Summary:

- TSMC remains pivotal in the AI revolution, but geopolitical risks and macro uncertainties may limit significant stock appreciation in the near term.

- Despite mixed recent stock performance, TSMC’s strong Q2 results and rising AI chip demand indicate continued business growth.

- Geopolitical tensions, especially involving Taiwan and Sino-American relations, pose substantial risks to TSMC’s future performance and stock stability.

- Current valuation concerns and limited margin of safety suggest that TSMC stock is a HOLD, despite favorable long-term growth prospects.

cbarnesphotography

The generative AI revolution is far from over and Taiwan Semiconductor Manufacturing (NYSE:TSM) undoubtedly will remain one of the most important companies that power this revolution in the upcoming years thanks to its dominant position in the semiconductors field. However, the company’s shares had a mixed performance in recent months due to the rising geopolitical risks and due to the increasing exposure of the business to things that are outside of its control. While TSMC still has several growth catalysts going for it, there’s a possibility that its shares won’t significantly appreciate anytime soon primarily because of the increasing macro risks that could undermine the company’s growth story.

The AI Revolution Is Far From Over

In late June, I wrote an article titled TSMC: This Could Be The Top where I explained that the company’s shares have likely found their technical top level for now and offer minimal margin of safety. Since that time, TSMC’s shares experienced weakness throughout all of July, have been trailing behind the broader market for a while, and only recently started to trade above the price at which my previous article was published. However, despite the relatively mixed performance of TSMC’s shares, there’s still an indication that the business itself is likely going to continue to show an exceptional performance in the foreseeable future.

This is primarily due to the expectations that the company will continue to show a strong performance thanks to the continuously rising demand for generative AI chips. The latest earnings report for Q2 which was released in late July showed that the company’s revenues during the quarter increased by 32.8% Y/Y to $20.82 billion and were above expectations by $730 million. Likely, the performance in the following quarters will also not disappoint TSMC’s investors.

A few months ago, it was announced that the AI chip constraints could last through the next year, while the latest report by Bain indicated that the heightened demand for AI chips could result in a chip shortage. Therefore, it looks like the current environment greatly favors TSMC.

At the same time, the increase in sales of TSMC’s biggest customers should also translate to greater growth for the chipmaker itself. Apple (AAPL), which is the biggest customer of TSMC, is expected to outperform the expectations for Q3 and Q4. In addition to that, TSMC’s second biggest client Nvidia (NVDA) also noted that the demand for its upcoming lineup of AI GPUs is insane. Thanks to this, Nvidia’s growth is expected to be in the double-digits in the next few years, which should benefit TSMC in the long run as well.

We already saw the company performing exceptionally well in Q3 as its sales its Q3 of $23.6 billion were above the expectations, while its profit has increased by 40% to $9.27 billion. The full earnings report for Q3 is expected to come out on Thursday, and it’s already safe to say that it will positively surprise the company’s shareholders.

On top of all of that, TSMC is unlikely to face any major competition in the foundry space for years to come, as it’s already on track for volume production of its upcoming N2 and N2P chips in 2025 and 2026, respectively.

Considering all of this, it’s obvious that the generative AI revolution is far from over and the demand for chips is unlikely to slow down anytime soon. This is great news for TSMC, which is expected to generate double-digit returns in the following years.

Risks To Consider

Despite all the growth opportunities, TSMC continues to be greatly exposed to developments that are outside of its control, which could undermine its growth story in the foreseeable future.

Back in July, after Donald Trump said that Taiwan should pay us for defense, TSMC’s shares greatly depreciated and only in late September rebounded to the levels at which they were trading during the middle of summer. The market’s reaction to political comments by the U.S. Presidential candidate shows that any geopolitical developments will continue to affect TSMC’s shares from time to time.

Since the United States political establishment believes that by 2027 Beijing is expected to be capable of invading Taiwan, while the PLA Navy constantly holds drills aimed at capturing the island in the future, it’s safe to assume that any escalation of tensions will also hurt TSMC’s shares.

