express (NYS: AXP) * | 4.36 | 32.98% | N/A | 50,757,000 | 15.06 | N/A | N/A | Other Financial Services |

| Coinbase (NAS: COIN) * | 2.49 | -20.68% | -1,466,425 | 5,063,563 | N/A | N/A | -23.54% | Financial Software |

*Not all data available for these companies, data sourced from Morningstar, Inc.

Mastercard is clearly a major player in the financial services industry. Not only does their revenue and impressive profitability suggest a stable market share, but I believe reading between the lines helps to explain Mastercard’s high valuation.

Due to Mastercard and Visa having a superior network of merchants and lenders, I believe that their ability to capitalize upon industry growth presents the most promising growth potential among competing firms. However, Mastercard’s smaller size suggests more room for future growth than Visa, presenting it as the more attractive long position to me. I find the growth potential afforded to Mastercard to justify its current valuation.

Further, these financials also have specific advantages over its competitors. Perhaps most promisingly, its operating margin and ROE are exceptionally impressive, both implications of high profitability. These impressive margins are only more enticing when future earnings growth is taken into account.

The data expressed in this table also lead me to believe that while Mastercard’s revenue and margins remain strong, its price has not yet fully accounted for Mastercard’s unique industry position and 2020 recovery (discussed later). Thus, I find Mastercard’s growth potential to supersede its competition and help justify its current price.

Financials and the Buy Argument

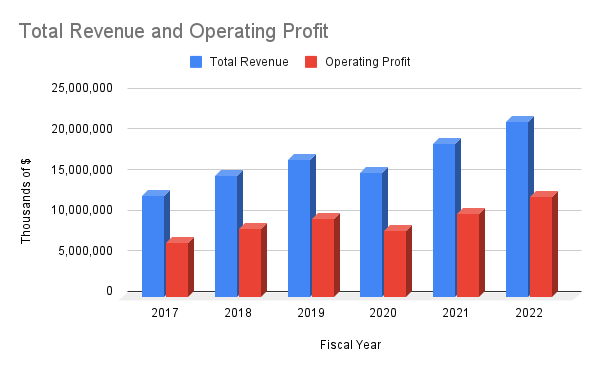

Overall, Mastercard’s financial health is very appealing. The company’s margins and projected growth are impressive, as shown below.

After 2020 dips in performance, Mastercard has bounced back stronger than ever. (Sourced from Mastercard’s 10k and 10q filings, but a summary can be found here)

The Author

Alongside this revenue growth, margins have returned to pre-pandemic levels (note that these are highly impressive, nearly rivaling Visa) and I suspect that they will continue to increase as electronic payments become more prevalent.

TTM P/E sits at levels similar to 2020 (a relatively weak year for Mastercard) despite a much more promising earnings outlook. This is yet another factor that leads me to believe that Mastercard’s valuation is reasonable.

Other measures are equally promising. EBITDA per share has risen 32.3% since its pre-pandemic levels, and TTM diluted EPS stands at 10.05, superseding 2019 and 2021 values despite Mastercard’s current price not yet regaining its highest peaks (suggesting that Mastercard has been historically “overvalued” by statistics, meaning its current valuation metrics are of little consequence when discussing a buy position). This, to me, implies that a buy in Mastercard is justified.

Another promising metric for the long position is that dividend growth has been very promising in recent years, more than trebling its value since 2017. Should even a portion of this dividend growth continue, I expect MA’s dividend yield to improve to a more competitive level of close to 1% in the near future.

FactSet analyst composites suggest a target price of $400 or $396.08 (median and mean of analyst estimates, respectively). Despite this sentiment, Mastercard still sits at a price ~5-6% lower than is fair, which I suggest capitalizing on due to their impressive revenue and earnings growth.

COVID Note

A big part of the 2020 dip in Mastercard’s performance came from a reduction in cross-border transfers (reduction in the global travel and general downturn) coupled with an increase in contra-revenue like rebates and incentives. However, cross-border transfer revenue has bounced back to levels close to pre-pandemic, and margins have improved since 2020 despite this contra-revenue increase.

I believe that the market price has not yet moved to fully accommodate Mastercard’s return to form, only up a few percent from its 2020 peak despite their much-improved earnings and dividend as well as much more promising growth prospects. This is another important factor that contributes to my impression of Mastercard as being undervalued.

Balance Sheet

While Mastercard’s total D/E ratio is unideal at 2.26, increases in assets have outpaced increases in liabilities in recent years and the D/E ratio is not a product of crushing debt, but rather minimal equity. Furthermore, much of recent liability increases and cash spending can be explained by recent strings of acquisitions (such as Ekata, Aiia, and Nets within 5 months in 2021). These acquisitions further suggest promising growth to me despite their negative effect on the balance sheet.

Since such moves, Mastercard has slowed down their spending and begun repairing their cash and cash equivalents. Not only does this suggest future balance sheet improvements, but this change in activity signifies to me that Mastercard has adopted a more forward-looking outlook that will focus more on maximizing earnings. This, coupled with a debt-to-assets measure of .37 and solid quick/current ratios, implies to me that Mastercard has a good handle on its assets and that the balance sheet presents no measures of concern.

Risks and Other Considerations

While Mastercard’s payment infrastructure yields a near uncrossable moat, there are still factors that could negatively affect Mastercard. Their most substantial risk as a company heavily reliant on consumer transactions is an extensive period of economic downturn. This would significantly slow growth rates, not dissimilar to what occurred in the 2020 pandemic, and in the most extreme cases could hold the firm back for a few years.

Other considerations may include Mastercard’s somewhat lacking dividend yield for a long position, suggesting suboptimal returns if projected growth is not realized. Furthermore, valuation statistics exist for a reason, and analysts are by no means infallible. It is possible that patience (or a 2023 recession) may allow investors to fetch a more appealing price.

However, within the industry, there are few, if any, factors that impede Mastercard from achieving double-digit growth, outpacing its competitors (and the broader index), in the coming years. This is due to high barriers to entry and a stable revenue base (for example, even in 2020, Mastercard recorded an operating profit of over $8 billion). I believe that their relatively small size (and thus future growth potential) compared to Visa makes Mastercard the premier digital payment investment.

The Bottom Line

With Mastercard finally making a full recovery from its pandemic woes, it stands poised to take advantage of a growing electronic payments industry using its well-established infrastructure and significant market share. Its financial health is promising, and with income sheet improvements (both at the industry and firm level) projected to continue in coming years, I find Mastercard to be likely to grow at least at a near-double-digit rate in the foreseeable future. Dividend growth should continue as earnings improve. High barriers to entry and the aforementioned infrastructure advantage make Mastercard’s moat comfortably wide. Their solid asset management and limited risk make Mastercard a secure investment, and a comfortable buy and hold.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.