This shows that the Taiwan risk premium is real, and it will continue to limit TSMC’s upside like it happened this summer when developments that are outside of the company’s control negatively affect its shares.

On top of that, the ongoing Sino-American chip war also creates new headwinds for TSMC. In addition to imposing chip export restrictions on China, the United States is expected to implement even harsher restrictions that could further decrease exports to the mainland. This could have a greater negative effect on TSMC in the long run, especially since Beijing is on the path to self-sufficiency in the foundry business.

What’s more, is that TSMC’s major customers face similar challenges that already negatively affect their performance. After years of dominance, Apple’s iPhone is rapidly losing its market share in China to domestic competitors. The company’s latest iPhone 16 is already selling at a discount in China, and it’s unlikely that its sales will rebound there given that the company’s generative AI platform Apple Intelligence is not going to be available in the country due to regulations.

Nvidia also faces issues in China despite the meteoric growth of its business in other markets. During its Q1 earnings call, the company’s management noted that the company’s data center revenues in China are down significantly due to American export restrictions. During the Q2 earnings call, Nvidia said that as a percentage of total data center revenue, sales in China remain below the previous levels.

If TSMC’s biggest clients continue to suffer in China due to developments that are outside of their control, then the performance of the Taiwanese chipmaker could suffer as well in the long run.

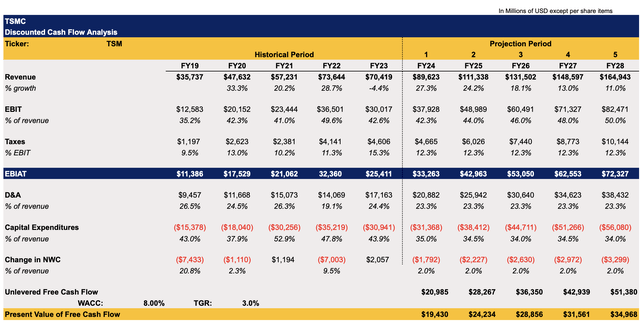

In addition to all of this, TSMC’s current valuation is also an issue. Seeking Alpha’s Quant system gives TSMC a rating of D+ for valuation, while my DCF model from the previous article showed that the company’s fair value is $156.51 per share. Since the company released an earnings report for Q2 after my latest article was published and the full Q3 results are just around the corner, I decided to update my model to figure out whether some assumptions need to change significantly.

The biggest change happened with the revenue assumptions in the updated model. After the great performance in Q2, TSMC received dozens of upward revenue revisions, which made me increase my revenue assumptions for the next couple of years as well. The revenue assumptions now closely correlate with the overall consensus for the next couple of years. The EBIT is expected to continue to increase as TSMC will likely retain its ability to expand margins due to the lack of major competitors in the foundry space. The assumptions for other metrics remained mostly the same. The CapEx assumptions have been slightly decreased and are mostly in-line with the management’s expectations, as various federal programs in the U.S. and abroad should cover some costs of expanding the business.

TSMC’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

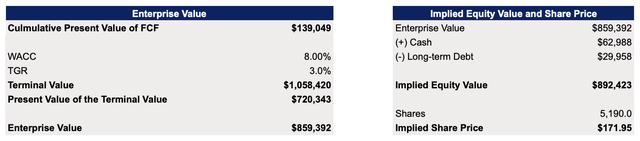

The updated model shows that TSMC’s fair value is $171.95 per share, which is below the current market price by ~10%. While the fair value in the updated model is higher in comparison to the previous model primarily due to the higher revenue assumptions caused by the great performance in Q2, the margin of safety for owning the company’s stock right now appears to be limited.

TSMC’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author )

The Bottom Line

The rising demand for AI chips is going to be one of the biggest tailwinds for TSMC in the foreseeable future. The company’s business is likely going to continue to perform well and even has a chance to exceed the expectations given the favorable environment. Despite this, the rising geopolitical risks coupled with valuation-related risks make TSMC stock a HOLD at best at this stage.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.